【光明 KOMYO】ついにMT5対応!1回の購入でMT4/MT5の両方を利用可能になりました。

【光明 KOMYO】MT5 版を同梱しました(再ダウンロードで利用可)

これまで MT4 版のみの配布でしたが、本日より MT5 版をパッケージに同梱 しました。

再ダウンロード いただくと、MT4/MT5 の両方が同一商品内でご利用いただけます。

開発背景と修正点

• 当初より MT5 版の原型はありましたが、サインのリペイント(表示位置の移動/消失) が起き得る実装箇所があり、公開を見合わせていました。

• 手元の検証環境では不具合は確認されていません。

不具合報告のお願い

以下の症状を見つけた方は、改善のため情報共有をお願いします。

• サインが消える

• ローソク足が確定した段階でサイン位置が変わる

• 通知が鳴らない/過去バーで過剰に鳴る

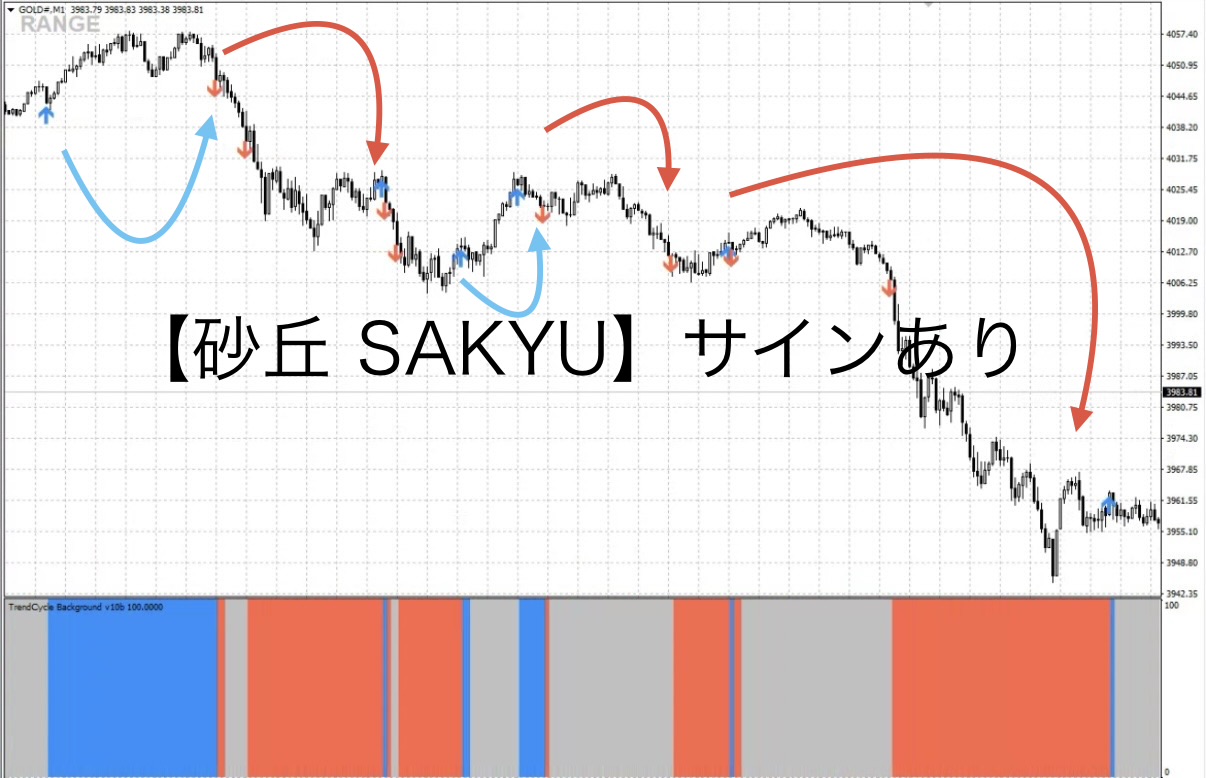

【砂丘 SAKYU】ランチ代ひとつ分で気づきを。雲海の裏で生まれた、“トレンドを色で見る”インジケーター。

別ツール雲海↓

10月13日(月)いっぱいまで

通常価格 20,000円 → 記念価格 11,111円 にてご提供いたします。

また、10月中は下記の関連ツールも特別価格でご利用いただけます。

• 【雲海 UNKAI MT4版】

• 【天空の狭間 】

どちらも、トレードの「迷いを減らす」ことを目的に設計されたロジックです。

光明(KOMYO)MT4版インジケーターなど、一連の環境を整えておきたい方にとって最適なタイミングかと思います。

ぜひ、この機会にご自身のルールを強化するツールとして

活用していただければ幸いです。

サイン読み取り式の雲海エントリーEAをご利用になりたい際は、

「雲海」および「光明」 のどちらかをご購入のうえ、

【狭間への軌跡】内のスレッドからご利用ください。

本EAは有料化せずに公開しておりますが、

パスワード確認時に「どなたがダウンロードされたか」の通知が届く仕様となっております。

そのため、利用条件にご協力いただける方のみ

パスワード入力の上でご活用いただけますと幸いです。

また、マニュアルも作成致しました。

同コミュニティのマニュアルスレッドからご覧頂けます。

レベル調整で相場に合わせた最適運用を

レンジ相場での雲海のサイン通りのエントリーや決済は、あまりおすすめしません。

