【Sea of Clouds UNKAI】NY time −2pips result — Sea of Clouds UNKAI is not a steady “drip” type, but a “boom” type

UNKAi CLOUD SEA UNKAI About

【 Cloud Sea 】 A thread of light that dyes the white clouds

Cloud Sea (UNKAI)─ A supplementary tool that elevates your method to the next level

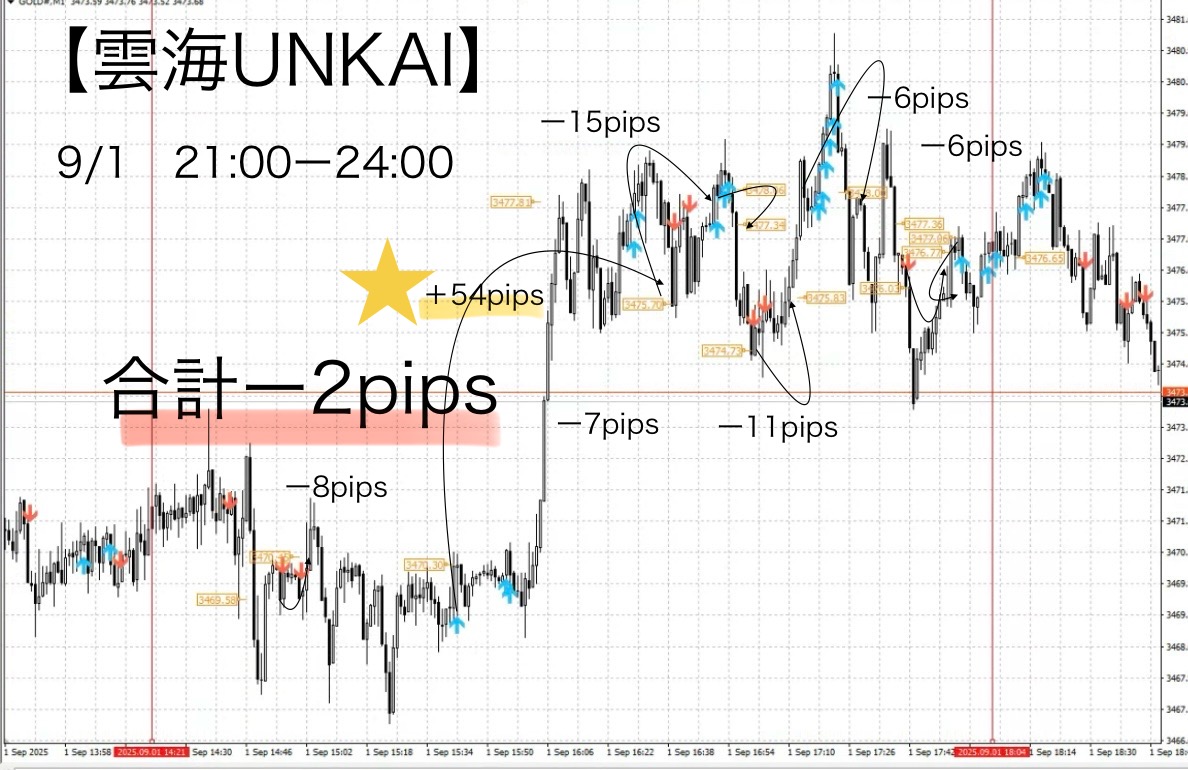

- Total P/L:−2 pips

Now, what Cloud Sea considers most important is to have a criterion like 「where to take profit when it grows briefly」

In the sky’s gap, we could clearly set target zones or lines in advance, but Cloud Sea starts from validation with only the “Cloud Sea indicator alone” and “no filter.”

First, by conducting forward testing on past charts for one week,

• to see whether the signal alone shows a certain edge

• or even with rules, practical use is difficult

to grasp the rough sense of it.

⸻

Verification conditions

• Subject: GOLD

• Timeframe: 1 minute

• Period: 09/01 21:00–24:00 (New York time)

• Rules: 「Sign → IN / Opposite sign → OUT」「Stop-loss conditions 1–2 items max」

⸻

Verification results

• Number of trades: 8

• Take profits: 1

• Stop losses: 7

• Total take profit: +54 pips

• Total loss: −56 pips

• Net profit: −2 pips

• Win rate: 12.5% (1 win / 8 trades)

• PF (Profit Factor): 0.96

⸻

Discussion

This time, there was 1 take profit out of 8 trades, but one trade gained 54 pips with a good risk-reward, making it a solid validation.

After that, losses accumulated and the result became −2 pips.

However, this is a valuable result that confirms that even if you trade exactly as the signals, you won’t always be positive.

The major difference from Sky’s Gap is that Cloud Sea tends to ride larger trends with a big thrust rather than steadily accumulating and taking profits at a good point one by one.

In short, there is a risk of being swayed by short-term noise, but the power when riding a trend is strong—this was a finding from the test.

⸻

Future directions

Investing Navigator posted daily in July and August, but

• Writing articles about Sky’s Gap

• New Cloud Sea verifications

• Course updates

• Q&A with purchasers

• Management, family, real trades

It is difficult to do all of these at once, so going forward I plan to focus on “Cloud Sea signal verification and post past verification articles to Investing Navigator.”

Although it is still in the verification stage, my goal is to eventually build a simple Cloud Sea rule that can be used in real trades as well.

I would be grateful for your warm watchful support.

From now on, Sky’s Gap and Cloud Sea, if there are requests like “Please test this currency pair,” or “Please review this time frame,” feel free to

leave a message or community post to tell me.

On GOLD 1-minute, there are markets that extend beyond what I felt in the Investing Navigator article, and if you had entered according to the signal, you might see even larger unrealized profits, making you uneasy.

