Let’s remember the characteristics of price movements [Fudou Shutarou]

Unlike a calm price movement in a box-range market, this is a volatile market where a unidirectional flow and a rebound flow mix. For such movements that are clearly different from the usual, cautious play is required. What strategies are effective? Shed a light with an explanation by Shutarou Fudou.

Table of Contents

1. Should switch methods and mindsets according to market conditions

2. What causes a volatile market?

3. Smart ways to profit in a volatile market

4. Do not chase fair value! Look at the technicals and trade cautiously

● Character count: 1853 characters (including headings)

● Images: 2

※This article is a revised edition of a July 2016 issue of FX攻略.com. Please note that the market information written in the main text may differ from the current market conditions.

Profile of Shutarou Fudou

Forex instructor and writer. Has released seminar DVDs and interview CDs from publishers. In addition to giving talks at financial exchanges, stock exchanges, FX brokers, and investment trust companies, he also writes for magazines and serves as a school instructor for FX and stocks.

Official site:Shutarou Fudou’s “Behind the Headlines of News Reporting”

Twitter:https://twitter.com/syutaro_fudo

Should switch methods and mindsets according to market conditions

In a volatile market, the methods and mindsets differ from those used in a calm market and are important.

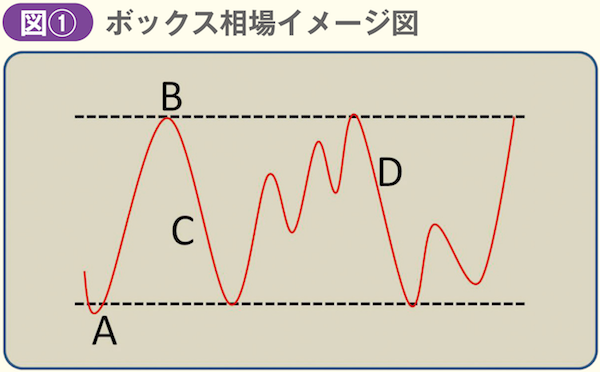

In a calm market, as in Diagram 1, prices tend to move back and forth within a certain range, forming a box market. In currency markets, the periods of “rising and then falling” or “going and coming back” tend to be longer, while the trend periods with clear upward or downward movement are relatively short.