【第82回】大きく負けず週+376pips/1ロット545,200円の結果に。平均勝率40%で積み上げた検証結果。

Will you include this chart?

【第82回】 Substantial week with +376 pips per 1 lot, 545,200 yen. Results built on an average win rate of 40%.

Pips gained:375 pips

1 lot →approximately545,200 yen

0.1 lot →approximately54,520 yen

⸻

From Monday, August 11 to Friday, August 15, over 5 days

Total result for the 5 days

• Total trades:77 trades

• Take-profit successes: 31 trades

• Breakeven/at-entry: 16 trades

• Stop losses: 30 trades (all within −10 pips)

• Total gained: +569 pips

• Total loss: −193 pips

• Net profit: +376 pips

• Win rate: about 40.3% (31 wins / 77 trades)

• PF (Profit Factor): 2.95

• Revenue (USD/JPY converted at 145 yen):

1 lot →Approximately 545,200 yen

0.1 lot →Approximately 54,520 yen

Stability brought by fixed maximum loss

With the rule of fixed maximum loss of -10 pips introduced in August, losses are confined to a defined limit.

Even though discretionary stops were possible before, setting a fixed width creates a clear standard of “−10 pips in the worst case,” removing doubt during trades.

As a result,even during sequences of stop losses, psychological swings are suppressed, allowing operations to proceed in a disciplined, rule-based manner.

Entries of the breakout type are handled by EA, while take profits are executed when predefined zones are reached or conditions for retracements are met.

⸻

Daily detail results

August 11 (Mon)

• Total trades: 11

• Take-profit successes: 5

• Breakeven: 2

• Stops: 4 (all within −10 pips)

• Total gained: +124 pips

• Total loss: −22 pips

• Net: +102 pips

• Win rate: about 45.5% (5 wins / 11 trades)

• PF: about 5.64

Key Point

Despite a lower win rate around 45%, the profit per trade is large, and PF of 5.64 indicates excellent efficiencyThis is highly efficient

