Dollar/yen in December moves with Bank of Japan rate hike and Fed rate cut: Reading the "expected" and the "unexpected" amid key interest-rate events

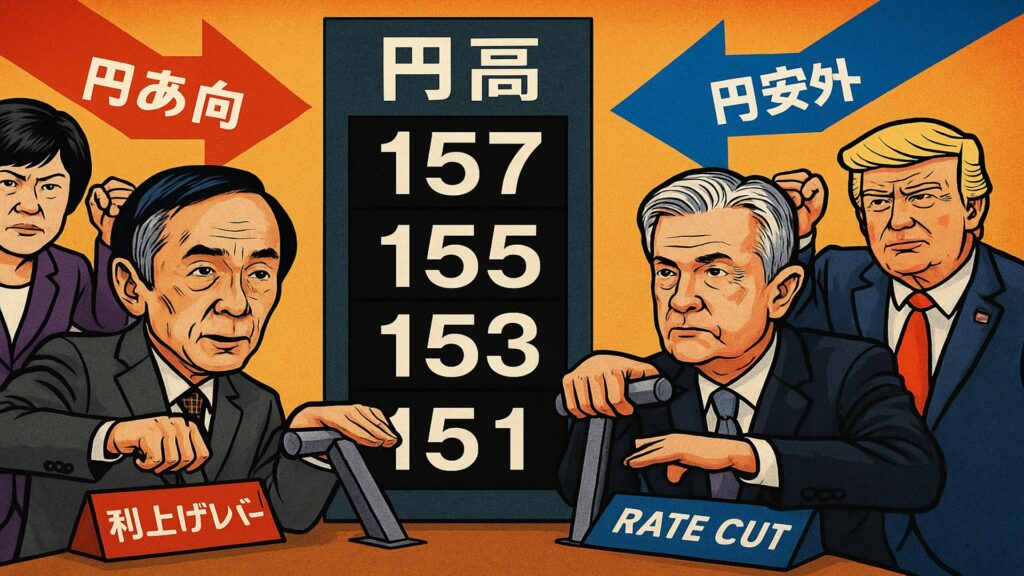

December is a month where conditions for large currency moves overlap. First, there is a high probability that the Fed will cut rates on December 10, and at the Bank of Japan meeting on December 18–19, an rate hike is already in the pipeline,the direction of USD/JPY is in a relatively readable phase.

On the other hand, if either side fails to meet market expectations, the reaction could be sharp, and there is a risk of rapid volatility in year-end trading. This article outlines the expected price movements and the criteria for judgment in case expectations are disappointed.

?December 10: If the Fed “properly” cuts rates, how will the market start moving?

If the December 10 FOMC announces a 0.25% rate cut, the USD/JPY is expected to react with a yen appreciation from the 155 area to the 154 area immediately after the announcement. Since rate cuts are already largely priced in at about 80–87%, the immediate move is expected to be limited (about 0.5–1 yen), butwhat to watch is the content of Powell’s press conference.

If language such as “two additional rate cuts in 2026” is indicated, a move toward the mid-153 to the low-153s could be in view. Also, since QT was completed in early December, a bias toward selling the dollar when paired with a rate cut is likely. In the short term the downside is possible, but the key is to check how much is already priced in and to wait for the calm level after the press conference.

?What if the Fed surprises the market? The swift reversal from hold or hawkish tone

When pricing is above 80% and there is a hold or hawkish press conference, strong dollar buying and yen selling reversals occur.Specifically, a rebound of more than 2 yen from the high-155s toward the high-157s is anticipated.

As seen when the minutes were released in November 2025, dollar buying spikes the moment the market revises its rate-cut expectations, and given low liquidity toward year-end, moves can expand. Although Trump’s administration urges rate cuts, the Fed maintains independence, so the possibility of a hold is not zero.

If rate cuts are delayed, the short-term trend toward a weaker yen becomes clear, and risk management should involve deepening the position of stop orders.

?December 19: What happens if the Bank of Japan implements a planned rate hike as expected?

If the BOJ decides to raise the policy rate from 0.50% to 0.75 at the December 18–19 meeting, the trend will continue to favor yen appreciation. Since the rate hike is announced on the afternoon of the 19th, USD/JPY is expected to move toward the 154 area to the 153 area, roughly 1 yen of yen strength right after the announcement.Rate hikes are already priced in at about 70–80%, so not a surprise, but what to watch is whether the press conference hints at further hikes.

With expectations of a 1.00% increase by 2026, a positive stance toward additional hikes could drive USD/JPY below 153. If long-term yields (10-year) move from 1.9% toward 2.0%, Japanese stocks (especially exporters) would be prone to adjustments, and a yen appreciation alongside stock declines would likely occur.

