【雲海UNKAI】─A supplementary tool to elevate your technique to the next level

UNKAIS SKY SEA About

Coming Soon

When you keep trading, everyone hesitates at least once.

“Is the current market going up or down?”

Until now,I traded by blindly following grid EA and signal tools, and I once incurred a loss of nearly 2 million yen.

From that painful experience I learned thatit is important not to rely entirely on signals or EAs, but to have your own rules.

Among such circumstances, for users of “Tenku no Kegarama” (Sky’s Gap),

“I have become able to trade while following my rules.

If possible,I would like a sign tool with even better visibility”

We received such feedback.

At first I hesitated.

The reason is that I had experience of large losses by blindly trusting signs in the past.

So I honestly told them.

“Please try not to trade strictly according to signals as much as possible. It’s fine to create, but it’s not a tool that guarantees entries; please use it as an auxiliary tool that reflects the market flow.”

After sharing this, with their understanding we proceeded with development.

The characteristic of UNKAIS SKY SEA is simple.

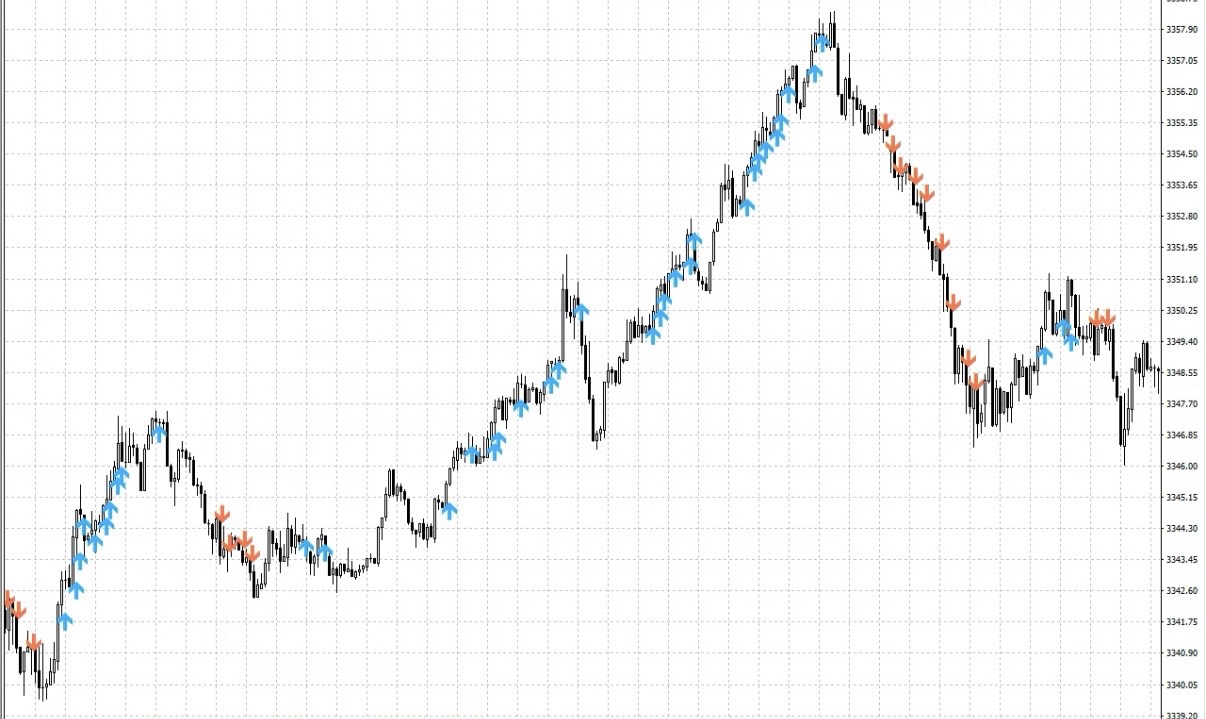

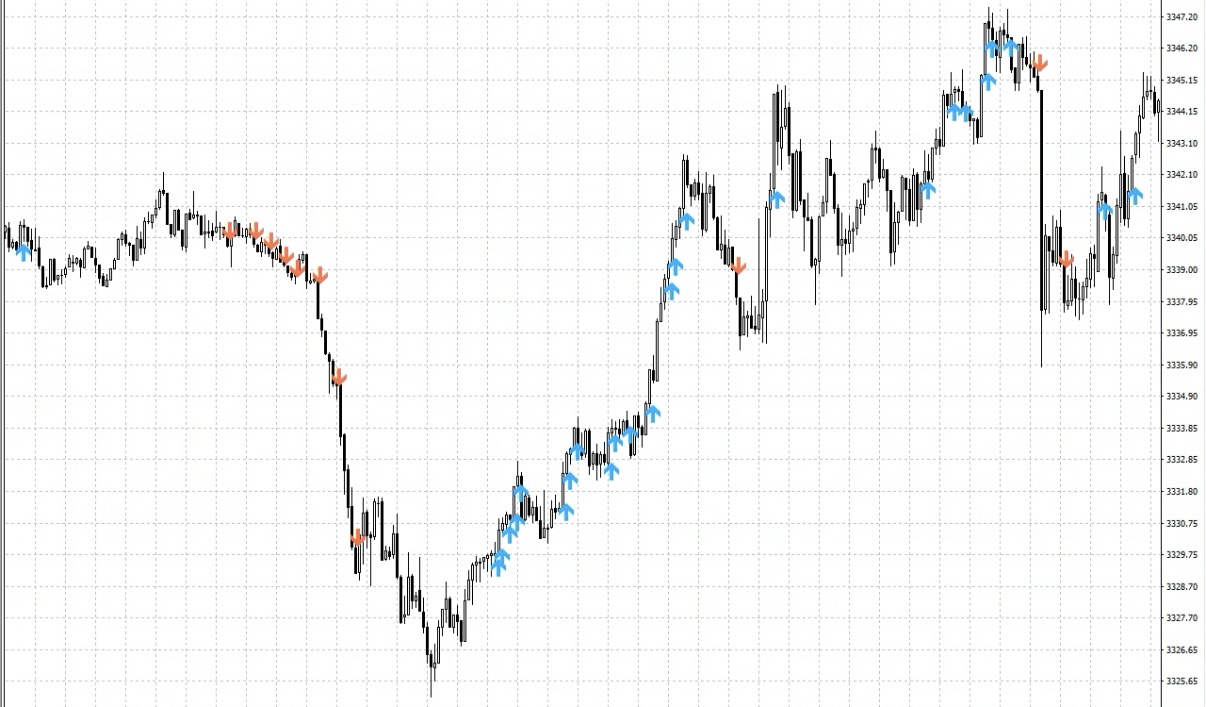

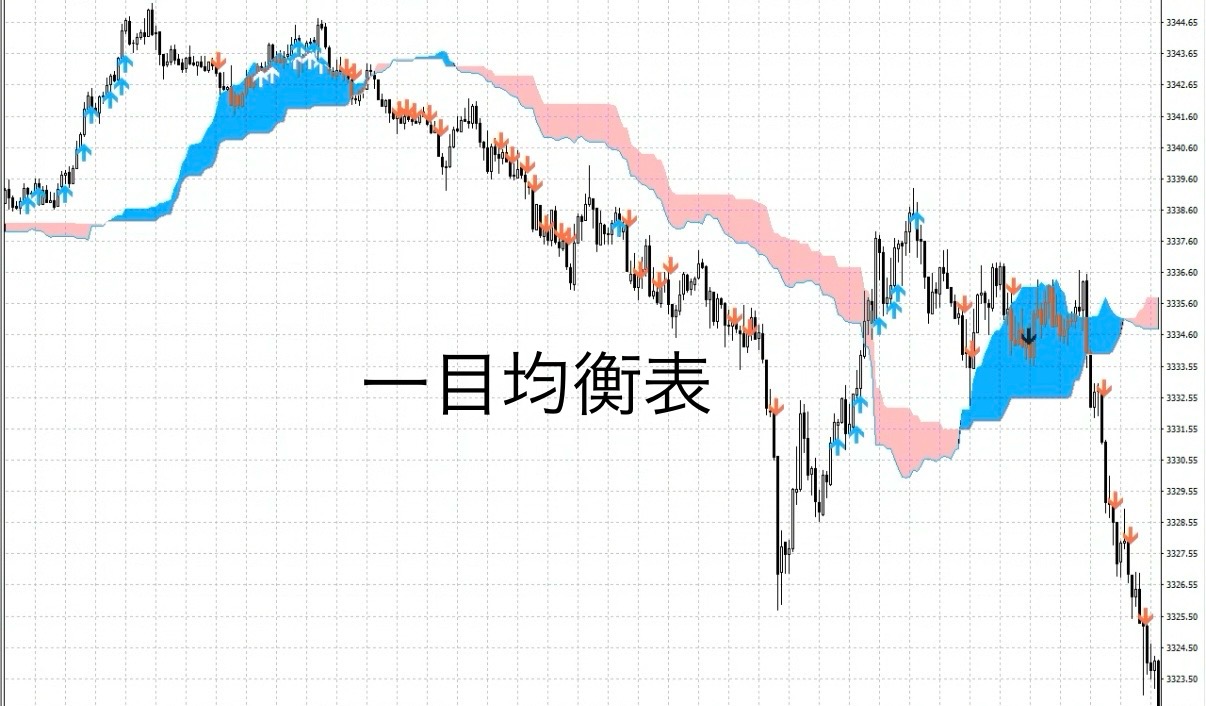

• Blue arrows = upward momentum

• Red arrows = downward momentum

• No repaint (once a signal appears, it does not disappear)

• Notification features (alerts, push, email)

Its sole role is.

“To reflect the market trend”.

It can be combined with any method.

Example) Ichimoku Kinko Hyo

It is not a rule-complete tool like Tenku no Kegarama; it is used as an auxiliary tool.

Suitable for those who already have rules or want to create rules.

It is so simple and highly flexible as an indicator.

