【Episode 83】A Rule to Protect Even in Losses: Win Rate 30% − 21 pips | The Day Range Market Where Position Averaging Worked

Should you include this chart?

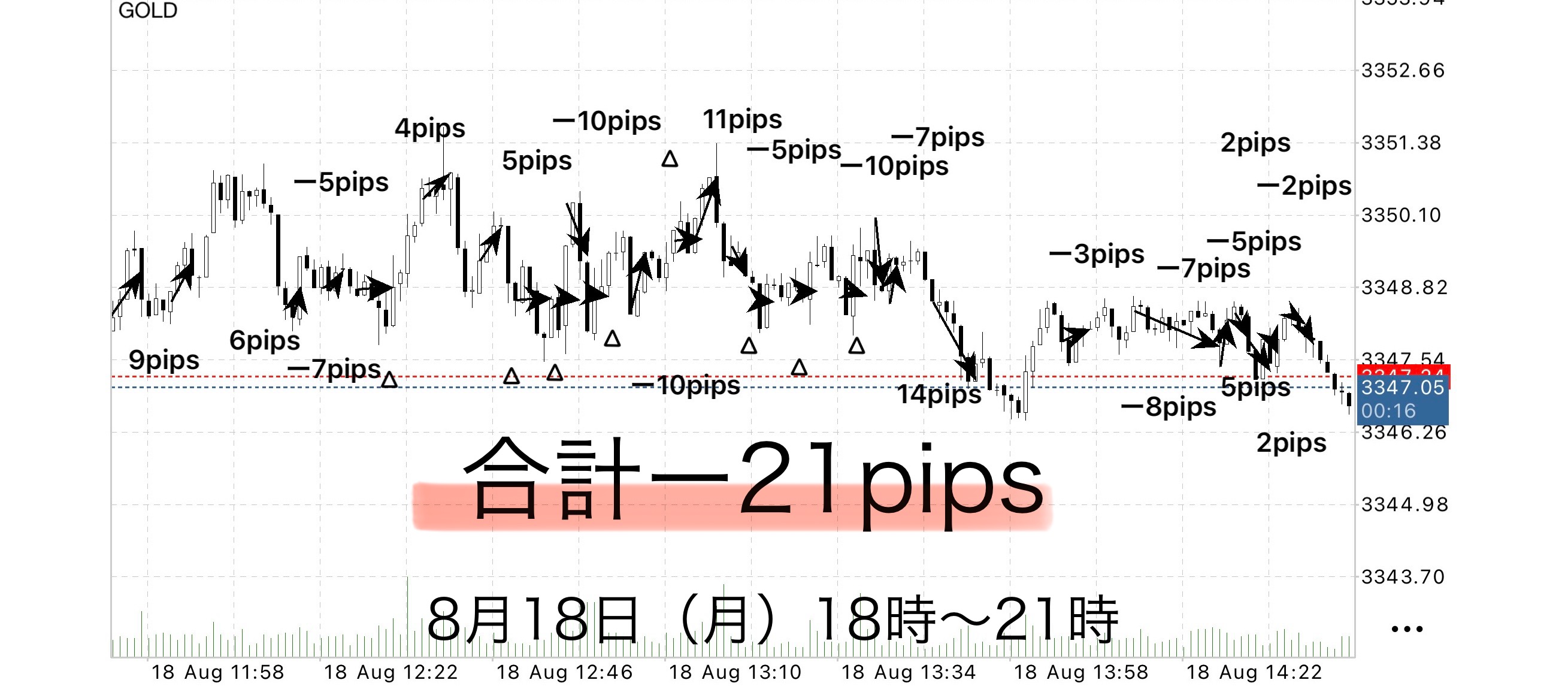

【No.83】 Position entry handling in range market and loss limitation / GOLD 1-minute chart

August 18, 2025 (Monday) | Japan time 18:00–21:00

Net profit:−21 pips

1 lot →−30,450 JPY/0.1 lot →−3,045 JPY

That day, the market had no clear direction,and there were many moments where stopping loss would occur no matter which way it moved.

Because I followed the rule of exit at entry price for the shakeouts, I did not incur large losses, but the final break also returned to entry, so the price range could not be extended much.

From the perspective of a range market, this environment is unfavorable for trend-following breakout methods, but by following the rules I was able to limit losses for the day.

⸻

Trading results

• Total trades: 29

• Profit-taking successes: 9

• Entry at break-even: 8

• Stop losses: 12 (all within −10 pips)

• Total gain: +58 pips

• Total loss: −79 pips

• Net profit: −21 pips

• Win rate: 30% (9 wins / 22 trades)

• PF (Profit Factor): 0.73

• Revenue (USD/JPY 145 rate)

1 lot → −30,450 JPY

0.1 lot → −3,045 JPY

⸻

Market characteristics and reflections

• Clear directional signal did not emerge, and breakouts tended to end as false breakoutsin many cases.

• By executing exits at entry price according to the rules, large losses were avoided.

