[Fourth week of December +553 pips: In 2026, truly win big and live freely|How to reduce trades to increase win rate] Points / Sure win column / Today's and tomorrow's outlook

Happy New Year ^^

The reason why win rate is not stable in trading is the high number of trades.

By narrowing the conditions and reducing entries, the quality of judgment, consistency, and mental state align, and the win rate structurally improves. I will explain why!

The free indicator released for this Awards Live festival is placed below,

so if you haven't downloaded it yet, please download it now!

If you haven't yet watched the AWARD LIVE archive, you can do so from here

Also, I received a certificate of commendation for this award lol

Thank you to everyone who voted ^^

Now, this is the usual article from here.

--------------------------------------------

Free Gift Indicator!

It has an ON/OFF function to overlay the higher time frames.

https://www.gogojungle.co.jp/tools/indicators/73674

【Free Gift PDF】 Big 3 Entry Triggers Revealed!

Classic trading can be categorized into any of these three.

https://www.gogojungle.co.jp/info/23295

↑Get it while you can

--------------------------------------------

As you continue trading,

everyone at least once thinks this way.

“If I don’t go through more trades, won’t I become able to win?”

So,

Keep searching for opportunities

React if there’s any movement, even a little

Today, if I don’t enter several times I won’t feel settled

That kind of state tends to occur.

However,

There are facts that have become clear through the previous series.

Fix your decision criteria

Create consistency in actions

Decide what not to do

Develop the ability to pass on trades

Remain steady even after passing on trades

The more you have these in place,

the natural result is a decrease in entry frequency.

This is not a coincidence.

▶ Trading is not a game of “guessing” but a game of “reducing”

Stable traders do not try to increase opportunities.

Rather,

bad trades

ambiguous trades

trades that cause doubt

are thoroughly pruned away.

As a result,

the win rate of the remaining small number of trades increases

that’s all there is to it.

In the series so far, we have covered,

the art of passing on trades

thinking that evaluates yourself by judgment

a system that fixes actions

All of these were foundations to create

“a state where you don’t feel anxious even if you reduce entry frequency.”

.

This article,

continues that flowby articulating it structurallyin language.

▶ Why does reducing the number of entries increase win rate?

Why does greater frequency degrade judgment quality

Why do bad trades “blend in”

Why is it easier to align actions with fewer trades

Why does it stabilize mental state

If you organize these,

the belief that “I must enter more to win”

structurally collapses.

When you finish reading this article,

you will feel that fewer entries are

not a cause of anxiety

butevidence of stability

you should feel.

And next time,

you’ll begin to feel this

“I feel anxious because opportunities are scarce”

We will delve into that very emotion.

Now, from here,

to why reducing entry frequency increases win rate

let’s examine each part of that structure.

↓ I have limited the video to the community only lol

Why does increasing trading frequency make you less likely to win?

Many people think

“Trading better means you can hit more often.”

They believe that.

Therefore,

・look for more opportunities

・enter sooner

・do more trades

In this way,

the time spent reading charts and the number of entries

continue to increase.

But the reality is the opposite.

The more stable the trader,

the fewer entries they make, and it is astonishing.

Moreover, that is not because they are cautious or timid.

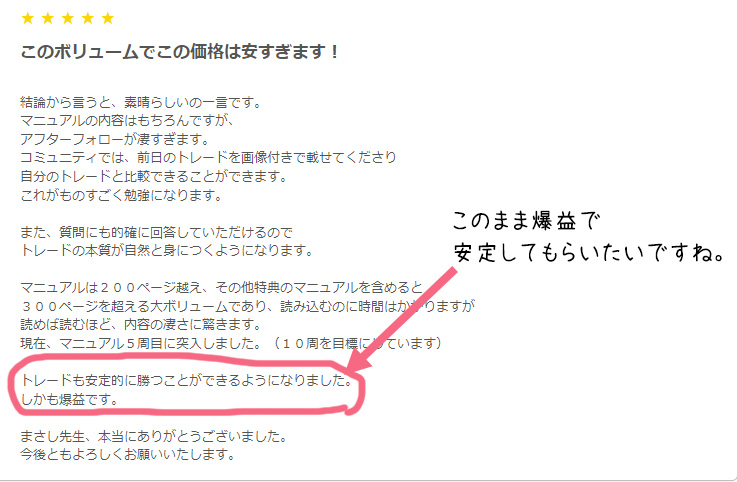

There have been happy reports of stable profits ^^

For details,reviewsplease refer to.

We have received many other reviews as well ^^

Although it says 2024 latest version, it still works fine in 2025 as well lol

▶ The complete攻略 manual is here ↓

https://www.gogojungle.co.jp/tools/ebooks/50406

Well, this is for the 4th week of December.w

I’ve summarized a week’s worth of trading points.

The columns needed for trading and the future market outlook

are written further on, so please read to the end ^^

This week +553pips!12/22–12/26 please see the section.

↓ This is the method said to be unbeatable inside Gogojan lol

https://www.gogojungle.co.jp/tools/ebooks/50406

↓ Last week’s update

I would be happy if there were many more trading allies,

so please join us during this opportunity ^^

Hello ^^

This is Masashi.

This blog is

・Yesterday’s points

・Trading columns

・Today (tomorrow)’s outlook

It has a three-part structure ^^

Everyone, how are you spending year-end and New Year’s?

I am planning to book a January session for horseback riding, which I started last year,

so I think I’ll fit that in more from this month ^^

I used to ride 2–3 times a week in the latter half of last year, but considering Investment Navigator+ and others,

I’ve taken a short break.

Horses become more active when it’s cold, so I’m a bit wary of them suddenly running, lol

【Why win rate increases as you reduce entry frequency】

The reason win rate rises is that the perspective shifted from “hitting” to “reducing”

Win rate increases when you reduce entries,

not by chance or a rule of thumb.

There is a structural reason for that.

The culprit lowering win rate in trading is

・the losing trades themselves

instead of

・the trades that didn’t need to be done creeping in.

Reducing frequency is not about discarding opportunities.

It’s about proactively pruning out the hard-to-win actions.

This time,

・why increasing frequency degrades judgment

・why tighter conditions stabilize results

・why “one less move” ultimately raises win rate

through,

I will explain the shift in perspective from

“a game of hitting” to “a game of reducing”

one by one.

Read moreand please read to the end ^^

Below this, I’ve listed the password for the overlay indicator released at this Awards.