[Episode 84] Weekly total leads to profits with “unpredicted trades” GOLD 1-minute chart | Morning small profit, night loss

Do you want to include this chart?

【No. 84】 Morning small profit, night loss. Accept the waves of results and accumulate / GOLD 1-minute chart

Trading is not about predicting “whether you will win or lose today.”

It is important to follow the decided rules, accept the waves of results, and accumulate over the long term.

August 18, 2025 (Monday) was a day that reaffirmed the importance of that stance. In the morning verification (9:00–12:00),a small profit was secured, but in the evening (18:00–21:00) there was a negative result after a long time..

A day where results varied greatly with market conditions, but losses were minimized by sticking to the rules.

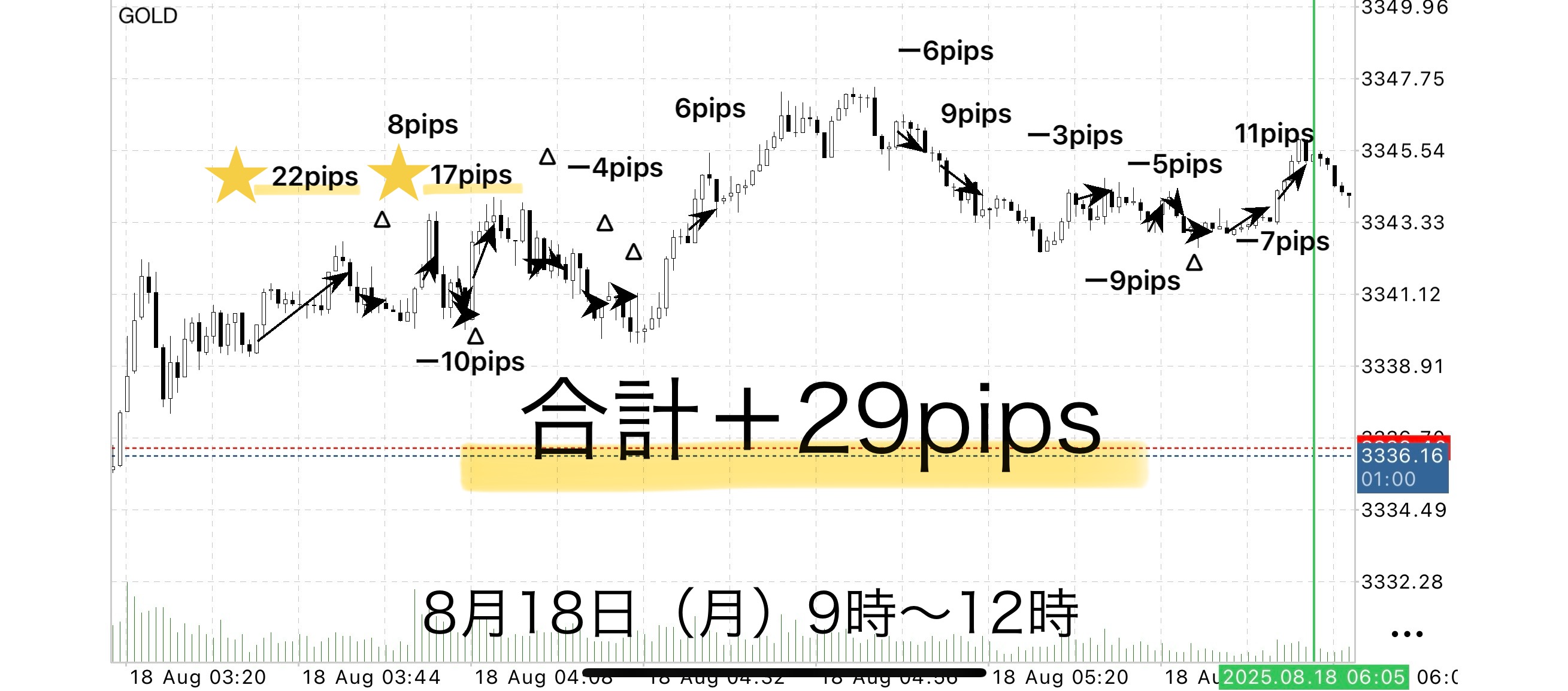

Morning trading results (9:00–12:00)

• Total trades: 19

• Profit-taking successes: 6

• Breakeven / flat: 6

• Stop losses: 7 (all within −10 pips)

• Total gain: +73 pips

• Total loss: −44 pips

• Net profit: +29 pips

• Win rate: 31.6% (6 wins / 19 trades)

• PF (Profit Factor): 1.66

• Profit (USD/JPY 145) equivalents

1 lot → about ¥42,050

0.1 lot → about ¥4,205

Breakouts often reverse quickly, many deceiving moves occur.

