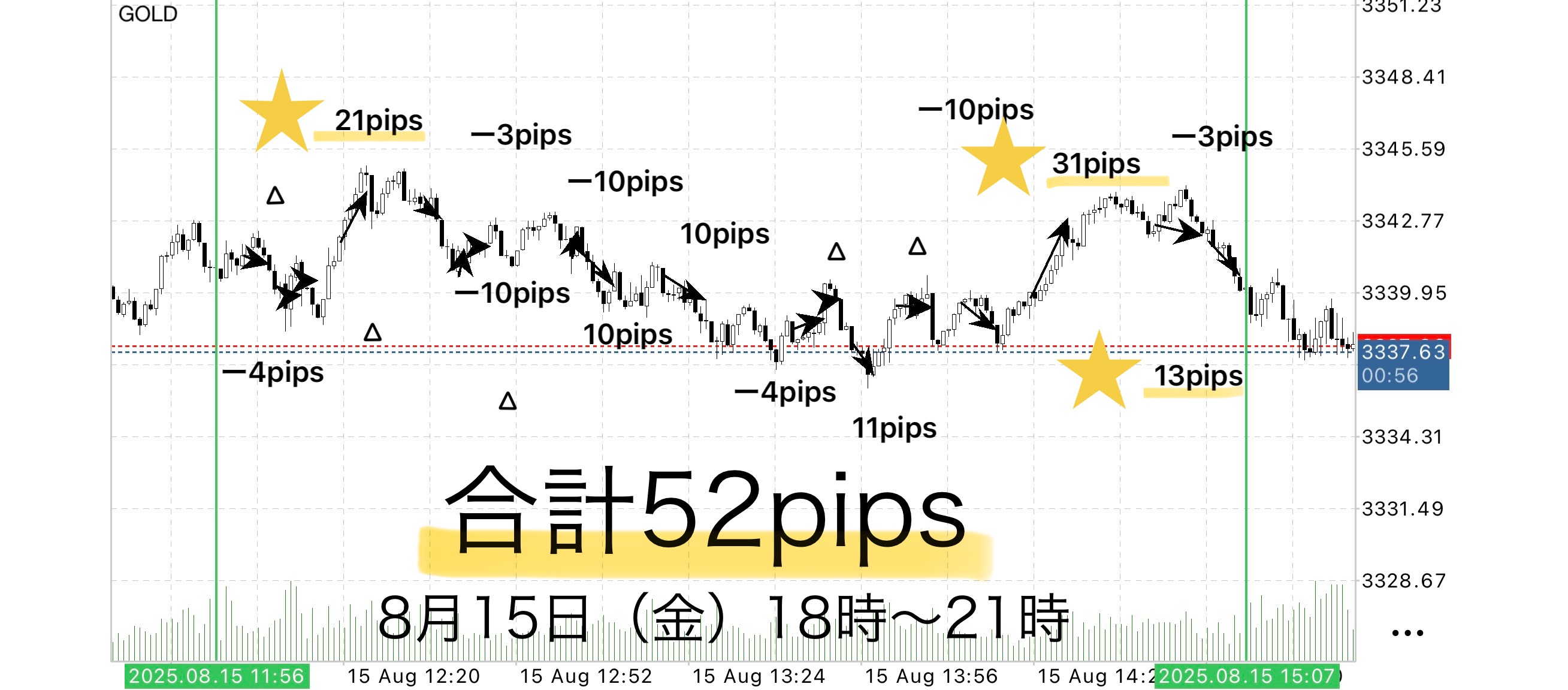

【Episode 81】Win rate 33% still PF2.18 / +52 pips / all positions exceeding 10 pips, focusing on risk-reward / GOLD 1 minute

Will you include this chart?

【81st】Win rate 33% but PF 2.18! All positions over 10 pips, focus on risk-reward / GOLD 1-minute chart

Prioritize RR ratio to stay profitable even with low win rate. If you hit the high-win-time, losses become smaller and profits larger

Net profit:+52 pips

1 lot → about75,400 JPY/ 0.1 lot → about7,540 JPY

Friday, August 15, 2025 — 18:00–21:00 Japan Time

On this day, I set a single-position target in the sky-zone and validated it with a return settlement rule.

The stop loss was基本 to a maximum −10 pips, and we also utilized “shallowest stop” that exits immediately when the recent high/low is broken, depending on the chart pattern.

This time, there were more instances of stops at the maximum SL, but the number of stops itself was not large, and the profit width far exceeded the loss width.

