This product is currently not available.

ドルレゴ|木里ゆうのドル円初心者向けEA

- Whole period

- 2 years

- 1 year

- 6 months

- 3 months

- 1 month

Profit

:

-28,307JPYProfit Factor

:

0.86Rate of return risk

?

:

-0.68Average Profit

:

5,000JPYAverage Loss

:

-989JPYBalance

?

:

971,693JPYRate of return (all periods)?

:

-19.93%Win Rate

:

14.48%

(32/221)

Maximum Position

?

:

1Maximum Drawdown

?

:

29.13%

(41,381JPY)

Maximum Profit

:

5,020JPYMaximum Loss

:

-1,040JPYRecommended Margin

?

:

142,036JPYUnrealized P/L

:

0JPYDeposit

?

:

1,000,000JPYCurrency

:

JPY- Account

Operable Brokers

Usable with MT4-adopting brokers.

※EA measurement is stopped

Forward testing (Profit)

Product Statistics

Product Comments

Monthly Statistics

2025

2024

2023

2022

2021

- Jan

- Feb

- Mar

- Apr

- May

- Jun

- Jul

- Aug

- Sep

- Oct

- Nov

- Dec

Calendar for Months

About EA's Strategy

Translating...

Currency Pairs

[USD/JPY]

Trading Style

[Day Trading]

Maximum Number Position

1

Maximum Lot

10

Chart Time Frame

H1

Maximum Stop Loss

10

Take Profit

50

Straddle Trading

No

Application Type

Metatrader Auto Trading

Other File Usages

No

みなさん、こんにちは。兼業トレーダーの木里ゆうです。ポンド円のあさぽんと並んで、私が毎朝エントリーしているドル円の裁量トレード手法をEA化してみました。その名も「ドルレゴ」!

GogoJungle内投資ナビ+の週刊連載で、この手法のトレード日記や収支報告を読むことができます♪

ドルレゴという名前は、「ドル円をレシオ5」でトレードするというところから来ています。

超メジャー通貨ペアのドル円を、レシオ(リスクリワードレシオ)が5という超損小利大の設定で運用する裁量トレードの手法を、ほぼそのままEAにしました。デフォルトの設定では、利益確定が50pips、損切りが10pipsと5倍差。これがリスクリワードレシオ5の意味です。

一発で稼ぐ金額が大きい代わりに勝率は低いEAですね。月曜~金曜までの1週間の平日5日間で、月曜~木曜まで1000円ずつ、合計4000円負けて、金曜日に5000円勝って、その週の収支が+1000円になるようなトレードをずっと繰り返します。

上記の日記で毎週の成績を公開していて、2019年12月24日から運用を始めて、89回トレードをして26勝92敗の+380pipsという成績になっています(2020年7月7日時点)。

