【雲海UNKAI】What is the edge with a simple rule? — Sharing the answer to your question

雲海 UNKAI about

雲海(UNKAI)─ A utility tool that takes your method to the next level

【雲海UNKAI】 What is the edge with simple rules? — Here is the answer to your questions

Recently I received very precise questions about trading rules for “雲海 UNKAI.”

I felt the contents would be helpful for those considering it, so I’ll share them here.

⸻

Question (excerpt)

After the signal lights up,when it grows, it hardly retraces and seems to extend a lot.

For example, wouldn’t a simple rule like the following yield profits?

• Entry: Signal lights up (can re-enter if same signal after stop loss)

• Settlement: Close on the opposite signal

• Stop loss: High/low of the candle before the signaling candle

Would this be effective for volatile assets like gold or Bitcoin?

⸻

Regarding 雲海, as stated on the product page and in the Investment Guide article,「The goal is to “catch the flow”, so at this stage a fully operational rule set has not been established.

However, through daily testing,

「Signal lights → Entry, opposite signal → Exit」

we have found a simple usage with a certain edge that seems advantageous.

The rule I personally adopt for testing in the Investment Navigator is as follows:

• Entry: Signal lights up

• Settlement: Opposite signal

• Stop loss: The high/low of the candle two bars before the entry, or the opposite signal

⸻

Reason for using two bars back

雲海’s signal lights when the condition is met on the “previous bar’s close,” and lights at the “opening price of the current bar.”

Therefore, if you tighten the stop loss too much, you may incur consecutive stop-outs and miss good opportunities.

So,by intentionally using two bars back as the standard, it reduces risk while enabling the potential of the signal’s extension.

