Just being alive is a huge gain ~ wrote exactly what I'm thinking without holding back

Good morning!

I’m Takashi, a former accountant, a former cancer patient, and a psychological counselor trader.

↑ Something different is included, isn’t it.

Last week, the results of my cancer screening came back and there were no abnormalities.

Seven years ago, I had cancer surgery. I also underwent chemotherapy and even went bald. Now I’m lush and fluffy! My hair is growing thick!

At that time, cancer was found, and the doctor told me I should be hospitalized immediately. Immediate hospitalization declared!

Back then, I had a cat.

Me: “I have a cat, and I can’t be hospitalized like this, so I need to have someone look after the cat..”

Doctor: “What are you saying, you fool? If it were in the old days, you’d be dead unless you had surgery right away.”

Me: “Old days? Does that mean in modern times it’s okay?”

Doctor: “It’s okay, but you’ll have to wait about a week. If it’s longer than that, even modern medicine can’t wait.”

If it had been in the old days, I might have died seven years ago. Modern medicine is wonderful. It keeps developing, doesn’t it?

That said, after the operation, the anesthesia didn’t work well, and it hurt a lot,

I whispered in my heart, “Modern medicine can’t take away the pain!” while cursing modern medicine in my mind, though haha.

After discharge, because there was a risk of recurrence, I underwent examinations every two months.

I think the recurrence rate is high for about three years, so for about three years there were many tests.

Then, without any abnormality, the frequency of examinations became every six months,

and last week I was told, “From now on, once a year is OK.”

I’m completely cured, right? Even healthy people should get cancer screenings about once a year.

Living is not a given.

I’ve also seen people in the same ward pass away.

I’m lucky to be alive.

Being alive isn’t normal; it’s a miracle.

In the old days, I might already be dead.

When I think about that, I feel like just being alive is a huge gain. Everything is grateful.

Because I’m alive, I can publish this series here and others can read it. It’s wonderful.

I started this series this year, and thanks to you all, it’s received very favorable responses.

When I looked at the article rankings, four of my articles were in the top ten! Thank you very much.

In the FX article ranking, I was also in fourth place. Thank you.

I hope more and more people will read and spread it.

In the world of trading, there is little accurate information.

Therefore,

I have a desire to spread accurate information.

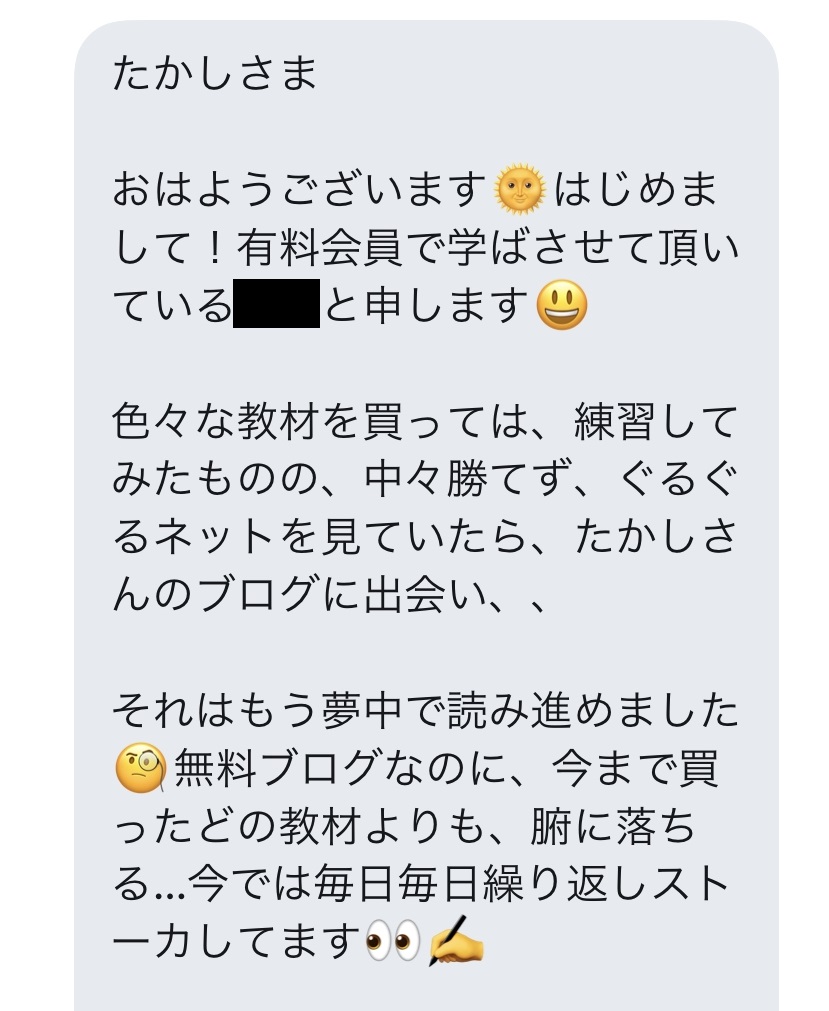

Recently, I received some impressions.

Even after buying various teaching materials, it’s hard to come across accurate information.

He’s a paid member, but I’m grateful that you also read my free blog.

Click the link to go to the blog⇒Free Blog

In the beginning, I posted on the above blog.

What started this was“Lately I haven’t been doing things that please many people.”and I realized that.

Happiness is a sense of contribution-Alfred Adler

In the past, I sometimes posted about psychology, happiness, and values on blogs and in newsletters.

Many people gathered there, I offered advice, and many were happy, which gave me a sense of contribution.

While doing that, I began to feel a responsibility for how I might influence people’s lives, which led me to obtain a counseling psychologist qualification.