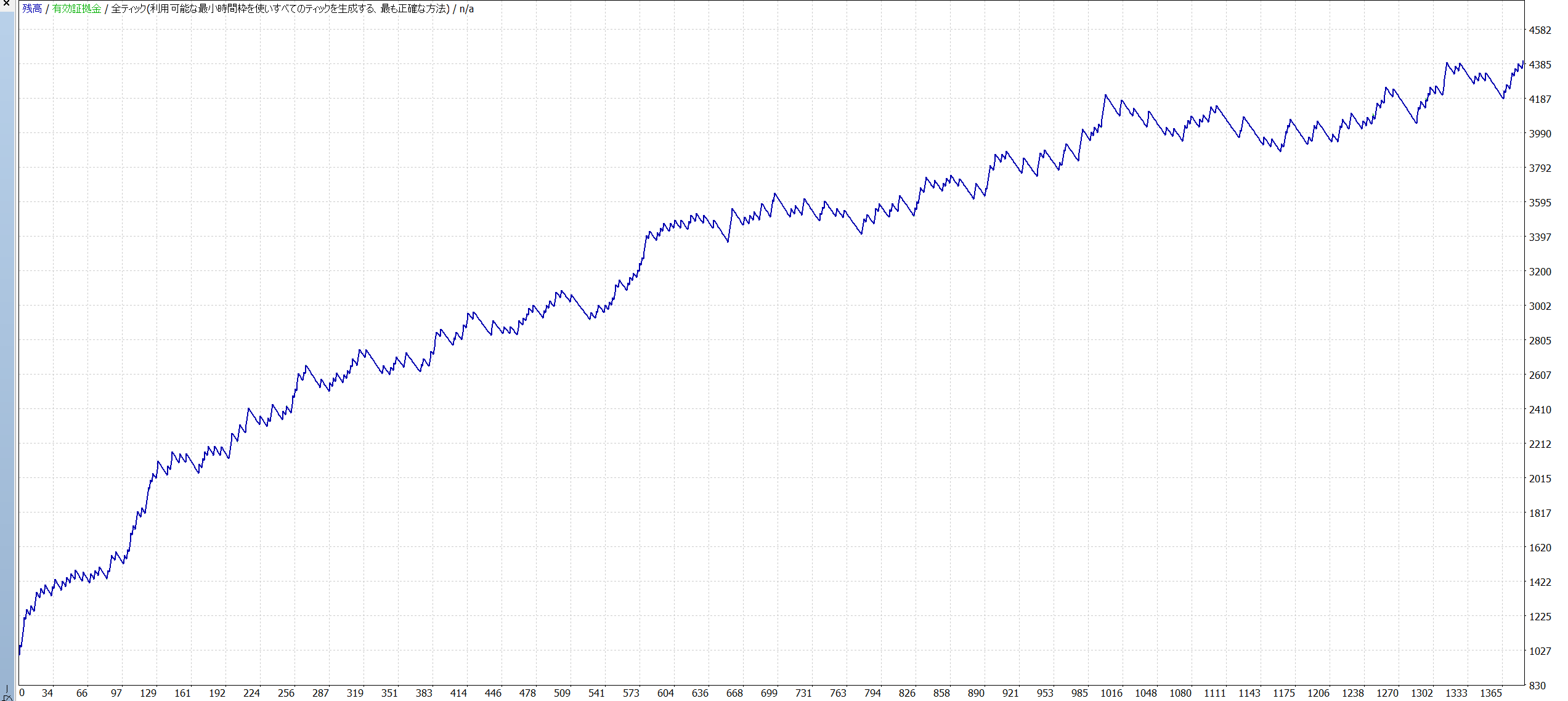

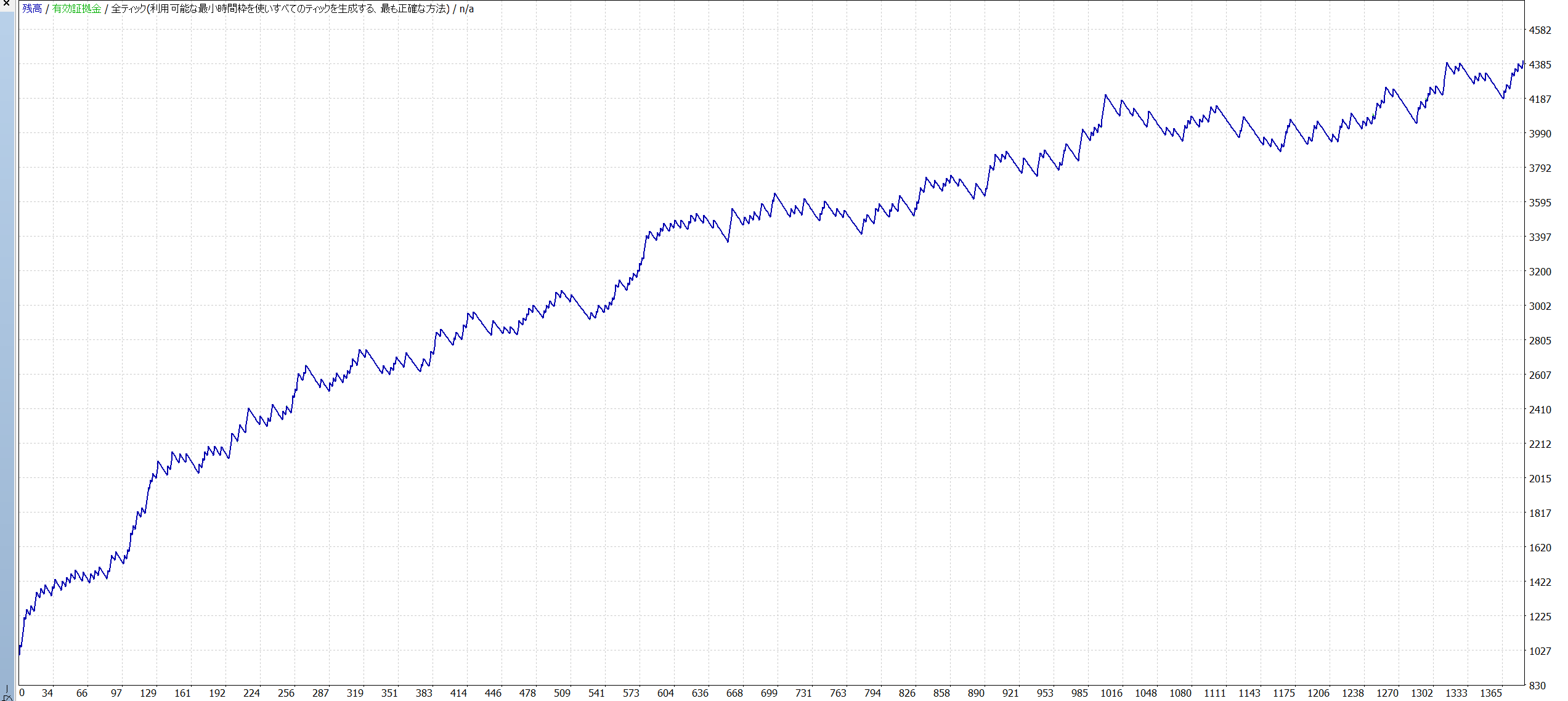

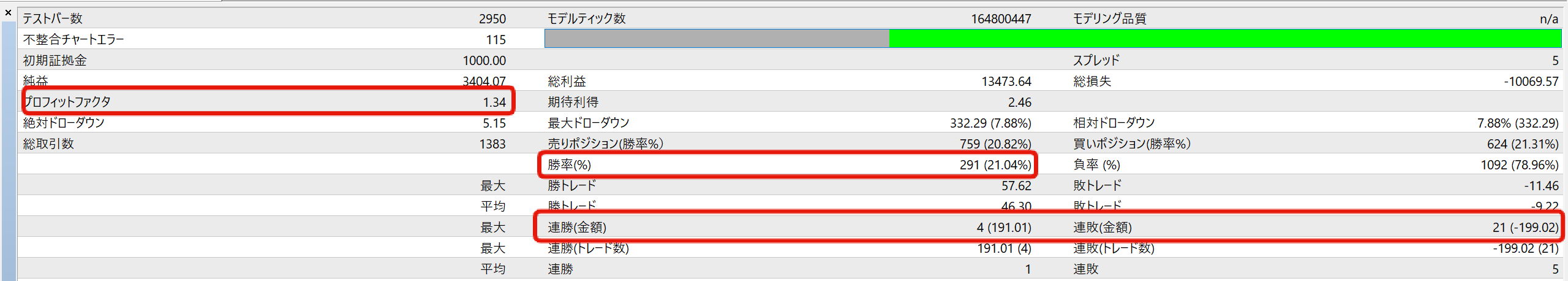

ここからはドルレゴのバックテスト結果から、どういうポテンシャルを秘めているかを見ていきましょう。

1000ドル(約10万円)の資金で、2013年の年初から2020年7月13日まで運用した場合、資金は47万円にまで増えています(純益は37万円)。7年間で資金を5倍弱にするポテンシャルは秘めています。

