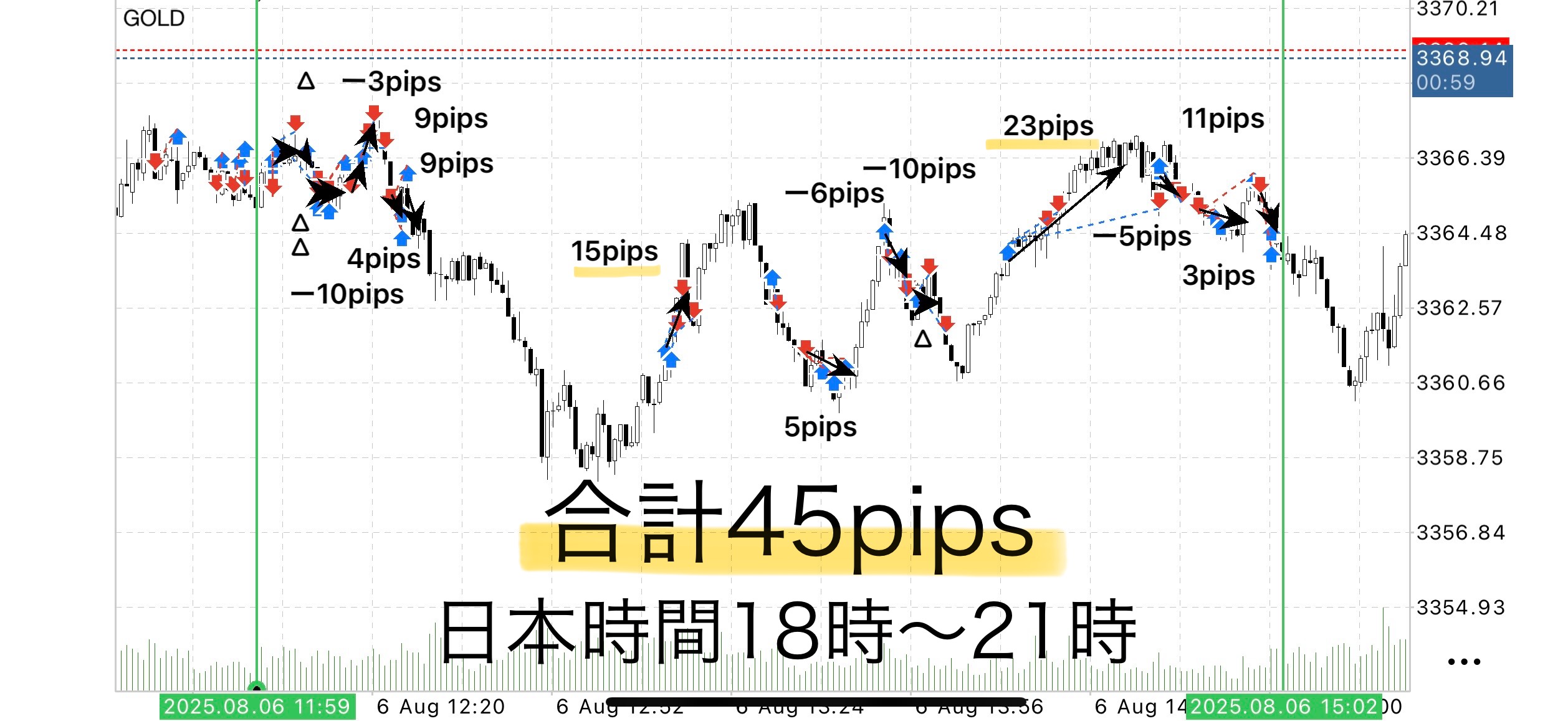

[第66回] GOLD 1-minute chart Verification | +45 pips (1 lot +62,500 yen)

Will you include this chart?

【66th】 GOLD 1-minute chart verification | +45 pips (1 lot + 62,500 yen)

Single-position type, 3-hour verification aiming for the sky line

August 5, 2025 (Wednesday) | Japan Time 18:00–21:00

This time, focusing on GOLD (XAU/USD) 1-minute chart, using a rule that is completed with a single position only to aim for the sky zone. The purpose is to confirm a mechanical, rule-following style by removing complex judgments.

⸻

Trade results (3 hours)

• Entries: 17

• Profit-taking successes: 8

• Breakeven closures: 4

• Stop losses: 5 (all within −10 pips)

• Total gained: +79 pips

• Total loss: −34 pips

• Net result: +45 pips

• Win rate: 47.0% (8 wins / 17)

• PF (Profit Factor):2.32

Note: USD/JPY converted at 145 yen

1 lot: approx. +65,200 yen / 0.1 lot: approx. +6,520 yen

⸻

Used rules (Single-position version)

▸ Take-profit rules

• Basically, close when the Sky Line ③ is reached

• If not reached by that point, close after breaking the line and returning to the previous line

• Example: crossed the Floating line and returned to the Air line → take profit

▸ Stop-loss rules

• Maximum stop width: −10 pips

• Even if tighter, if the rule is deemed broken, exit immediately

⸻

✦Characteristics of single-position type

By limiting entries to one, reduce the burden of decision-making.