EA-initiated breakout strategy

“Tenku no Kegarama” entrusts entries to an automatic entry EA, and the trader only needs to monitor after entry and execute the exit rules—a simple strategy.

The EA continuously monitors the chart and can enter precisely at the moment of breakout without missing it.

This eliminates the stress of staring at the screen before entry and the worry of missing the timing.

ADX, ATR, SMA and other filters are also under preparation.

As a purchaser reward, this EA is available for use.

If you wish to use it, please send a message and we will provide the download password.

Why publish negative results?

Invest Navi+ deliberately posts negative results without hiding them.

The reason is that “trading cannot always win.”

Rather, by recording losses you can analyze what situations cause losses and make the logic more robust.

Instead of obsessing over each win or loss,

Over a span of a week or a month, having a total positive result is most important. Total positive over the period is key

• “I’m glad I won today”

• “I’m anxious today because I lost”

To eliminate these emotional waves, let the EA handle entries,and have humans focus on executing the rules for exits.

“I want to win” but “I want to earn”──this mindset is the foundation for long-term profit accumulation.

Stability gained by following the rules

A common trait of those who lose big in trading is “the desire to win”drives rule-breaking.

For example, if you think “I want to extend it further” or “watch a little more,” delaying the exit can wipe out profits quickly.

Tenku no Kegarama is

• Entries are fully automated by EA

• Exits are governed by fixed, rule-based conditions

Thus,human intervention is minimized to the extreme, removing hesitation.

By mechanically following the rules, win rate and risk-reward naturally stabilize.

⸻

There are countless technical analysis methods—from moving averages, RSI, MACD, Stochastics, Parabolic SAR, ADX, ATR, CCI, trendlines and channels, Fibonacci retracements and extensions, Ichimoku, volume, to support/resistance lines—

There is no single correct method;what matters is decide on one personal rule you believe in, then actually test it repeatedly. By doing so you gain "confidence that works in the market" that you cannot obtain by knowledge alone, and you experience "the sense of expectancy building."

⸻

We conduct tests with the “maximum profit exit” rule in Tenku no Kegarama,

there are times when break-even exits occur frequently, but by following the rules you can calmly seize the next opportunity.

Even in moments when you think, “I could have taken more actually…,”

because you exited at break-even according to the rules, you end up keeping a total positive result, which is the strength of this strategy.

What matters in trading is not “win rate” but “reproducibility”

Many traders worry about “win rate,”

but even with a 50% win rate, capital can grow if the risk-reward (RR) is favorable.

What is important is to have a rule that is, a rule that yields the same results

Tenku no Kegarama is,

•EA entry → mechanical stop-loss → rule-based take profit

トレードを“ビジネス”として成立させる発想を重視しています。

⸻

Strategy aimed at overall profit

Be careful about daily wins and losses;

for example, over a week or a month, even with some negative days, as long as the total is positive, it’s OK.Since the EA has no emotions, it is also optimal for long-term capital management.

By operating the rules with the mindset of “earning” rather than “winning,” the growth curve of capital becomes more stable.

ℹ️Guide to the dedicated tools (purchase perks)

Currently, purchasers of Tenku no Kegarama receive auxiliary tools (automatic entry + stop-loss processing).

This was created from a desire to use it daily yourself,

and is designed to leave the breakouts and risk management to follow the market structure.

Profit-taking is still primarily your own decision, and this tool is well-suited for that approach.

Reviews are not many yet, perhaps because the structure is simple and straightforward enough that you don’t need extensive interaction before or after purchase.

However, if usage grows in the future, a paid model may be considered.

This is because there is a possibility that you will need to operate it as a “support-and-set” package rather than standalone tool sales.

____

◻️ For those who want automatic entry by EA

This logic-to-EA tool is currently distributed as a purchase perk.

If you are considering the purchase, please feel free to contact us.

Tenku no Kegarama Entry EA is here

If you are interested in Tenku no Kegarama, you will be invited to an online community

Join the online community here

In the online community, trade logic cannot be explained in detail, but

you can participate in a “chart critique community” that uses Tenku no Kegarama.

• If you send an interested chart image,

“What would be the correct judgment in this situation?”

“Where were the entry and take-profit points?” etc.,you will receive feedback with rule-based examples.

•Past charts for specific timeframes are also OK.

We respond in order as time permits.

To those who have become interested in Tenku no Kegarama

In short-term trading, laying the foundation to “decide by rules without hesitation”

That is the fundamental idea of Tenku no Kegarama.

Free教材 here:

▶︎ Download 'Trajectory to the Gap'

In 'Trajectory to the Gap,' you will learn more clearly when you can trade in actual situations.

It explains more clearly the entry points and zone selection that could not be conveyed by the sales page of “Tenku no Kegarama,”

with diagrams and case-based explanations.

Even beginners can reproduce it easily, so

if you’re interested, please use it as well.

If you’re interested, first receive the無料教材『狭間への軌跡』

From there, your step in the gap begins.

“Should I enter this chart?”

When you hesitate,I hope this helps switch your thinking to “judge by rules, not by gut feeling.”