Dr. Neko's Safe and Risk-Limited martingale-type EA 'EA_Blizzard'

Dr. Neko's new creation is an AUDCAD-specific averaging-down EA with a maximum of 30 positions!

We will answer questions such as recommended margin and expected annual return through backtest analysis!

【EA_Blizzard Overview】

Currency pair: [AUD/CAD]

Trading style: [Scalping]

Maximum number of positions: 30

Used timeframe: M5

Maximum stop loss: 0 ( Note: stop loss is triggered at the specified maximum loss value (initial value: $5,000))

Take profit: 50

~EA_Blizzard~

This EA performs high-frequency swing trading,

and is an undefeated averaging-down EA.

By steadily taking profits, as shown in the backtests,

from 2005 through 2018 to the present, it has remained undefeated without drawdowns.

【Trading Style】

The trading style of this EA is "averaging-down", entering with "0.01 lot" first,

and then aiming to take profit of "+50 pips".

And if the price moves in the opposite direction, we increase the lot by 0.01 lot, creating an additional position at 0.02 lots (averaging-down entry).

And, as needed, add averaging-down positions so that the total profit/loss across all positions continually remains at +50 pips, and take profits accordingly.

Many averaging-down EAs on the market have very narrow take-profit values, making profitability rather limited relative to risk, but this EA has a take-profit of +50 pips, allowing profits over a relatively wider price range, and despite being averaging-down, it aims for high profitability—quite a rare type of EA.

(Excerpted from the product description on the sales page.)

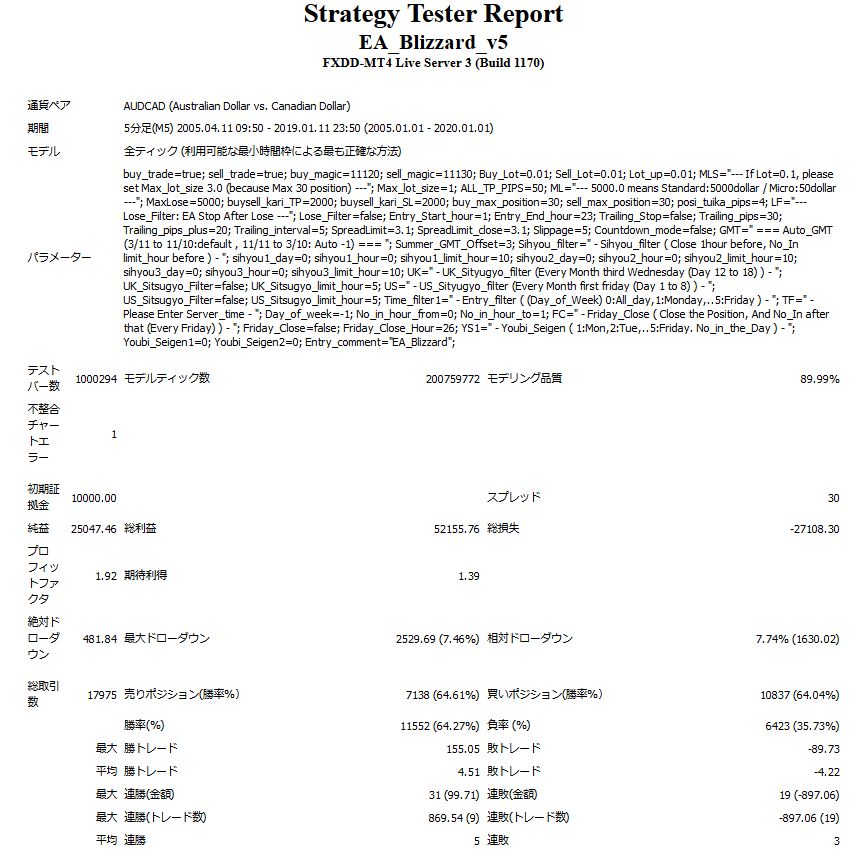

【Backtest Analysis】

AUDCAD 5-minute chart

2005.01.01-2019.01.11

Spread 3.0 pips

Initial 0.01 lot, maximum 0.3 lot

Net profit +$25,047 (annual average ~$1,789)

Maximum drawdown -$2,529

Total trades 17,975 (annual average 1,283)

That is how it is.