Eliminating elements like "split" or "hold out" and simply following the predetermined flow makes it hard to waver, enabling stable continuation.

Also, the rule "take profit after a break and return" is designed to harvest practical profits without forcing targets.

⸻

?Verification impressions

The win rate is not particularly high at 47.0%, but

the average take-profit width (about 9.9 pips) exceeds the average loss width (about 6.8 pips).

It is structured to preserve profits without strain, and the PF is high at 2.32.

EA-driven breakout strategy

The “Sky Gap” is a simple strategy where entry is delegated to an automated entry EA, and the trader focuses on monitoring after entry and executing the take-profit rule.

The EA constantly monitors the chart and can enter precisely at the moment of breakouts.

This eliminates stress from watching the screen before entry and the anxiety of missing the timing.

As a purchaser perk, this EA is available for use.

If you wish to use it, send a message and I will provide the download password.

Here is the Sky Gap main edition

Why publish negative results?

Investment Navigation Plus deliberately publishes negative results without hiding them.

The reason is that “trading is not always about winning.”

Rather, by recording losses, you can analyze what conditions lead to losses and strengthen the logic.

Rather than obsessing over win/loss per trade,

Over a span of a week or a month, the total P/L being positive is what matters.

• “I’m happy today because I won”

• “I’m anxious today because I lost”

To eliminate these emotional swings, delegate entries to EA and let humans focus on executing the rules for closure as their role.

“Want to win” but “Make money”── this mindset is the foundation for long-term profitability.

Stability gained by following the rules

The common trait of those who lose big in trading is a strong urge to win that causes rule-breaking

For example, if you think “I want to stretch it more” or “I want to wait a bit longer,” delaying the exit can wipe out profits quickly.

Sky Gap is,

• Entries fully automated by EA

• Fixed, rule-based closures

As a result, human intervention is minimized to the extreme, eliminating hesitation.

By mechanically adhering to the rules, win rate and risk-reward naturally stabilize.

⸻

Verifications using the “max profit-taking” rule targeting the Sky Zone show that breakeven closures can occur, but by adhering to the rules you can calmly seize the next opportunity.

Even in moments where you think “I could have taken more,”

because you closed at breakeven according to the rules, you end up keeping a total positive result—this is the strength of the strategy.

What matters in trading is “Win rate” rather than “Reproducibility”

Many traders worry about win rate, but

with a win rate of 50% and good risk-reward (RR), capital can grow.

What is important is having a rule that ensuresthe same result no matter who uses it“reproducibility”

Sky Gap is,

•EA entry → mechanical stop → rule-based take-profit

By carrying out this sequence with zero emotion, we emphasize making trading a “business.”

⸻

Strategy aimed at overall positive results

It is dangerous to focus on daily gains and losses.

For example, over a week or a month, even with some negative days, as long as the total is positive, it’s OK.

EA has no emotions, making it ideal for long-term capital management.

By operating the rules with the mindset of “earn” rather than “win,” the capital growth curve tends to stabilize.

ℹ️Announcement of dedicated tools (purchase bonus)

Currently, those who purchase Sky Gap receive auxiliary tools (auto-entry plus stop processing) as a bonus.

This was created from the desire that I would like to use it daily, and

it is designed to delegate break decisions and risk management according to market structure.

Take profit is still important as a personal judgment, making this a compatible tool for those who value that.

Reviews are not many yet, perhaps because the structure is simple and clear enough that there is little need for active dialogue before and after purchase.

However, if users increase, price changes may be considered.

Reason: there is a possibility that selling tools alone without support would be insufficient.

____

◻️ For those who want automatic EA entries

This logic-to-EA tool is being distributed as a purchase bonus.

If you are considering purchasing, please feel free to contact us.

If you’re interested in Sky Gap, you can join our online community

Join the online community here

Within the online community, we cannot explain specific trading logic, but

you can participate in a “chart critique community” using Sky Gap.

• If you send a chart image you’re curious about,

“What would have been the right judgment in this moment?”

“Where were the entry and take-profit points?” etc., we provide feedback with examples based on rules.

•Past charts for specific times are also OK.

We respond as time allows.

To those interested in Sky Gap

In short-term trading, building a foundation to judge by rules without hesitation—

that is the core idea of Sky Gap.

Free material here:

▶︎ Download ‘Trail to the Gap’

In ‘Trail to the Gap,’ you’ll learn in which situations you can actually trade

and how to judge those decisions more clearly.

The selling page for “Sky Gap” couldn’t fully convey,

the exact entry points and zone selection will be clarified with diagrams and case-by-case explanations as well.

Even beginners can reproduce easily, so

if you’re curious, please make use of it as well.

If you’re interested, please first receive the free material ‘Trail to the Gap’.

From there, your first step into the Gap begins.

“Will you include this chart?”

When unsure, switch to thinking “Judge by rules, not by intuition.” That would be a helpful hint.