基本的なバックテスト結果を見ていきましょう。

損益グラフは綺麗な右肩上がりになっています。

損益グラフは綺麗な右肩上がりになっています。

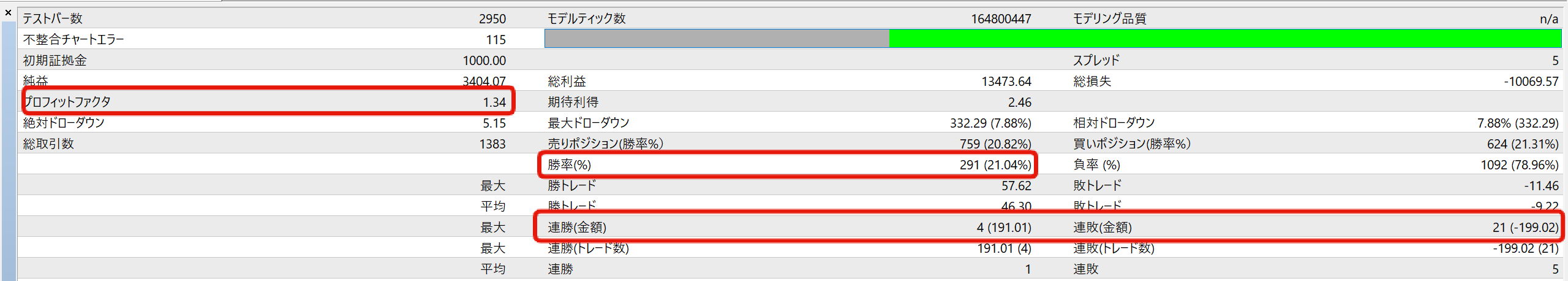

基本的なバックテスト結果です。

・プロフィットファクタ:1.34

総利益を総損失で割った値で、1を超えていればプラス収支。ドルレゴの場合は1.34ですから、もちろんテスト結果全体はプラス収支です。

・勝率:21.04%

だいたい5回に1回しか勝ちません。でも、1回の負けが小さく、勝つと大きいため、トータルでプラス収支であることが、ドルレゴというEAの大きな特徴です。

・最大連勝:4、最大連敗:21

7年のバックテストでは、最大で21連敗しています。これくらいは連敗することがあって当たり前と思っておきましょう。

基本的なバックテスト結果です。

・プロフィットファクタ:1.34

総利益を総損失で割った値で、1を超えていればプラス収支。ドルレゴの場合は1.34ですから、もちろんテスト結果全体はプラス収支です。

・勝率:21.04%

だいたい5回に1回しか勝ちません。でも、1回の負けが小さく、勝つと大きいため、トータルでプラス収支であることが、ドルレゴというEAの大きな特徴です。

・最大連勝:4、最大連敗:21

7年のバックテストでは、最大で21連敗しています。これくらいは連敗することがあって当たり前と思っておきましょう。

資金10万円、1万通貨取引というそれなりに現実的なロット運用の場合でも、年間で+47,775円ですから、2年動かせば資金はだいたい倍になる計算です。

さらに細かい分析結果は、木里ゆうブログ内の会員ページで確認可能です。ページへのアクセス方法は、GogoJungleさんからご連絡いたします。

ドルレゴは、デフォルト設定では勝つ場合には50pips、負ける場合には10pipsとなります。

トレードは最大で1日に1回。ポジションをすでに持っていたり、相場の展開によってはトレードしないこともあります。

自動売買の取引ロット数には最適解はなく、ロットを増やせば稼げる金額と、失う金額が同時に上がりますし、下げればどちらも落ち着いた金額になります。

上記バックテストでは、資金10万円の1万通貨運用でテストしていますが、慣れないうちは1000通貨から始めるのがオススメ。これだと、勝ったら500円、負けたら100円ですので、初めて自動売買をされる方にぴったりです。

1000通貨運用なら、資金が5万円しかなくても、ある程度は危険を抑えた運用ができるでしょう。

また通貨ペアもおなじみのドル円なので、ほとんどの口座でスプレッドも一番狭く、すんなり始めやすいと思います。

負ける場合は、すぐに損切りになりますから、ポジションを長く持ち続けてストレスを感じることもないでしょう。

・通貨ペア:ドル円でのみ稼働

・時間足:チャート設定はどの時間足でも動きます

・MANO:マジックナンバーです。他のEAと被らなければ何でもOK。数字しか使えません

・Lots:ロット数です。慣れないうちは0.01(1000通貨)が良いでしょう

・rikaku:ポジション保有後の利食い値幅です。特に変更しなくても問題ありません

・songiri:ポジション保有後の損切り値幅です。特に変更しなくても問題ありません

●ドルレゴの仕様や使い方などに関するご質問はこちらからお願いします♪

https://tokyo-cloud.net/p/r/WzQh09cA

毎日同じ時間に条件を満たしていればエントリーをするタイプなので、相場の展開にはあまり影響されません。よって、得意な相場、苦手な相場は基本的にないのですが、値動きが乏しいとなかなか決済されず、トレード機会が減少するため、ある程度ボラティリティがある相場の方が良いでしょう。