• Total trades: 18

• Profit-taking successes: 6

• Position close: 5

• Stops: 7 (all within −10 pips)

• Total gained: +96 pips

• Total loss: −44 pips

• Net profit: +52 pips

• Win rate: 33.3% (6 wins / 18)

• PF (Profit Factor): 2.18

• Revenue (USD/JPY converted at 145 JPY):

1 lot → about 75,400 JPY / 0.1 lot → about 7,540 JPY

⸻

Development and profitability after breaking the floating zone

This time, after entry many positions broke through the floating zone andcontinued to rise by more than 10 pips.

There were many cases where the entry was closed at cost, but by eliminating downside risk while securing the profit range, the overall result was a high risk-reward trade.

⸻

Points seen from validation

Even with a low win ratethe high RR ratiodirectly contributed to positive cash flow.

Furthermore, if this aligns with a high-win-time or day, the small losses with larger gains become even clearer, potentially making the equity curve steadily rise.

Therefore, it is essential to be in a “steady, methodical” mode rather than aiming for a single big hit.

By combining the sky-zone targeting with the rule-based move to break even after there is a breakout in floating zone, it was a validation that you can minimize losses while efficiently stacking profits.

EA-driven breakout strategy“The Sky Between” is a simple strategy where entry is automated by an EA, and traders focus on monitoring after entry and implementing exit rules.The EA continuously watches the chart and can enter the breakout precisely at the moment it occurs.This eliminates the stress of staring at the screen before entry and the anxiety of missing timing.As a bonus for purchasers, this EA is available for use.If you’d like to use it, please message me and I will send you a download password. Sky Between Main Story HereWhy publish negative results?Investment Navi+ deliberately publishes negative results as well.The reason is that “trading isn’t something you can win all the time.”On the contrary, recording losses helps analyze what conditions lead to losses and strengthens the logic.Rather than fixating on each win or loss,Over a span of a week or a month, a net positive overall is what matters,”is most important•“Today I’m happy because I won”•“Today I’m worried because I lost”To eliminate these emotional swings, let the EA handle entries, and have humans focus on “settling according to the rules.”“Want to win” rather than “Want to earn”—this mindset is the foundation for long-term profitability.Stability obtained by following the rulesOne common trait of those who lose big is the urge to win leads to breaking the rules.For example, postponing settlement to extend gains or see a bit longer can wipe out profits in a flash.Sky Between is•Entry fully automated by EA•Settlement under fixed, rule-based conditionsThis reduces human intervention to a minimum and eliminates hesitation.By mechanically following the rules, win rate and risk-reward naturally stabilize.⸻Validation with the “maximum profit” rule aiming for the Sky ZoneThere are times when cost-basis closeouts are frequent, but by adhering to the rules, you can calmly seize the next opportunity.Even in scenes where you think “I could have taken more,”because you closed at cost according to the rules, you end up maintaining a net positive overall; that is the strength of this strategy.In trading, what matters is “reliability” rather than “win rate””.Many traders worry about win rate, buteven with a 50% win rate, a good risk-reward can still grow capital.What matters is having a rule withreproducibility that yields the same result regardless of who uses it“reproducibility”.Sky Between is,•EA entry → mechanical stop → rule-based takePerforming this sequence with zero emotion is the key to treating trading as a business. ⸻Strategy aimed at total profitabilityFocusing on daily wins and losses is risky.For example, looking at a week or month, even if there are some negative days, as long as the total is positive, it’s OK.Since the EA has no emotions, it is ideal for long-term capital management.Operating the rules with the mindset of “earn” rather than “win” helps the capital curve become more stable.ℹ️Dedicated tools (purchase bonus) informationCurrently, for those who purchased Sky Between, we provide auxiliary tools (automatic entry + stop processing) as a bonus.This was created out of a desire to use it daily, and it is designed to delegate only breakouts and risk management to follow market structure.For those who believe profit-taking remains a personal judgment, this tool is well-suited.Reviews are not many yet, perhaps because of the simple and straightforward structure that requires little active discussion before or after purchase.However, if the number of users grows, we may consider monetization.The reason is that it may be necessary to operate “support and set” rather than selling the tool alone.____◻️For those who want automatic entry by EAThis tool, which turned this logic into an EA, is distributed as a purchase bonus.If you are considering a purchase, feel free to contact us.Sky Between Entry EA hereIf you are interested in Sky Between, you can join online communityJoin Online Community hereWe cannot explain specific trading logic inside the online community, butyou can participate in the “chart critique community” using Sky Between.If you have a chart image you’re curious about,we’ll provide feedback with a rule-based judgment such as“What would have been the right decision in this moment?”“Where were the entry and take-profit points?” etc.,with examples based on rules.•Past charts from specific times are OK.We respond in order as time allows.To those interested in Sky BetweenIn short-term trading, building a foundation to judge by rules without hesitation—that is the core philosophy of Sky Between.Free materials here:▶︎Download ‘Trail to the Gap’In ‘Trail to the Gap,’ you’ll learn in which situations you can actually trade,the judgment criteria is explained more clearly.The sales page for ‘Sky Between’ couldn’t fully conveythe specifics of entry points and how to choose zones; this is supplemented with diagrams and case-by-case explanations.Even beginners can reproduce it easily, so if you’re curious, please use it as well.If you’re interested, please first receive the free material ‘Trail to the Gap’.From there, your first step into the Gap begins.“Will you include this chart?”When unsure,switch to a mindset of judging by rules rather than by intuition.

