【第91回】Don't be greedy, follow the rules and achieve +40 pips — steady verification of GOLD 1-minute chart

Should I include this chart?

【第91st Time】 Achieved +40 pips by sticking to the rules without greed / Steady testing of GOLD 1-minute chart

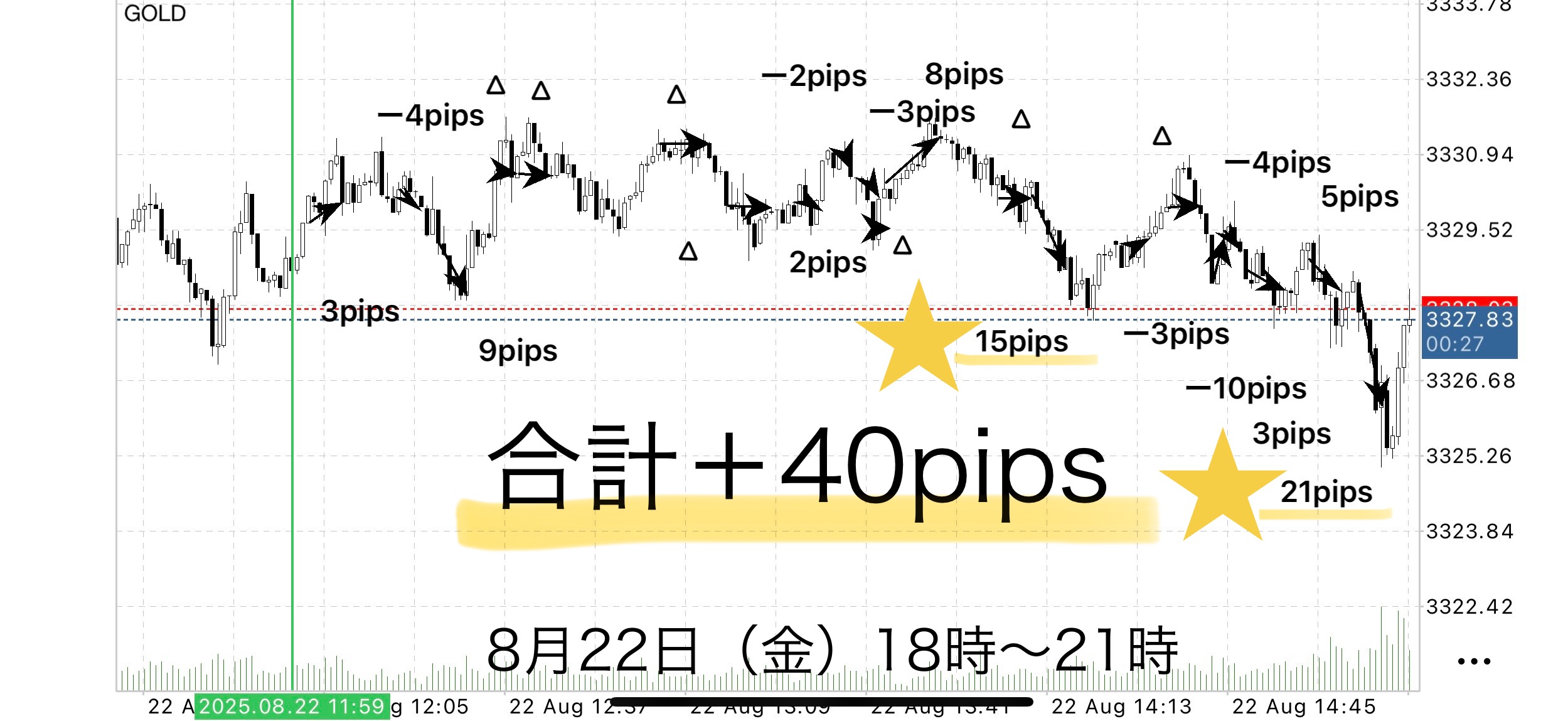

Friday, August 22, 2025 | Japan Time 18:00–21:00

Net profit:+40 pips

1 lot →+58,000 yen/0.1 lot →+5,800 yen

⸻

Trading overview

That London session day featured more small movements than a strong directional move.

Thus, instead of “taking a large price range all at once,” the flow centered on diligently picking up minor breaks and accumulating steadily.

In particular, during the early and late stages, price movement was fine,with many break-even exits and shallow stop-outs,grow gradually without rushing.”

⸻

Trading results

• Total trades: 21

• Profit-taking successes: 8

• Breakeven exits: 7

• Stop losses: 6 (all within −10 pips)

• Total gain: +66 pips

• Total loss: −26 pips

• Net profit: +40 pips

• Win rate: about 38% (8 wins / 21 trades)

• PF (Profit Factor): 2.53

Profit (USD/JPY at 145 rate)

• 1 lot → +58,000 yen

• 0.1 lot → +5,800 yen

⸻

Discussion

In markets like this where “small price swings continue,”the key is not to try to stretch gains, but to steadily accumulate.

