[Episode 71] 5 consecutive days of gains +447 pips / 648,100 yen! GOLD 1-minute chart – Stability guided by the rules

Will you include this chart?

【71st】 GOLD 1-minute chart – Maximum drawdown fixed at −10 pips with strict rules to stay positive for 5 consecutive days

Total P/L:+447 pips

1 lot:+648,100 yen/0.1 lot:+64,810 yen

⸻

5 days from August 4 (Mon) to August 8 (Fri)

5-day total performance

• Total trades:78 trades

• Profit target reached:32 times

• Breakeven close:19 times

• Stop loss:27 times (all within −10 pips)

• Total gained:+653 pips

• Total loss:−206 pips

• Total net:+447 pips

• Win rate:41.0%(32 wins / 78 trades)

• PF:3.17

• 1 lot:+648,100 yen

• 0.1 lot:+64,810 yen

From August, the maximum drawdown will be limited to−10 pips as a rule.

Even before that, trades were closed automatically when the rules dictated,

so risk was minimized, but

with the additional safety valve of fixed maximum drawdown,

operation became more stable.

Breakout entries are handled by the EA, and all profits are realized when the predetermined zones are hit or by retracement exit conditions.

As a result, the first day of the week (Aug 4) and the end of the week (Aug 8) saw particularly large gains,

while the midweek continued to accumulate profits steadily, ending all five days in the positive.

Daily detailed results

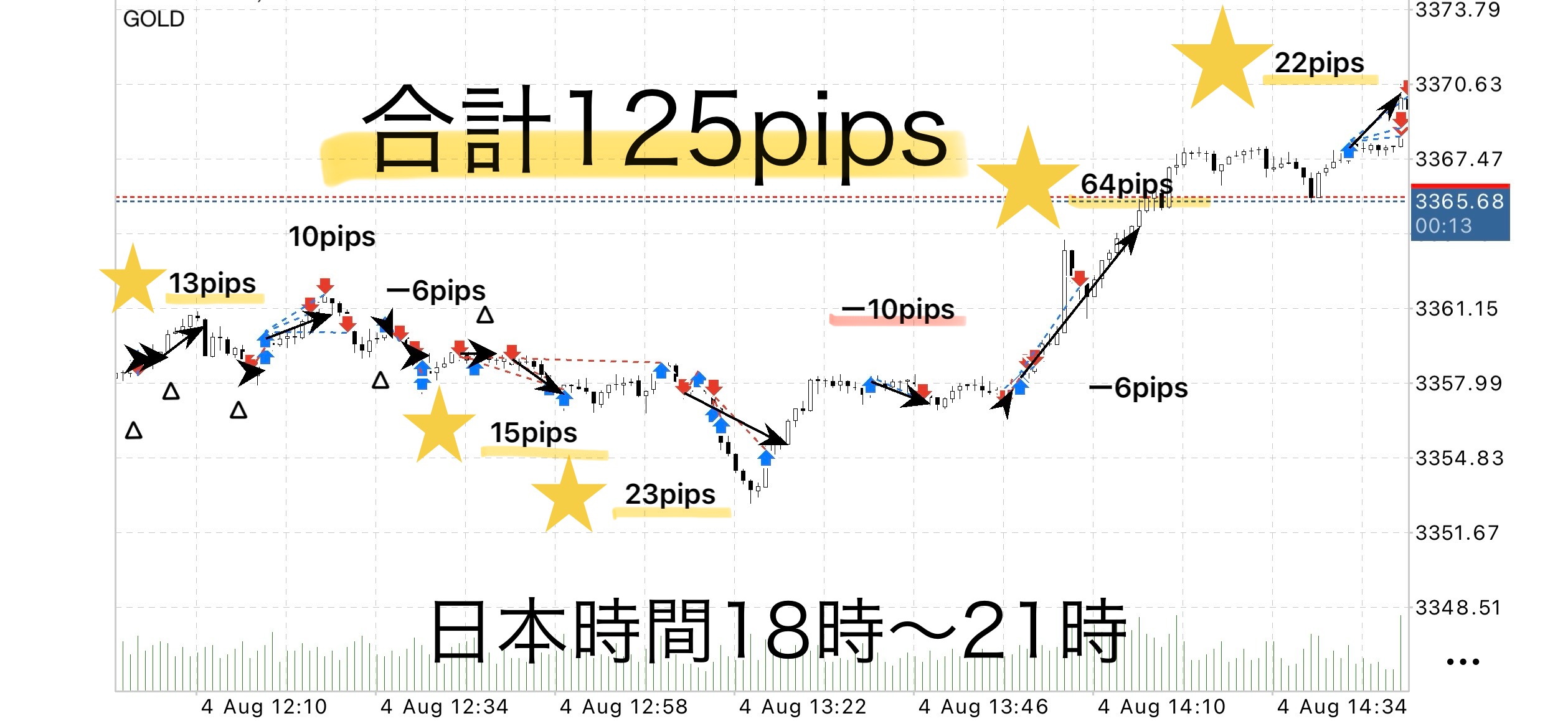

August 4 (Mon)