あくまで「トレンドが発生している相場」でこそ、雲海のサインは本来の力を発揮します。

ただし、完全なレンジ局面では、

「雲海のエントリー」と「光明レベル1〜3での決済」を組み合わせることで、

小さな値幅でもリズムよくトレードを繰り返す運用も可能です。

一方で、明確なトレンドが出ている場面では、

雲海が押し目・戻りを示す補助となり、

光明 KOMYOのレベルを4〜5に上げて運用することで、

「利益がある程度乗った状態」での決済を目安にできます。

⸻

トレンド判断を自動化する「雲海エントリーEA」

雲海エントリーEAでは、ADX値によるトレンド判断機能を搭載しています。

これにより、レンジとトレンドをある程度自動で見極めたうえでエントリーが可能となり、

勢いのない場面での無駄なエントリーを抑え、

流れが出た時にだけEAが自動で波に乗るよう調整できます。

また、光明 KOMYOのサインには「レベル1〜5」の調整機能があり、

• レンジ傾向・勢いが乏しいとき → レベル1〜3

• トレンドが明確に出ているとき → レベル4〜5

と切り替えることで、相場の状態に合わせた柔軟な運用が可能です。

⸻

◆ 決済についてのご注意

決済に関しては、取引例を参考にしていただいても構いませんし、エントリー後に含み益が出た段階でルールを決めて決済していただいても問題ありません。

放置してドテントレードに任せると、大きなトレンドに乗った場合には一度で何百pipsとれることもあります。

しかし、レンジ相場ではフォワードテストの結果、往復ビンタで負けにつながる可能性も大きいため、利確と損切りの基準は必ず持った上でのご活用をおすすめします。

最後に

もし「こんなルールで過去検証してほしい」といったリクエストがあれば、ぜひコメントやメッセージで教えてください。

検証テーマとして取り上げることで、今後のアップデートや改善にもつながると思います。

特に東京時間前半やNY時間など、流れが出やすい時間帯では雲海サインの特性が顕著に出る場面があります。投資ナビに掲載しているチャート画像も参考になると思いますので、ぜひ併せてご覧ください

GOLD 1分足では、投資ナビの記事で「反対のサインが出るまで伸びすぎて怖い」と感じた場面よりもさらに伸びる相場があり、もしサイン通りに入っていたら逆に不安を覚えるほどの含み益が出る可能性もあります。

