[Episode 65] GOLD 1-Minute Chart | Partial Protection + Extension Operation for +54 pips (+78,300 JPY)

Will you include this chart?

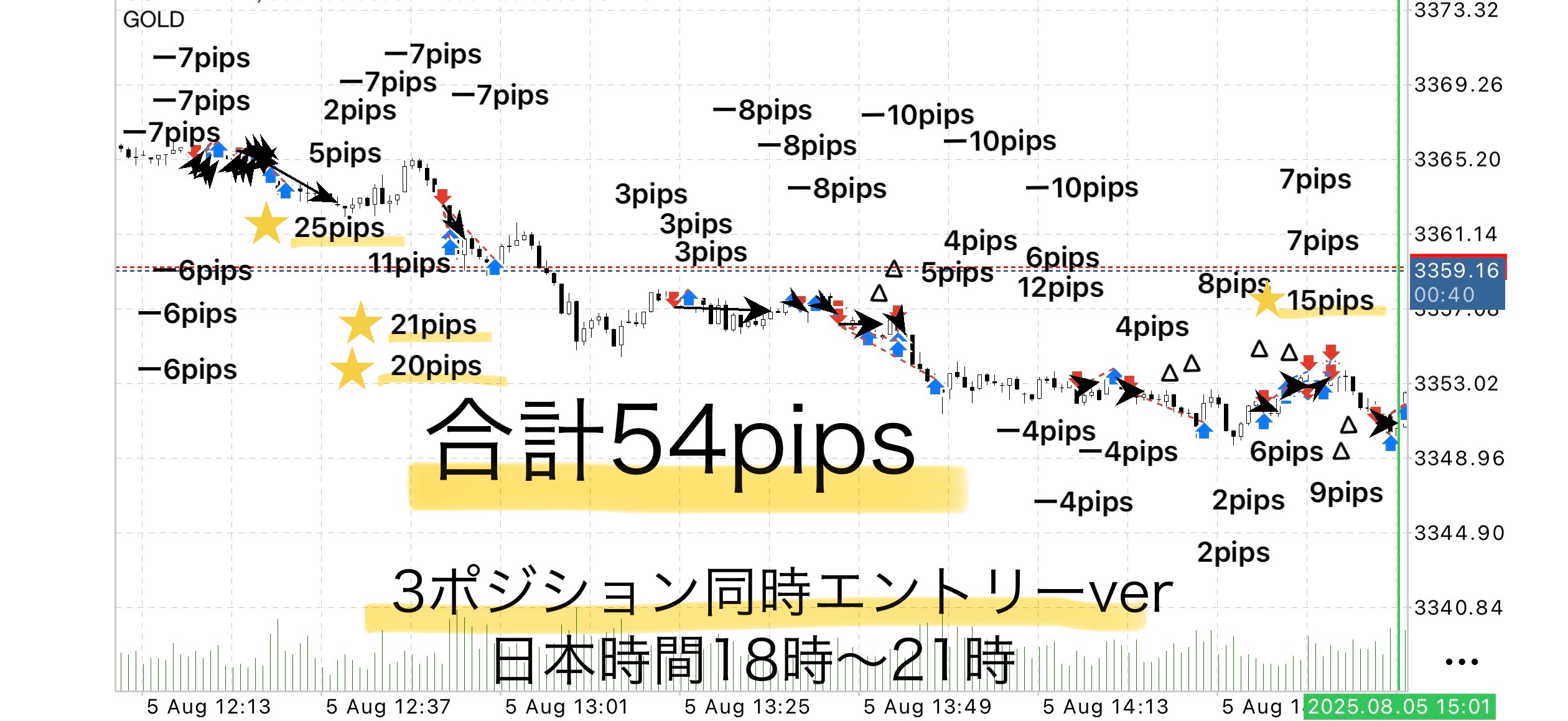

【65th】 GOLD 1-minute chart|+54 pips (1 lot + 78,300 yen)

── Validation of “3 positions with structural exits” monitored trading

Overview of the validation

August 5, 2025 (Tue) | Japan time 18:00–21:00

This time, we adopted a more aggressive approach than a single-position model by entering three positions simultaneously,

and operated with clear exit rules based on zone structure.

The three-position model assumes real-time monitoring, but

by differentiating exit conditions for each position,

you can avoid missing profits while maximizing gains in advantageous moments.

Comparison with 1-position

⸻

Trading results

• Total trades: 48

• Profit-taking successes: 22

• Breakeven exits: 8

• Cut losses: 18 (all within -10 pips)

• Total gained: +180 pips

• Total loss: -126 pips

• Net P/L: +54 pips

• Win rate: 45.8% (22 wins / 48 trades)

• PF (Profit Factor): 1.43 (180 ÷ 126)

• 1 lot: +¥78,300 / 0.1 lot: +¥7,830 (1 pip = ¥145)

⸻

Trading rules

Entry and profit-taking conditions

Hold three positions simultaneously, clarifying each role.

• After Break of Sky Line ③ → If it returns to Sky Line ③, exit (profits realized after a strong move)

• Airline Break → Basically exit on break(however, if it doesn’t reach and returns, do a provisional exit)

• Floating Line Break → Exit on break(secure short-term, reliable profits)

When unrealized gains exceed a certain level,move the stop loss to breakevento prevent unnecessary losses.