Total trades: 14

Profit target reached: 6

Breakeven: 5

Stop losses: 3 (all within −10 pips)

Total gained: +147 pips

Total loss: −22 pips

Total net: +125 pips

Win rate: ≈43% (6/14)

PF: ≈6.7

August 5 (Tue)

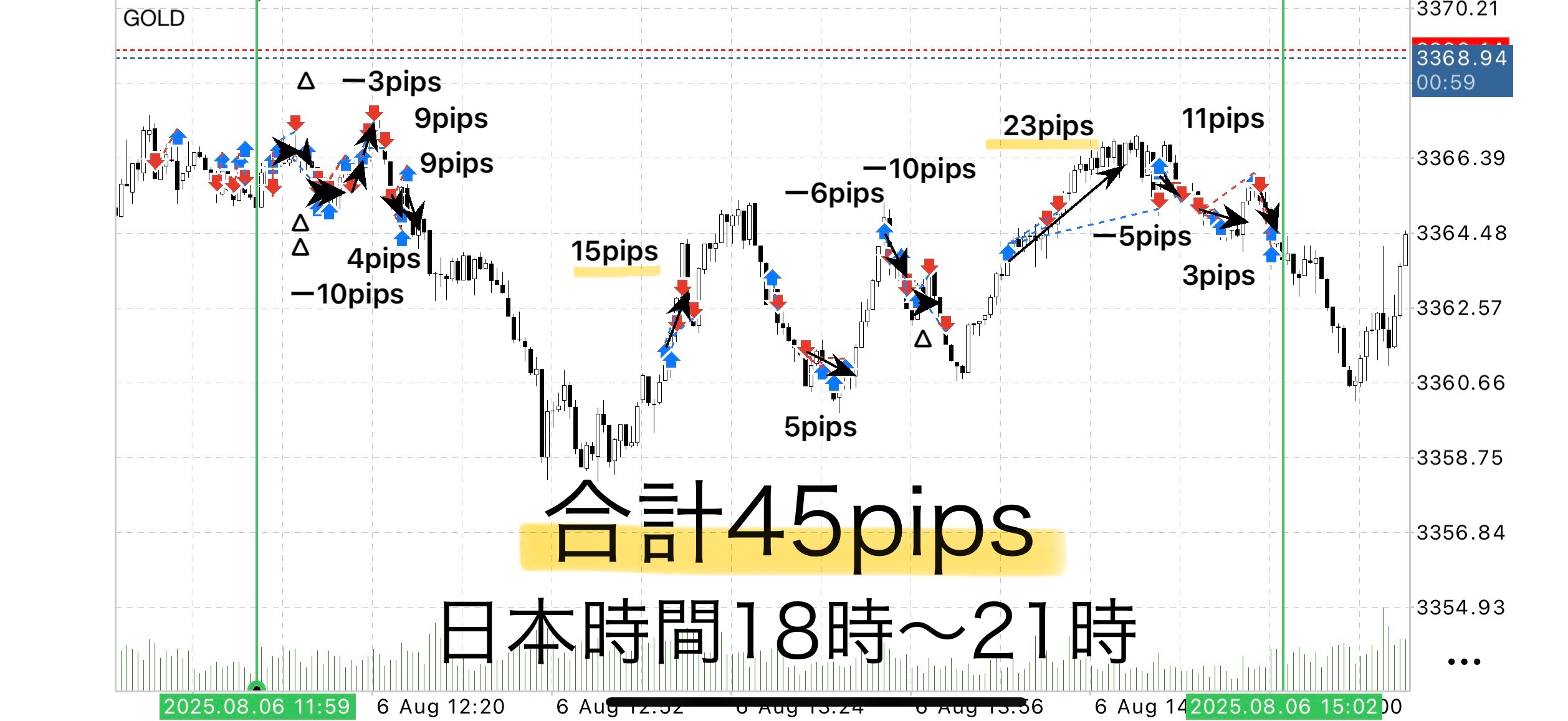

August 6 (Wed)

