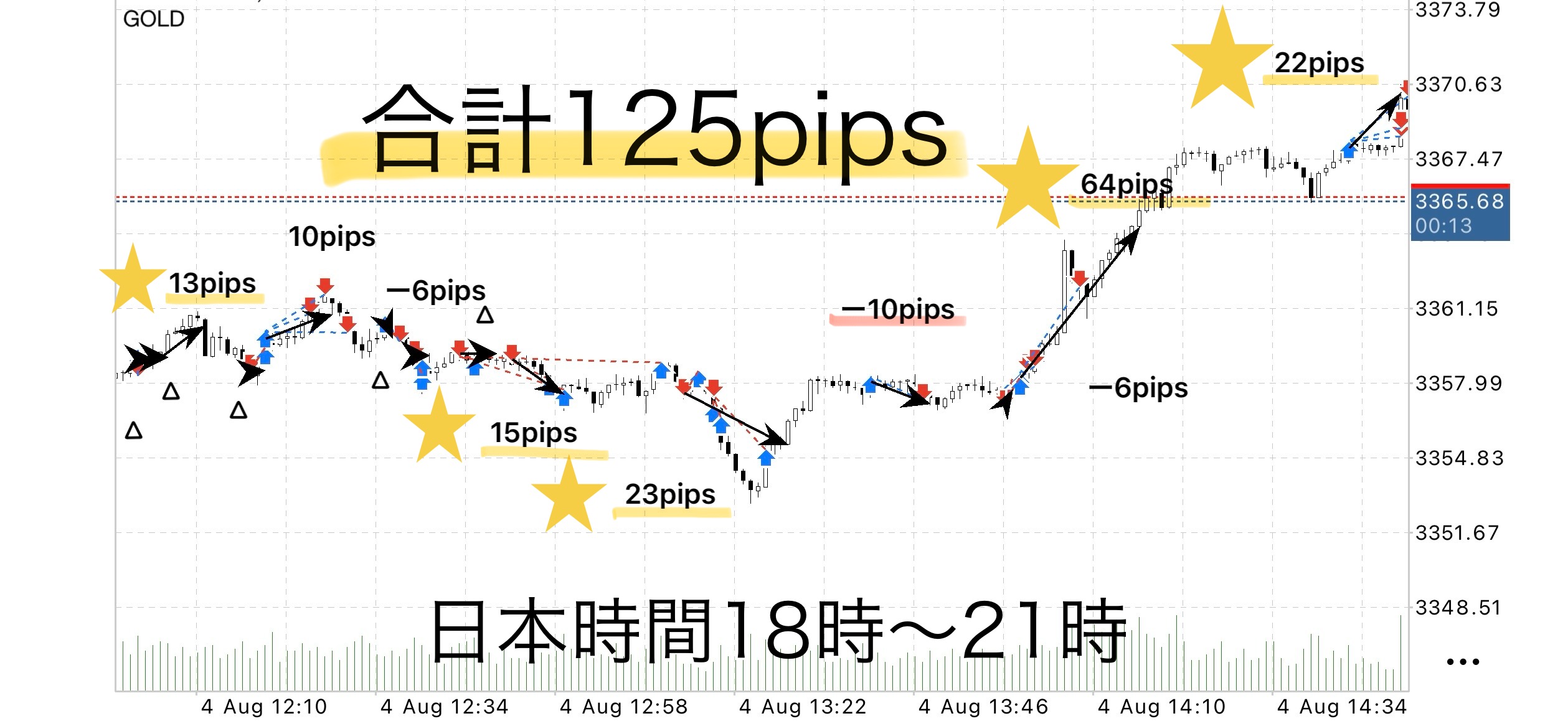

【Episode 62】GOLD 1-Minute Chart|+125 pips (1 lot + 180,000) 3-hour test from the evening

Should we include this chart?

— Record of the “gap” discerned by rules [62nd installment]

In GOLD,

a new rule fixing the maximum stop loss width at −10 pips was introduced,

and all trades wereexecuted without discretion, strictly by the rules..

⸻

Total P/L:+125 pips

1 lot:+¥181,000 / 0.1 lot:+¥18,100(Converted from USD/JPY 145)

※ The chart history is for verifying the operation of an EA that enters 3 positions simultaneously.

Actual settlement timing may differ.

2025 August 4 (Mon)

GOLD (XAU/USD) 1-minute chart | Japan time 18:00–21:00

⸻

▷ Introduction of maximum stop loss of −10 pips and its aim

Previously, stop-loss decisions were made case by case based on recent highs/lows and reversal structures.

However, this often caused doubt about whether to stop out, delaying decisions.

From now on, a clear standard is introduced: stop loss at a maximum of −10 pips.This reduces decision pressure and creates an environment focused on settlement decisions.

⸻

▷ Trade result summary

• Total trades: 14

• Profit-taking successes: 6

• Break-even settlements: 5

• Stop losses: 3 (all within −10 pips)

• Total gained: +147 pips

• Total lost: −22 pips

• Total result: +125 pips

• Win rate: about 43% (6 wins / 14)

• PF (Profit Factor): about 6.7

• 1 lot: +¥181,000 / 0.1 lot: +¥18,100

※ GOLD is calculated as 1 pips = 0.1 USD, 1 lot = 100 oz, converted at USD/JPY 145

⸻

▷ Actual stop loss rule operation

Even before reaching −10 pips, if any of the following conditions are met, we stop out immediately:

• Break of the most recent high/low

• Clearly broke the opposite entry line

• Broken the center line (baseline)

In other words, it is not about “holding until −10 pips” but about eliminating risk even at shallower points.)

