【Episode 59】Stable Result +289 pips|Aim for a “fail-safe” trade in the Sky’s Gap “No-guessing” Trade [7/28–8/1] This chart, should you include it? ──Record of the “gap” seen through the rules

Will you include this chart?

— Recording the “gap” discerned by rules [Issue 59]

GOLD | Verification records from July 28 to August 1

July 28, 2025 (Mon) – August 1, 2025 (Fri) – 18:00–21:00 Japan Time

Weekly total (Sky Zone target)

• Total acquired pips: +478 pips

• Total lost pips: −189 pips

• Net profit/loss:+289 pips

• PF (Profit Factor): 2.53

• 1-lot equivalent:+419,000 yen

• 0.1-lot equivalent:+41,900 yen

We tested GOLD on a 1-minute chart with a trade each day at the same time and under the same rules for 5 days.With the same time window and rules every dayfor five days.

Not a temporary strong performance,buta multi-day “accumulation”that reveals the strategy’s stability and risk handling.

This week’s results, except for Day 1, produced steady profits and especially showed an advantage in PF (Profit Factor).

This was a week that reaffirmed the strength of adhering to the rule of “break → pullback” and accumulating gains without hesitation.

⸻

Daily detail results

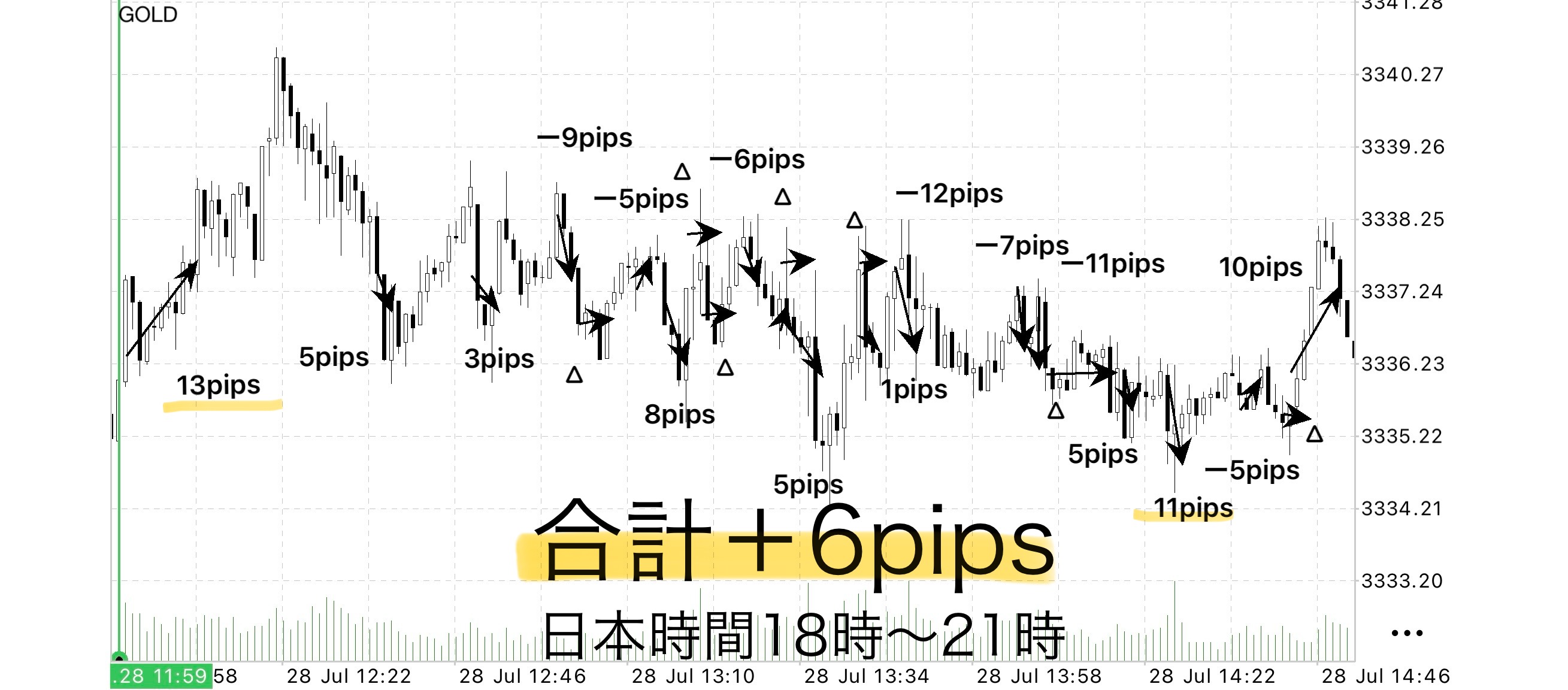

July 28 (Mon)

