[The 61st] GOLD 1-minute chart +61 pips | What happened by fixing the stop loss at -10 pips?

Should we include this chart?

— Recording the “In-Between” through Rules【61st installment】

New rule introduction– Start verification with fixed −10 pips stop loss

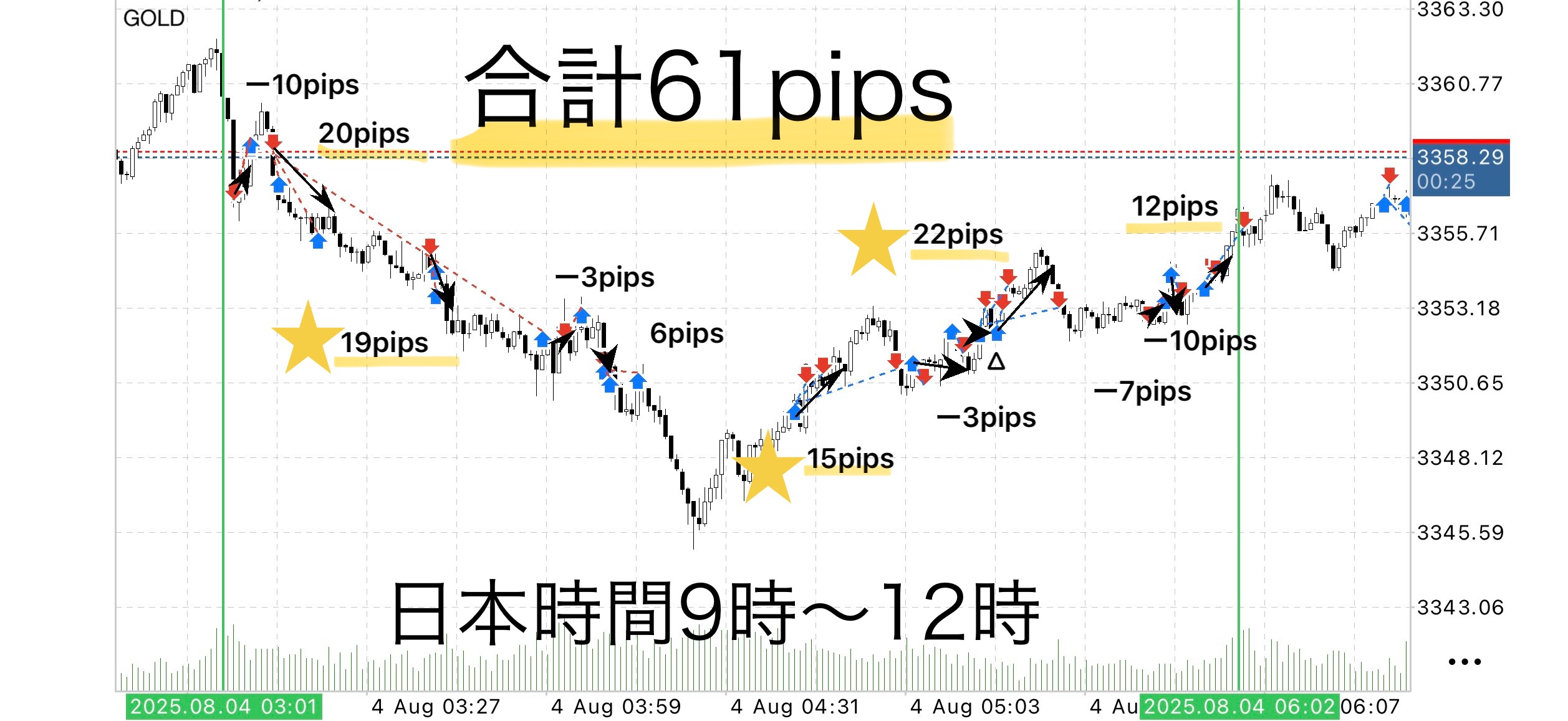

GOLD 1-minute chart / August 4, 2025, 9:00–12:00

Pips earned/61 pips

1 lot:¥88,450/ 0.1 lot:¥8,845

From today, a new rule has been added to the verification: fix the stop loss at −10 pips.

Until now, profit-taking was determined by structure, and stop losses were judged by recent highs/lows or clear reversals per the rules.

However, to reduce indecision and fluctuations, I felt that making the stop loss clearly fixed would allow more stable execution, so we are adopting and testing this formally from now on.

⸻

Today’s results (targeting the sky zone)

• Total trades: 12

• Profit-taking successes: 6

• Position-matching closes: 1

• Stop losses: 5

• Total gained: +94 pips

• Total loss: −33 pips

• Net P/L: +61 pips

• Win rate: approx. 50% (6 wins/12 trades)

• PF (Profit Factor): approx. 2.85

・1 lot: ¥88,450 / 0.1 lot: ¥8,845

⸻

※ Note: the current “−10 pips fixed stop loss” does not completely replace prior stop-loss judgments. It does not eliminate previous stop-loss criteria.

As before, we will continue to use stop-loss judgments based on recent highs/lows, opposite entry lines, center lines, etc.