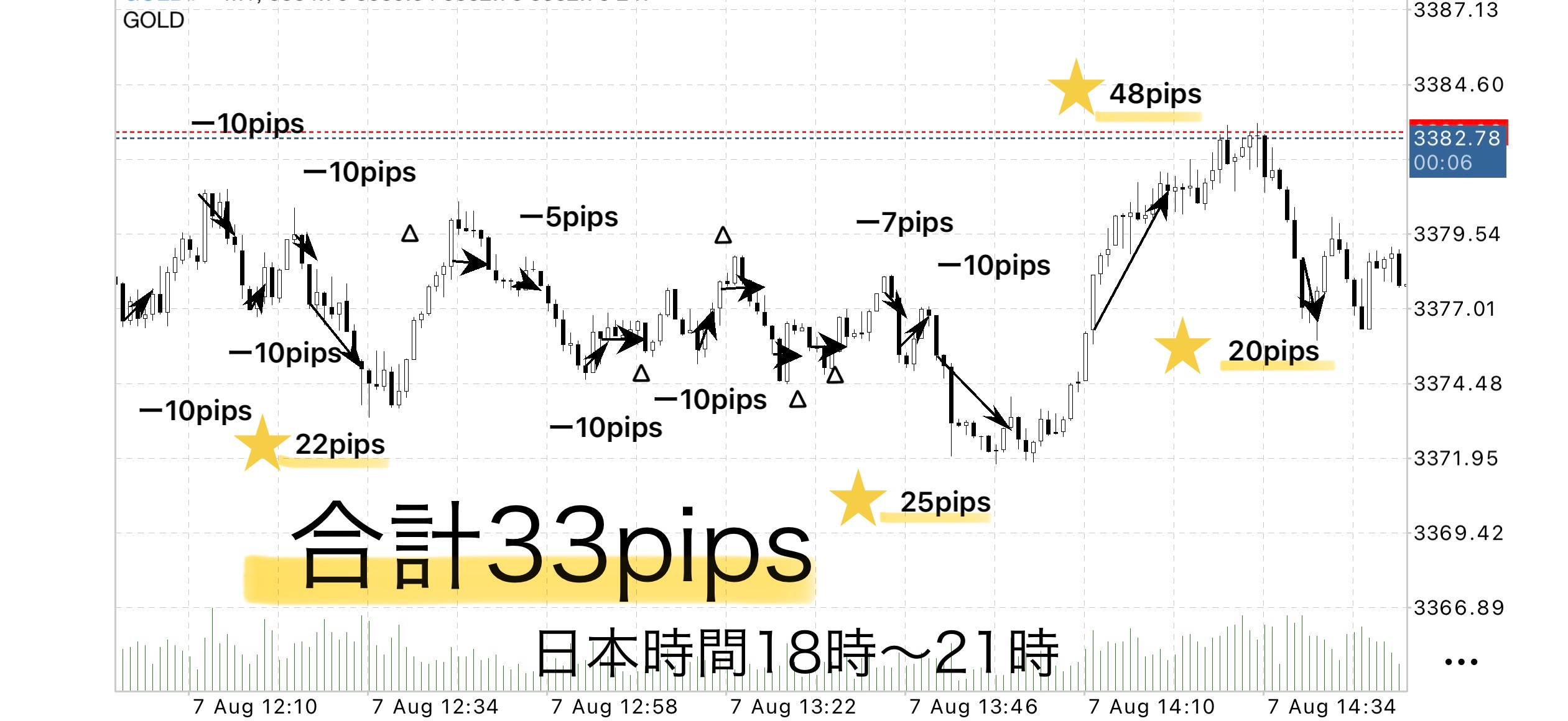

August 7 (Thu)

Entries: 18

Profit target reached: 4

Breakeven: 5

Stop losses: 9 (all within −10 pips)

Total gained: +115 pips

Total loss: −82 pips

Total net: +33 pips

Win rate: ≈22.2% (4/18)

PF: ≈1.40

August 8 (Fri)

Entries: 13 Profit target reached: 8

Breakeven: 1

Stop losses: 4 (all within −10 pips)

Total gained: +250 pips

Total loss: −26 pips

Total net: +224 pips

Win rate: 61.5%

PF: 9.62

Strengths revealed by the verification

1. Fixed maximum drawdown at −10 pips to completely limit risk

Even during large reversals, losses are minimized, directly stabilizing the mindset.

2. Double guard with traditional rule-based stop management

Before hitting the maximum drawdown, many cases close by rule, making the actual average stop width even smaller.

3. Big gains at the start and end of the week

The first day (8/4: +125 pips) and last day (8/8: +224 pips) boosted weekly results,

while the midweek profit accumulation remained steady.