Total trades: 23

• Profitable exits: 9

• Loss exits: 7

• At-the-price exits: 7

• Gained pips: +61 pips

• Lost pips: −55 pips

• Net: +6 pips

• Win rate: ≈39% (9 wins / 23 trades)

• PF: 1.11

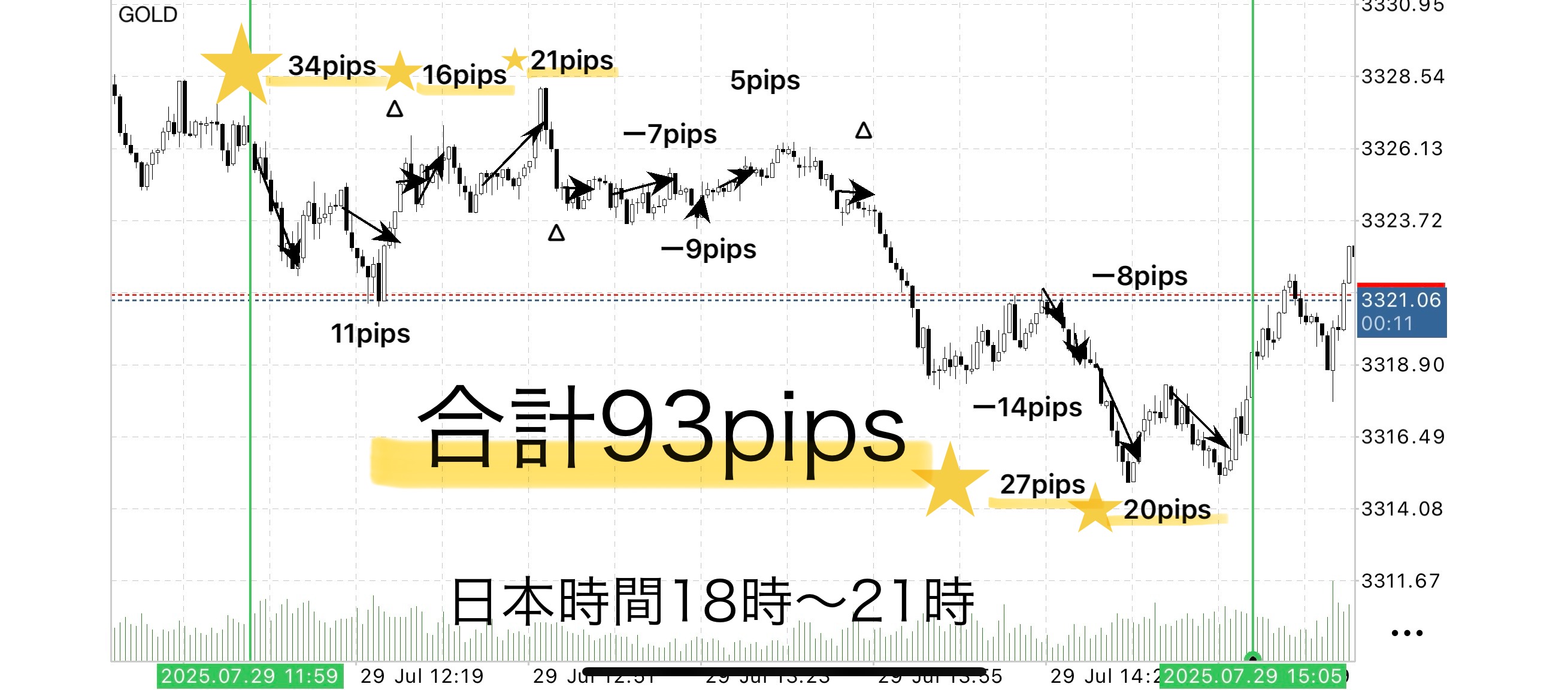

• Total trades: 14

• Profit exits: 7

• Stop loss: 4

• At-the-price exits: 3

• Total acquired pips: +131 pips

• Total lost pips: −38 pips

• Net: +93 pips

• Win rate: ≈50% (7 wins / 14 trades)