⸻

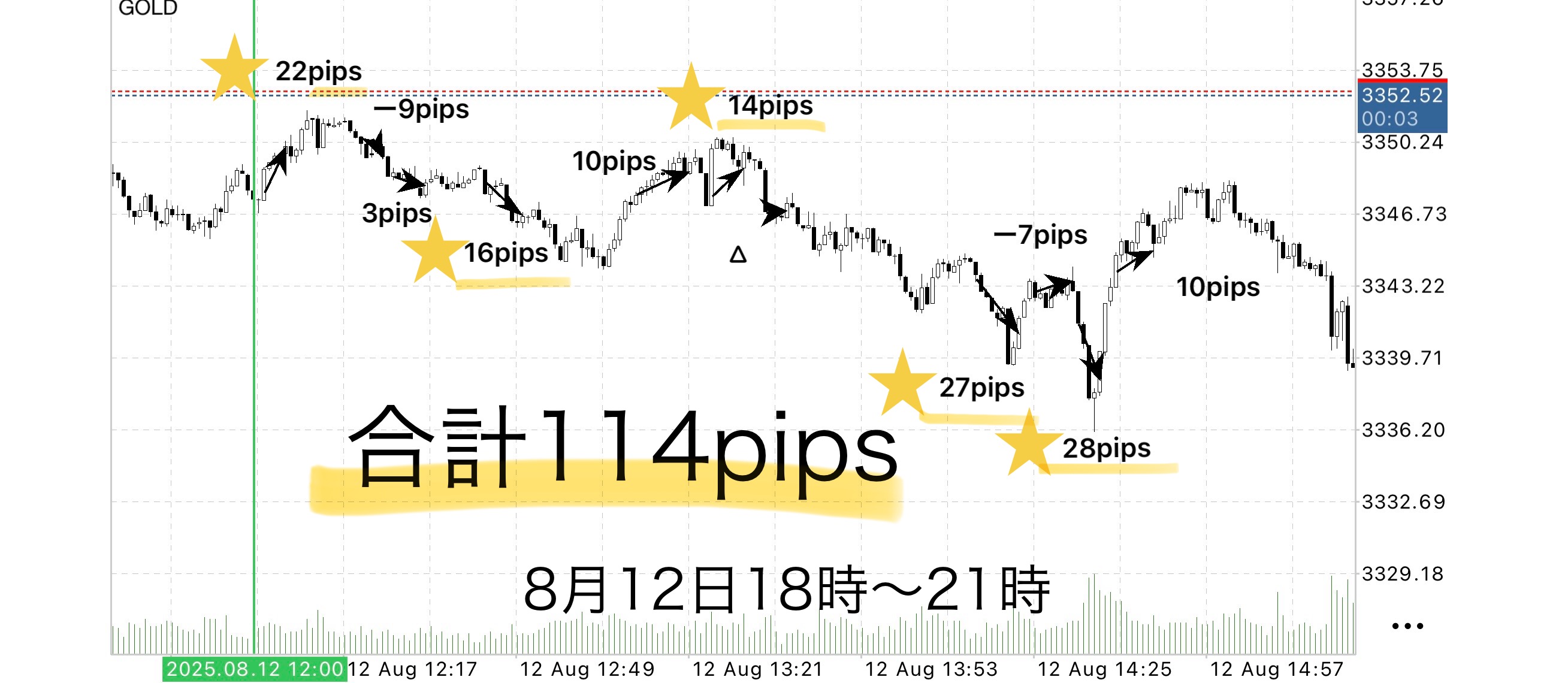

August 12 (Tue)

• Total trades: 11

• Take-profit successes: 8

• Breakeven: 1

• Stops: 2 (all within −10 pips)

• Total gained: +130 pips

• Total loss: −16 pips

• Net: +114 pips

• Win rate: about 72.7% (8 wins / 11 trades)

• PF: 8.13

Key Point

Win rate 72.7% and PF 8.13, the best weekly result. Riding a strong trend increased stability..

⸻

August 13 (Wed)

• Total trades: 15

• Take-profit: 4

• Breakeven: 3

• Stops: 8 (all within −10 pips)

• Total gained: +78 pips

• Total loss: −47 pips

• Net: +31 pips

• Win rate: 26.7% (4 wins / 15 trades)

• PF: 1.66

Key Point

Directionless days kept win rate in the 26% range. Losses tended to grow, but fixed −10 pips minimized damage.

⸻

August 14 (Thu)

• Total trades: 22

• Take-profit: 8

• Breakeven: 5

• Stops: 9 (all within −10 pips)

• Total gained: +141 pips

• Total loss: −64 pips

• Net: +77 pips

• Win rate: 36.4% (8 wins / 22 trades)

• PF: 2.20

Key Point

Highest trade count so far. More breakeven closures, emphasizing “defense,” allowed preserving profits.“Protecting profits” resulted in favorable outcomes.