I did everything for free, but even if free, I decided to study properly, acquire knowledge, and be useful to people.

I stopped that activity for a while and didn’t do much that pleased a lot of people.

Then, I decided to try to bring joy to many people through trading, and that’s why I started.

When I began sharing trading information,

“I learned this way of thinking for the first time” “I wish I’d known this sooner”

“I finally met a truly credible person”←That part should be called real, right? lol

These were some of the impressions I received.

Even among seasoned traders, there are people who give such feedback.

That alone showshow little correct thinking and information there isout there.

What I share regarding thinking and information isn’t something unique or special to me; it’s

the common sense of winning traders.

For winning traders, it’s something obviousthat I just write about.

Techniques and the exact trading methods vary from person to person, butthe basic way of thinking is the same for everyone.

Many people don’t know that way of thinking.

It’s a world where many publish incorrect information (the mindset of losing traders).

The information from people who appear on TV, magazines, and media = correct information

Is a misconception,and many believe that to be the correct information, the mindset of winning traders..

Most people studying in this environment see that, no matter how hard they try, they can’t win as they are now.

To change this situation, I want to do at least something for myself.

That may be my current purpose in life.

It may sound grand, but continuing such activities is enjoyable, so I plan to keep doing it.

If you’ve read my blog or series and found it educational or useful, I’d like you to spread it on social networks like Twitter and Facebook.

And it’s not limited to my content; if you think “this is good” or “this was educational,” please share it with others.

Don’t think “only I benefit.” Share with others with a spirit of giving.

That is also a way of happiness.

I myself have learned and shared things about psychology, happiness, values, and trading, and I’ve kept sharing what I’ve learned with others.

Don’t think only of yourself. When you receive from others, you should also share with others.

If reading my blog made you say, “I wish I’d known this sooner,” there may be others who don’t know yet.

Please teach them soon.

When you receive from others, share with others. By doing so, you yourself become happier.

Adlerian psychology calls this “contributing to others.”

For example, if you read a blog and think, “This blog is good,” don’t let it go to waste—click the ranking banner.

Even such small acts are a form of contribution.

If the ranking goes up, the blog author’s motivation also rises.

That increases the likelihood that the blog will continue, right?

It’s good for both the writer and the reader. Both become happier.

Making yourself and those around you happier. This is the kind of mindset that matters.

It’s not about not thinking of yourself at all, but about not thinking only of yourself.

I learned such ideas about happiness while reading many books during my hospital stay.

When seriously ill, you tend to reflect on life, how you live, and happiness.

Having a lot of free time allowed me to read many books.

I was able to study many things, so I think I’m glad I got cancer.

When you read many books, you can find “common threads.”

The same goes for happiness and the mindset of traders who win.

Last year, I read Richard Dennis’s book, a famed trader.

I also read the book about the legendary group of traders, the Turtles.

Sure enough, the winning people all shared the same thinking.

“Don’t forecast,” “bet on edge,” “bet on trends,” “money management,” “think with probability,” and so on.

Losers share similar traits too; naturally, they are doing the opposite of winners.

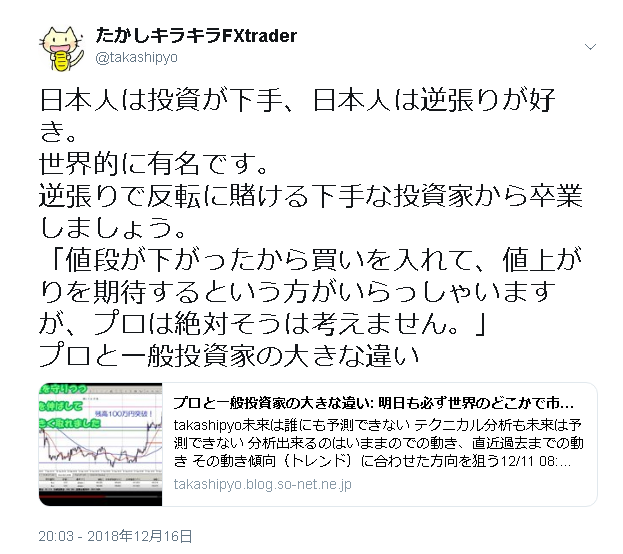

You bet on which way it will go and try to predict up or down

There’s no edge (some famous people say you can win without an edge)

Bet on reversal instead of following the trend (contrarian thinking); recently, selling pounds/yen during an upward trend

You don’t manage funds

Don’t think in terms of probability; cling to a single chance of a win in the near term

If you win with this, it would be suspicious.

There is a clear answer like this.

The answer is clear, so it isn’t that hard to understand.

Knowing it doesn’t instantly make you win, but if you know the correct direction and work toward it, you’ll be rewarded.

This morning,I made about 600,000 yen from buying USD/JPY. Since it’s in an uptrend, I’m aiming to buy. Winning traders think in a trend-following way.

Were there people who got burned by selling as well? That means their premise was wrong.

Showing how to actually win by thinking like this is important, isn’t it?

The mindset of losers, contrarian thinking.

Aren’t losers and those who exit the market all using contrarian thinking?

I don’t hear stories of people exiting after trading along with the trend.

There may be, but those who exit are all looking contrarian, aren’t they?

Holding positions stubbornly against the trend.

If you switch from contrarian thinking to trend-following thinking, most people would avoid major losses, I think.

My Twitter pinned to the top; I want to spread this kind of talk.

I think it helps many people avoid big losses and find relief, so I want to spread it widely.

If you agree, please help spread it.

Sorry for the long talk, but I wrote what I’m thinking now as it is.

Starting from cancer, now about how I think and what I’m doing.

From now on, I will continue to contribute within my ability to those around me, and both they and I will become happier as we live.

Thank you for reading to the end.