Chart Divine Analysis [1] Simple Entry & Stop-Loss with RSI! A High-Accuracy Scalping Method Reading the Trend with Three Timeframes [Takami Murai]

I can say this clearly. Even professional traders who base their approach on fundamental analysis always look at charts. There are no FX traders who win without looking at the charts at all. Chart analysis is the theory for mastering FX, and it is an essential technique that should be learned with sufficient time.

This time, we asked traders of different types to explain the chart analysis and trading methods they actually use in real trades.

Table of Contents for This Article

1. Takayoshi Muraida (Taka-yo Muraida) Profile

2. Strategic Points

3. Trading Procedure

4. Trading Commentary

5. Point 1 | Determine Trend Reversal with Long-Term Trend Lines

6. Point 2 | What is RSI?

7. Entry | After the 4-hour trend reversal, check RSI on the 15-minute and 1-minute charts

8. Exit | Take profit using RSI, stop loss with the 4-hour horizontal line

9. Trading Example ① | A high-probability scalping move at the early stage of a trend reversal (USD/JPY 4-hour, 15-minute, 1-minute – October 17, 2018)

10. Trading Example ② | Secure profits conservatively by also using counter-trend movements (AUD/JPY 4-hour, 15-minute, 1-minute – November 21, 2018)

● Number of characters: 2341 characters (including headings)

● Images: 7

※ This article is a revised edition of an article from FX攻略.com February 2019 issue

※ The “Strategic Points” and the main text are written assuming a rising market with long positions. In a falling market with short positions, the rules are reversed.

Takayoshi Muraida Profile

President of Super Trading School REED. A system trader who develops his own tools mainly for Nikkei 225 futures, FX, and individual stocks, achieving over 50% yield. In 2006, he opened the “Super Trading School REED” for individual investors. He traveled abroad, directly hearing from hedge funds and top traders, studying their common trading secrets. In the Nikkei 225 mini market, he devised a trading method using the system trading software “KENSHIRO-225” that enables a trader to easily construct buy/sell rules, manage mindset, and manage risk/funding like a professional. He has also developed FX tools and stock screening tools. He is the author of “Philosophy of Trading Success” (Panrolling). Previously, he appeared as a coach for traders earning billions on BS Japan’s “Nikkei Plus 10.” He has appeared as a guest on Radio NIKKEI’s “Trade Party,” and “Go! Go! Jungle Market.” He has also written for “FX攻略.com,” “The Economist Investment Master,” and “The Economist Money” (both published by Mainichi Shimbun).

Official site:Super Trading School REED

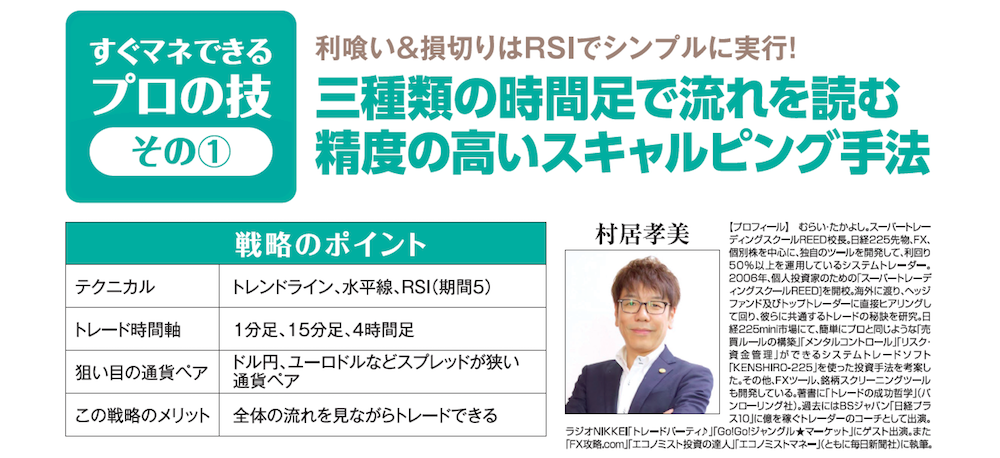

Strategic Points

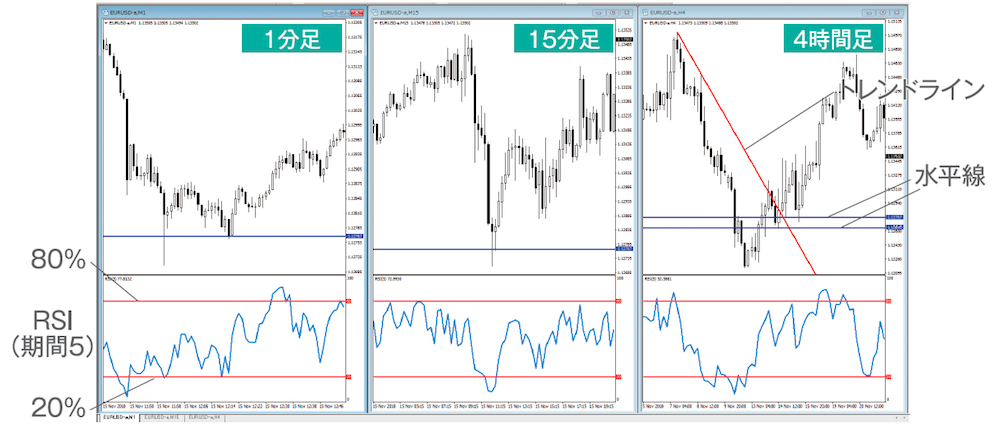

- Technical: Trend lines, horizontal lines, RSI (period 5)

- Trading timeframes: 1-minute, 15-minute, 4-hour

- Target currency pairs: USD/JPY, EUR/USD and other pairs with tight spreads

- Benefits of this strategy: You can trade while viewing the overall trend

Trading Procedure | 4-Hour Chart Trend Reversal as Entry Trigger!

New

- After a 4-hour trend reversal, draw a horizontal line at the low, wait for a pullback (down to the 15-minute horizontal line, RSI 20% or lower)

- Near the 1-minute horizontal line, enter long when RSI reverses from 20%

Profit Target

- Take profit when the 1-minute RSI reaches 80%

Stop Loss

- Stop loss when the price touches the 4-hour horizontal line