日本時間の朝、毎日同じタイミング、同じルールでポジションを持ち、事前に設定した利食い幅・損切り幅(初期設定では50-10)で利食い、損切りをします。2つ以上ポジションを持ちません。

しません。

エントリー時間にすでにポジションがあれば、2つめのポジションは持ちません。

また発生頻度は高くないですが、相場に動きがないときにエントリーを見送るフィルターがあります。

設定項目が少なく、売買頻度も一定なので、初心者の方でも始めやすいEAだと思います。

ドル円でのみ動きます。

ドル円のスプレッドが狭く、スリッページが狭い口座がオススメです。

★EAを購入された方に、MT4口座の比較レポートをプレゼントいたします。GogoJungleより入手方法をご連絡いたします。

あさぽんとエントリーするタイミングは同じですが、ドルレゴの方がトレード1回の損失が10pipsと少なく、また決済までの時間も早い傾向があるため、非常にさっぱりした売買ロジックです。

ドル円の自動売買を少額資金で始められるので、こちらのほうがさらに初心者向きです。

あさぽんはポンド円で売買の方向や値動きも違ってくるため、両者を組み合わせて使うのもありですね。

ドルレゴが動いてるMT4がずっと通信されている必要があるため、パソコンの電源を切ると新規エントリーが発生しません(すでに持っているポジションの決済はされます)。

ただこれだと電気代や停電、Windowsアップデートの影響を受けるので、VPSの利用がオススメです。

★EAを購入された方に、VPS入門とオススメVPSを解説したマニュアルをプレゼントいたします。GogoJungleより入手方法をご連絡いたします。

1000通貨運用なら、10万円から始められます。

しぶとく続けることです。

勝ち続けることも負け続けることもなく、今の相場の傾向が続く限りは、じわじわお金が増えていく可能性が高いので、あせらずずっと動かし続けることが大事です。

あまりロットを上げすぎると口座が破綻する可能性があります。そうなってしまうと、運用が止まってしまうため、リスク上げすぎに注意です。

絶対に勝てる手法やEAがあれば、相場自体が成り立ちませんし、もしそういうものがあるとしたら誰にも教えません。

このEAは、「開発時点で統計的にお金が増える期待がある手法を自動化したもの」です。永遠に通用することはありませんが、ただちに使えなくなる可能性も低いです。

初期設定で問題ありません。もちろんもっと良い設定もあるかもしれないので、バックテストをしても良いでしょう。

★EAを購入された方に、ドルレゴの全設定をバックテストした結果をプレゼントいたします。GogoJungleより入手方法をご連絡いたします。

設定項目が少ないため、極端にロット数を多くしなければ、毎日手を掛けなくても大丈夫です。

勝率は低いですけど、1回の負けが小さいので安心感、安定感はあると思います。

●ドルレゴの仕様や使い方などに関するご質問はこちらからお願いします♪

https://tokyo-cloud.net/p/r/WzQh09cA

木里ゆうさんは、システムトレーダーの私から見てとてもセンスがあって、シストレ的な思想を手法を上手に落とし込んで活用されている、優れたトレーダーだと思います。

木里さんが作るEAは時間の概念が強く意識されていて、実はこれは手法やEAを作る際にもっとも重要な部分の1つです。マーケットは基本的にランダムウォークをしていますけど、一時的にこのバランスが崩れるときがあり、こういった「マーケットエッジ」を狙って利益を取るのが、私が得意とするシステムトレード。

木里さんのこのEAは、こういったシストレの考え方や発想が上手に取り入れられてて、シンプルながらも奥が深いです。

トレンドを追いかけるタイプではないので、非常に安定感があります。初めての自動売買にうってつけではないでしょうか。

木里ゆうさんは、システムトレーダーの私から見てとてもセンスがあって、シストレ的な思想を手法を上手に落とし込んで活用されている、優れたトレーダーだと思います。

木里さんが作るEAは時間の概念が強く意識されていて、実はこれは手法やEAを作る際にもっとも重要な部分の1つです。マーケットは基本的にランダムウォークをしていますけど、一時的にこのバランスが崩れるときがあり、こういった「マーケットエッジ」を狙って利益を取るのが、私が得意とするシステムトレード。

木里さんのこのEAは、こういったシストレの考え方や発想が上手に取り入れられてて、シンプルながらも奥が深いです。

トレンドを追いかけるタイプではないので、非常に安定感があります。初めての自動売買にうってつけではないでしょうか。

あさぽんに続いて、このドルレゴも私が毎日裁量トレードでエントリーしている手法を、ほぼそのままEA化したものです。

私の手法は裁量でもとても簡単でスマホだけでできますけど、それがEAになって自動化されているわけですから、それはもうとてつもなくシンプルなんです。

勝率が20%くらいなので、もしかして怖いと思われる方もいるかもしれないですけど、実際の運用はかなり安定しています。1回の負け額が小さく、勝つときには5倍の利益なので、週単位の損失くらいならすぐに取り返せます。

ドル円で動くEAなので、スプレッドの問題もあまり気にしないでいい点もポイントですね。

あまり意気込みすぎることなく、まったり回すEAを探している方、そしてこれから初めてFXの自動売買をするなら、ぜひともドルレゴをご検討ください。

●ドルレゴの仕様や使い方などに関するご質問はこちらからお願いします♪

https://tokyo-cloud.net/p/r/WzQh09cA

あさぽんに続いて、このドルレゴも私が毎日裁量トレードでエントリーしている手法を、ほぼそのままEA化したものです。

私の手法は裁量でもとても簡単でスマホだけでできますけど、それがEAになって自動化されているわけですから、それはもうとてつもなくシンプルなんです。

勝率が20%くらいなので、もしかして怖いと思われる方もいるかもしれないですけど、実際の運用はかなり安定しています。1回の負け額が小さく、勝つときには5倍の利益なので、週単位の損失くらいならすぐに取り返せます。

ドル円で動くEAなので、スプレッドの問題もあまり気にしないでいい点もポイントですね。

あまり意気込みすぎることなく、まったり回すEAを探している方、そしてこれから初めてFXの自動売買をするなら、ぜひともドルレゴをご検討ください。

●ドルレゴの仕様や使い方などに関するご質問はこちらからお願いします♪

https://tokyo-cloud.net/p/r/WzQh09cA

ドルレゴはどんなEA?

