The technical indicators I rely on | Oscillator-type charts RCI [Mamumi Torii]

Table of Contents

1. FX trading with RCI

2. Displaying three RCIs simultaneously

3. Now able to wait

4. Email from M in Osaka

5. Has a concept of time

6. The concept of price movement is not great

● Character count: 2040 characters (including headings)

● Images: 2

※This article is a reedited version of an article from FX攻略.com, August 2014

Profile of Mayumi Torii (Torii Mayumi)

Representative Director of Pure Edge. After divorce, while raising children, she started FX to secure an income, and her unique investment style has been featured in overseas media in the United States, Korea, and Hong Kong. Her books include the series “My Method to Earn 1 Million Yen a Month with FX” (4 volumes in total, Diamond, Inc.), which has also been translated and released in Korea and Taiwan. The latest volume is “Even Busy Moms Can Earn Big: My Method to Earn 1 Million Yen a Month with FX” (Diamond, Inc.).

Official site:Mayumi Torii’s FX Life

Twitter:https://twitter.com/mayumitorii

FX Trading with RCI

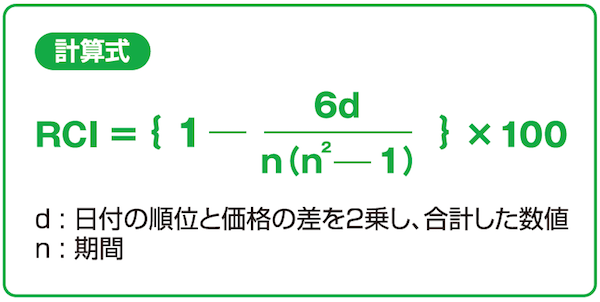

My FX trading method's most distinctive feature is that it uses a technical indicator called RCI. RCI stands for Rank Correlation Index, in Japanese “順位相関指数.” It is an oscillator-type chart used to judge overbought and oversold conditions, moving within a range from -100 to +100.

The calculation is fairly simple: within the set period, it looks at how consistently the order of time matches the order of price (highs and lows) for the closing price.

For example, if prices rise over time, it approaches +100; if prices fall over time, it approaches -100.

Generally, when RCI rebounds from around -100 to about -80, it is considered a buying signal; conversely, when it falls back from around +80 to +100, it is considered a selling signal.

Display three RCIs simultaneously

However, a common issue with oscillator-type charts is that during strong trends, they stop functioning properly while pinned to the top or bottom. There are many false signals, making it dangerous to use them alone.

So what should you do—