⸻

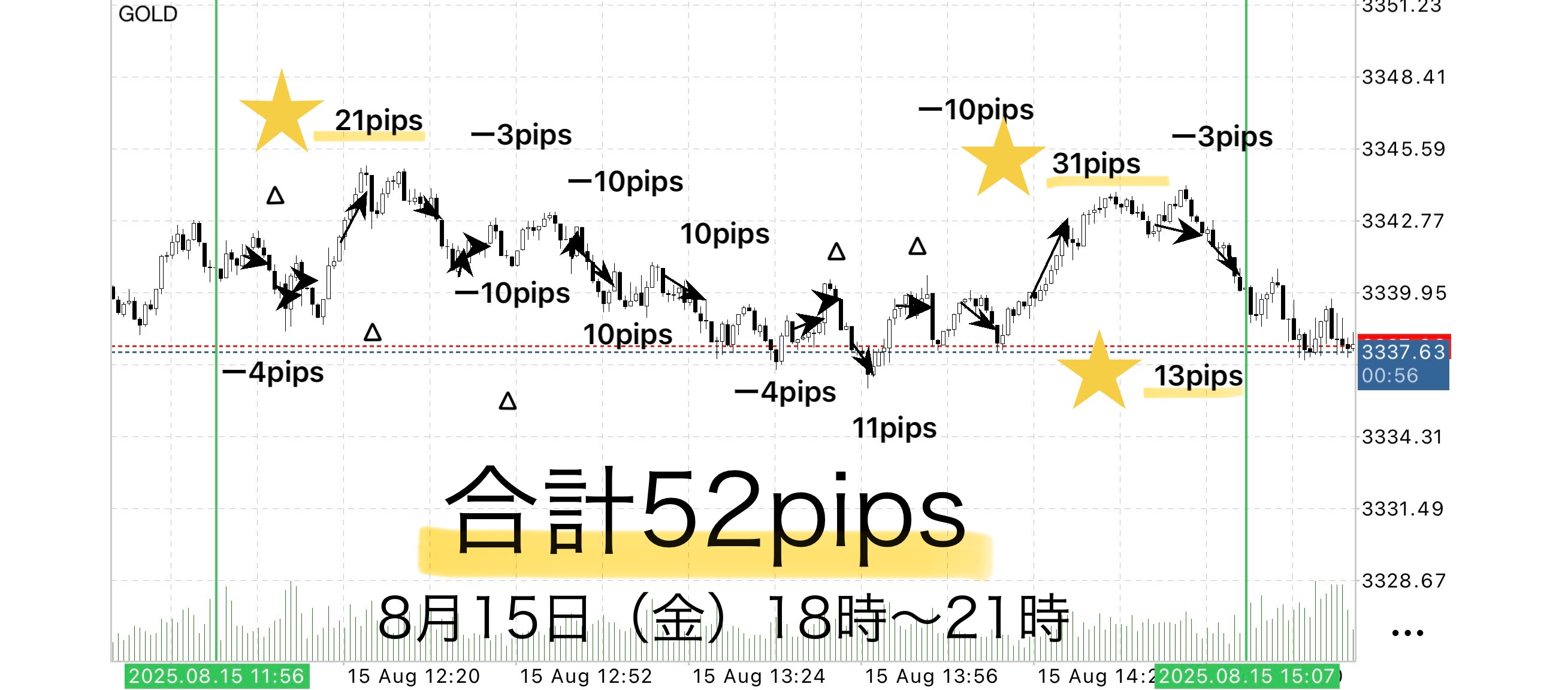

August 15 (Fri)

• Total trades: 18

• Take-profit: 6

• Breakeven: 5

• Stops: 7 (all within −10 pips)

• Total gained: +96 pips

• Total loss: −44 pips

• Net: +52 pips

• Win rate: 33.3% (6 wins / 18 trades)

• PF: 2.18

Key Point

Most stops were at the maximum width, but the number of stops was kept down, securing +52 pips.

⸻

Daily tendency

Looking at it this way, on days with a clear trend (Tuesday) there is strong growth, and on range days (Wednesday) the rule-based approach of defending with breakevens and stops shows in the numbers.

⸻

Summary

What this test reinforced is

“Lose small, win big through rules.”This basic idea

becomes even more powerful when combined with fixed losses.

This strategy matches a philosophy of seeking stability while still taking opportunities.

It is a highly practical style that can reliably accumulate profits without being swayed by emotions.

A week that reaffirmed the ability to steadily build profits without emotional influence.

EA-driven breakout strategy

“Skies Between” is a simple strategy where entry is automated by an EA, and the trader focuses on monitoring after entry and executing the exit rules.

The EA constantly monitors the chart and can enter precisely at breakout moments.

This eliminates the stress of staring at the screen before entry or the anxiety of missing the timing.

As a bonus to purchasers, this EA is available for use.