Nevertheless, a small profit was preserved.

⸻

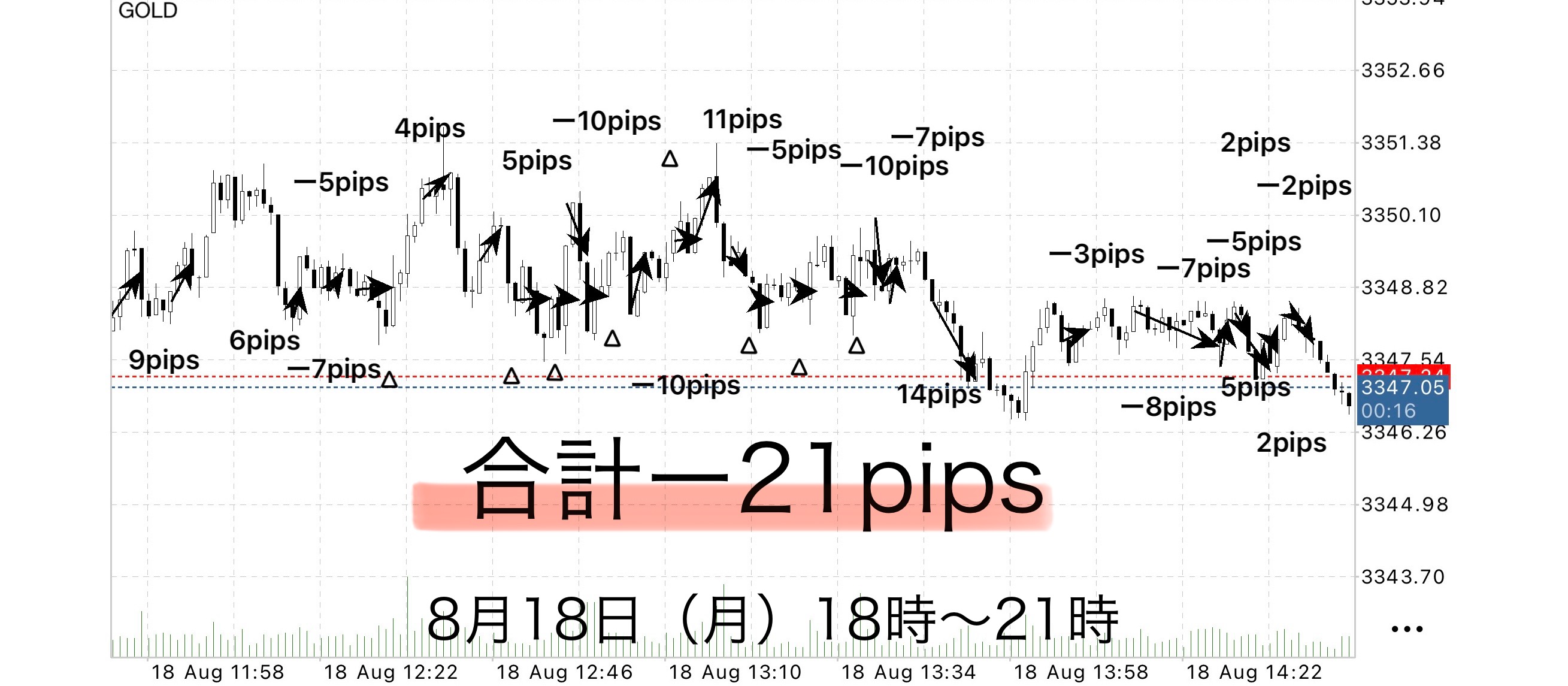

Evening trading results (18:00–21:00)

This time period was challenging, and the result was −21 pips(about −¥30,450 per 1 lot).

A rare deficit, but the maximum stop loss rule of −10 pips functioned, preventing a large loss.

It was striking that the morning and night yielded completely opposite results within a single day.

That’s why“not predicting” is important.On days with low win rates, ending with breakeven or small losses is enough.If you can make significant gains on high-win-rate days, you can build a stable overall total.

Because EA-based breakouts, strict breakeven handling, and stop-loss discipline exist, you can accept results without trying to predict market moves.

