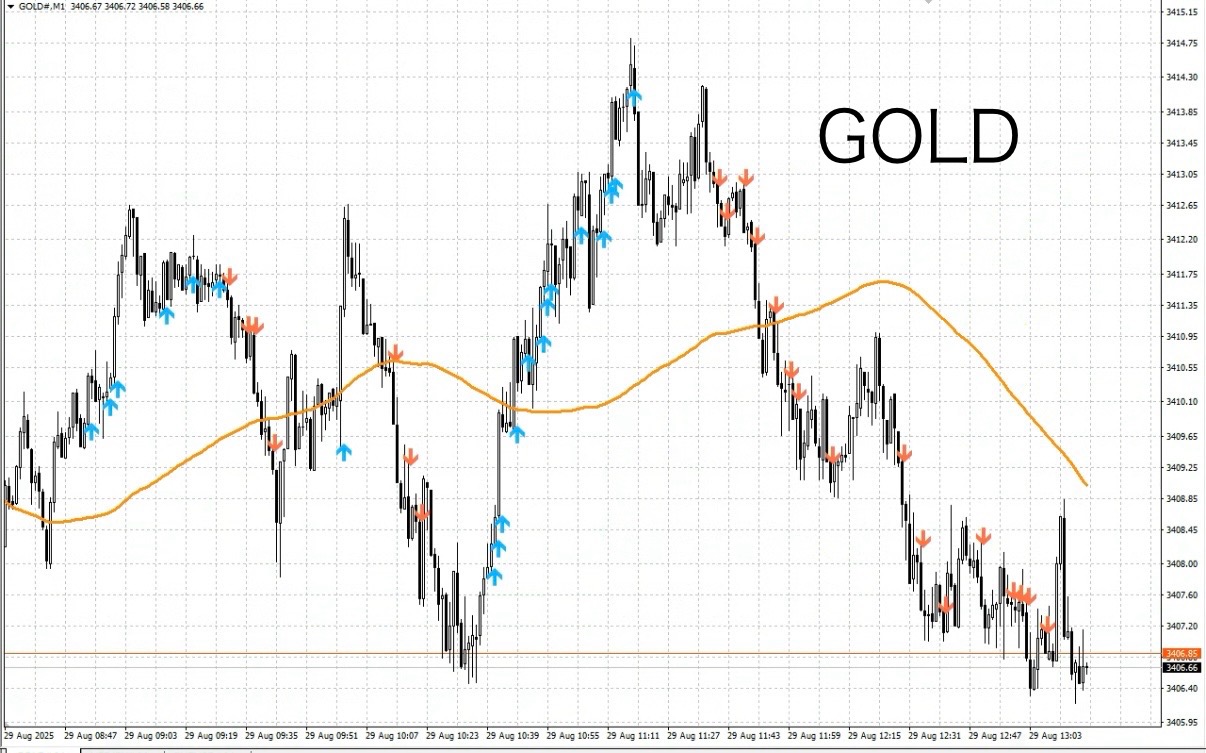

【Cloud Sea UNKAI】Example: 8/29 19:30/Copy of GOLD 1-minute chart

UNKAI Cloud Sea About

【 Cloud Sea 】 A thread of light dyeing the white clouds

Cloud Sea (UNKAI)─An auxiliary tool that takes your method to the next level

⸻

As of Friday, August 29, 19:30, GOLD1 This chart applies Cloud Sea UNKAI to a 1-minute chart.

Note: shows 100SMA

The point isto establish your own rules and, in support of those rules, to incorporate Cloud Sea.This makes it easier to visually confirm the momentum direction and adds confidence to trading.

(Supplement) While not necessarily recommending using it together, in post-trade reviews you might think:

“Did I aim for the sky zone here and do well?”

“There are many signals, so I’ll be mindful of the sky zone.”

“There are few signals, so I’ll close in the float/air zones.”

Such judgments become easier.

Color-coding of zones helps reduce cognitive load, which is a major benefit.

Cloud Sea × Compatibility with Rules

For example

• When combined with trend-following rulesthe blue arrows (upward momentum) and red arrows (downward momentum) of Cloud Sea serve as a “directional confirmation boost,” helping to avoid unnecessary counter-trend trades.

• Rules using zones or lines When combined, you can simply determine “Is this a good spot to enter?” by confirming momentum after reaching a zone.This makes it easy to decide if entry is appropriate.

• Logic focusing on small losses, big gains In such cases, trading when arrows continue helps you pick only the moments that “move” and ride them.

Cloud Sea is not intended to be a sign-based entry tool.

Rather, relying solely on signs increases the risk of “buying at a high price or selling at a low price.”

The role of Cloud Sea is to visually reflect market momentum.