As a result, losses were minimized and trades could be processed calmly according to the rules.

⸻

▷ Profit-taking decision: “zone break → revert to reduce”

For profit-taking, instead of “watching and extending,” we adopt zone-aware exit decisions.

For example, after breaking the Skyline II, if it retraces to Line I, exit.

Rather than waiting for Line III, we structurally view the retracement after a break to lock in profits.

This “zone-based settlement rule”

• ensures profits are not brought back to break-even

• drastically reduces decision uncertainty

• maintains rule consistency

makes for a very stable trading result.

⸻

▷ Future verification and policy

This “−10 pips fixed stop loss rule” is still in the verification phase, but

we plan to continue testing this rule in August as the base.

By using flexible stop conditions according to the situation and profit-taking decisions leveraging zone structure,

we will further enhance the ability to trade without hesitation.

When results become stable, we will reflect them clearly in the教材 (educational materials).

EA-driven breakout strategy

The “Gap in the Sky” entrusts entries to an automatic entry EA, and the trader focuses on monitoring after entry and executing the exit rules. This is a simple strategy.

The EA continuously monitors the chart and can precisely enter at the breakout moment without missing it.

This eliminates the stress of staying glued to the screen before entry and the anxiety of missing the timing.

As a purchaser bonus, this EA is available for use.

If you wish to use it, please send a message and we will provide the download password.

Why publish negative results?

Investing Navi+ publishes negative results openly, not hiding them.

The reason is that “trading is not something you can always win.”

Rather, by recording losses you can analyze under what conditions you lose and strengthen the logic.

Instead of fixating on each win or loss,

Over a week or a month, the most important thing is that the total balance is positive..

• “I’m happy because I won today”

• “I’m anxious because I lost today”

To eliminate these emotional swings, entrust entries to the EA, and have humans focus on settling strictly by the rules.

“Want to win” but “Want to earn”── this mindset is the foundation for long-term profit.

Stability gained by following the rules

A common trait of those who lose big in trading is the “desire to win” leading to rule violations.

For example, wanting to push more or wait a bit longer to see can often wipe out profits.

Sky Gap is

• Entries are fully automated by the EA

• Settlements are fixed by a rule

This reduces human intervention and eliminates doubt.

By mechanically following the rules, win rate and risk-reward stabilize naturally.

⸻

We conducted tests using a “maximum profit-taking type” rule targeting Sky Zone,

and although some situations lead to more break-even settlements, sticking to the rules allows catching the next opportunity calmly.

Even in scenarios where you think, “I could have taken more,”

because you cut at break-even as per the rules, you end up maintaining a total positive result, which is a strength of this strategy.

What matters in trading is not “Win rate” but “Reproducibility”

Many traders worry about “win rate,” but

even with a 50% win rate, capital can grow if the risk-reward (RR) is good

What matters is to have a rule that isreproducible that yields the same results regardless of who uses it.

Sky Gap is,

•EA enters → mechanical stop → rule-based profit-taking

Carrying out this sequence with zero emotion emphasizes the idea of trading as a business.

⸻

Strategies aimed at total positive results

Focusing on daily gains/losses is risky.

For example, over a week or a month, if the total is positive even with some negative days, that’s okay.

The EA has no emotion, making it ideal for long-term capital management.

Operating the rules with a vision of “earn” rather than “win” helps the capital curve to rise steadily.

ℹ️Guide to dedicated tools (purchase bonus)

Currently, buyers of Sky Gap are eligible to receive a supplementary tool (automatic entry + stop processing).

It was created from the desire to use it daily, and

it delegates only breakout judgment and risk management according to market structure.

While profit-taking remains a matter of personal judgment, this tool is compatible for those who prefer.

Reviews are not many yet, perhaps because the structure is simple and clear enough before and after purchase.

However, if usage expands, charging may be considered.

The reason is that selling the tool alone may not suffice; a bundled support arrangement may be required.

____

◻️ For those who want automatic entries by EA

This logic-to-EA tool is being distributed as a purchase bonus.

If you are considering purchase, feel free to contact us.

If you are interested in Sky Gap, you can join our online community

Join the online community here

We cannot explain specific trading logic inside the online community, but

you can join the “chart critique community” using Sky Gap.

• If you send a chart image you are curious about,

“What should I have judged in this moment?”

“Where were the entry and profit-taking points?”, we will provide feedback with rule-based judgment examples.

•Past charts at specific times are also OK.

We respond in order as time permits.

To those interested in Sky Gap

In short-term trading, the foundation is to judge with rules without hesitation—

that is the core philosophy of Sky Gap.

Free materials here:

In ‘Path to the Gap,’ you’ll learn in what scenarios you can actually trade?

The judgement criteria are explained more clearly.

Here, the entry points and zone selection that could not be fully conveyed on the Sky Gap sales page are also thoroughly explained with diagrams and case studies.

Even first-time readers will find it easy to reproduce, so

If you’re curious, please also take advantage of it.

If you’re interested, please first receive the free material ‘Path to the Gap’.

From there, your first steps in the Gap begin.

“Should I include this chart?”

When you’re unsure, it would be helpful to switch to thinking in terms of rules rather than intuition.