"Seventy-three percent of the entire period is in range-bound markets, and twenty-seven percent is in trending markets" (from The Market Wizards System Trading Edition).

『Market Wizards System Trade Edition』 quotes from Tom DeMark in an interview.

“According to our testing, 73 percent of the entire period is a ranging market, and 27 percent is a trending market. 17 percent of the entire period is an uptrend, and about 10 percent is a downtrend. The reason why downtrends are fewer than uptrends is that buyers tend to increase their positions, which strengthens the trend. In the case of selling, the decision is made only once and does not occur multiple times. If you dislike it, you end up disliking everything. Therefore, declines are rapid.”

He states the reason for the rapid fall very clearly.

But is that really all there is to it???

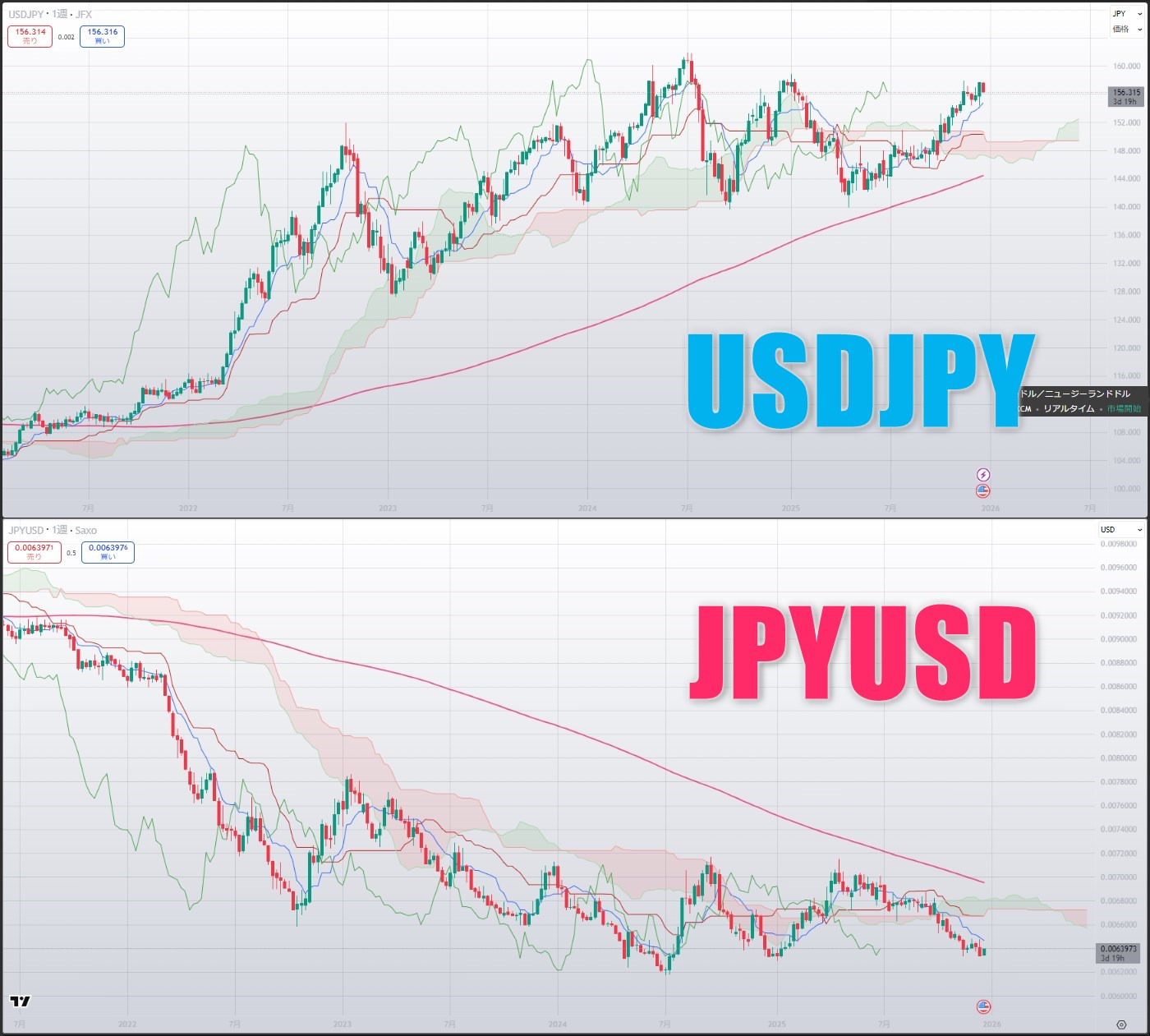

Looking at the USD/JPY market, the decline does indeed appear rapid.

Comparison with JPYUSD... is this just a lame excuse (laughs)?

USDJPY somehow makes me not want to buy. But...

JPYUSD somehow makes me think about selling.

It's strange.

I wonder if I also have some bias in my eyes…

See you next time.

[Free] Spread Monitoring Indicator “Spread Monitor (Spread Monitor)”

Protect your EA from spread risk!

[Promotion] We are selling a single-position EA (Seven-Colored USDJPY). Four years of forward testing results.

We also publish our real-time operations. Please use as a reference.

× ![]()