⸻

Current impression

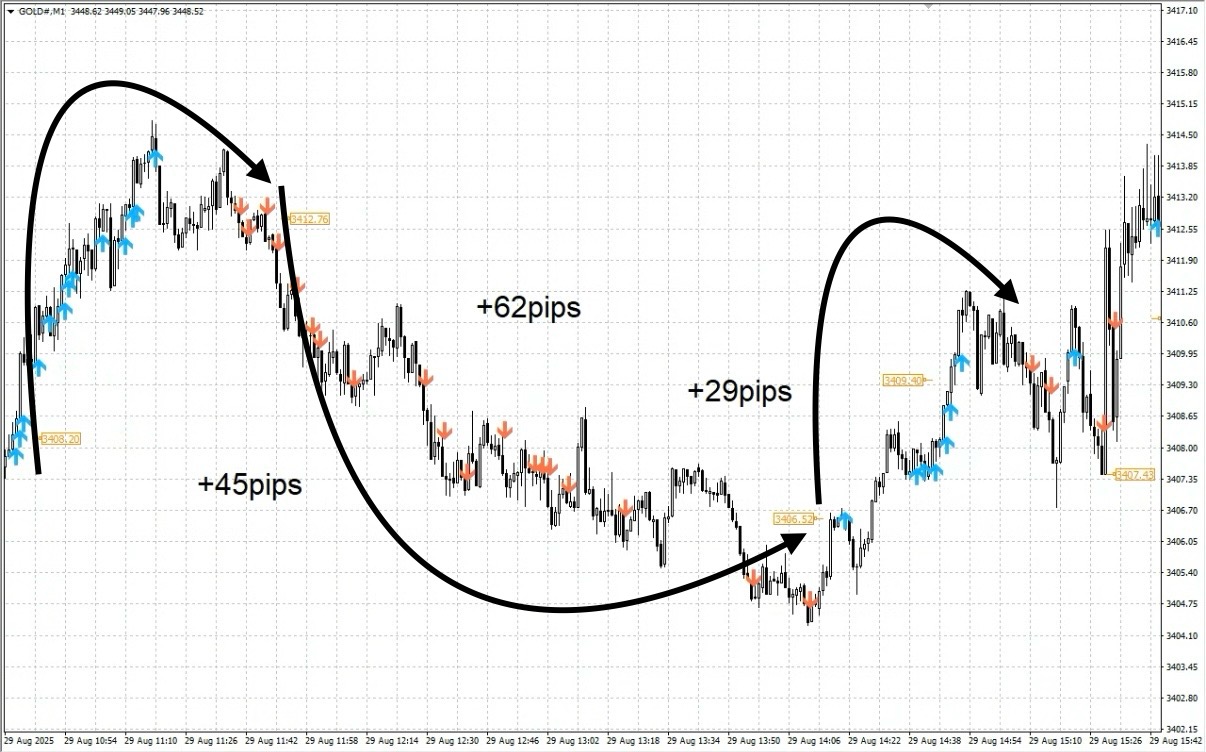

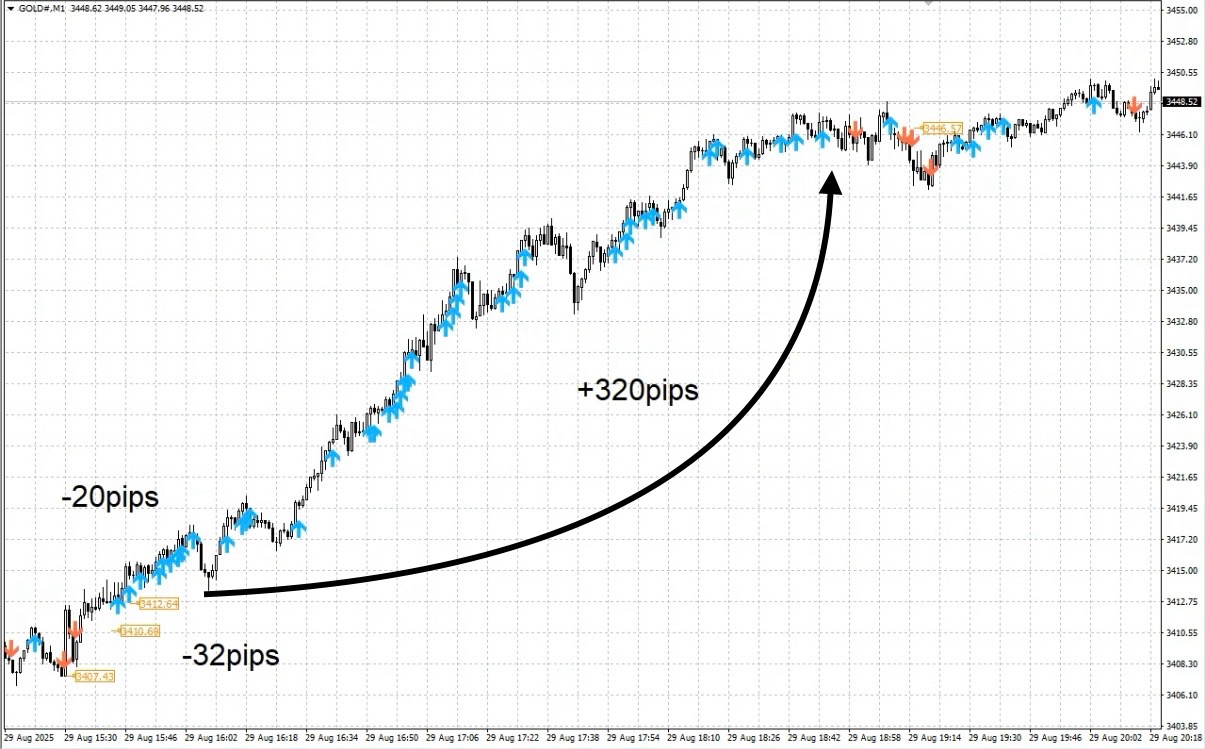

• Depending on time of day and market momentum,there are cases where the move exceeds 100 pips.

• When the opposite signal appears, the move may be around 10–20 pips, or a stop loss may occur

Thus, at present, the function is best described as a reference indicator for catching the flow.

⸻

Future prospects

If a robust rule is established through testing,

• Manualization

• Development of an MT5 version

• EAization (in the form of an entry EA similar to Leaping Between Heaven)

is under consideration.

Entry EA will be distributed as a bonus or offered as a new product depending on production cost.

Regarding MT5, we are contemplating whether to price it the same or to price it for both MT4 and MT5.

⸻

Lastly

If you have a request like “test this rule on past data,” please tell us via comments or messages.

By taking up testing as a theme, it will contribute to future updates and improvements.

In particular, in the Tokyo session’s early hours or during NY time, when momentum tends to show, 雲海’s signal characteristics are pronounced. The chart images published in Investment Navigator should be helpful, so please view them together.

On the Gold 1-minute chart, there are scenarios where the market extends even further than the moments described in Investment Navigator articles as “scary when the opposite signal appears,” and if entered as per the signal, there may be yield that could cause anxiety.

Nevertheless, what I want to emphasize is that 雲海 is not a tool to point to exact entries.It is a tool to visually reflect the market flow. Instead of relying solely on signals, please use it in conjunction with your own rules as an indicator to confirm momentum. It will be a powerful tool if used as a supplementary aid without arrogance.

Key point, after you decide your own rules, incorporate 雲海 in a way that supports those rules.

By doing so, you can visually confirm the direction of momentum and add extra confidence to trades.

(Note) It is not necessarily recommended to use 雲海 together with the Sky Between Heaven, but during review after trading, you may judge things like

“Was it good to aim for the sky zone?”

“There are many signals, so I should be mindful of the sky zone.”

“There are few signals, so I should settle in hovering or mid-air zones.”

These judgments become easier.

The color-coding of zones helps reduce cognitive load, which is a big advantage.

雲海 × Rules compatibility

For example

• If used with a trend-following rulethe blue arrows (upward momentum) and red arrows (downward momentum) in 雲海 can serve as “support after direction confirmation,” making it easier to avoid unnecessary counter-trend trades..

