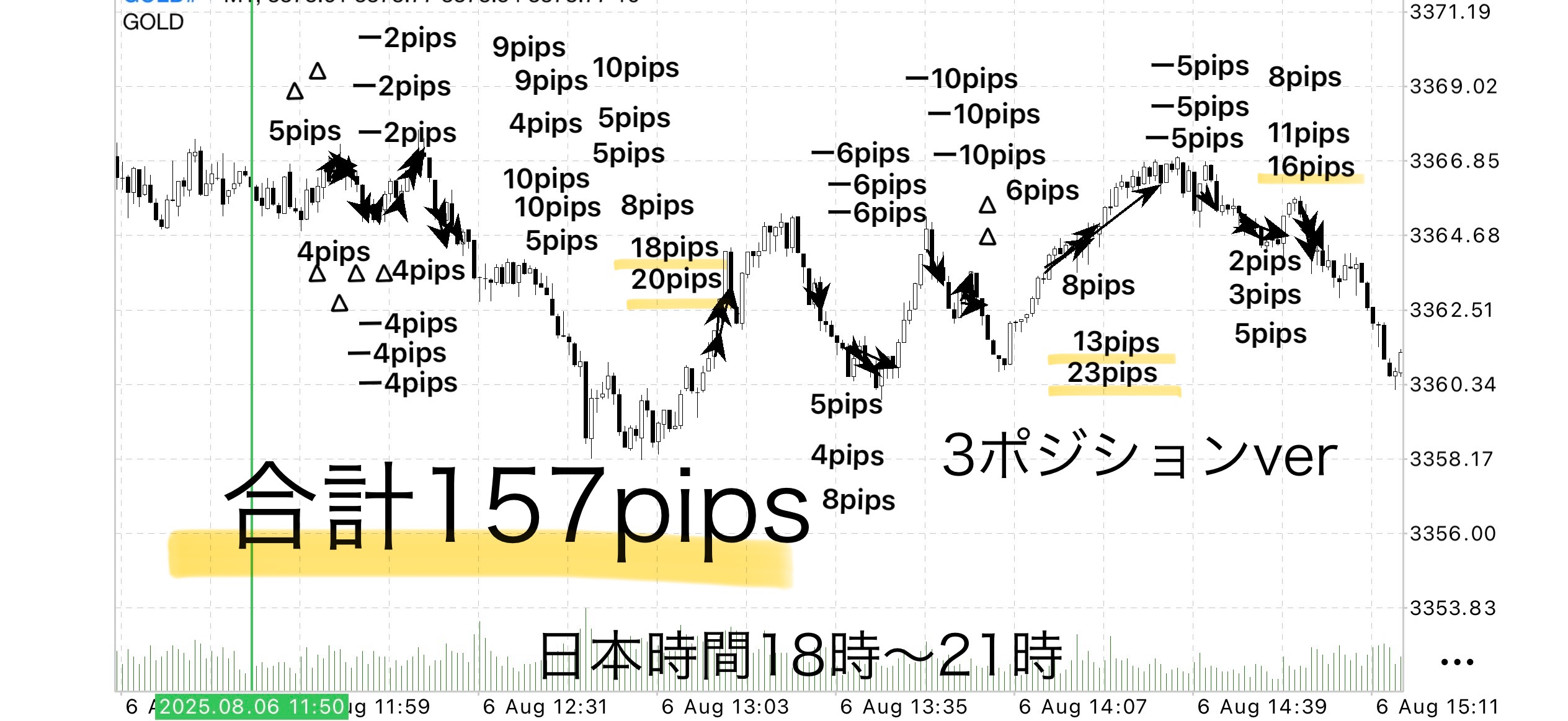

[Episode 67] We have set the rules. We will aim for 157 pips in 3 hours with 3 positions (1 lot + 227,600 yen))

Will you include this chart?

【No. 67】 GOLD 1-minute chart | +157 pips (1 lot + ¥227,600)

── Verification of “3 positions × structural exits” monitored trading

August 6, 2025 (Wednesday) | Japan time 18:00–21:00

This time, we took a more aggressive stance than a single-position approach

Adopting 3 positions entered simultaneously + structural partial exits for verification.

While entry on breakouts remains entrusted to the EA as before,

the exit decision (take profit) is split and clarified based on zone structure, aiming to balance accumulating profits and maximizing gains.

⸻

Trading results

• Total trades: 51

• Take profit successes: 28

• Breakeven exits: 8

• Stop losses: 15 (all within −10 pips)

• Total gains: +238 pips

• Total losses: −81 pips

• Net profit/loss: +157 pips

• Win rate: about 54.9% (28 wins / 51 trades)

• Profit factor (PF): about 2.94

1 lot: +¥227,600 / 0.1 lot: +¥22,760 (1 pip = ¥145)

⸻

Operating rules | Roles of 3 positions

Hold all 3 positions simultaneously and give each different exit (settlement) points to optimize risk and return.

⸻

Settlement rules per position

1. Break of floating line → immediate settlement

→ Secure profit quickly in the short term

※ This settlement isautomatically processed by the EA, so even instantaneous breaks are not missed.

2. Break of the airborne line → basically immediate settlement (pending or retracement settlement if not reached)

→ Quickly secure mid-term upside

※ Also herethe EA reacts instantly to execute settlement.

3. Break of Heaven Line ③ → settle when it returns to Heaven Line ③

→ A long-term position to leverage explosive power when a trend occurs.

※ This position requires waiting and watching.

⸻

Stop-loss rules

• Maximum stop loss is −10 pips (fixed)

• When there is a clear opposite-direction breakout or a key line breakimmediate settlement

Furthermore,when unrealized gains exceed a certain level,

the stop loss is moved to breakeven to prevent unnecessary losses.

