This week's Pound/yen was a simple market, wasn't it?

This weekthe pound-yen had a simple market, right?

“No no, it was tough!” “I got wiped out, a big loss,”

“I learned the dangers of a deadly currency” “I never want to touch pound-yen again”

are some voices you might hear.

It’s not just that I personally say it’s simple; in the market world, this is the kind of move that’s considered simple.

Market moves can be broadly divided into two types.

Trend and range movements. (We can count three: uptrend, downtrend, and range)

And,the easy one (the easy to take) is the trend movement.

When a trend is present, it’s easier to take advantage of the market.

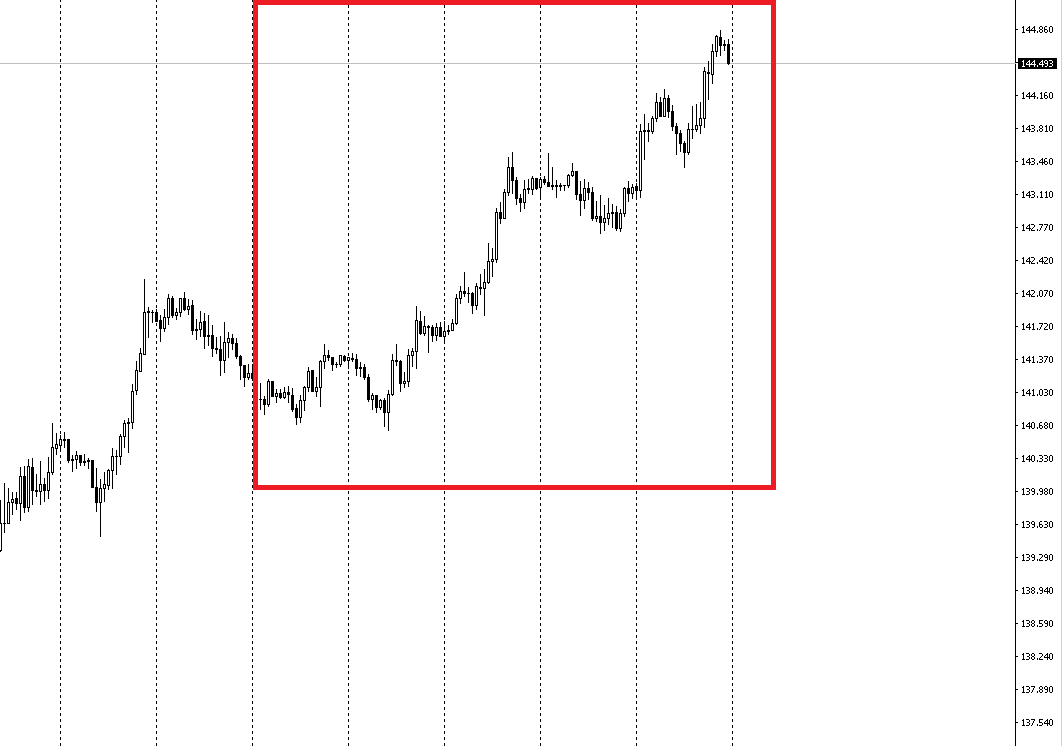

Pound-yen 4-hour chartThis week’s movement is the red-framed part

Pound-yen 1-hour chart

It is an uptrend.

The uptrend has been continuing for a while.

Since a solid trend is clearly present, this is an easy movement, an easy move to take.

For those who say trends are difficult,it means the market basics are not in place.

People who are losing need first the correct knowledge, the correct understanding.

It’s not that the market is difficult and that caused the losses,the losses come from you not having the basics in place, you need the correct recognition.

It may be hard to hear for those losing, but if you blame market moves or the currency itself for your losses, you won’t become able to win.

The path of a crude advanced trader is to know one’s own clumsiness and take the first step

Slam Dunk: Coach Anzai

In trends and ranges, trends are easier.

If you’re losing badly with that easy movement, you’re quite unskilled.

The more you’re losing, the more you’ll feel that ranges are easier than trends.

Characteristics of those who are losing:inability to cut losses, contrarian thinking.

With a range, even if you can’t cut losses and endure, you can recover and survive.

If you are buying while it’s rising (or selling against the trend) in a range, the trend won’t continue, so you’ll gain from the range.

That’s why ranges feel easier.

However, you must recognize that this is a wrong method.

“Enduring without cutting losses” is a wrong approach.

To say it is wrong means you won’t survive.

Those who survive and become profitable traders are those who can cut losses properly.

Nikkei Money magazine conducts annual surveys of individual investors.

One result that consistently appears each year is that high-return investors have “a loss-cutting rule and they strictly follow it.”

Successful traders are trend-followers.

There is a famous saying.

The trend is your friend

George Soros, American investor

Let’s position according to the trend. Do not go against the trend.

Pound-yen has been in an uptrend for a while, so taking a long position is basic.

If you have the basics, if it continues rising through the week, simply buying and holding should yield a profit.

That’s how easy it was.

There are many methods, like day trading for one day, swing trading held for a few days, entry timing, etc., but taking positions in alignment with the trend is fundamental.

Summary of this time

Market moves have trends and ranges.

It’s easier when a trend is present.

Trend is your friend

Take positions aligned with the trend.

Do not blame losses on market moves or the currency.

Accept that 100% the cause is yourself.

Recognize that losses happen because you are not yet skilled and lack fundamentals, and work on improving yourself.

Path to becoming an advanced trader who’s not clumsy is to know one’s own clumsiness

Continuing the same thing while losing, hoping for a different result is odd.

If you keep doing the same thing, you’ll receive the same result.

Those who win do what it takes to win and obtain winning results.

Those who lose do what leads to losing results.

It’s the obvious cause-and-effect of outcomes.

I’m on Twitter:https://twitter.com/takashipyo

I post trading videos:Trading that turned 100,000 into 1,000,000

Ta-kashi Kirakira FXtrader series

Winning isn’t by chance…!

Those who win are winning as they should…!

I had been complacent…!

It hadn’t happened at all…

The path to winning…

Without building the power to win

You only fight aimlessly

accumulating losses

Of course… losing is natural

To “win”

is the extension of more concrete actions toward a secure future…

inevitable… a natural thing indeed!