• If used with zone or line-based rulescombining it with momentum confirmation after reaching a zone makes it straightforward to judge whether “this is a good place to enter.”.

• If logic focuses on small losses, big gains, trading when arrows align can help select only the times when the momentum grows.

雲海 is not intended for entering exactly on signals.

Rather, relying on signals alone can increase the risks of “buying at highs or selling at lows.”

雲海’s role is to visually reflect the market flow.

• When more of the top blue arrows appear, momentum is strengthening upward

• When more of the bottom red arrows appear, momentum is strengthening downward

This design helps you intuitively sense the direction of momentum.

雲海 is not a pinpoint entry signal tool.

It is designed as a tool to “confirm the flow.”

We’ve compiled a short video showing how the signals appear, so please take a look.

⸻

■ How the signals work

• On a confirm/solid bar basis

• Blue arrow (upward):Displayed when the prior momentum is upward

• Red arrow (downward)Displayed when the prior momentum is downward

If the blue arrow’s bar is a bullish candle, it indicates “the range could have been captured”

If the red arrow’s bar is a bearish candle, it visualizes that you could have taken profits in the downward direction.

• No repaint

Once a signal appears, it does not disappear. Even if price moves against you, it remains, making it easy to review and test.

• Notification features

Alerts, push notifications, and email notices reduce chart monitoring effort.

EA that implements breakout strategy

Sky Between Heaven Entry EA is here

Entry EA manual is complete

“Sky Between Heaven” entrusts the entry to an automatic entry EA, while the trader focuses on monitoring after entry and executing the exit rules.

The EA continuously monitors the chart, and can enter at the exact moment of breakout without missing it.

This eliminates the stress of staying in front of the screen before entry and the anxiety of missing the timing.

ADX, ATR, SMA and other filters are built-in.

As a purchase bonus, this EA is available to buyers.

Sky Between Heaven main story here

For those who already have solid rules—雲海 UNKAI will further strengthen your method.

Why publish negative results?

Investment Navigator+ deliberately publishes negative results without hiding them.

The reason is that “trading never always wins.”

Rather, by recording losses, you can analyze what situations cause losses and make your logic more robust.

Instead of focusing on each win or loss,

1 week or 1 month span where the total balance is positive is what matters most.

• “I’m glad I won today”

• “I’m anxious today because I lost”

To reduce these emotional swings, let the EA handle entries, and let humans focus on “exiting strictly by the rules.”

“I want to win”This mindset is the prerequisite for long-term profit.

Stability gained by following the rules

A common reason traders incur large losses is the urge to win leads to breaking the rules.

Sky Between Heaven is designed so that

•

• Entry is fully automated via EAExits follow fixed, rule-based conditions

By mechanically following the rules, win rate and risk-reward become naturally stable.

⸻

There are countless technical analysis methods: moving averages, RSI, MACD, stochastic, Parabolic SAR, ADX, ATR, CCI, trendlines, channels, Fibonacci retracements and expansions, Ichimoku, volume, support/resistance lines—oscillator indicators abound.

There is no one correct method; what matters isThis gives you confidence that can withstand market conditions and a sense of expectancy.

⸻

We are conducting tests using a “maximum profit realization” rule with Sky Between Heaven, and

there are times when price moves to break-even after entries, but staying by the rules allows you to calmly seize the next opportunity.

Even in moments when you could have captured a larger gain, following the rules and exiting at break-even helps maintain overall positive results.

What matters in trading is “reproducibility,” not “win rate.”

Many traders chase win rate, but even with 50% win rate, if risk-reward is favorable, funds can grow.

The important thing is to have a rule with reproducible results, so that anyone can achieve the same outcome.

Sky Between Heaven enables Entry with EA → mechanical stop loss → fixed take profit.

Carrying out this sequence with zero emotion makes trading a viable business.

⸻

Strategy aimed at overall profit

Focusing on daily wins and losses is risky.

Viewed over a week or a month, you can tolerate some negative days as long as the overall balance is positive.

EA has no emotions, making it ideal for long-term capital management.

By operating under the vision of “earning” rather than merely “winning,” the capital growth curve tends to stabilize.

If you’re interested in Sky Between Heaven, you can join the online community

In the online community, specific trading logic cannot be described, but you can join a “chart review community” that uses Sky Between Heaven.

To those interested in Sky Between Heaven

In short-term trading, lay a foundation to enable decisions by rule rather than by hesitation—

that is the core philosophy of Sky Between Heaven.

Free materials here:

▶︎ Download “Trail to the Gap”

In “Trail to the Gap,” we explain more clearly the decision criteria for when you can actually trade in certain situations.

It clarifies the entry points and how to choose zones beyond what the Sky Between Heaven sales page conveys.

Even beginners can follow along easily, so if you’re curious, please also check that out.

If you’re interested, please first receive the free material “Trail to the Gap.”

From there, your first steps into your own Gap begin.

“Should I enter this chart?”

When you’re unsure,the guidance is to switch to thinking in terms of rules rather than intuition.