[Week 2 of December +1109 pips, reports of wins piling up toward year-end! | What are the criteria for skipping?] Points / Must-win column / Today and tomorrow's outlook

Sending off does not mean opportunity loss.

By deciding the “reasons not to do it” in advance on the 4-hour, 30-minute, and 1-minute charts,

we will explain a mindset and practice method to eliminate unnecessary entries and quietly stabilize trading.

The free indicator released at this award drive festival is placed below,

so if you haven’t downloaded it yet, please download it now!

Also, I received an award at this festival, haha

Thank you to everyone who voted ^^

Now, as usual, here is the article.

--------------------------------------------

Free gift indicator!

With an ON/OFF function for overlaying higher time frames.

https://www.gogojungle.co.jp/tools/indicators/73674

【Free Gift PDF】Large disclosure of the 3 major entries and triggers!

Classic trades fall into one of these three categories.

https://www.gogojungle.co.jp/info/23295

↑Get it now while you can

--------------------------------------------

The more unstable your trading is,

the more you try to enhance your “entry power.”

Is there a better setup?

Could you enter a little earlier?

Can you avoid missed opportunities?

However, as repeatedly stated in the series so far,

the more stable a trader is,the more accurate the decision not to enteris.

Fix the decision criteria

Create consistency of actions

Decide what not to do in advance

With these in place,

the next step is the theme of this issue.

▶ The power of abstaining = active behavior to avoid losses

This is extremely important.

When you hear abstaining,

・Patience

・Endurance

・Giving up on opportunities

Many may picture it like that.

But in reality, it is the exact opposite,

the more you can abstain, the more quietly your trades grow.

Because abstaining already means you have

figured out in advance

Where to take on risks

Where you will absolutely not trade

that is,a state where that design is already in place.

In previous articles,

Fix the judging criteria to remove doubt

Create consistency of actions with systems

Decide what not to do to narrow choices

Thus,

we have built a “non-fluctuating trading structure.”

This article is

about how that structure actually functions on real chartsthrough experience.

▶ Abstaining = proactive action to prevent losses

Those who cannot abstain are not afraid of missing opportunities.

More often,

The target setup is vague

Where to trade is not decided

As a result,

“There might only be this moment”haunting them with anxiety.

This time,

The true reason you cannot abstain

A way to end abstaining decisions at higher time frames

Evaluation criteria to turn abstained trades into successful experiences

Concrete practice methods to train abstaining in real trading

will be organized in line with the series so far.

This is not a mental theory.

▶A result of creating a non-ambiguous structure makes abstaining natural

Next time

“Mental organization to prevent fluctuation after abstaining”

will be a very important session connected directly to this.

From here, let’s look at why people who cannot abstain are ruled by “insufficient grounds” anxiety!

↓ Video has been made publicly visible to the community

People with fewer entries see their trading grow quietly.

Those whose trading results are stable often have in common the fact that they are “almost not entering.”

That is not because their judgment is dull or because they miss opportunities.

They abstain from the right moments with precision..

Many people think,

“I waited so long, now this is the only chance”

“If I miss this, I don’t know when the next one will come”

This anxiety drives them to act in situations where they should not.

However, in trading,

abstaining is not opportunity loss.

Rather,it is the most important strategy to eliminate risk.

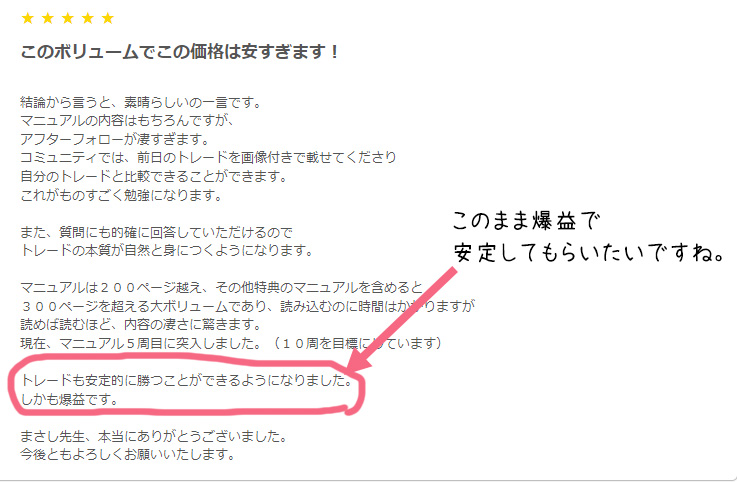

There was joyful news of stable huge gains^^

For details, please seereviews.

▶The Complete Strategy Manual is here↓

https://www.gogojungle.co.jp/tools/ebooks/50406

Now, this is the previous one (two cycles late, haha) lol

I have summarized a week's worth of trading points.

The columns needed for trading and the market outlook are

written further below, so please read to the end ^^

This week +553pips!12

↓ This is the method said to be unbeatable inside Gogojungle haha

https://www.gogojungle.co.jp/tools/ebooks/50406

↓ Last week's update

I would be glad to have more trading friends,

so please join this opportunity^^

・Yesterday’s points

・Trading columns

・Today’s/Tomorrow’s outlook

as a three-part structure^^

In the end, writing up the article took longer than expected (sigh)

I’m already preparing the next article, and I’ll send it as soon as it’s ready!

I am worried that each article might exceed 30,000 characters and become hard to read, so I will finish it carefully to avoid misunderstandings by repeating the key points!

The paid version, Investment Navigator+, is updating rapidly, and I hope to reach a good stopping point by tomorrow lol

【Thinking and practice methods to acquire the power to abstain in trading】

Yes, indeed ^^

Not abstaining is not due to weak will.

Many who cannot abstain are not lacking courage,

nor are they unable to endure.

The issue is simpler.

✔ Where to trade is unclear

✔ The reasons for not doing it are not verbalized

✔ They try to abstain on a 1-minute chart

In this state, every abstention will bring a sense of “waste.”

Conversely,

people who have decided not to act at the higher time framewill not have their hearts shaken at all when abstaining.

This time,

・The essence of why you cannot abstain

・A way to design abstaining as a decision

・Concrete practice methods to train abstaining in practice

will be organized as we proceed in the series,

to create a state where abstaining becomes normal.

When you can abstain,

trading quietly and steadily builds up,

almost mysteriously.

Read moreand please read to the end ^^

Below is the password for the layered indicator released in this award.