“The Sky Between” is a simple strategy where entry is automated by an EA, and traders focus on monitoring after entry and implementing exit rules.

The EA continuously watches the chart and can enter the breakout precisely at the moment it occurs.

This eliminates the stress of staring at the screen before entry and the anxiety of missing timing.

As a bonus for purchasers, this EA is available for use.

If you’d like to use it, please message me and I will send you a download password.

Why publish negative results?

Investment Navi+ deliberately publishes negative results as well.The reason is that “trading isn’t something you can win all the time.”

On the contrary, recording losses helps analyze what conditions lead to losses and strengthens the logic.

Rather than fixating on each win or loss,

Over a span of a week or a month, a net positive overall is what matters,”is most important

• “Today I’m happy because I won”

• “Today I’m worried because I lost”

To eliminate these emotional swings, let the EA handle entries, and have humans focus on “settling according to the rules.”

“Want to win” rather than “Want to earn”—this mindset is the foundation for long-term profitability.

Stability obtained by following the rules

One common trait of those who lose big is the urge to win leads to breaking the rules.

• Entry fully automated by EA

• Settlement under fixed, rule-based conditions

This reduces human intervention to a minimum and eliminates hesitation.

By mechanically following the rules, win rate and risk-reward naturally stabilize.

⸻

Validation with the “maximum profit” rule aiming for the Sky Zone

There are times when cost-basis closeouts are frequent, but by adhering to the rules, you can calmly seize the next opportunity.

Even in scenes where you think “I could have taken more,”

because you closed at cost according to the rules, you end up maintaining a net positive overall; that is the strength of this strategy.

In trading, what matters is “reliability” rather than “win rate””.

Many traders worry about win rate, but

even with a 50% win rate, a good risk-reward can still grow capital.

What matters is having a rule withreproducibility that yields the same result regardless of who uses it“reproducibility”

Sky Between is,

•EA entry → mechanical stop → rule-based take

Performing this sequence with zero emotion is the key to treating trading as a business.

⸻

Strategy aimed at total profitability

Focusing on daily wins and losses is risky.

For example, looking at a week or month, even if there are some negative days, as long as the total is positive, it’s OK.

Since the EA has no emotions, it is ideal for long-term capital management.

Operating the rules with the mindset of “earn” rather than “win” helps the capital curve become more stable.

ℹ️

Currently, for those who purchased Sky Between, we provide auxiliary tools (automatic entry + stop processing) as a bonus.

This was created out of a desire to use it daily, and it is designed to delegate only breakouts and risk management to follow market structure.

For those who believe profit-taking remains a personal judgment, this tool is well-suited.

Reviews are not many yet, perhaps because of the simple and straightforward structure that requires little active discussion before or after purchase.

However, if the number of users grows, we may consider monetization.

The reason is that it may be necessary to operate “support and set” rather than selling the tool alone.

____

◻️For those who want automatic entry by EA

This tool, which turned this logic into an EA, is distributed as a purchase bonus.

If you are considering a purchase, feel free to contact us.

If you are interested in Sky Between, you can join online community

We cannot explain specific trading logic inside the online community, but

you can participate in the “chart critique community” using Sky Between.

If you have a chart image you’re curious about,

we’ll provide feedback with a rule-based judgment such as

“What would have been the right decision in this moment?”“Where were the entry and take-profit points?” etc.,with examples based on rules.

•

We respond in order as time allows.

To those interested in Sky Between

In short-term trading, building a foundation to judge by rules without hesitation—

that is the core philosophy of Sky Between.

Free materials here:

▶︎ Download ‘Trail to the Gap’

In ‘Trail to the Gap,’ you’ll learn in which situations you can actually trade,

the judgment criteria is explained more clearly.

The sales page for ‘Sky Between’ couldn’t fully convey

the specifics of entry points and how to choose zones; this is supplemented with diagrams and case-by-case explanations.

Even beginners can reproduce it easily, so if you’re curious, please use it as well.

If you’re interested, please first receive the free material ‘Trail to the Gap’.

From there, your first step into the Gap begins.

“Will you include this chart?”

When unsure,switch to a mindset of judging by rules rather than by intuition.