ドルレゴはどれくらい稼げる?バックテスト結果を検証!

資金1000ドルで1万通貨運用(2013年1月2日~2020年7月13日)

損益グラフは綺麗な右肩上がりになっています。

損益グラフは綺麗な右肩上がりになっています。

基本的なバックテスト結果です。

・プロフィットファクタ:1.34

総利益を総損失で割った値で、1を超えていればプラス収支。ドルレゴの場合は1.34ですから、もちろんテスト結果全体はプラス収支です。

・勝率:21.04%

だいたい5回に1回しか勝ちません。でも、1回の負けが小さく、勝つと大きいため、トータルでプラス収支であることが、ドルレゴというEAの大きな特徴です。

・最大連勝:4、最大連敗:21

7年のバックテストでは、最大で21連敗しています。これくらいは連敗することがあって当たり前と思っておきましょう。

基本的なバックテスト結果です。

・プロフィットファクタ:1.34

総利益を総損失で割った値で、1を超えていればプラス収支。ドルレゴの場合は1.34ですから、もちろんテスト結果全体はプラス収支です。

・勝率:21.04%

だいたい5回に1回しか勝ちません。でも、1回の負けが小さく、勝つと大きいため、トータルでプラス収支であることが、ドルレゴというEAの大きな特徴です。

・最大連勝:4、最大連敗:21

7年のバックテストでは、最大で21連敗しています。これくらいは連敗することがあって当たり前と思っておきましょう。

バックテスト結果をさらに分析!

| ドルレゴ バックテスト(2013年~2020年) | ||

| 通貨ペア | ドル円(USDJPY) | |

| スプレッド | 0.5pips | |

| 取引ロット数 | 0.1(1万通貨) | |

| 運用開始日 | 2013/01/01 | |

| 集計日 | 2020/07/13 | |

| ドル計算 | 円計算 | |

| 入金額 | $1,000.00 | 105,741円 |

| 口座残高 | $4,404.07 | 465,689円 |

| 損益 | $3,404.07 | 359,948円 |

| ここまでの利回り | 340.41% | |

| 経過日数 | 2750 | |

| 1日あたりの損益 | $1.24 | 131円 |

| 予想年間損益 | $451.81 | 47,775円 |

| 1日あたりの利回り | 0.12% | |

| 予想年間利回り | 45.18% | |

| PF | 1.34 | |

| 最大ドローダウン | $332.29 | 35,137円 |

| 合計取引回数 | 1383 | |

| 勝ちトレード数 | 291 | |

| 負けトレード数 | 1092 | |

| 勝率 | 21.04% | |

| 最大連勝数 | 4 | |

| 最大連敗数 | 21 | |

| 総利益 | $13,473.64 | 1,424,709円 |

| 総損失 | $10,069.57 | 1,064,761円 |

| リスクリワードレシオ | 5.02 | |

| 米ドル円計算レート | 105.7405 | |

ドルレゴは5万円から始められる初心者向けドル円EA!

ドルレゴの運用設定

ドルレゴのよくある質問と回答

▼どういう相場が得意ですか?また、苦手は相場はありますか?

▼どういうロジックですか?

▼必ず毎日トレードをしますか?

▼自動売買初心者でも大丈夫ですか?

▼通貨ペアは何ですか?

▼どのMT4口座がオススメですか?

▼あさぽんとはどう違いますか?

▼パソコンの電源を切ったらだめですか?

▼資金はどれくらいから始めればいいですか?

▼どうすれば勝てますか

▼絶対勝てますか?

▼値幅設定はどうすればいいですか?

▼放置できますか?

村居孝美さんからの推薦コメント

木里ゆうさんは、システムトレーダーの私から見てとてもセンスがあって、シストレ的な思想を手法を上手に落とし込んで活用されている、優れたトレーダーだと思います。

木里さんが作るEAは時間の概念が強く意識されていて、実はこれは手法やEAを作る際にもっとも重要な部分の1つです。マーケットは基本的にランダムウォークをしていますけど、一時的にこのバランスが崩れるときがあり、こういった「マーケットエッジ」を狙って利益を取るのが、私が得意とするシステムトレード。

木里さんのこのEAは、こういったシストレの考え方や発想が上手に取り入れられてて、シンプルながらも奥が深いです。

トレンドを追いかけるタイプではないので、非常に安定感があります。初めての自動売買にうってつけではないでしょうか。

木里ゆうさんは、システムトレーダーの私から見てとてもセンスがあって、シストレ的な思想を手法を上手に落とし込んで活用されている、優れたトレーダーだと思います。

木里さんが作るEAは時間の概念が強く意識されていて、実はこれは手法やEAを作る際にもっとも重要な部分の1つです。マーケットは基本的にランダムウォークをしていますけど、一時的にこのバランスが崩れるときがあり、こういった「マーケットエッジ」を狙って利益を取るのが、私が得意とするシステムトレード。