⸻

Stop-loss rules

• Maximum stop: -10 pips

• In cases of clear opposite-direction break or important line breach, exit immediately

⸻

Utility of the three-position model

1. Diversified profit-taking to reduce risk

With a single-position model, all profits come at once, but with three positions you can “secure part and let the rest run.”

This reduces the risk of losing all profits on a temporary pullback.

2. Don’t miss big moves

By securing profits on the first two positions, you can aggressively pull the third position to capitalize on trend bursts.

3. Flexible operation aligned with market conditions

You can manage positions for short-term small moves, mid-term growth, and long-term trends simultaneously, making you less vulnerable to market conditions.

4. Psychological stability

Because some profits are secured, you gain mental leeway to calmly monitor the remaining positions.

⸻

This study

Achieved +180 pips, with -126 pips losses, win rate 45.8%, yet net +54 pips.

Three-position trading is very effective when you can observe zone structure in real time, and

enables the accumulation of profits and maximization of profits that single-position cannot provide.

EA-driven breakout strategy

“The Sky Gap” uses an automated entry EA, while the trader focuses on monitoring after entry and executing the exit rules, a simple strategy.

The EA continuously monitors the chart and can enter accurately the moment of the breakout without missing it.

This eliminates the stress of staring at the screen before entry and the anxiety of missing the timing.

As a buyer perk, this EA is available for use.

If you wish to use it, send a message and I will provide the download password.

Why publish negative results?

Investing Navigator+ intentionally publishes negative results as well.The reason is that “trading will not always be profitable.”

Rather, by recording losses, you can analyze which situations cause losses and make the logic more robust.

Instead of chasing each individual win or loss,

over a span of a week or a month,it's most important that the total result is positive.

• “I won today, so I’m happy”

• “I lost today, so I’m anxious”

To remove these emotional swings, let the EA handle entries, and have humans focus on executing according to the rules.

“I want to win” instead of “I want to earn” —this mindset is the foundation for long-term profitability.

Stability gained by following the rules

The common trait of traders who incur large losses is the desire to win leads to rule-breaking

Sky Gap is

• Entry automated by EA

• Exit under fixed, rule-based conditions

This minimizes human intervention and removes hesitation.By mechanically adhering to the rules, win rate and risk-reward naturally stabilize.

⸻

We tested with the “maximum profit-taking” rule targeting Sky Zone,

and there are times when breakeven exits occur, but adhering to the rules allows calmly seizing next opportunities.

Even in situations where you think “I could have taken much more,”

by exiting at breakeven according to the rules, you can maintain an overall positive total, which is the strength of this strategy.

What matters in trading is not “win rate but “reproducibility”

Many traders worry about win rate, but

with a win rate of 50% and favorable risk-reward, capital grows.

What matters is having a rule that yields the same result no matter who uses it

Sky Gap provides

•EA entry → mechanical stop → rule-based profit taking

Executing this sequence with zero emotions emphasizes treating trading as a business.

⸻

Strategy aimed at overall positive returns

Focusing on daily gains and losses is risky.

Viewed over a week or a month, even with some negative days, as long as the total is positive, it’s OK.

Since the EA has no emotions, it is ideal for long-term fund management.

By operating the rules with a vision of “earn,” not just “win,” the capital growth curve becomes more stable.

ℹ️Guide to a dedicated tool (purchase bonus)

Currently, buyers of Sky Gap receive auxiliary tools (automatic entry + stop processing) as a bonus.

This was created from the desire to use it daily, and

it delegates break detection and risk management to follow market structure.

Profit-taking remains mainly depending on your own judgment, making it a good fit for those who prefer manual decision-making.

Reviews are not many yet, possibly because it is simple and straightforward in structure, with minimal need for pre- or post-purchase interaction.

However, if usage increases, a paid option may be considered.

This is because it may become necessary to operate tools not as standalone sales but as a packaged service with support.

____

◻️ For those who want automatic entry by EA

The tool that automates this logic is currently distributed as a purchase bonus.

If you are considering purchasing, please feel free to contact us.

If you are interested in Sky Gap, you can join the online community

Join the online community here

We cannot explain concrete trading logic inside the online community, but

you can participate in the “chart critique community” using Sky Gap.

• If you send a chart image you’re curious about,

“What should have been the judgment in this situation?”

“Where were the entry and profit-taking points?”,we will provide feedback with rule-based judgments.

•Past charts for specific time frames are OK.

We will respond in order as time permits.

To you who are interested in Sky Gap

In short-term trading, lay the foundation to judge with rules without hesitation—

that is the core philosophy of Sky Gap.

Free教材 here:

In “Path to the Gap,” you’ll learn in which situations you can actually trade?

This clarifies the decision criteria more clearly.

The sales page for “Sky Gap” didn’t fully convey it,

and details on entry points and zone selection are also

explained with diagrams and case studies.

Even beginners can reproduce easily, so

if you’re interested, please also utilize this resource.

If you’re interested, please first receive the free material “Path to the Gap.”

From there, your first step in Sky Gap begins.

“Will you include this chart?”

When you’re unsure,switch to thinking “judge by rules, not by intuition” and I hope this helps.