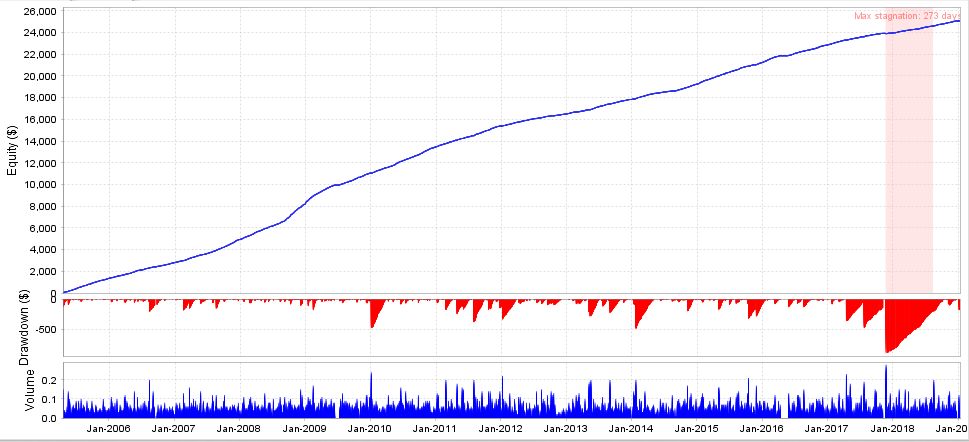

Looking at the backtest profit/loss chart, you can see that unrealized losses increased at the start of 2018.

【Trading Image】

We trade contrarian averaging-down against the trend, alternately. The design allows up to 30 positions.

Because positions are not added at uniform intervals, we place sells at high levels where retracements are likely, and buys at lower levels where prices tend to rise, making it relatively easy to turn positive. Also, we close all positions once total profits reach 50 pips.

The more averaging-down entries, the larger the lot size, so this profit grows.

【Recommended Margin, Maximum Lot Size, and Maximum Drawdown】

The most concern with averaging-down EAs is how much margin is required.

With the initial setting of 0.01, you can hold up to 3.0 lots, so if you hold all 30 positions,

the maximum lot would be 4.65 lots. Taking into account the maximum drawdown, we derive the recommended margin.

The required margin per 0.1 lot for AUDCAD is a relatively small 31,000 yen, so

(3.1 × 46.5) + (27.8 × 2) = 199.75

Having roughly 2,000,000 yen allows safe operation with maximum drawdown within 50%.

However, during the 14-year backtest from 2005, the largest position held was up to 0.28 lots in November 2007.

The next largest was 0.24 lots in 2009.

Typically the maximum is 0.2-0.21 lots, so a recommended margin of around 1.8 million yen should be fine as well.

(Leverage 25x, so if leverage differs, the recommended margin will change)

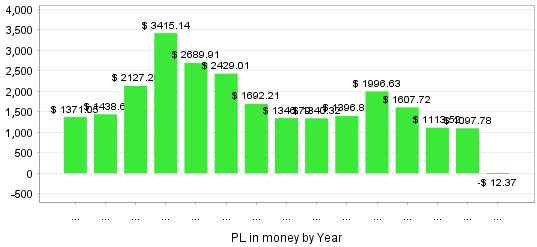

【Monthly and Yearly Profit/Loss】

A characteristic of averaging-down EAs is that there are almost no monthly losses. Losses occur when positions opened in a previous month are closed, and positions held in the previous month are closed at a loss.

Looking at yearly profits, 2008 was particularly good, but on average it earns over $1,000, maintaining stable profits.

On average, around $1,800 per year, and with a broker offering 25x leverage you can expect around 10% annual return relative to a recommended margin of 1.8–2.0 million yen.

Rather than a get-rich-quick EA, it's a solid asset management EA.

Even though it's averaging-down, with the initial settings the maximum drawdown stays in the low thousands of dollars, making it an extremely low risk of ruin EA.

Price is also fairly affordable(hehe)