• All stops were within a maximum of −10 pips, maintaining a certain level of financial stability.

Key takeaway this time

As shown here, even with a low win rate, combining exit-at-entry processing with shallow stops can uphold the principle of “small losses, large gains.”

However, in a range market the win rate tends to drop, so concentrating trades in times with clearer directional movement could greatly improve results.

Regarding future updates

The method described in the previous article, “A simple way to decide maximum stop loss,” is currently being formalized into a rule.

If applied,you should be able to shorten stops further.

An update will be published soon, so I’d appreciate your参考.

Summary

The rules of the Sky between the heavens are such that, depending on market conditions, stops and exit-at-entry can continue, and as a result you may end up with a negative outcome.

With that premise in mind, I plan to continue steadily from tomorrow onward.

Breakout strategy triggered by EA

“Sky between the heavens” is a simple strategy where entry is handled by an automated entry EA, and the trader focuses only on monitoring after entry and executing the exit rules.

The EA continuously monitors the chart and can enter at the breakout moment without missing it.

This eliminates the stress of staring at a screen before entry and the anxiety of missing the timing.

As a purchaser perk, this EA is available for use.

If you wish to use it, please send a message and I will provide a download password.

Sky between the heavens main page

Why publish negative results?

Investment Navi+ deliberately publishes negative results without hiding them.Reason: trade does not always win continuously.

Rather, by recording losses, you can analyze when you lose and strengthen the logic.

Rather than focusing on each win or loss,

the most important is that over a span such as one week or one month, the total result is positive.Total net positive is what matters.

• “I won today, so I’m happy.”

• “I lost today, so I’m uneasy.”

To remove these emotional waves, let the EA handle entries,and have humans focus on “exiting according to the rules.”.

Not “I want to win,” but “I want to earn” —this mindset is the foundation for long-term profitability.

Stability gained by following the rules

A common reason people lose heavily in trading is the urge to win leads to breaking the rules

• Completely automated entry by EA

• Fixed exit conditions that are rule-based

human intervention is minimized and hesitation is eliminated.

We verified using the “maximum profit target” rule that aims for the Sky zone,

there are times when exit-at-entry becomes more common, but by sticking to the rules you can calmly seize the next opportunity.

Even in scenarios where you could have taken more,

because you cut at entry price according to the rules, you end up maintaining a total positive result— this is the strength of the strategy.

What matters in trading is not “Win rate but “Reproducibility”

Many traders worry about the win rate, but

even with a 50% win rate, capital can grow if the risk-reward (RR) is good

What matters is to have rules that arereproducible by anyone— a reproducible system

Sky between the heavens is,

•EA entry → mechanical stop → rule-based take profit

With this zero-emotion flow, we aim to establish trading as a “business”.

⸻

Strategy aiming for overall profit

Focusing on daily wins and losses is risky.

For example, over a week or a month, even with some losing days, if the total is positive, it’s OK.

EA has no emotions, making it ideal for long-term fund management.

Operating the rules with a vision of “earn” rather than “win” helps the capital growth curve stay stable.

ℹ️Information on dedicated tools (purchase bonus)

Currently, for those who purchased Sky between the heavens, we are providing auxiliary tools (automatic entry + stop processing).

This was made because I want to use it daily, and

it delegates breakout judgments and risk management to align with market structure.

Take profits remain a matter of personal judgment, and this tool suits those who prefer such an approach.

Reviews are not abundant yet, perhaps because it is simple and straightforward in structure, requiring minimal interaction before and after purchase.

However, if the user base grows, monetization may be considered.

The reason is that selling the tool alone may not suffice; a bundled support approach could be required.

____

◻️ For those who want automated EA entry

This tool, which automates the logic into an EA, is distributed as a purchase bonus.

If you are considering purchasing, please feel free to contact us.

Sky between the heavens Entry EA here

If you are interested in Sky between the heavens, you can join the online community

Join the online community here

We cannot explain specific trading logic inside the online community, but

you can participate in a “chart critique community” using Sky between the heavens.

• If you send a chart image you are curious about,

“What would have been the right judgment here?”

“Where were entry and take-profit points?” etc., with feedback that includes rule-based decision examples.

•Past charts for specific time periods are also OK.

We will reply in due course as time allows.

To those interested in Sky between the heavens

In short-term trading, the foundation is to make decisions calmly by rules—

that is the core philosophy of Sky between the heavens.

Free materials here:

▶︎ Download 'Paths to the Rift'

In 'Paths to the Rift', you will learn in which situations you can actually trade,

and the decision criteria are explained more clearly.

Compared to the sales page of “Sky between the heavens” alone,

it also provides detailed entry points and zone selections with diagrams and case studies.

Even first-time readers can replicate easily, so

if you are curious, please give it a try as well.

If you are interested, please first receive the free material 'Paths to the Rift'.

From there, your next step in the Rift begins.

“Should I enter this chart?”

When you hesitate,I hope this helps shift your thinking to “judge by rules, not by intuition.”