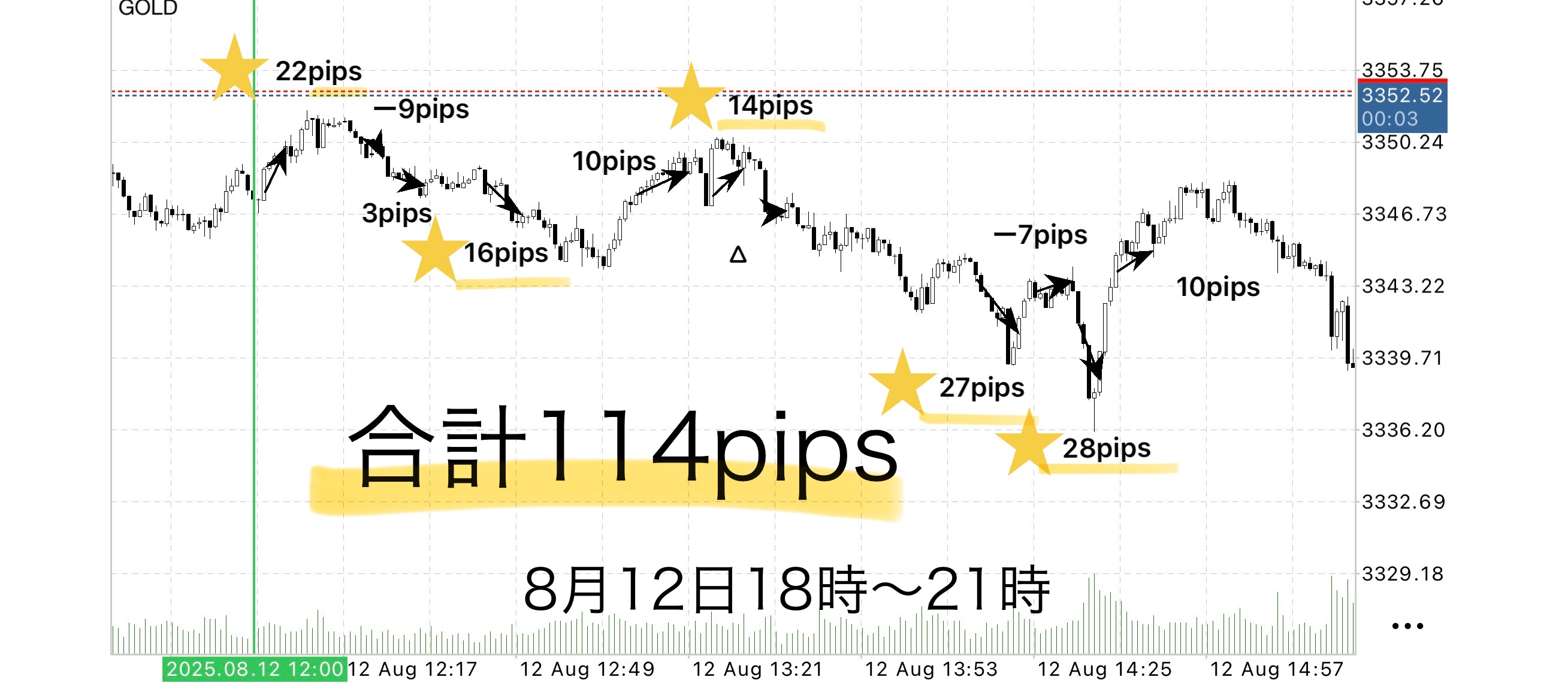

【Episode 75】 GOLD 1-minute chart verification|±114 pips with Sky Zone target (Win rate 72.7%・PF 8.13)

Do you want to include this chart?

[Issue 75] GOLD 1-minute chart verification: Single-position type, sky zone target, +114 pips (win rate 72.7%, PF 8.13)

Earned pips:114 pips

1 lot:¥165,300/ 0.1 lot:¥16,530

Single-position type, sky zone target × pullback exit rule (18:00–21:00)

On August 12, 2025 (Tuesday), from 18:00 to 21:00, we tested using a single-position type with the sky zone as the target and exiting on pullbacks.

That day had many directional changes; after reaching the sky zone, momentum slowed and pulled back, highlighting the effectiveness of pullback exits.

Stop loss ismaximum −10 pips, but we prioritized chart structure and used “shallow stop” by exiting immediately on a break of the most recent high/low.

As a result, several trades kept loss to 7–9 pips, and total loss was limited to −16 pips.

Verification conditions

• Date: 2025-08-12 (Tue)

• Instrument: GOLD (XAU/USD) 1-minute chart

• Time: Japan time 18:00–21:00

• Method: Sky gap, single-position type (sky zone target)

• Settlement method: If price returns into the zone after reaching the sky zone, exit immediately (even if target not reached, exit if it returns)

• Stop loss: fixed at max −10 pips, or shallow exit on break of recent high/low

⸻

• Total trades: 11

• Profit-taking successful: 8 times

• Breakeven exit: 1 time

• Stop losses: 2 times (all within −10 pips)

• Total gained: +130 pips

• Total loss: −16 pips

• Net result: +114 pips

• Win rate: about 72.7% (8 wins / 11 trades)

• PF (Profit Factor): 8.13

• Example of profits (1 pip = ¥1,450):

1 lot → about ¥165,300 / 0.1 lot → about ¥16,530

⸻

Points where pullback exits were effective

When momentum slowed just after reaching the sky zone, exiting as soon as the price returned inside the zone helped prevent profit loss from a reversal.

