One winner among the stagnating EAs! — Latest trends of the middle-price EAs

One Winner Among Stagnant EA Traders! — Latest Trends of the N(Y) Value (Nikkei?) EAs

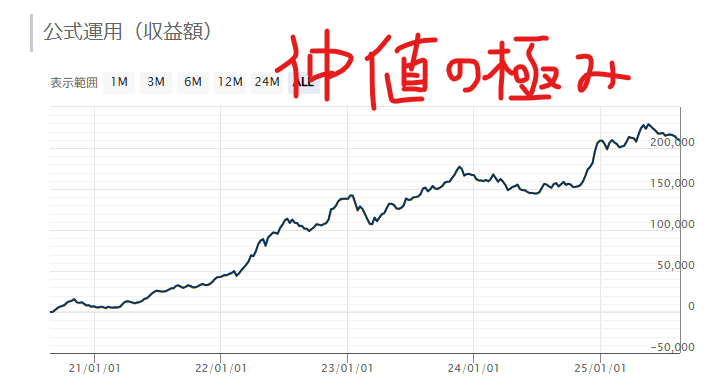

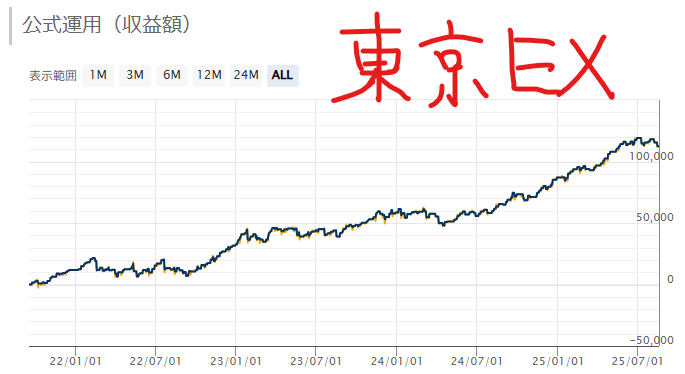

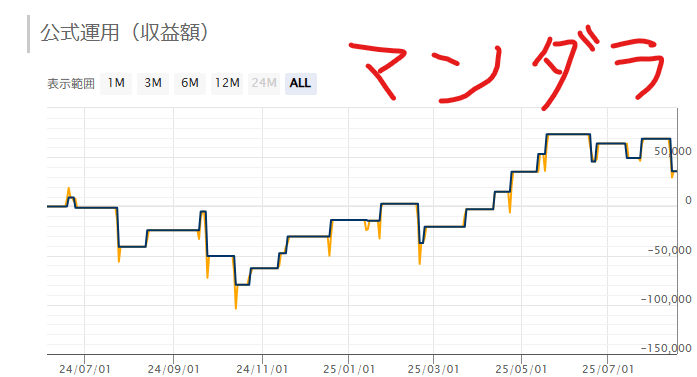

Recently, the performance of the N(Y) Value (Nikkei) EA army has shown a clear divergence.“The Pinnacle of the N(Y) Value”has been stagnant and struggling to grow,“Tokyo Extreme”is decent and not bad, landing fairly well.“N(Y) Lite”isn’t bad either, but there are signs of a slight stall,“Mandala”has also been slightly stagnant recently.

First, let’s review thesefour existing EAperformance all together.

Official Forward (Existing 4)

Summary of Latest Status

- The Pinnacle of the N(Y) Value: stagnating and struggling to grow

- Tokyo Extreme: decent and not bad (leaning toward stability)

- N(Y) Lite: not bad but slightly stagnant

- Mandala: recently somewhat stagnant

Why Is the “Other” N(Y) EA Performing So Well

In fact, in addition to the four above,there is another N(Y) Value EA. The logic concept is“N(Y) Lite”as a close reference,but the trade-day selection criteria are broader, designed to capture different trading opportunities from Lite. Therefore, even with a similar philosophy, outputs (profit/loss) tend to differ, and in the recent market, that “gap” has worked in its favor.

In other words, even if you hold multiple EA of the same family, the correlation is not a perfect match due to differences in selection days and entries. This is precisely where there isroom for risk diversification through portfolio management.

Revealing the Truth

Apart from the existing four, there is a recently exceptionally performing N(Y) Value EA—their true identity is,