Summary

The strength of the Skyline Between Rules is to have 「small losses, big gains」 and 「strict rule adherence」.. .

As in this example, mornings can be positive and nights negative, but that is part of trading.

What matters isto keep losses small and capture profits on days you can win.

That accumulation leads to ultimately stable performance.

Upcoming updates

Regarding the “how to easily determine the maximum stop width” mentioned in the last article, it is currently being formalized into a rule.

If applied, you should be able to further shorten stop losses.

An update will be released soon, so please feel free to reference it.

Summary

The Sky Between Rules can lead to losses in some market conditions where stop losses or breakevens continue, resulting in negative results.This is a natural phenomenon in trading and cannot be completely avoided.

What matters is to aim for long-term total performance, including temporary negatives.

With that premise, I will continue to steadily accumulate from tomorrow.

Breakout strategy triggered by the EA“Sky Between” entrusts entry to an automated entry EA, and the trader focuses on monitoring after entry and executing the exit rules.The EA continuously monitors the chart and can enter precisely at the breakout moment without missing it.This eliminates the stress of staying glued to the screen before entry and the anxiety of timing.As a purchaser benefit, this EA is available for use.If you wish to use it, please message me and I will send the download password. Sky Between Main Book HereWhy publish negative results?Invest Navi+ prints the negative results as well, without hiding them.The reason is that “trading is not always possible to win.”Rather, by recording losses you can analyze under what conditions you lose and make the logic more robust.Instead of chasing wins per trade, consider a span of 1 week to 1 month where a positive total is most important.•“Today I’m happy because I won”•“Today I’m anxious because I lost”To eliminate these emotional swings, entrust entry to the EA, and have humans focus on executing according to the rules.Not “I want to win” but “I want to earn” —this mindset is the foundation for long-term profitability.Stability gained by following the rulesThe common trait of people who lose heavily in trading is the urge to win causes rule-breaking.For example, delaying a decision to see more profits or a bit longer can wipe out gains quickly.Sky Between operates with•Entry fully automated by EA•Fixed, rule-based exitsThis minimizes human intervention and removes hesitation.By mechanically adhering to the rules, win rate and risk-reward become naturally stable.⸻We validated with the “maximum profit-taking” rule targeting the Sky Zone,and though breakeven exits are more common in some situations, adhering to the rules allows calmly seizing the next opportunity.Even in cases where you could have earned more, by cutting at breakeven per the rules, you still maintain a total positive result—this is the strength of the strategy.What matters in trading is not “win rate” but “reproducibility.”Many traders worry about win rate, buteven with a 50% win rate, funds can grow if risk-reward is favorable.The key is having a rule that yields the same result no matter who applies it—“reproducibility.”Sky Between•EA entry → mechanical stop → rule-based takeBy performing this sequence with zero emotion, we aim to make trading a viable business.⸻Strategy aiming for overall profitabilityFocusing on daily wins and losses is risky.Viewed over a week or month, small negative days are acceptable if the total is positive.EA, having no emotions, is ideal for long-term capital management as well.Operating the rules with the vision of “earn” rather than “win” makes the capital growth curve easier to sustain.ℹ️Announcement of a dedicated tool (purchase bonus)Currently, purchasers of Sky Between receive a supplementary tool (automatic entry + stop processing).This was created from the desire for daily use and automatically handles breakout judgments and risk management according to market structure.For those who only value take profits as own judgment, this tool is compatible and helpful.Reviews are not many yet, perhaps because the structure is simple and clear enough that there is little need for pre- or post-purchase interaction.However, if the user base grows, paid options may be considered.Reason: the possibility that tools will require operation as a package with support rather than standalone sale.____◻️ For those who want EA-based automatic entryThis logic-as-a-tool is distributed as a purchase bonus.If you are considering purchasing, please contact us.Sky Between Entry EA hereIf you are interested in Sky Between, you can join the online communityJoin the online community hereWithin the online community, specific trade logic cannot be explained, butyou can participate in a “chart critique community” using Sky Between.• If you send a chart image you are curious about,“What would have been the right decision in this moment?”“Where were the entry and take-profit points?”,we will provide feedback with rule-based decision examples.•Past charts for specific times are also OK.We will respond in order as time permits.To those interested in Sky BetweenBuild a foundation to judge with rules without hesitation in short-term trading — that is the core philosophy of Sky Between.Free materials here:▶︎Download ‘Path to the Margin’In ‘Path to the Margin,’ you’ll learn what scenarios actually allow trading and the criteria for judgment more clearly.It also provides more concrete entry points and zone selection guidance beyond what was conveyed on the Sky Between sales page,with diagrams and case-by-case explanations.Even first-time readers can reproduce the content easily, so if you’re curious, please also use that.If you’re interested, first receive the free material ‘Path to the Margin.’From there, your next step within Sky Between begins.“Do you want to include this chart?”When you’re unsure,switch your thinking from “feel” to “rule-based judgment.”