If you’d like to use it, please send a message and we will provide the download password.

Why reveal negative results?

Investing Navigator+ intentionally publishes negative results as well.

The reason is that “trading cannot always be winning.”

Rather, recording losses helps analyze what situations lead to losses and strengthen the logic.

Rather than obsessing over each win or loss,

over a span of a week or a month, as long as the total revenue is positive, that is most important

• “Today I won, so I’m happy”

• “Today I lost, so I’m anxious”

To eliminate these emotional swings, let the EA handle the entries, and have humans focus on executing the rules for exits.

Not “I want to win,” but “I want to earn” —this mindset is the foundation for long-term profit.

Stability gained by following the rules

A common trait among those who lose a lot is the urge to win, which leads to rule violations.For example, delaying a decision to see if it can be stretched further can wipe out profits quickly.

Skies Between uses:

• Fully automated entry by EA

• Fixed, rule-based exits

This reduces human intervention to the minimum and eliminates hesitation.

By mechanically following the rules, win rate and risk-reward become naturally stable.

⸻

Testing using the “Max Take Profit” rule targeting the Sky Zone,

there are times when breakeven closes are frequent, but adhering to the rules enables calmly seizing the next opportunity.

Even in moments where you think, “I could have taken more,”

because you closed at breakeven according to the rules, you end up with a total positive result—this is the strength of the strategy.

In trading, it’s not about “win rate” but “repeatability.”Most traders worry about win rate, buta 50% win rate with good risk-reward grows capital.What matters is having a rule that yields the same results for anyone to reproduce.

Skies Between

•EA entry → mechanical stop → rule-based exit

Performing this sequence with zero emotion prioritizes treating trading as a business.

⸻

A strategy aimed at overall profit

Focusing on daily wins and losses is risky.

Viewed over a week or month, slight negative days can be acceptable if overall is positive.

The EA, without emotions, is optimal for long-term capital management.

Operating the rules with the goal of earning rather than just winning stabilizes capital growth.

ℹ️Guide to the dedicated tool (purchase perk)

Currently, for those who purchase Sky Between, we provide a supplementary tool (auto-entry + stop processing).

This was made from the desire to have something I would want to use daily,

and it delegates breakout judgment and risk management according to market structure.

Take profits remain a matter of “your judgment,” making this a compatible tool for many.

Reviews are still limited, perhaps because the structure is simple and clear enough that active discussion before or after purchase is not required.

However, if user numbers grow, we may consider monetization.

This is because there is a possibility that tools would need to be sold not just as standalone, but as “support and set” usage.

____

◻️ For those who want automatic EA entries

The tool that automates this logic is currently distributed as a purchase perk.

If you are considering purchasing, feel free to contact us.

If you’re interested in Sky Between, you can join the online community

Join the online community here

Inside the online community, detailed trading logic cannot be explained, but

you can participate in a “chart critique community” using Sky Between.

• Send a chart image you’re curious about,

“What would have been the correct judgment in this situation?”

“Where was the entry and take-profit point?” etc.,we provide feedback with rule-based decision examplesattached.

•Past charts at specific times are OK.

We respond in order as time allows.

For those interested in Sky Between

Build a foundation to decide with rules without hesitation in short-term trading—

that is the core philosophy of Sky Between.

Free教材 here:

▶︎ Download “Trail to the Gap”

In “Trail to the Gap,” you’ll learn what kinds of scenarios can be traded and how to judge them more clearly.

It also covers concrete entry points and zone selection in detail with diagrams and cases, which was not fully conveyed on the Sky Between sales page.

The material is written in an accessible way, so even first-time readers can reproduce it easily. If you’re curious, please take advantage of it.

If you’re interested, please first receive the free material “Trail to the Gap.”

From there, your first step in the Sky Between begins.

“Will you include this chart?”

When you’re unsure,it’s helpful to switch to thinking in terms of rules rather than intuition.