4. Ninjan style and martingale are risky in volatile markets, but compatible

Unlike martingale that can lead to big losses in volatile moves,

this strategy avoids catastrophic damage with fixed losses.

Summary

From this test, the key idea is clarified:

“Minimize losses, let rules maximize wins”

The combination with fixed drawdown strengthens this further.

Gains at the start and end of the week boosted stability,

and midweek small profits accumulated meaningfully.

This strategy matches an approach that aims for stability while seizing opportunities,and is highly practical.

Being free from emotions, this week confirmed the ability to steadily accumulate profit.

EA-driven breakout strategy

“Sky Interval” is a simple strategy where entries are automated by an EA, and the trader concentrates only on monitoring after entry and executing the exit rules.

The EA constantly monitors the chart and can enter exactly at the breakout moment without missing it.

This eliminates the stress of staying in front of the screen and fear of missing timing.

As a bonus, this EA is available to purchasers.

If you wish to use it, please message to receive the download password.

Why publish negative results?

Investing Navigator+ deliberately publishes negative results as well.

The reason is that “trading cannot always win.”

Rather, by recording losses, we can analyze when we lose and make the logic more robust.

Rather than chasing every win or loss,

over a week or a month, we want to see a total positiveprofit as the most important measure.

• “I’m happy because I won today”

• “I’m anxious because I lost today”

To reduce these emotional swings, the EA handles entries, and humans focus on executing according to the rules.

“Want to win” but “Make money”—this mindset is the prerequisite for long-term profitability.

Stability gained by following the rules

The common trait of those who lose big in trading is“desire to win”driving rule violations

For example, delaying exits to “let it run a bit longer” can wipe out profits quickly.

Sky Interval provides:

• Fully automated EA entry

• Exit based on fixed, rule-based conditions

This reduces human intervention to a minimum and eliminates hesitation.

By mechanically following the rules, win rate and risk-reward balance become naturally stable.

⸻

We tested with the “maximum profit” rule aiming at the sky zone,

there are times when breakeven closes are more frequent, but keeping to the rules allows calmly seizing the next opportunity.

Even in moments when you think “we could have taken more,”

because you closed at breakeven according to the rules, you maintain overall positive results.

What matters in trading is “Win rate” rather than “Reproducibility”

Many traders worry about the win rate, but

even with a 50% win rate, capital grows if the risk-reward (RR) is favorable

What’s important is having a rule that isreproducible no matter who uses it

Sky Interval is,

•EA entry → mechanical stop → rule-based profit-taking

Carrying out this sequence with zero emotions emphasizes trading as a business.

⸻

Strategy aimed at overall positive results

Focusing on daily wins and losses is risky.

Viewed over a week or month, even with some negative days, as long as total is positive, it’s OK.

The EA, with no emotions, is ideal for long-term capital management.

Using rules to operate with the mindset of “go for profits” rather than “just win” helps the growth curve of capital to be more stable.

ℹ️Guide to special tools (Purchase bonus)

Currently, buyers of Sky Interval receive a supplementary tool (automatic entry + stop processing).

This was created from a desire to use it daily and is designed to automatically judge breakouts and manage risk according to market structure.

Profit-taking remains a matter of your own judgment, making this tool particularly compatible for those who decide exits themselves.

Reviews are not abundant yet, perhaps because the structure is simple and clear enough that extensive pre- or post-purchase discussion is not required.

However, if usage grows, a paid option may be considered.

Reason: It may become necessary to operate not just as a tool, but as a serviced package.

____

◻️ For those who want automated EA entries

This logic is distributed as a purchase bonus.

If you are considering purchasing, please feel free to contact us.

If you are interested in Sky Interval, you can join the online community

Join the online community here

In the online community, while we cannot describe specific trading logic in detail,

you can participate in a “chart critique community” using Sky Interval.

• If you send a chart image you’re curious about,

“What would have been the right judgment in this scenario?”

“Where were the entry and profit-taking points?” and feedback with rule-based examples will be provided.

•Past charts at certain times are also OK.

We reply in order as time allows.

To those interested in Sky Interval

In short, the goal is to build a foundation for making rule-based judgments without hesitation in short-term trading—

that is the core philosophy of Sky Interval.

Free material here:

▶︎ Download 'Trails to the Interval'

'Trails to the Interval' explains when and how you can trade in various situations more clearly.

It also complements the Sky Interval sales page by detailing entry points and zone selection with diagrams and case studies.

Even beginners can reproduce easily, so if you’re curious, please take advantage of it.

If you’re interested, please first receive the free material 'Trails to the Interval'.

From there, your path into the Interval begins.

“Will you include this chart?”

When in doubt, switch to thinking “judge by rules, not by feel.”