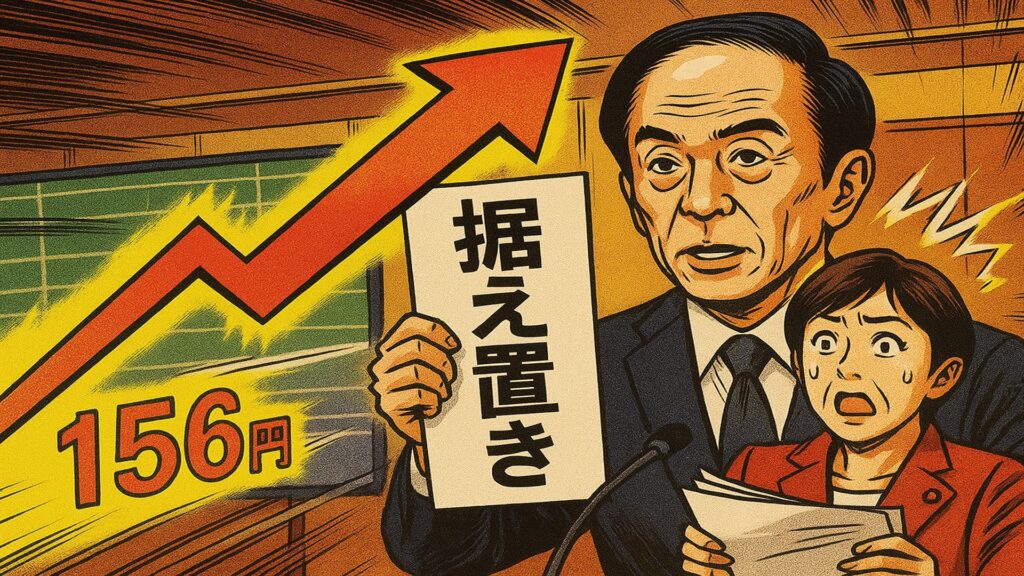

?What if the BOJ delays a rate hike? A moment when year-end trading could change

If the BOJ delays a rate hike when pricing has already heavily priced in the move, reactions will be even sharper than the Fed’s. In past examples, October 2025 meeting saw a more than 3 yen depreciation of the yen. This time too, a scenario of jumping from the 153 area to the 156–157 area is expected.In the market, criticism of “be-hind the curve (BOJ slow to act)” could flare up again, and if year-end liquidity tightens, views toward the 156–157 area become plausible.

In particular, if the Fed cuts right after, yen selling driven by BOJ surprises could dominate US-dollar weakness, making USD/JPY surge. Delaying the hike is the scenario most disliked by the market, making risk management with stop orders that anticipate sharp rises important.

?Why Trump keeps pressuring interest rates and the moment when “pricing in” reaches its limit

President Trump has demanded a large-scale rate cut of about 3 percentage points from the Fed, continuing pressure on Powell. However, the market has hardly priced in beyond a 0.25% cut. If the press conference hints at a large-cut possibility, USD/JPY would sharply fall below 153 toward 152.

On the other hand, BOJ rate hikes of 0.25% are the baseline, and a large hike of 0.50% is not priced in. If a large hike occurs, a sudden yen appreciation of around 1.5–2.0 yen could push it into the low-152s.

Pricing in is only what the majority believes; if the forecast is wrong once, positions are unwound en masse, and price moves can expand to 2–3 times usual levels.Combined with year-end trading, misreading the direction can lead to substantial losses in a short time, so it is crucial to clearly map out scenario branches in advance.

?If you’re going to trade in December? The pros’ view on “price ranges” and “time windows”

The market currently considers three levels: 155.5 yen (upper bound), 153 yen (lower bound), and the 151 yen area (deepening strong yen trend line). The most active trading times are around Japan time 4:00 when the Fed announces, the afternoon of the BOJ announcement on the 19th, and the Europe–NY session the following trading days.

If the Fed and BOJ directions align, a mid-term trend from 153 to the low-151 yen area is likely; however, if either side misses, there is a risk of a reversal toward 155–157 yen.

After policy announcements, the first five minutes are noisy, and a more settled direction becomes clearer about an hour later. For short-term trading, entering right after data releases is not advisable; waiting for a pullback or bounce to confirm reduces risk substantially.

?Summary: If everything goes as expected, the yen strengthens; if not, it reverses sharply. Scenario branching is your greatest weapon

If things go as expected, the yen strengthens; if not, a sharp reversal occurs. The key weapon is branching the scenarios. December is a month where the Fed cuts on the 10th and the BOJ hikes on the 19th occur in sequence. If things go smoothly, the yen strengthens as the interest-rate gap narrows, and the mid-term focus shifts from 153 to 151 yen.

On the other hand, if the Fed holds or the BOJ delays the hike, a strong rebound to the 155–157 yen area is likely. The crucial factor is the prior pricing and the magnitude of the rebound when that assumption is broken. Rather than judging direction based on immediate volatility, determine direction in the hour after and the following day to avoid unnecessary risk.

December is a period of “calm if in-line with expectations, or volatile if not.”To be prepared for either scenario, organize price ranges and timeframes in advance, as this will be the best defense in the year-end market. Do you want to see a volatile December or a calm one?

Practice and verify freely with the completely risk-free trading simulator!

Details page for One-Click FX Training MAX