Nevertheless, I want to emphasize that Cloud Sea is a tool that “maps the market flow.” It is not a sign tool that dictates exact entries. Instead, use it as an indicator to confirm momentum in line with your own rules, and apply it as a supportive tool without becoming complacent.

The key is to adopt your own rule set, and then incorporate Cloud Sea to reinforce that rule.

By doing so, you can visually confirm the direction of momentum and add further confidence to your trades.

(Note) It is not necessarily recommended to use it together with Sky’s Gap, but after a trade, you can decide, for example,

“Was it good to target the Sky Zone?”

“There are many signals, so let’s be aware of Sky Zone.”

“There are few signals, so I’ll settle in the floating or mid-air zones.”

These judgments become easier.

Color-coding of zones helps reduce mental workload

Cloud Sea × Compatibility with rules

For example

• Rule that follows the trendWhen combined, Cloud Sea’s blue arrows (upward momentum) and red arrows (downward momentum) serve as a “momentum confirmation aid,” helping avoid needless counter-trend trades.

• Rules using zones or linesWhen combined, confirming momentum after zone reach makes it simple to judge “Is this a place to enter?”This can be judged simply.

• Logic focusing on small loss, big gainIn cases where arrows continue, trading then makes it easier to pick only when it grows.

Cloud Sea is not designed for entering strictly on signals.

Rather, relying solely on signals increases the risk of “buying high and selling low.”

Cloud Sea’s role is to visually reflect the market flow.

• When more blue arrows appear above, the upward strength is increasing

• When more red arrows appear below, the downward strength is increasing

This design makes it intuitive to sense the momentum direction.

Cloud Sea is not a sign tool to pinpoint exact entries.

“A tool to confirm the trend” is how it is designed.

There is a short video summarizing how the signals appear, please take a look.

⸻

■ How the signals work

•

• Blue arrow (up arrow):Displayed when the previous momentum is rising

• Red arrow (down arrow)Displayed when the previous momentum is falling

If the bar with a blue arrow is a bullish candle, it means the range was captured

If the bar with a red arrow is a bearish candle, it means you could have taken profit on the downside, visualized as a retrospective result.

• No repaint

Once a signal appears, it does not disappear. It remains even if price moves against, making it easy to review and test.

• Notification features

EA that drives the breakout strategy

Here is the Sky’s Gap Entry EA

EA with complete entry manual

“Sky’s Gap” is a simple strategy where entry is automated by an Entry EA, while traders focus on monitoring after entry and executing exit rules.

The EA continuously monitors the chart and can enter precisely at the breakout moment without missing it.

This eliminates the stress of staring at the screen before entry and the anxiety of missing timing.

ADX, ATR, SMA and other filters are built in.

As a purchase bonus, this EA will be made available to purchasers.

【 Cloud Sea 】 The light that dyes white clouds is here

For those who already have solid rules—Cloud Sea UNKAI will further strengthen your method.

Why publish negative results?

Investing Navigator+ intentionally publishes negative results as well.

The reason is that “trading cannot always win.”

Rather, by recording losses, you can analyze under what conditions you lose and strengthen the logic.

Instead of focusing on every win or loss,

1 week, 1 month, and other spans where the total balance remains positive is most important.

• “Happy because today I won”

• “Worried because today I lost”

To reduce these emotional swings, let the EA handle entries and have humans focus on “settling according to the rules.”

“Want to win”—This mindset is a prerequisite for long-term gains.

Stability gained by following the rules

The common trait of those who lose big in trading is a strong urge to win that leads to breaking the rules

•

•

⸻

There are countless techniques in technical analysis, including moving averages, RSI, MACD, Stochastics, Parabolic SAR, ADX, ATR, CCI, trendlines and channels, Fibonacci retracements and expansions, Ichimoku, volume, and support/resistance lines—there is no single correct method.

What matters is to pick one personal rule you believe in and repeatedly verify it based on evidence.

⸻

We verify the Sky’s Gap with a “max profit” type rule; at times there are situations where break-even occurs, but by adhering to the rule, you can calmly seize the next opportunity.

Even in scenarios where you could have captured more, sticking to the rule and exiting at break-even keeps the overall total positive—this is a strength of the strategy.

Trading is not about “win rate” but about “reproducibility”.

Most traders worry about win rate, but

a 50% win rate with a good risk-reward can grow capital.

What matters is having rules that are reproducible, so anyone can achieve the same results.

Sky’s Gap is

•

⸻

Total-profit-focused strategy

Focusing on daily gains and losses is risky.

For example, looked over a week or a month, you can tolerate some negative days as long as the total remains positive.

Given that the EA has no emotions, it is ideal for long-term capital management.

Operating the rules with a “want to earn” mindset rather than “want to win” helps stabilize the capital growth curve.

If you’re interested in Sky’s Gap, you’ll be invited to the online community

Join the online community here

Within the online community, exact trading logic cannot be explained, but you can join a “chart critique community” using Sky’s Gap.

To those who are interested in Sky’s Gap

Build a foundation to judge rules confidently for short-term trades—

that is the core philosophy of Sky’s Gap.

Free materials here:

In ‘Path to the Gap,’ you’ll learn in more accessible terms when you can actually trade,

and the judgment criteria are explained more clearly.

It details specific entry points and zone selection that could not be fully conveyed on the Sky’s Gap sales page, with diagrams and case-by-case explanations.

Even beginners can reproduce it easily, so if you’re curious, please make use of it.

If you’re interested, please first receive the free material ‘Path to the Gap.’

From there, your first step into the Gap begins.

“Will I enter this chart?”

When you’re unsure, shift to thinking in terms of rules rather than intuition.