[December 23] 30-second chart GOLD non-discretionary scalping + [Part 2 30-second chart GOLD automatic FX] Trade results!

Details of 30-second GOLD discretionary-free scalping here

The long-awaited “30-second bar” x “GOLD” Part 2!!

↓↓Details of 30-second GOLD Automatic FX here↓↓

https://www.gogojungle.co.jp/tools/indicators/66726

+++++++++++++++++++++++++++++++++

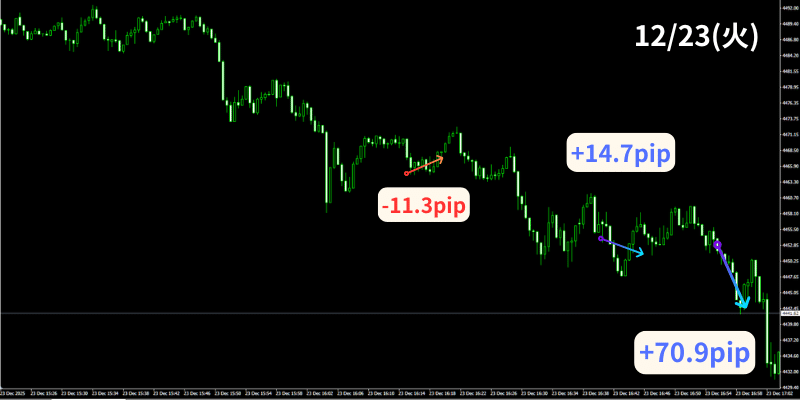

Trade on December 23.

22:30

United States: Real GDP (Advance) Q3 [Real GDP, QoQ annualized]

22:30

United States: Real GDP (Advance) Q3 [Personal consumption, QoQ annualized]

22:30

United States: Real GDP (Advance) Q3 [GDP deflator, QoQ annualized]

22:30

United States: Real GDP (Advance) Q3 [Core PCE price index, QoQ annualized]

22:30

United States: Durable goods orders (Advance) Oct [MoM]

22:30

United States: Durable goods orders (Advance) Oct [Total minus transportation; MoM]

23:15

United States: Industrial Production Oct [MoM]

23:15

United States: Industrial Production Oct [ Capacity Utilization]

23:15

United States: Industrial Production Nov [MoM]

23:15

United States: Industrial Production Nov [Capacity Utilization]

Such as important indicators with high volatility cluster in the same time frame, so caution is needed during this period.

Trade with that in mind.

GOLD had shown abnormal gains the previous day and continued on the 23rd.

It has surged significantly since the Tokyo market and is already up nearly 500 pips.

After a pause, it has stagnated around that level, with no movement entering the London market.

Nevertheless, volatility remains high, wandering around that area as it enters the NY market.

When the NY market opens, the situation quickly changes and declines sharply.

Once it starts falling, it breaks the London market support and drops rapidly, then rebounds in Tokyo to recover nearly 500 pips, and continues to fall rapidly.

Quite strong momentum and a brief range repeat, making it hard to trade.

At the very end, it finally extended pips greatly, allowing recovery from early-week losses.

However, with so many indicators and year-end approaching, the market is quite unstable.

This year’s final trade is planned for the 25th, but let’s push a bit further.

Continue to enter mechanically without discretion.

-+-+-+-+-+-+-+-+-+-+-+-+-+-+-+-+-+-+-+-+

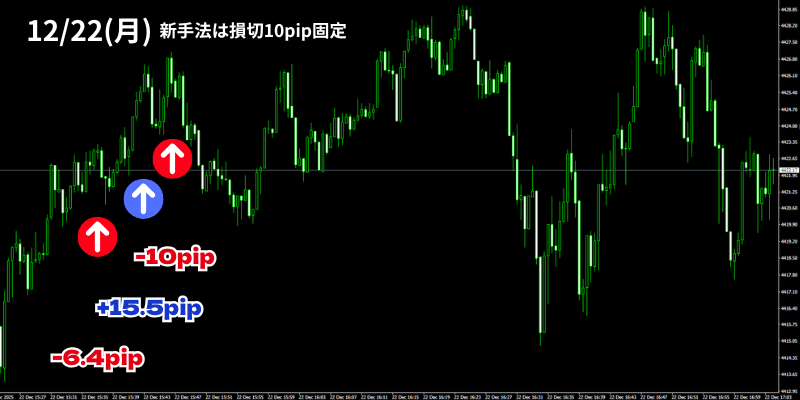

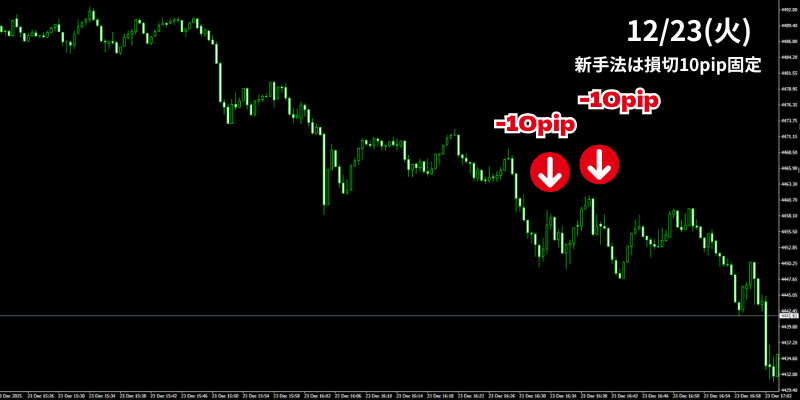

Trading result of “30-second GOLD Automatic FX” on December 23

GOLD’s market feel and analysis are largely repetitive, so please refer to the 30-second GOLD Discretionary Scalping article for details.

Today’s GOLD entry!! ✅?

The price surge in the Tokyo market, followed by a range in London and a plunge in NY, shows unusual price action.

Price movement is over 500 pips and quite volatile.

During the monitored times, there were rapid declines and brief ranges, making it hard to enter.

There were opportunities, but volatility caused an instant stop-out; losses were kept as small as possible and the day ended.

On the 22nd and 23rd, abnormal price movement continued, and it is unclear how this week will proceed, but trading is planned to end on the 25th.

Continue to trade mechanically according to the Automatic FX rules!

*********************************

Details of 30-second GOLD discretionary-free scalping here

*********************************

The long-awaited “30-second bar” x “GOLD” Part 2!!

↓↓Details of 30-second GOLD Automatic FX here↓↓