木里さんのこのEAは、こういったシストレの考え方や発想が上手に取り入れられてて、シンプルながらも奥が深いです。

トレンドを追いかけるタイプではないので、非常に安定感があります。初めての自動売買にうってつけではないでしょうか。

最後に木里ゆうから皆さんにメッセージ

あさぽんに続いて、このドルレゴも私が毎日裁量トレードでエントリーしている手法を、ほぼそのままEA化したものです。

私の手法は裁量でもとても簡単でスマホだけでできますけど、それがEAになって自動化されているわけですから、それはもうとてつもなくシンプルなんです。

勝率が20%くらいなので、もしかして怖いと思われる方もいるかもしれないですけど、実際の運用はかなり安定しています。1回の負け額が小さく、勝つときには5倍の利益なので、週単位の損失くらいならすぐに取り返せます。

ドル円で動くEAなので、スプレッドの問題もあまり気にしないでいい点もポイントですね。

あまり意気込みすぎることなく、まったり回すEAを探している方、そしてこれから初めてFXの自動売買をするなら、ぜひともドルレゴをご検討ください。

●ドルレゴの仕様や使い方などに関するご質問はこちらからお願いします♪

https://tokyo-cloud.net/p/r/WzQh09cA

あさぽんに続いて、このドルレゴも私が毎日裁量トレードでエントリーしている手法を、ほぼそのままEA化したものです。

私の手法は裁量でもとても簡単でスマホだけでできますけど、それがEAになって自動化されているわけですから、それはもうとてつもなくシンプルなんです。

勝率が20%くらいなので、もしかして怖いと思われる方もいるかもしれないですけど、実際の運用はかなり安定しています。1回の負け額が小さく、勝つときには5倍の利益なので、週単位の損失くらいならすぐに取り返せます。

ドル円で動くEAなので、スプレッドの問題もあまり気にしないでいい点もポイントですね。

あまり意気込みすぎることなく、まったり回すEAを探している方、そしてこれから初めてFXの自動売買をするなら、ぜひともドルレゴをご検討ください。

●ドルレゴの仕様や使い方などに関するご質問はこちらからお願いします♪

https://tokyo-cloud.net/p/r/WzQh09cA

Sales from

:

08/02/2020 22:55

Purchased: 0times

Price:¥24,800 (taxed)

●Payment

Forward Test

Back Test

Sales from : 08/02/2020 22:55

Purchased: 0times

Price:¥24,800 (taxed)

●Payment

About Forex Automated Trading

What is Forex Automated Trading (MT4 EA)?

Forex Automated Trading refers to trading that is automated through programming, incorporating predetermined trading and settlement rules. There are various methods to conduct automated trading, but at GogoJungle, we deal with Experts Advisors (hereinafter referred to as EA) that operate on a trading platform called MT4.

Trading Types of Forex Automated Trading

There are various types of EAs (Expert Advisors) for different trading types that can be used on MT4.

Just like discretionary trading, there are those that decide trading and settlement timings by combining indicators, those that repeatedly buy or sell at certain price (pips) intervals, and trading methods that utilize market anomalies or temporal features. The variety is as rich as the methods in discretionary trading.

To categorize simply,

・Scalping (Type where trades are completed within a few minutes to a few hours),

・Day Trading (Type where trades are completed within several hours to about a day),

・Swing Trading (Type where trades are conducted over a relatively long period of about 1 day to 1 week)

・Grid/Martingale Trading (Holding multiple positions at equal or unequal intervals and settling all once a profit is made. Those that gradually increase the lot number are called Martingale.)

・Anomaly EA (Mid-price trading, early morning scalping)

Just like discretionary trading, there are those that decide trading and settlement timings by combining indicators, those that repeatedly buy or sell at certain price (pips) intervals, and trading methods that utilize market anomalies or temporal features. The variety is as rich as the methods in discretionary trading.

To categorize simply,

・Scalping (Type where trades are completed within a few minutes to a few hours),

・Day Trading (Type where trades are completed within several hours to about a day),

・Swing Trading (Type where trades are conducted over a relatively long period of about 1 day to 1 week)

・Grid/Martingale Trading (Holding multiple positions at equal or unequal intervals and settling all once a profit is made. Those that gradually increase the lot number are called Martingale.)

・Anomaly EA (Mid-price trading, early morning scalping)

Risks, Advantages, and Disadvantages of Forex Automated Trading

When engaging in Forex, there are risks in automated trading just as there are in discretionary trading.

However, a substantial advantage of automated trading is its ability to limit and predict risks beforehand.

[Risk]

Inherent to forex trading are the trading risks that undeniably exist in automated trading as well.

・Lot Size Risk

Increasing the lot size forcibly due to a high winning rate can, in rare instances, depending on the EA, lead to substantial Pips loss when a loss occurs. It is crucial to verify the SL Pips and the number of positions held before operating with an appropriate lot.

・Rapid Market Fluctuation Risk

There are instances where market prices fluctuate rapidly due to index announcements or unforeseen news. System trading does not account for such unpredictable market movements, rendering it incapable of making decisions on whether to settle in advance or abstain from trading. As a countermeasure, utilizing tools that halt the EA based on indicator announcements or the VIX (fear index) is also possible.

[Benefits]

・Operates 24 hours a day

If there is an opportunity, system trading will execute trades on your behalf consistently. It proves to be an extremely convenient tool for those unable to allocate time to trading.

・Trades dispassionately without being swayed by emotions

There is an absence of self-serving rule modifications, a common human tendency, such as increasing the lot size after consecutive losses in discretionary trading or, conversely, hastily securing profits with minimal gains.

