【Episode 102】 London Time | +14 pips — In the midst of small fluctuations, not winning but not losing, ending this week

Will you add this chart?

【102nd Edition】London Time|+14pips──In the midst of small price movements, not winning yet not losing, closing the week

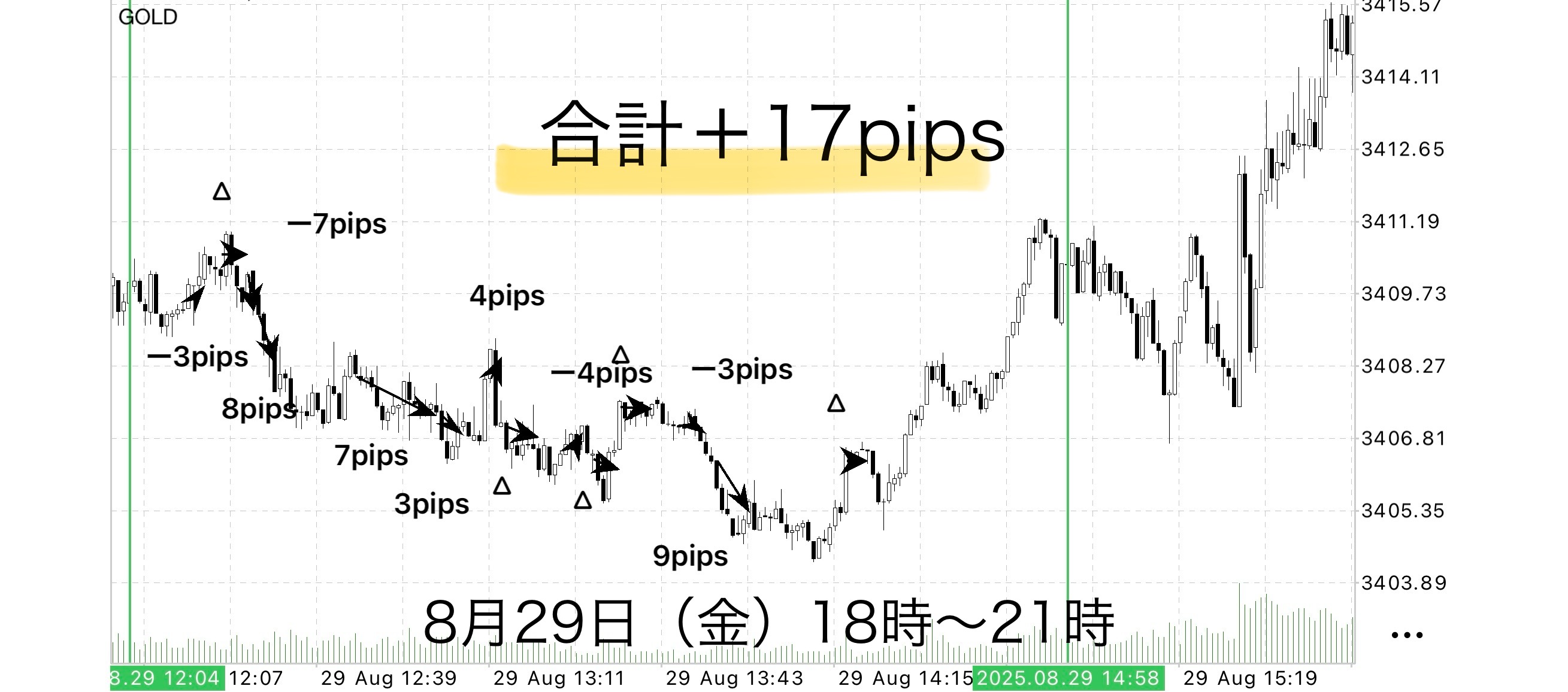

Profit:+17pips

1 lot:¥20,300/0.1 lot:¥2,030

This week’s London time verification has come to an end.

In Tokyo time there were days with large price swings, but during London time there were many moments where small price movements kept me on edge, and I couldn’t extend as much as I hoped.

Even so, by consistently adhering to the rule “stop-loss fixed at a maximum −10 pips,” I have avoided inflating losses unnecessarily and finished the week positively.

What remains important is“focusing on adhering to the rules and accumulating results day by day”I reaffirm this.

Friday, August 29, 2025, 18:00–21:00

⸻

Trading results (18:00–21:00)

• Total trades: 14

• Profit-taking successes: 5

• Breakeven closures: 5

• Stop losses: 4 (all within −10 pips)

• Total gained: +31pips

• Total loss: −17pips

• Net profit: +14pips

• Win rate: 35%(5 wins/14 trades)

• PF (Profit Factor): 1.18

Earnings (USD/JPY converted at 145)

• 1 lot → +¥20,300

• 0.1 lot → +¥2,030

Discussion

In the London session’s early hours,the market moved up and down in small ranges.

As I repeated entries, take-profits and breakevens centered on a few pips, and there were many instances where a large trend did not materialize.