Also, when the price stalled after breaking out without re-entering the zone, exiting before the price was dragged back avoided the risk of returning close to breakeven.

⸻

From this verification, it was confirmed that even with a single-position type, combining the sky zone with pullback exits can maintain small losses and large gains in markets with frequent direction changes. By setting a maximum stop loss width and shallowly cutting losses based on chart shape, drawdowns can be suppressed, and clearly distinguishing “when to extend” and “when to protect” leads to stable results.

EA-triggered breakout strategy

The “Sky Gap” is a simple strategy where entry is entrusted to an automatic entry EA, and the trader focuses only on monitoring after entry and executing the exit rules.

The EA continuously monitors the chart and can enter precisely at the moment of a breakout.

This eliminates the stress of staring at the screen before entry and the fear of missing the timing.

As a bonus for purchasers, this EA is available for use.

If you wish to use it, please send a message and we will provide a download password.

Why publish negative results?

Invest Navi+ deliberately publishes even negative results without hiding them.

The reason is that “trading cannot always be winning.”

Rather, by recording losses, you can analyze what conditions lead to losing and make the logic more robust.

Instead of clinging to each win or loss,

Over a period like a week or a month, the most important is that the total balance is in positive.Total balance stays positive..

• “I’m happy because I won today.”

• “I’m anxious because I lost today.”

To eliminate this emotional roller coaster, the EA handles entries while humans focus on “exit rule adherence.”

“I want to win”>> rather, “I want to earn””—”—This mindset is essential for long-term profitability.

Stability gained by following the rules

A common trait of people who lose big in trading is the urge to win, which leads to rule-breaking.For example, wanting to extend profits or waiting to see more can cause profits to vanish all at once.

Sky Gap is

• Entry fully automated by EA

• Exit under fixed, rule-based conditions

This reduces human intervention to an absolute minimum and eliminates hesitation.

By mechanically following the rules, win rate and risk-reward become naturally stable.

⸻

We validated with an “optimal profit-taking” rule targeting the sky zone; there are times when breakeven exits occur, but by following the rule and staying in the frame, you can calmly seize the next opportunity.

Even in scenes where you think “I could have taken more,”

because exits were taken at breakeven according to the rules, you end up with a total positive result—this is the strength of the strategy.

What matters in trading is not “win rate but “reproducibility”

Many traders focus on “win rate,” but

even with a win rate of 50%, capital can grow if the risk-reward is favorable

What matters is having a rule that isreproducible by anyone and yields the same results

Sky Gap is,

•EA entry → mechanical stop loss → fixed take profit

prioritizing making trading a business..

⸻

A strategy aimed at overall profitability

Focusing on daily wins and losses can be dangerous.

Over a week or month, even with some negative days, if the total balance remains positive then it’s fine.

Because the EA has no emotions, it is ideal for long-term capital management as well.

Operation of rules with a vision of “earn” rather than “win” tends to produce a smoother capital growth curve.

ℹ️

Currently, purchasers of Sky Gap receive an auxiliary tool (auto-entry + stop loss processing).

This was created from the desire to have a tool I would personally want to use daily, and it automatically handles breakouts and risk management according to market structure.

For those who want take profits based on their own judgment, this tool is well-suited.

Reviews are not plentiful yet, possibly because the structure is simple and clear both before and after purchase.

If usage grows, there is a possibility of making it paid in the future.

This is because it may no longer be sold as a standalone tool but required as part of a “support and set” package.

____

◻️ For those who want automated EA entry

This tool, which has been turned into an EA, is distributed as a purchase bonus.

If you are considering purchasing, please feel free to contact us.

If you are interested in Sky Gap, you can join the online community

Join the online community here

In the online community, we cannot explain specific trading logic, but

you can join a “chart critique community” utilizing Sky Gap.

If you send a chart image you’re concerned about,

“What should I have judged in this moment?”

“Where were the entry and take-profit points?” etc.,we will provide feedback with examples based on the rules.

・Past charts for specific times are also OK.

We will respond in order as time allows.

To you who are interested in Sky Gap

In short-term trading, building a foundation to decide by rules without hesitation—

that is the core philosophy of Sky Gap.

Free materials here:

▶︎ Download ‘Trajectory to the Gap’

In ‘Trajectory to the Gap,’ you’ll learn in what situations you can actually trade and the criteria for judgment in a clearer way.

It also explains more precisely about entry points and zone selection than the Sky Gap sales page alone, with diagrams and case-by-case explanations.

Even if you are new, the structure is designed to be easy to reproduce, so

if you’re curious, please make use of it as well.

If you’re interested, please first receive the free material ‘Trajectory to the Gap’.

From there, your first step in the Gap begins.

“Do you want to include this chart?”

When you hesitate, switch to thinking “judge by rules, not by instinct.”