・Accessible for beginners

To engage in Forex trading, there is no prerequisite to study; anyone using system trading will achieve the same results.

[Disadvantages]

・Cannot increase trading frequency at will

Since system trading operates based on pre-programmed conditions, depending on the type of EA, it might only execute trades a few times a month.

・Suitability may vary with market conditions

Depending on the trading type of the EA, there are periods more suited to trend trading and periods more suited to contrarian trading, making consistent results across all periods unlikely. While the previous year might have yielded good results, this year's performance might not be as promising, necessitating some level of discretion in determining whether it is an opportune time to operate.

However, a substantial advantage of automated trading is its ability to limit and predict risks beforehand.

[Risk]

Inherent to forex trading are the trading risks that undeniably exist in automated trading as well.

・Lot Size Risk

Increasing the lot size forcibly due to a high winning rate can, in rare instances, depending on the EA, lead to substantial Pips loss when a loss occurs. It is crucial to verify the SL Pips and the number of positions held before operating with an appropriate lot.

・Rapid Market Fluctuation Risk

There are instances where market prices fluctuate rapidly due to index announcements or unforeseen news. System trading does not account for such unpredictable market movements, rendering it incapable of making decisions on whether to settle in advance or abstain from trading. As a countermeasure, utilizing tools that halt the EA based on indicator announcements or the VIX (fear index) is also possible.

[Benefits]

・Operates 24 hours a day

If there is an opportunity, system trading will execute trades on your behalf consistently. It proves to be an extremely convenient tool for those unable to allocate time to trading.

・Trades dispassionately without being swayed by emotions

There is an absence of self-serving rule modifications, a common human tendency, such as increasing the lot size after consecutive losses in discretionary trading or, conversely, hastily securing profits with minimal gains.

・Accessible for beginners

To engage in Forex trading, there is no prerequisite to study; anyone using system trading will achieve the same results.

[Disadvantages]

・Cannot increase trading frequency at will

Since system trading operates based on pre-programmed conditions, depending on the type of EA, it might only execute trades a few times a month.

・Suitability may vary with market conditions

Depending on the trading type of the EA, there are periods more suited to trend trading and periods more suited to contrarian trading, making consistent results across all periods unlikely. While the previous year might have yielded good results, this year's performance might not be as promising, necessitating some level of discretion in determining whether it is an opportune time to operate.

Equipment and Environment Needed for Automated Trading Operation

The requirements for operating automated trading (EA) on MT4 are as follows:

・MT4 (MetaTrader 4. An account needs to be opened with a Forex company that offers MT4.)

・EA (A program for automated trading)

・The operating deposit required to run the EA

・A PC that can run 24 hours or a VPS (Virtual Private Server), where a virtual PC is hosted on a cloud server to run MT4.

・MT4 (MetaTrader 4. An account needs to be opened with a Forex company that offers MT4.)

・EA (A program for automated trading)

・The operating deposit required to run the EA

・A PC that can run 24 hours or a VPS (Virtual Private Server), where a virtual PC is hosted on a cloud server to run MT4.

Installation of MT4 and Account Login

If you open an account with a forex broker that supports MT4, you can use MT4 as provided by that forex broker. MT4 is a stand-alone type of software that needs to be installed on your computer, so you download the program file from the website of the FX company where you opened the account and install it on your computer.

Additionally, there are both demo and real accounts available. You can experience trading with virtual money by applying for a demo account. After opening a real account, you select the connection server assigned by the Forex broker, enter the password, and log in to the account.

When you deposit money into your account using the method specified by the forex broker, the funds will be reflected in your MT4 account, and you can trade.

Additionally, there are both demo and real accounts available. You can experience trading with virtual money by applying for a demo account. After opening a real account, you select the connection server assigned by the Forex broker, enter the password, and log in to the account.

When you deposit money into your account using the method specified by the forex broker, the funds will be reflected in your MT4 account, and you can trade.

How to Install EA on MT4

To set up an EA when you purchase it through GogoJungle, follow the steps below:

Firstly, download the purchased EA file from your My Page on GogoJungle. You will download a zip (compressed) file, so right-click to extract it and retrieve the file named ‘◯◯◯ (EA name)_A19GAw09 (any 8 alphanumeric characters).ex4’ from inside.

Next, launch MT4 and navigate to ‘File’ → ‘Open Data Folder’ → ‘MQL4’ → ‘Experts’ folder, and place the ex4 file inside. Once done, close MT4 and restart it. Then, go to the upper menu ‘Tools’ → ‘Options’, and under ‘Expert Advisors’, ensure ‘Allow automated trading’ and ‘Allow DLL imports’ are checked, then press OK to close.

The necessary currency pair and time frame for the correct operation of the EA are specified on the EA sales page. Refer to this information and open the chart of the correct currency pair time frame (e.g., USDJPY5M for a USD/Yen 5-minute chart).

Within the menu navigator, under ‘Expert Advisors’, you will find the EA file name you placed earlier. Click to select it, then drag & drop it directly onto the chart to load the EA. Alternatively, you can double-click the EA name to load it onto the selected chart.

If ‘Authentication Success’ appears in the upper left of the chart, the authentication has been successful. To operate the EA, you need to keep your PC running 24 hours. Therefore, either disable the automatic sleep function or host MT4 on a VPS and operate the EA.

Firstly, download the purchased EA file from your My Page on GogoJungle. You will download a zip (compressed) file, so right-click to extract it and retrieve the file named ‘◯◯◯ (EA name)_A19GAw09 (any 8 alphanumeric characters).ex4’ from inside.

