Chart Divine Analysis [2] Enter with market order and set an OCO order, then just leave it alone! OK on a smartphone, settings in 1 minute! Highly recommended super-easy method for beginners [MuKi Yuri]

I can say this clearly. Even among professional traders who base their approach on fundamental analysis, they always look at the charts. There is no FX trader who wins without looking at the charts at all. Chart analysis is the theory for mastering FX, and it is an essential technique that should be learned with sufficient time.

This time, we asked traders of different types to explain the chart analysis and trading methods they actually use in real trades.

Table of contents for this article

1. Yu Kobori's profile

2. Key points of the strategy

3. Trading steps

4. Trade commentary

5. Point 1 | What exactly is Heikin Ashi?

6. Point 2 | Enter profit and stop-loss at the same time with OCO orders

7. Entry | Buy on a bullish candlestick! Timing can be anytime

8. Exit | With a limit order, you can execute decisively!

9. Trading example 1 | The order was filled within hours and took profit (GBP/JPY daily chart, November 1, 2018)

10. Trading example 2 | Two profits in a downtrend (GBP/JPY daily chart, October 24–26, 2018)

● Number of characters: 2114 characters (including headings)

● Images: 7

※ This article is a revised edition of an article from FX Guide.com February 2019 issue

※ The “Key points of the strategy” and the main text are explained assuming a long position in an uptrend. In a downtrend and short position, the rules are reversed

Yu Kobori's profile

FX history about 10 years. Does not perform detailed technical analysis; aims to win using probability theory and psychology. Conservatively compounds gains through swap carry. A free-spirited person who loves spirituality and music. Based in Tokyo.

Official Twitter:@KizatoFX

Key points of the strategy

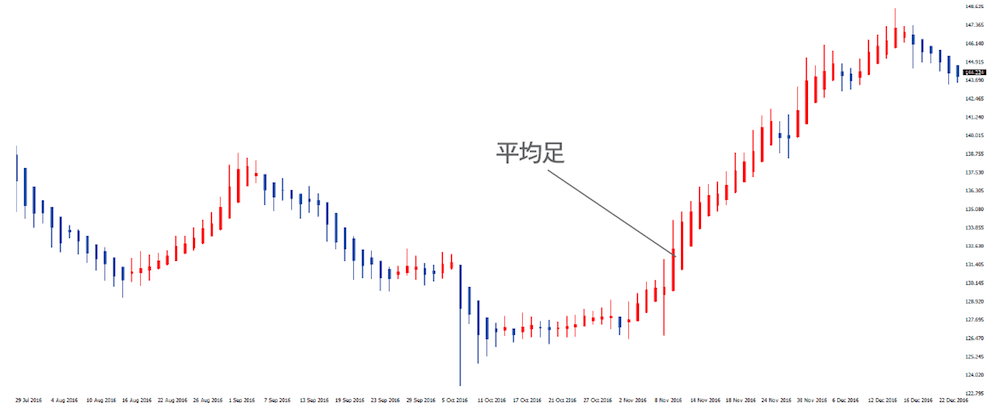

- Technical: Heikin Ashi

- Trading time frame: Daily chart

- Target currency pair: GBP/JPY

- Advantages of this strategy: Extremely simple and straightforward, requires little effort or time

Trading steps | Enter with Heikin Ashi only and exit with OCO orders

New position

- Check the daily Heikin Ashi

- If bullish and not a doji, enter a market buy

Take profit

- Set take-profit price at entry price plus 60 pips using an OCO order

Stop loss

- Set stop-loss price at entry price minus 50 pips using an OCO order