• Small price moves such as −3pips, −7pips, +8pips continued one after another.

• In the middle, developments such as −4pips, +3pips, +9pips continued with “loss small, win small.”

• There were moments when the market rose at the end, but they were outside the testing period and not part of the trades.

Therefore, the result was a day of “accumulating small trades,” with no large price swings.

If you have the ability to extract entry points by drawing inspiration from the “Sky’s Between” and build your own absolute rules, you may be able to realize a form of “lose less, win bigger”.

I myself also constantly ask, “How can I take bigger profits?”, but this thinking is limited to time outside trading. Because once you hold a position, you may fall into the same hesitation that leads to losses.

That’s why I believe it is essential, whether discretionary or not, to predefine the rules, verify them, and then challenge real trading.

Trading is not something you “think about on the spot,” but something that is decided "in the preparation phase." And the things you should think about should be done outside trading time, while during actual trading you simply follow the rules.

Whether you are able to maintain this approach may determine whether you can continue long-term.

That’s my belief, so if you resonate, I’d be glad if you start by referring to the Investment Navi articles.

EA executes breakout strategies

Complete entry EA manual

“Sky’s Between” delegates entries to an automated entry EA, and the trader simply monitors after entry and executes the exit rules—a simple strategy.

The EA continuously monitors charts and can enter instantly at breakouts without missing them.

This eliminates the stress of watching the screen before entry and the anxiety of missing timing.

ADX, ATR, SMA, and other filters included.

As a bonus for purchasers, this EA is available to use.

【 Sea of Clouds 】 The light that dyes the white clouds

To those who already have solid rules — UNKAI of the Sea of Clouds will further strengthen your methods.

Why publish negative results?

Investment Navi+ publishes negative results openly, not hiding them.

The reason is that “trading cannot always win.”

Rather, recording losses helps analyze what conditions cause losses and makes the logic more robust.

Instead of obsessing over each win or loss,

Over a week or a month, as long as the total is positivethe overall result is what matters.”.

• “I’m happy because I won today.”

• “I’m anxious because I lost today.”

To remove this emotional rollercoaster, let the EA handle entriesand have humans focus on “exiting according to the rules.”.

“Want to win” instead of “Want to earn” —this mindset is the foundation for long-term profitability.

Stability from following the rules

A common trait of those who lose big in trading is the urge to win causes rule-breaking

For example, delaying a closure to “let it run a bit longer” or “watch a little longer” can erase profits in an instant.

Sky’s Between provides:

• Entries are fully automated by EA

• Exits are fixed by a rule-based condition

This minimizes human intervention and eliminates hesitation.

By mechanically following the rules, win rate and risk-reward naturally stabilize.

⸻

There are countless techniques in technical analysis, such as moving averages, RSI, MACD, Stochastics, Parabolic SAR, ADX, ATR, CCI, trendlines and channels, Fibonacci retracements and expansions, Ichimoku, volume, and support/resistance lines—

there is no single correct method; what matters isto decide on one’s own rule that “feels right” and to test it through verification. In doing so you gain a “confidence that works in the market” and a sense of “expectation building.”

⸻

We will verify with the “maximum profit” rule in Sky’s Between,

there are times when breakeven closures increase, but by following the rules you can calmly seize the next opportunity.

Even in situations where you think “you could have taken more,”

because you closed at breakeven according to the rules, you ultimately keep a positive total result.That is the strength of this strategy.

What matters in trading is “Win rate” not “Reproducibility”

Many traders worry about “win rate,” but

even with a 50% win rate, capital can grow if the risk-reward (RR) is favorable

What matters is having a rule that is“reproducible” so that anyone can achieve the same results.

Sky’s Between is

•EA entry → mechanical stop → fixed take profit

focusing on establishing trading as a business mindset.

⸻

Strategy aimed at overall profit

Focusing on daily gains and losses is risky.

For example, viewed over a week or month, if there are some negative days but the total is positive, that’s OK.

EA, devoid of emotion, is ideal for long-term capital management.

Operating rules with the vision of “earn, not just win” helps the capital growth curve to become more stable.

If you’re interested in Sky’s Between, you are invited to join the online community

Specific trading logic cannot be explained inside the online community, but

you can participate in a “Chart Review Community” using Sky’s Between.

For those interested in Sky’s Between

In short-term trading, laying the groundwork to make decisions by rules without hesitation—

that is the core philosophy of Sky’s Between.

Free materials here:

▶︎ Download ‘Trace to the Between’

In ‘Trace to the Between,’ you’ll learn the criteria for when to actually trade and how to decide them more clearly.

This explains in more detail the entry points and zone selection that could not be fully conveyed on the Sky’s Between sales page.

Even first-time readers will find it easy to reproduce,

so if you’re curious, please make use of it as well.

If you’re interested, first receive the free material ‘Trace to the Between’.

From there, your first step in between begins.

“Will you add this chart?”

When you’re unsure,I hope this helps switch your thinking from “intuition” to judging by rules.