In addition, when using EA for automatic entries, we are considering adding “fixed −10 pips stop loss” as a supplementary rule to improve trade stability with shallower stop losses.

If enough results are obtained with this rule in the future, we plan to add a more understandable explanation in the book as well.

▷ Looking back on the trades

Today’s verification used a “watchful” trading style that aims to extend to the sky zone as much as possible, rather than splitting into 3 positions.

Profit-taking is approached by waiting for a temporary pullback after the breakout and aiming for a return-based exit at Sky Line ③, structured accordingly.

What was especially striking was that “when the stop loss is clearly defined, you can focus on taking profits.”

Because there is no need to re-evaluate stop-loss judgments after entry, focus after entry was greatly narrowed, allowing to watch without hesitation.

⸻

✦ Entry by EA, exits by rules

Today's entry was automatically split into 3 positions by a dedicated EA, and all exits were executed according to the structured rules.

The style is that entries are automatic, while take profits and stops are determined manually according to the rules.

Today we ran the EA to confirm its operation; the recorded entry history differs from real-world performance.

When trading in practice, operate flexibly considering the structure-based profit-taking points.

⸻

Finally

Based on the validation from July, August restarts with a clear axis: fix the stop loss and extend profit-taking.

Even with simple rules, with proper preparation, trading can be executed with surprising clarity—

I was reminded of that feeling again.

EA-driven breakout strategy

“Sky Between” is a simple strategy where entry is automated by an EA, and traders focus on after-entry monitoring and execution of the exit rules.

The EA constantly monitors the chart and can enter precisely at the moment of breakout without missing it.

This eliminates the stress of staring at the screen before entry and the anxiety of missing the timing.

As a bonus, this EA is available to purchasers.

If you’d like to use it, please send a message and we will provide a download password.

Why publish negative results?

Investing Navigation Plus intentionally posts negative results as well.

The reason is that “trading cannot always be profitable.”

Rather, by recording losses, we can analyze under what conditions losses occur and strengthen the logic.

Instead of focusing on each win or loss,

over a span of a week or a month, the total balance being positive is what mattersand keeps growing.

• Today’s win makes us happy

• Today’s loss creates anxiety

To eliminate these emotional swings, let the EA handle entries and have humans focus on settlements according to the rules.

is not the goal; “want to earn” is—and this mindset is the foundation for long-term profitability.

Stability gained by following the rules

A common point among traders who lose big is the urge to win, which leads to breaking rules.

Sky Between is,

• Entry fully automated by EA

• Exits fixed by a rule-based framework

Thus,we reduce human intervention to the minimum and eliminate hesitation.

By mechanically following the rules, win-rate and risk-reward stabilizes naturally.

⸻

We validated the “maximum profit-taking” rule aiming at sky zones,

even if it results in many position closures at break-even, following the rule allows calmly seizing the next opportunity.

Even in moments when you think, “I could have taken more if I was allowed,”

the fact that you cut at break-even according to the rule helps maintain overall positive results.

What matters in trading is not “win rate but “reproducibility”

Many traders worry about “win rate,” but

What is important is having rules that are reproducible:anyone can achieve the same results with the same rules.

Sky Between is,

•EA entry → mechanical stop loss → rule-based take profit

.

⸻

Strategy aimed at overall profitability

Focusing on daily gains and losses is risky.

By operating the rules with the mindset of “earn” rather than “win,” the capital growth curve tends to stabilize.

ℹ️

Currently, for those who purchase Sky Between, we provide supplementary tools (automatic entry plus stop-loss processing) as a bonus.

This was created from the desire for self-use and is designed to entrust breakout decisions and risk management to the market structure.

For those who prefer profit-taking to be a personal decision, this tool is well-suited.

Reviews are still few, perhaps because the structure is simple and clear enough not to require active discussion before or after purchase.

However, if usage increases in the future, a paid model may be considered.

This is because “selling the tool alone may not suffice; it may require support and a bundled package.”

◻️ For those who want automatic EA entries

This logic-as-EA tool is distributed as a purchase bonus.

If you are considering purchasing, please feel free to contact us.

If you are interested in Sky Between, you can join our online community

Join the online community here

We cannot explain specific trading logic inside the online community, but

you can join a “chart critique community” that utilizes Sky Between.

• If you send a chart image you’re curious about,

we will provide feedback with rule-based judgments such as

“What would have been the right decision here?”,“Where were the entry and take-profit points?”

• Past charts at specific times are also OK.

We respond as time permits, step by step.

To those interested in Sky Between

We aim to build a foundation for making rule-based decisions without hesitation in short-term trading—this is the core philosophy of Sky Between.

Free material here:

▶︎ Download ‘Traces to the In-Between’

In ‘Traces to the In-Between,’ you’ll learn in what situations you can actually trade and how to judge them more clearly.

The explanation of entry points and zone selection is clarified with diagrams and case studies.

Even beginners will be able to reproduce the setup, so if you’re curious, please also use that resource.

If you’re interested, please first receive the free material ‘Traces to the In-Between.’

From there, your first step in the In-Between begins.

“Should I enter this chart?”

When you hesitate,I hope this helps shift your thinking to “judge by rules, not by feel.”