Next, launch MT4 and navigate to ‘File’ → ‘Open Data Folder’ → ‘MQL4’ → ‘Experts’ folder, and place the ex4 file inside. Once done, close MT4 and restart it. Then, go to the upper menu ‘Tools’ → ‘Options’, and under ‘Expert Advisors’, ensure ‘Allow automated trading’ and ‘Allow DLL imports’ are checked, then press OK to close.

The necessary currency pair and time frame for the correct operation of the EA are specified on the EA sales page. Refer to this information and open the chart of the correct currency pair time frame (e.g., USDJPY5M for a USD/Yen 5-minute chart).

Within the menu navigator, under ‘Expert Advisors’, you will find the EA file name you placed earlier. Click to select it, then drag & drop it directly onto the chart to load the EA. Alternatively, you can double-click the EA name to load it onto the selected chart.

If ‘Authentication Success’ appears in the upper left of the chart, the authentication has been successful. To operate the EA, you need to keep your PC running 24 hours. Therefore, either disable the automatic sleep function or host MT4 on a VPS and operate the EA.

In Case You Want to Change the Account in Use

EAs from GogoJungle can be used with one real account and one demo account per EA.

If you want to use it with an account other than the authenticated one, you need to reset the registered account.

To reset the account, close the MT4 where the Web authentication is registered, then go to My Page on GogoJungle > Use > Digital Contents > the relevant EA > press the ‘Reset’ button for the registration number, and the registered account will be released.

When the account is in a reset state, using the EA with another MT4 account will register a new account.

Also, you can reset the account an unlimited number of times.

If you want to use it with an account other than the authenticated one, you need to reset the registered account.

To reset the account, close the MT4 where the Web authentication is registered, then go to My Page on GogoJungle > Use > Digital Contents > the relevant EA > press the ‘Reset’ button for the registration number, and the registered account will be released.

When the account is in a reset state, using the EA with another MT4 account will register a new account.

Also, you can reset the account an unlimited number of times.

Solutions for Errors During Web Authentication or Non-Functional Account Trading

If you encounter an error with Web authentication, or if the EA is trading on GogoJungle's forward performance page but not on your own account, there could be various reasons. For more details, please refer to the following link:

→ Items to Check When EA is Not Operating

→ Items to Check When EA is Not Operating

About the Size of Trading Lots

In Forex trading, the size of a lot is usually:

1 lot = 100,000 currency units

0.1 lot = 10,000 currency units

0.01 lot = 1,000 currency units

For USD/JPY, 1 lot would mean holding 100,000 dollars.

The margin required to hold lots is determined by the leverage set by the Forex broker.

If the leverage is 25 times, the margin required to hold 10,000 currency units of USD/JPY would be:

10000*109 (※ at a rate of 109 yen per dollar) ÷ 25 = 43,600 yen.

1 lot = 100,000 currency units

0.1 lot = 10,000 currency units

0.01 lot = 1,000 currency units

For USD/JPY, 1 lot would mean holding 100,000 dollars.

The margin required to hold lots is determined by the leverage set by the Forex broker.

If the leverage is 25 times, the margin required to hold 10,000 currency units of USD/JPY would be:

10000*109 (※ at a rate of 109 yen per dollar) ÷ 25 = 43,600 yen.

Glossary of Automated Trading

・Profit Factor: Total Profit ÷ Total Loss

・Risk-Return Ratio: Total Profit and Loss during the period ÷ Maximum Drawdown

・Maximum Drawdown: The largest unrealized loss during the operation period

・Maximum Position Number: This is the maximum number of positions that the EA can theoretically hold at the same time

・TP (Take Profit): The set profit-taking Pips (or specified amount, etc.) in the EA's settings

・SL (Stop Loss): The set maximum loss pips (or specified amount, etc.) in the EA's settings

・Trailing Stop: Instead of settling at a specified Pips, once a certain profit is made, the settlement SL is raised at a certain interval (towards the profit), maximizing the profit. It is a method of settlement.

・Risk-Reward Ratio (Payoff Ratio): Average Profit ÷ Average Loss

・Hedging: Holding both buy and sell positions simultaneously (Some FX companies also have types where hedging is not allowed)

・Risk-Return Ratio: Total Profit and Loss during the period ÷ Maximum Drawdown

・Maximum Drawdown: The largest unrealized loss during the operation period

・Maximum Position Number: This is the maximum number of positions that the EA can theoretically hold at the same time

・TP (Take Profit): The set profit-taking Pips (or specified amount, etc.) in the EA's settings

・SL (Stop Loss): The set maximum loss pips (or specified amount, etc.) in the EA's settings

・Trailing Stop: Instead of settling at a specified Pips, once a certain profit is made, the settlement SL is raised at a certain interval (towards the profit), maximizing the profit. It is a method of settlement.

・Risk-Reward Ratio (Payoff Ratio): Average Profit ÷ Average Loss

・Hedging: Holding both buy and sell positions simultaneously (Some FX companies also have types where hedging is not allowed)

Useful related pages

・How to Install MT4 EA (Expert Advisor) and Indicators

・MT4 Beginner's Guide

・Understanding System Trading Performance (Forward and Backtesting)

・Choosing Your First EA! Calculating Recommended Margin for EAs

・Comparing MT4 Accounts Based on Spread, Swap, and Execution Speed

・What is Web Authentication?

・Checklist for When Your EA Isn't Working

・MT4 Beginner's Guide

・Understanding System Trading Performance (Forward and Backtesting)

・Choosing Your First EA! Calculating Recommended Margin for EAs

・Comparing MT4 Accounts Based on Spread, Swap, and Execution Speed

・What is Web Authentication?

・Checklist for When Your EA Isn't Working