• When the blue arrows at the top increase, “the upward force is strengthening”

• When the red arrows at the bottom increase, “the downward force is strengthening”

Designed so you can intuitively sense the direction of momentum.

Cloud Sea is not a sign that directs exact entries.

It is designed as a tool to help you check the flow.

We have condensed the signs into a short video, please take a look.

⸻

■ How the signs work

•

• Blue arrow (up arrow):Shown when the prior momentum was rising

• Red arrow (down arrow)Shown when the prior momentum was falling

If a candle that shows a blue arrow closes as a bullish candle, it means the price range was captured

If a candle that shows a red arrow closes as a bearish candle, it visualizes that you could have realized profits on the downside.

•

Once a sign appears, it does not disappear. It remains even if price moves against you, making it easy to review and verify.

•

■ How to use it

• To check the flow and assist in making decisions according to your rules

• Don’t take signs at face value; use them to understand how the power of up and down momentum is changingas material for your understanding

• For reviewing past charts

Cloud Sea is not about teaching you how to win directly; it is a tool to reinforce your own methods and rules.

⸻

■ Cautions

Cloud Sea is not designed for standalone use.

We do not recommend trading strictly according to signs.

Always use it in combination with your own rules and methods.

Cloud Sea UNKAI is here

E-books, Introduction to the Sky’s Narrow Gap

EA-driven Breakout Strategy

“The Sky’s Narrow Gap” is a simple strategy where entry is automated by an EA, and traders focus on monitoring after entry and executing exit rules.

The EA can continuously monitor charts and enter accurately the moment of breakout.This eliminates the stress of staring at the screen before entry and the anxiety of missing timing.

Filters such as ADX, ATR, SMA are also included.

As a purchaser perk, this EA becomes usable.

Why publish negative results?

Investment Navigator+ intentionally publishes negative results without hiding them.

The reason is that “trading is not always winning.”

Rather, by recording losses you can analyze under what conditions you lose and strengthen the logic.

Instead of focusing on every win/loss,

over a span of a week or a month, what matters is that the total result is positive,” which is most important. This is how profits accumulate

• “Today I won, so I’m happy.”

• “Today I lost, so I’m anxious.”

To reduce these emotional swings, entrust entries to the EA and let humans focus on “exiting according to the rules.”

“Want to win”“But to earn”── this mindset is the fundamental prerequisite for long-term profitability.

Stability gained by following the rules

“the urge to win” causes rule-breaking

•

•

⸻

There are countless technical indicators and methods in technical analysis, such as moving averages, RSI, MACD, Stochastics, Parabolic SAR, ADX, ATR, CCI, trendlines and channels, Fibonacci retracements and expansions, Ichimoku, volume, and support/resistance lines—even oscillator-type indicators—the list is long.

There is no single “correct” method;what matters isfinding one own rule that you believe in and testing it through actual verification.This way you gain a sense of “confidence that works in the market” and the feeling of “waiting for favorable expectations to accumulate.”

⸻

In Sky’s Narrow Gap, we validate using the “maximum profit realization” rule,

there are times when many positions are closed at breakeven, but adhering to the rules allows you to calmly seize the next opportunity.

Even in cases where you could have earned more,

the strength of the strategy is that you can maintain overall positive results by following the rules.

What matters in trading is not “win rate” but “reproducibility.”

Many traders worry about win rate, but

The important thing is to have a rule that is reproducible, so that anyone can achieve the same result.

Sky’s Narrow Gap is thus

•

⟲

A strategy aimed at overall positive returns

Be careful not to focus on daily wins or losses.

For example, over a week or month, if the total result is positive, it is okay even if some days were negative.

Because the EA has no emotions, it is ideal for long-term capital management.

By operating the rules with the vision of “earning” rather than “winning,” the capital growth curve tends to stabilize.

If you are interested in Sky’s Narrow Gap / Cloud Sea, you are invited to join our online community

Join the online community here

In the online community, detailed trading logic cannot be explained, but

you can join a “chart critique community” that uses Sky’s Narrow Gap.

To those interested in Sky’s Narrow Gap

We aim to lay the foundation for making decisions by rules without hesitation in short-term trading—

that is the basic philosophy of Sky’s Narrow Gap.

Free materials are here:

▶︎ Download 'The Path to the Gap'

In 'The Path to the Gap,' you’ll learn what actual situations you can trade in and how to judge them more clearly.

The sales page for "Sky’s Narrow Gap" could not convey everything,

and it also explains more concrete entry points and zone selection with diagrams and case-by-case notes.

Even beginners can reproduce it, so if you’re curious, please also use that resource.

If you’re interested, please first receive the free material 'The Path to the Gap'.

From there, your path into the gap begins.

“Should I enter this chart?”

When you’re unsure,It’s helpful to switch to thinking “judge by rules, not by feel.”