それでも強調したいのは、雲海はあくまで相場の“流れを映す補助” という点です。サインに頼り切るのではなく、ご自身のマイルールと合わせて「勢いを確認する指標」として活用していただければと思います。慢心せず、あくまで補助的に活かしていただければ十分に力を発揮するツールになるはずです。

ポイントは、自分のルールを決めたうえで、そのルールを後押しする形で雲海を取り入れること。

そうすることで、勢いの方向を視覚的に確認でき、トレードに一層の安心感を加えられると思います。

(補足)天空の狭間と一緒に使うことを推奨しているわけではありませんが、トレード後の振り返りで、

「ここは天空ゾーンを狙って良かったかな」

「サインが多いから天空ゾーンを意識しよう」

「サインが少ないから浮遊ゾーンや空中ゾーンで決済しておこう」

といった判断がしやすくなります。

ゾーンの色分けによって、判断の負担をある程度軽減できるのは大きな利点だと思います

雲海 × ルールの相性について

例えば

• トレンドフォロー型のルールと合わせると、雲海の青矢印(上昇の勢い)や赤矢印(下降の勢い)が「方向確認の後押し」となり、無駄な逆張りを避けやすくなります。

• ゾーンやラインを用いたルールと組み合わせれば、ゾーン到達後に矢印の勢いを確認することで「ここは仕掛けても良い場面かどうか」をシンプルに判断できます。

• 損小利大を重視するロジックにおいては、矢印が連続する局面でトレードすれば「伸びる時だけに乗る」選別がしやすくなります。

雲海は何も決めずにサイン通りのエントリー、決済を目的としたものではありません。

むしろ、サインだけを頼りにすると「高値掴み・安値掴み」のリスクが高まります。

雲海が担う役割は、相場の流れを視覚的に映すことです。

• 上の青矢印が増えてきたら「上昇の力が強まっている」

• 下の赤矢印が増えてきたら「下降の力が強まっている」

そうした「勢いの方向」を直感的に感じ取れるように

「流れを確認していただくためのツール」 として設計されています。

そのサインの出方を、短い動画にまとめましたのでぜひご覧ください。

⸻

■ サインの仕組み

• 確定足ベース

1本前の足が確定した時点での勢いを判定し、次の足の始値で矢印が表示されます。

• 青矢印(上矢印):直前の勢いが上向きの場合に表示

• 赤矢印(下矢印):直前の勢いが下向きの場合に表示

※仮に青矢印が出た足が陽線であれば「値幅が取れていた」

赤矢印が出た足が陰線であれば「下落方向で利確できた」という振り返りの結果が視覚化される形になります。

• リペイントなし

一度出たサインは消えません。逆行しても残るため、振り返りや検証に使いやすい仕様です。

• 通知機能

アラート・プッシュ通知・メール通知に対応し、チャート監視の負担を軽減します。

EAが仕掛けるブレイクアウト戦略

エントリーEAマニュアル完備

「天空の狭間」は、エントリーを 自動エントリーEA に任せ、トレーダーはエントリー後の監視と決済ルールの実行に集中するだけのシンプルな戦略です。

EAは、チャートを常に監視し、ブレイクの瞬間を逃さず正確に仕掛けることができます。

これにより、 エントリー前に画面に張り付くストレスや、タイミングを逃す不安が解消 されます。

ADX,ATR,SMA等のフィルター搭載。

購入者特典として、このEAを利用できるようになっています。

既に確固たるルールをお持ちの方へ──雲海 UNKAIが、あなたの手法をさらに強固にする。

なぜマイナス結果も公開するのか?