“Sky Between” entrusts entry to an automated entry EA, and the trader focuses on monitoring after entry and executing the exit rules.

The EA continuously monitors the chart and can enter precisely at the breakout moment without missing it.

This eliminates the stress of staying glued to the screen before entry and the anxiety of timing.

As a purchaser benefit, this EA is available for use.

If you wish to use it, please message me and I will send the download password.

Why publish negative results?

Invest Navi+ prints the negative results as well, without hiding them.

The reason is that “trading is not always possible to win.”

Rather, by recording losses you can analyze under what conditions you lose and make the logic more robust.

Instead of chasing wins per trade, consider a span of 1 week to 1 month where a positive total is most important.

•“Today I’m happy because I won”

• “Today I’m anxious because I lost”

To eliminate these emotional swings, entrust entry to the EA, and have humans focus on executing according to the rules.

Not “I want to win” but “I want to earn” —this mindset is the foundation for long-term profitability.

Stability gained by following the rules

The common trait of people who lose heavily in trading is the urge to win causes rule-breaking.

• Entry fully automated by EA

• Fixed, rule-based exits

This minimizes human intervention and removes hesitation.

By mechanically adhering to the rules, win rate and risk-reward become naturally stable.

⸻

We validated with the “maximum profit-taking” rule targeting the Sky Zone,

and though breakeven exits are more common in some situations, adhering to the rules allows calmly seizing the next opportunity.

Even in cases where you could have earned more, by cutting at breakeven per the rules, you still maintain a total positive result—this is the strength of the strategy.

What matters in trading is not “win rate” but “reproducibility.”

Many traders worry about win rate, but

even with a 50% win rate, funds can grow if risk-reward is favorable.

The key is having a rule that yields the same result no matter who applies it—“reproducibility.”

Sky Between

•EA entry → mechanical stop → rule-based take

⸻

Strategy aiming for overall profitability

Focusing on daily wins and losses is risky.

Viewed over a week or month, small negative days are acceptable if the total is positive.

EA, having no emotions, is ideal for long-term capital management as well.

Operating the rules with the vision of “earn” rather than “win” makes the capital growth curve easier to sustain.

ℹ️Announcement of a dedicated tool (purchase bonus)

Currently, purchasers of Sky Between receive a supplementary tool (automatic entry + stop processing).

This was created from the desire for daily use and automatically handles breakout judgments and risk management according to market structure.

For those who only value take profits as own judgment, this tool is compatible and helpful.

Reviews are not many yet, perhaps because the structure is simple and clear enough that there is little need for pre- or post-purchase interaction.

However, if the user base grows, paid options may be considered.

Reason: the possibility that tools will require operation as a package with support rather than standalone sale.

____

◻️ For those who want EA-based automatic entry

This logic-as-a-tool is distributed as a purchase bonus.

If you are considering purchasing, please contact us.

If you are interested in Sky Between, you can join the online community

Join the online community here

Within the online community, specific trade logic cannot be explained, but

you can participate in a “chart critique community” using Sky Between.

• If you send a chart image you are curious about,

“What would have been the right decision in this moment?”

“Where were the entry and take-profit points?”,we will provide feedback with rule-based decision examples.

•Past charts for specific times are also OK.

We will respond in order as time permits.

To those interested in Sky Between

Build a foundation to judge with rules without hesitation in short-term trading — that is the core philosophy of Sky Between.

Free materials here:

▶︎ Download ‘Path to the Margin’

In ‘Path to the Margin,’ you’ll learn what scenarios actually allow trading and the criteria for judgment more clearly.

It also provides more concrete entry points and zone selection guidance beyond what was conveyed on the Sky Between sales page,

with diagrams and case-by-case explanations.

Even first-time readers can reproduce the content easily, so if you’re curious, please also use that.

If you’re interested, first receive the free material ‘Path to the Margin.’

From there, your next step within Sky Between begins.

“Do you want to include this chart?”

When you’re unsure,switch your thinking from “feel” to “rule-based judgment.”