⸻

Benefits of the 3-position system

①Diversified take profits to reduce risk

With a single-position system, one decision governs all exits, but

splitting into three allows securing part and letting part run as a flexible operation.

②Can 크게 extend in trending markets

Profit is secured at floating and airborne lines first,and the position can be watched safely until it reaches Heaven Line.

That is the biggest strength.

③Less affected by market conditions

Holding short-, mid-, and long-term viewpoints simultaneously makes it easier to trade in ranges or trends.

④Acts with psychological stability

With profits already realized on some positions,

trading stress and indecision are greatly reduced.

⸻

This study

Win rate around 55% and PF around 2.94 yielded very stable results.

In particular, the breakout detection by the EA and immediate settlementfunctioned well,

allowing even small short-term price moves to be captured as profits.

Apart from the Heaven Line watching (which requires discretion),

the take profits at Floating Line and Airborne Line are all auto-handled.

Therefore, even though monitored, the trader's burden is greatly reduced.

The 3-position system is designed to maximize the zone-structure concept.Flexibility of take-profit timing and loss control are both achieved,

and I believe this style remains highly effective for future operations.

EA-triggered breakout strategy

“Heavenly Gap” is a simple strategy where entry is automated by an entry EA, and the trader focuses on monitoring after entry and executing the settlement rules.

The EA continuously monitors the chart and can enter exactly at breakout moments without missing them.

This eliminates the stress of staying glued to the screen before entry and the anxiety of missing the timing.

As a buyer perk, this EA is made available for use.

If you would like to use it, please send a message and we will share the download password.

Heavenly Gap Main Edition here

Why publish negative results?

Investment Navi+ intentionally publishes negative results as well,not hiding them.

The reason is that “trading cannot always win.”

Rather, by recording losses you can analyze “under what conditions you lose” and strengthen the logic.

Instead of being fixated on each win or loss,

over a span of a week or a month, a net positive overall is what matters.The total balance being positive is what mattersoverall

• “I’m happy because I won today”

• “I’m anxious because I lost today”

To remove this emotional rollercoaster, let the EA handle entries,and have humans focus on “settling strictly by the rules.”

“I want to win” instead of “I want to earn” —this mindset is the foundation for long-term profitability.

Stability gained by following the rules

The common point of those who lose heavily in trading is the urge to win leads to breaking the rules

For example, postponing a decision to let it run longer or see a bit more can cause profits to vanish rapidly.

Heavenly Gap is

• Entrances are fully automated by EA

• Settlements are under fixed, rule-based conditions

This reduces human intervention to an absolute minimum, eliminating doubt.By mechanically following the rules, win rate and risk-reward stabilize naturally.

⸻

We tested with Heaven Zone targeting the “maximum take-profit” rule,

and there are times when breakeven settlements are frequent, but sticking to the rules allows calmly seizing the next opportunity.

Even in moments when you think “I could have taken more,”

because you cut at breakeven according to the rules, you end up keeping a net positive overall — that is the strength of this strategy.

What matters in trading is “profitability” not “win rate”

Many traders worry about “win rate,” but

a 50% win rate with a good risk-reward (RR) can still grow capital.

What’s important is to have a rule that is reproducible —a method that yields the same results no matter who uses it.

Heavenly Gap is,

•EA entry → mechanical stop-loss → fixed take-profit

Carrying out this sequence “emotion-free” focuses on making trading a business.

⸻

Strategies aimed at overall profit

Focusing on daily wins and losses is risky.

For example, over a week or month, small negative days may occur, but as long as the total remains positive, it’s okay.

EA has no emotions, making it ideal for long-term capital management.

By operating the rules with a mindset of “earn” rather than “win,” capital growth tends to stabilize.

ℹ️Announcement of a dedicated tool (purchase bonus)

Currently, we provide auxiliary tools (auto-entry + stop-loss handling) to those who purchased Heavenly Gap.

This was created from the desire to have something I would want to use daily,

a tool that entrusts breakout judgment and risk management to the market structure.

Take-profit is ultimately up to your own judgment, making this a compatible tool for those who value personal discretion.

Reviews are not numerous yet, perhaps because it is simple and clear in structure, requiring little interaction before or after purchase.

However, if usage grows, we may consider monetization in the future.

Reason: this would involve operating not simply as a tool for sale but as a support-and-set package.

____

◻️ For those who want automatic EA entries

The tool that converts this logic into an EA is currently distributed as a purchase bonus.

If you are considering a purchase, please feel free to contact us.

If you are interested in Heavenly Gap, you can join our online community

Join the online community here

In the online community we cannot explain specific trading logic, but

you can join a “chart critique community” using Heavenly Gap.

- If you send a chart image you’re curious about,

“What would have been the correct judgment in this moment?”

“Where was the entry and take-profit point?” etc., with feedback based on rules.

- Past charts for specific time frames are also OK.

We will respond sequentially as time allows.

To those who have become interested in Heavenly Gap

In short-term trading, build a foundation to “decide by rules without hesitation” — that is the core philosophy of Heavenly Gap.

Free material here:

In “Path to the Gap,” you can learn in more understandable terms in what situations you can trade,

the decision criteria, and how to select zones,

with diagrams and case-by-case explanations.

if you’re curious, please also make use of it.

If you’re interested, please first receive the free material “Path to the Gap.”

From there, your first step in Heavenly Gap begins.

“Will you include this chart?”

When you’re unsure,it’s helpful to switch to thinking in terms of rules rather than intuition.