投資ナビ+では、あえて マイナスの結果も隠さずに掲載 しています。

その理由は「トレードは常に勝ち続けられるものではない」からです。

むしろ、マイナスを記録することで“どういう状況で負けるのか”を分析でき、ロジックをより堅牢にできるのです。

1回ごとの勝ち負けに執着するのではなく、

1週間・1か月といったスパンで“トータル収支がプラス”になることが最も重要。

• 「今日は勝ったから嬉しい」

• 「今日は負けたから不安」

この感情の波をなくすためにも、EAにエントリーを任せ、人間の役割は“ルール通りに決済する”という部分に特化します。

「勝ちたい」ではなく「稼ぎたい」── このマインドが、長期的に利益を積み重ねるための大前提です。

ルールを守ることで得られる安定

トレードで大きく負ける人の共通点は、「勝ちたい欲」がルール破りを引き起こすことです。

例えば、「もっと伸ばしたい」「もう少し様子を見たい」と思って決済を先送りすると、利益が一気に消えることも少なくありません。

天空の狭間は、

• エントリーはEAで完全自動化

• 決済はルール化された固定条件

これにより、人間が介入する余地を極限まで減らし、迷いを排除しました。

ルールを機械的に守るだけで、勝率やリスクリワードが自然と安定する仕組みです。

⸻

移動平均線やRSI、MACD、ストキャスティクス、パラボリックSAR、ADX、ATR、CCI、トレンドラインやチャネルライン、フィボナッチ・リトレースメントやエクスパンション、一目均衡表、出来高といったオシレーター系指標、さらにはサポート/レジスタンスラインなど──テクニカル分析には数えきれないほどの手法があります。

どれが正解ということはなく、大切なのは 「これだ」と思える自分のルールを一つ決めて、そのルールに基づいて実際に検証を重ねてみること です。そうすることで、ただ知識を持っているだけでは得られない「相場に通用する自信」と「期待値を積み上げる実感」を持つことができます。

⸻

天空の狭間で狙う「最大利確型」のルールで検証を行い、

建値決済が多くなる場面もありますが、ルールを守ったことで次のチャンスを冷静に捉えることができます。

「本来ならもっと大きく取れたのに…」という場面でも、

ルール通りに建値で切ったからこそ、結果的にトータルでプラスを維持できるのが、この戦略の強みです。

トレードで大切なのは「勝率」ではなく「再現性」

トレーダーの多くが「勝率」を気にしますが、

勝率50%でも、リスクリワード(RR)が良ければ資金は増えていきます。

重要なのは、誰がやっても同じ結果になる“再現性”のあるルールを持つこと。

天空の狭間は、

• EAエントリー → 機械的損切り → ルール利確

この一連の流れを「感情ゼロ」で行うことで、トレードを“ビジネス”として成立させる発想を重視しています。

⸻

トータルでプラスを狙う戦略

1日単位の勝ち負けにこだわるのは危険です。

例えば1週間・1か月といった単位で見れば、多少のマイナス日があってもトータルでプラスならOKです。

EAは感情がないため、こうした長期スパンの資金管理にも最適。

「勝ちたい」ではなく「稼ぐ」というビジョンでルールを運用することで、

資金の増加曲線は安定しやすくなります。

天空の狭間に興味がある方はオンラインコミュニティにご招待

オンラインコミュニティ内で具体的なトレードロジックは説明出来ませんが

天空の狭間を活用した「チャート添削コミュニティ」にご参加いただけます。

天空の狭間に興味を持ってくださったあなたへ

短期トレードにおいて「迷いなくルールで判断する」ための土台を築く──

それが天空の狭間の基本思想です。

無料教材はこちら:

『狭間への軌跡』では、実際にどのような場面でトレードできるのか?

その判断基準を、より分かりやすく解説しています。

「天空の狭間」の販売ページだけでは伝えきれなかった、

具体的なエントリーポイントやゾーンの選び方についても、

図解とケース別で丁寧に補足されています。

初めて読む方でも再現しやすい構成になっていますので、

気になった方は、ぜひそちらもご活用ください。

ご興味がある方は、まずは無料教材『狭間への軌跡』をお受け取りください。

そこから、あなたの狭間での一歩が始まります。

「このチャート、入れる?」

と迷ったとき、“感覚ではなくルールで判断する”という思考に切り替えるためのヒントになれば嬉しいです。