30-second Gold Scalper reviews and总结 of GOLD in 2025

Details of 30-second GOLD discretionary-free scalping here

The long-awaited “30-second chart” × “GOLD” Part 2!!

↓↓Details of 30-second GOLD Automatic FX here↓↓

https://www.gogojungle.co.jp/tools/indicators/66726

+++++++++++++++++++++++++++++++++

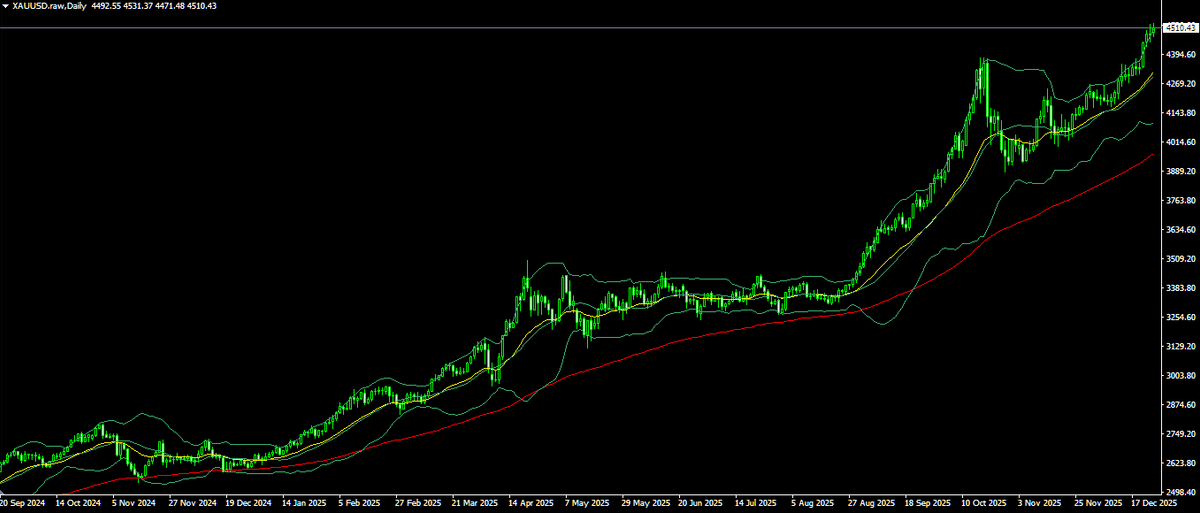

Looking back at the GOLD market in 2025 technically,

the most notable feature was the one-way trend in which “pullbacks hardly functioned”

continued for a long period.

On monthly and weekly levels,

• Major moving averages (50EMA, 100EMA, 200EMA) formed a complete perfect order

• An upward wave that did not break its highs or lows

depicted a typicallong-term bullish trend completion.

This bullish uptrend also had a significant impact on the Japanese market.

Because it moved in a double structure of “GOLD priced in USD × USD/JPY,”

even if one side was in a trend, 2025 saw both moving in the same direction.

Technically, the timing when USD/JPY clearly broke the long-term range ceiling

and when GOLD broke above resistance on a weekly chart were almost the same.

This is not a coincidence;it can be interpreted that risk-averse forces “avoiding the yen and turning to gold” moved in unison.

If you look at shorter timeframes (1-hour to 15-minute),

GOLD repeatedly formed a pattern of “sharp rise → shallow pullback → re-acceleration.”

Even Fibonacci levels show pullbacks of 38.2%, and at most 50% depth.

36.1% up to 61.8% pullbacks were rare,

and price ranges favorable to sellers hardly ever reached.

This technical environment clearly affected Japanese market participants.

USD/JPY not falling

↓

GOLD not falling

↓

Yen-denominated GOLD did not even retrace

This three-layered structure

put an unconscious pressure on Japanese individual investors: “Rather than leaving yen idle, isn’t it better to switch to something else?”

From the perspective of Japan’s FX/CFD traders,

the market where there was no technical reason to start selling persisted for a long time.

As a result,

• GOLD was left alone

• If you traded, it was only buy-on-pullback

which increased participants and reinforced the market’s directional bias.

In 2025, GOLD’s rise can be seen less as overheating

and more as a market where price bands moved up in steps.

・The yen-denominated asset base rose persistently

・GOLD became not “expensive,” but “an asset at that level”

and this shift in perception became evident across charts.

Normally, a dollar strength would lead GOLD to decline, but GOLD did not fall, and buyers of yen could not bid.

GOLD rising × USD/JPY not falling

formed a combination that made it difficult for corrections to take hold in Japan.

The fact that USD/JPY not falling further spurred GOLD buying helps explain how such a sharp uptrend was sustained.

As GOLD’s value is recognized as having risen a notch, more and more asset holders will buy GOLD.

・Gold’s asset value

・Japan’s yen depreciation

As long as these do not break down, we anticipate further gains next year.

*********************************

Details of 30-second GOLD discretionary-free scalping here

*********************************

The long-awaited “30-second chart” × “GOLD” Part 2!!

↓↓Details of 30-second GOLD Automatic FX here↓↓