Translate to English (keeping HTML format, no code formatting, single line): Fight strategically with a broad perspective

Tweet

A way of thinking to win at trading.

Think in terms of probability.

As I often write, I don’t consider it a single bet just once.

People who can’t win are betting on a single round.

They try to predict just to hit once.

This time, I’d like to talk using the word “big-picture view.”

For example, there is a game called mahjong.

It is a game played by four people.

You shuffle the mahjong tiles, form a mountain, deal the tiles, and then the game starts.

In simple terms, it’s a matching game.

When someone completes the matching and wins, one round is over.

Then you shuffle the mahjong tiles again to form a new mountain.

Everyone takes from that mountain, and you play the next round.

I’m keeping it simple so even people who don’t know mahjong can understand.

There is a thing called “dealer turn,” and one person gets two turns in a row.

You stack the mountain and treat that as one game, and there are a total of eight games (eight rounds).

After eight games, totals are calculated and the ranking is decided.

There are eight opportunities to score points in eight games.

If this were just a single game, what would happen?

You would feel you must score points no matter what.

Whether you win or lose, since it’s only one game, you’d have to push forward anyway.

Since you’re participating, you’re in it to win, of course.

If it were just one game, that tends to happen, but if you’re doing eight games, it becomes different.

Eight games equal one cycle of opportunities.

Then strategy comes into play.

Since there are eight-game opportunities, if your hand is not favorable, losing a few games is fine.

In this game, you can think strategically about giving up, etc.

Losing three or four times is not a problem at all.

If you can score somewhere within the eight games, that’s enough.

Only when your hand is favorable should you advance and push forward.

It might be a bit hard to grasp?

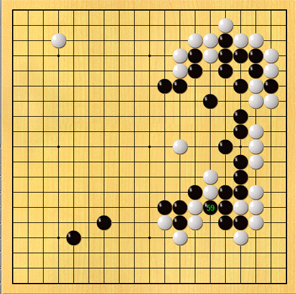

Shall we move on to go (the board game Go) for another example?

Go, simply put, is a game of territory control.

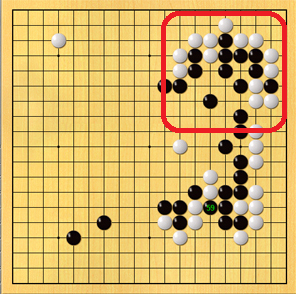

First, suppose you’re contesting the top-right territorial area.

For example,

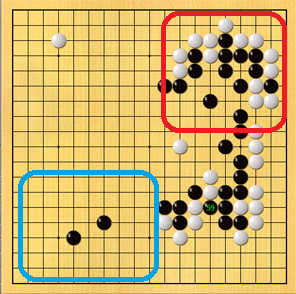

In the top-right area, you were fighting, but Black thought, “We’re already being pushed here and I don’t think we can win this.”

“Then I’ll concede the top-right area to the opponent. I’ll give up here and push into the bottom-left area first.”

Aim for the blue-outlined area in the bottom-left.

Don’t cling only to the top-right. There are other territories too.

Even if the top-right area is taken by the opponent, if we can take more in other areas, we can still win, so it’s okay to sacrifice.

This is what we call a big-picture view.

Big-picture view — from Wikipedia

In board games, the ability to step back from partial confrontations and assess the overall shape, determine your current level of advantage or disadvantage, decide whether to take a safe, solid approach or to take risks, and make strategic judgments.

If you excel at big-picture view, you can launch surprising attacks from places where pieces aren’t clashing, proceeding with long-term, holistic planning.

Conversely, without a big-picture view, you end up focusing only on clashes on a portion of the board or short-term gains and losses.

End

People without big-picture view, when fighting in the top-right area, can only see that area and the immediate battle, unable to see the larger context.

Even if you’re at a disadvantage or the chances of winning are thinning, you still feel compelled to win there.

In trading, people who lack big-picture view and insist on a single trade tend to behave like this.

To win in trading, big-picture view is essential.

Don’t cling to just the immediate trade.

One characteristic of traders who can’t win is that they insist, “I cannot lose this trade.”

Because they can’t afford to lose, they also can’t cut losses easily.

With only one trade in view, they feel they must not lose at all costs.

“If you don’t have a big-picture view, you can only think about clashes and short-term gains and losses.”

To think, “I don’t want to lose this one trade,” means you’re only thinking about short-term gains and losses.

On the other hand, a successful trader with big-picture view can retreat quickly when they think they’re at a disadvantage. They can cut losses.

Because you’re looking at things on a larger scale, you can decide to cut losses and move on to the next trade, rather than clinging to a bad trade.

“Proceed with a long-term, holistic perspective.”

When I teach trading, I have students complete 25 trades.

It’s not about just one trade,but about thinking of 25 trades as one game in a big-picture sense— a training method like that.

Enter and, if the scenario differs from what you expected, you can easily discard it. Cut the loss.

It’s just one trade out of 25 trades.

If you think this way and trade strategically, you’re less likely to cling to a losing trade.

Consider a game after a certain number of trades.

Then a high-leverage one-shot trade becomes impossible.

For example, if you view 25 trades as one game, you need to allocate enough capital for all 25 trades.

Capital management is essential.

If you ignore capital management and go all-in, you’ll inevitably end up with a single-trade mindset.

It becomes a strategy-free fight.

Don’t fixate only on the immediate trade. Don’t just look at short-term gains and losses.

Let’s trade with big-picture view and strategically.

I’m on Twitter:https://twitter.com/takashipyo

Trading videos are up:Trading that turned 100,000 yen into 1,000,000 yen

List of Takashi Kirakira FXtrader installments