【25.08.10】From a full-time trader’s perspective on USD/JPY! A rough environmental recognition!

◉ USD/JPY Situation

① From retreating rate-cut expectations and soft U.S. employment data, pricing in all FOMC rate cuts this year

Change in rate-cut expectations

? The FedWatch chart from CME Group shows the timing of rate cuts. The left dates are FOMC meeting dates. Looking at three cuts this year (9/17, 10/29, 12/10), the current policy rate

has been lowered by 25 basis points from 425-450.Market participants expect the first cut of 0.25% at the next meeting, another 0.25% at the October second cut, and a third 0.25% cut in December.

⇒ Therefore, with rate-cut expectations, dollar weakness has emerged, making USD/JPY more prone to decline.

② BOJ holding rates with no hike within the year. Could it be as early as the start of next year? It was said, but

From the status of U.S.-Japan trade talks and tariffshas accelerated

⇒ In Ueda’s press conference, the yen weakened, but now there is indecision about whether it will turn into yen appreciation. If the yen weakens, it benefits companies; if the yen strengthens, it benefits citizens. It is a binary choice: will it curb inflation or tolerate it?

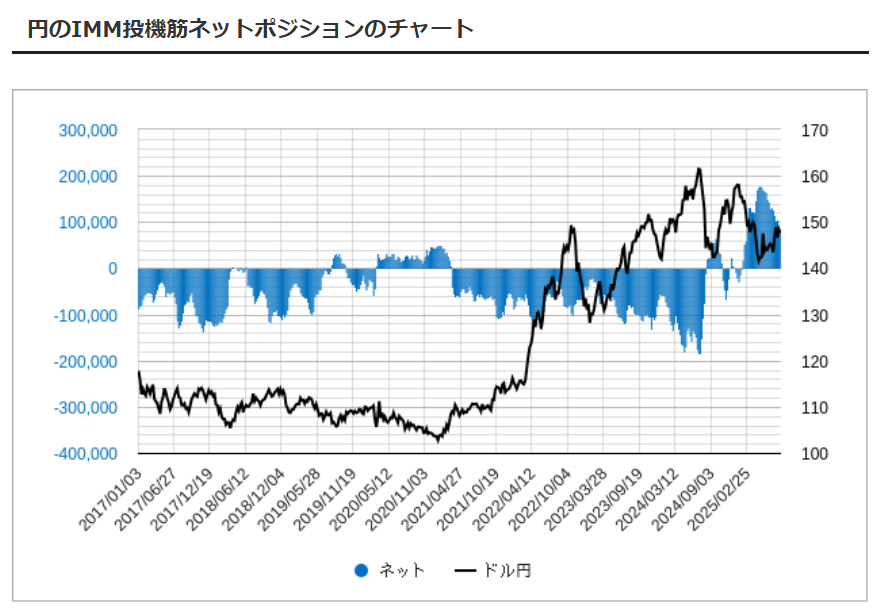

③ Movements of speculative funds

? Historically, speculators have sold the yen, but this time they were buying at a historically high level. They have not clearly broken past 140. Gradually, perhaps wary of a floor in USD/JPY, yen short positions have been unwound and the market is turning toward yen weakness. It remains to be seen whether speculators will readily switch from yen buying to selling.

⇒ This suggests USD/JPY is pointing upward as yen is being sold.

④ Technical analysis

? Monthly chart/ during the COVID rally rose, now correcting with Fibonacci 61.8 as support.If a clear pullback forms, 50% retracement at 132 yen. If 38.2% held, a break below 126 yen.If there is strong yen weakness, there may be no meaningful pullback to be called a pullback?However, if the decline to 38.2% occurs, a resistance line could flip to support, creating a roll reversal, and potentially clearing out positions that were bought at high prices before a rebound..

※ For weekly and lower timeframes, see coaching release.

⑤ Summary

What I am watching isthe decline in U.S. stocks due to a slowdown in the U.S. economy.

If USD/JPY firmly declines, it is a risk-off signal. I currently believe that a risk-off outcome requires a global stock market sell-off to trigger yen buying.

Conversely, if the U.S. economy can achieve a soft landing and U.S. stocks stabilize, USD/JPY may rise without sharp yen buying, showing only modest pullbacks.

I will continue to monitor stock movements and refine my trading strategy accordingly.

× ![]()