• Even if price retraces after a breakout, you can avoid losses with “breakeven management”

• All stop-outs are kept shallow, minimizing drawdown

• When price moves in your favor, secure profits to stay overall positive

This repetition is the strength of the “Sky Between” zone.

Also, the feeling of wanting to “grow it bigger” is natural,but when the chart moves in small increments, avoid greed andfinish according to the rules for the most stability. Conversely, if the market suddenly moves, it can be合理 to decide: “Today, taking this one wave is enough” and end for beginners not to regret.

Breakout strategy driven by EA

“Sky Between” uses an automated entry EA, while the trader focuses on monitoring after entry and executing the exit rules—a simple strategy.

The EA constantly monitors the chart and can enter precisely at breakout moments without missing them.

This eliminates the stress of staring at the screen before entry and the fear of missing the timing.

As a buyer bonus, this EA is available for use.

If you would like to use it, please message me and I will send you a download password.

Why publish negative results?

Investing Navi+ openly publishes negative results too, rather than hiding them.

The reason is that “trading is not always about winning.”

Rather, by recording losses we can analyze what conditions cause losses and make the logic more robust.

It is more important to aim for a positive total over a span of 1 week to 1 month than fixating on individual wins or losses.

Over a span of 1 week, 1 month, etc., achieving a total positive is what matters.

• “Happy because I won today”

• “Worried because I lost today”

To eliminate these emotional swings, let the EA handle entries and have humans focus on executing the rules for exits.

“I want to win”vs“I want to earn”—This mindset is the foundation for long-term profitability.

Stability gained by following the rules

The common point of people who lose big in trades is the “desire to win”driving rule-breaking

For example, postponing exits to “let it run a bit longer” can wipe out profits quickly.

Sky Between provides

• Fully automated EA entries

• Fixed, rule-based exits

This reduces human intervention to a minimum and eliminates hesitation.

By mechanically following the rules, win rate and risk-reward become naturally stable.

⸻

There are countless technical indicators: moving averages, RSI, MACD, Stochastics, Parabolic SAR, ADX, ATR, CCI, trend lines and channels, Fibonacci retracements and expansions, Ichimoku, volume, as well as support/resistance lines—there are countless methods in technical analysis.

There is no single correct method; what matters isto decide on one personal rule you believe in and actually test it based on that rule. Doing so provides the confidence to trade that cannot be gained from knowledge alone, and gives a feeling of building expected value.

⸻

We tested with a maximum profit-taking approach aimed at the Sky zone,

where breakevens occur often, but by following the rules you can calmly seize the next opportunity.

Even in cases where you could have taken a larger profit,

the rule-based breakeven exit allows you to maintain a positive overall result, which is the strength of this strategy.

What matters in trading is not “Win rate” but “Reproducibility”

Many traders worry about “win rate,” but

with a good risk-reward ratio, even a 50% win rate can grow your capital

Importantly, you need a rule that isreproducible no matter who uses it, a rule that yields consistent results.

Sky Between is

•EA entry → mechanical stop loss → rule-based take profit

prioritizing business-like trading.

⸻

Strategy aimed at overall profit

Focusing on daily gains or losses is risky.

For example, over a week or a month, even with some losing days, as long as the total is positive, it is OK.

Because the EA has no emotion, it is ideal for long-term capital management as well.

Operating the rules with the vision “to earn” rather than just “to win” helps the capital growth curve to be more stable.

ℹ️

Currently, buyers of Sky Between receive auxiliary tools (auto-entry + stop loss processing) as a bonus.

This was developed from the desire to have something I would personally want to use daily,

and it is designed to handle breakouts and risk management according to market structure.

Profit-taking remains a personal decision and this tool is well-suited for that purpose.

Reviews are not many yet, but that may be because it is simple and straightforward in structure both before and after purchase.

However, if usage increases, commercialization may be considered.

Reason: it may require operating as a package with support rather than selling the tool alone.

____

◻️ For those who want automated entry by EA

This logic-to-EA tool is distributed as a purchase bonus.

If you are considering purchasing, please feel free to reach out.

If you are interested in Sky Between, you can join the online community

Join the online community here

Trade strategies cannot be explained in detail inside the online community, but

you can join the “Chart Review Community” using Sky Between.

• If you send a chart image you’re curious about,

we will provide feedback with an explanation of what decision should be made in that moment

“Where were the entry and take-profit points?”, all based on the rules.

•Past charts at specific times are OK.

We reply in order as time allows.

To you who became interested in Sky Between

In short-term trading, the foundation for making decisions strictly by rules—

that is the basic philosophy of Sky Between.

Free教材 here:

▶︎ Download 'Path to the Abyss'

In 'Path to the Abyss,' how do you actually trade in certain situations?

We explain the decision criteria more clearly.

The selling page for Sky Between could not fully convey

the具体 entry points and zone selection,

so diagrams and case-based explanations are provided in detail.

Even beginners can reproduce it easily, so

if you're curious, please use that as well.

If you’re interested, please first receive the free material ‘Path to the Abyss’.

From there, your first step in the Abyss begins.

“Should I include this chart?”

When you’re unsure,switch your thinking to “decide by rules, not by intuition.”