• PF: 3.44

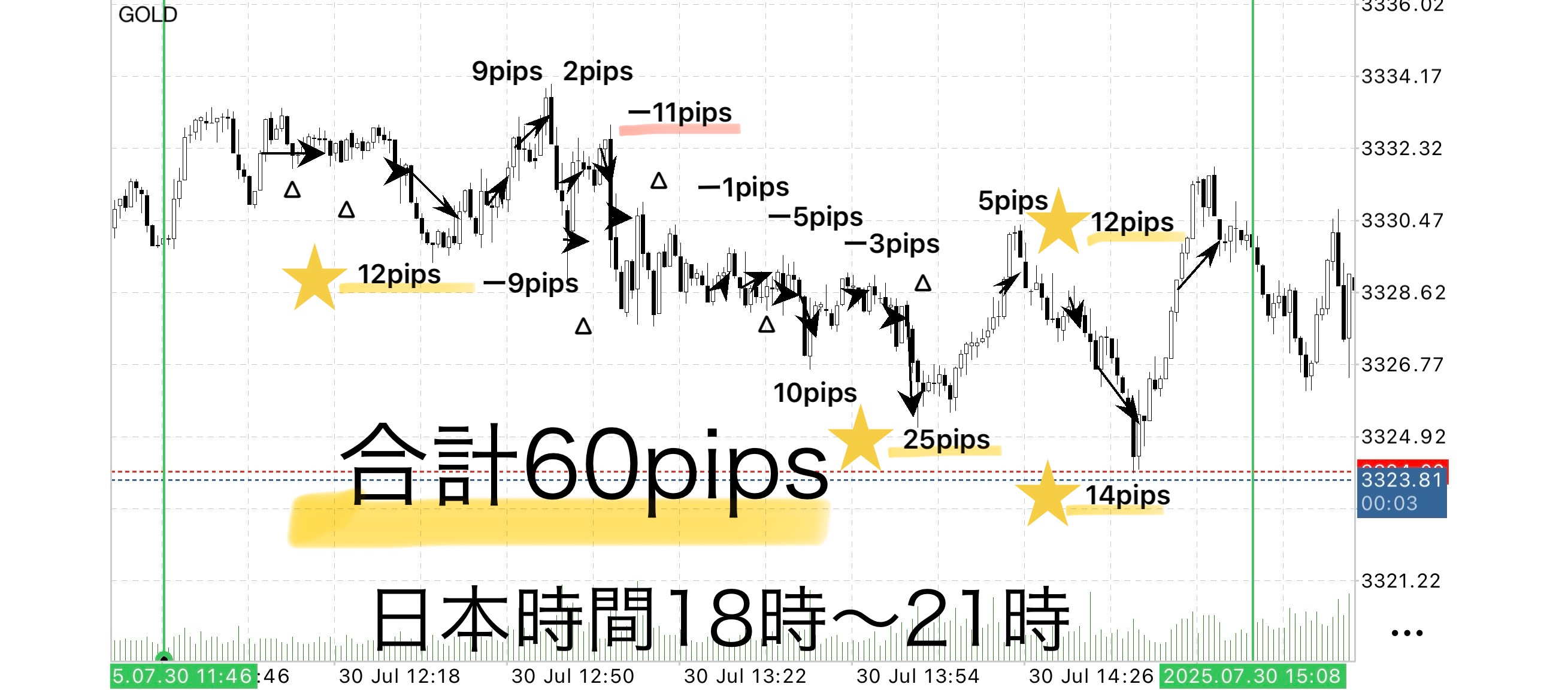

• Total trades: 19

• Profit exits: 8

• Stop loss: 5

• At-the-price exits: 6

• Total acquired pips: +89 pips

• Total lost pips: −29 pips

• Net: +60 pips

• Win rate: ≈42% (8 wins / 19 trades)

• PF: 3.07

• Total trades: 9

• Profit exits: 5

• At-the-price exits: 2

• Stop loss: 2

• Gained pips: +85 pips

• Lost pips: −24 pips

• Net: +61 pips

• Win rate: ≈55.5% (5 wins / 9 trades)

• PF: 3.54

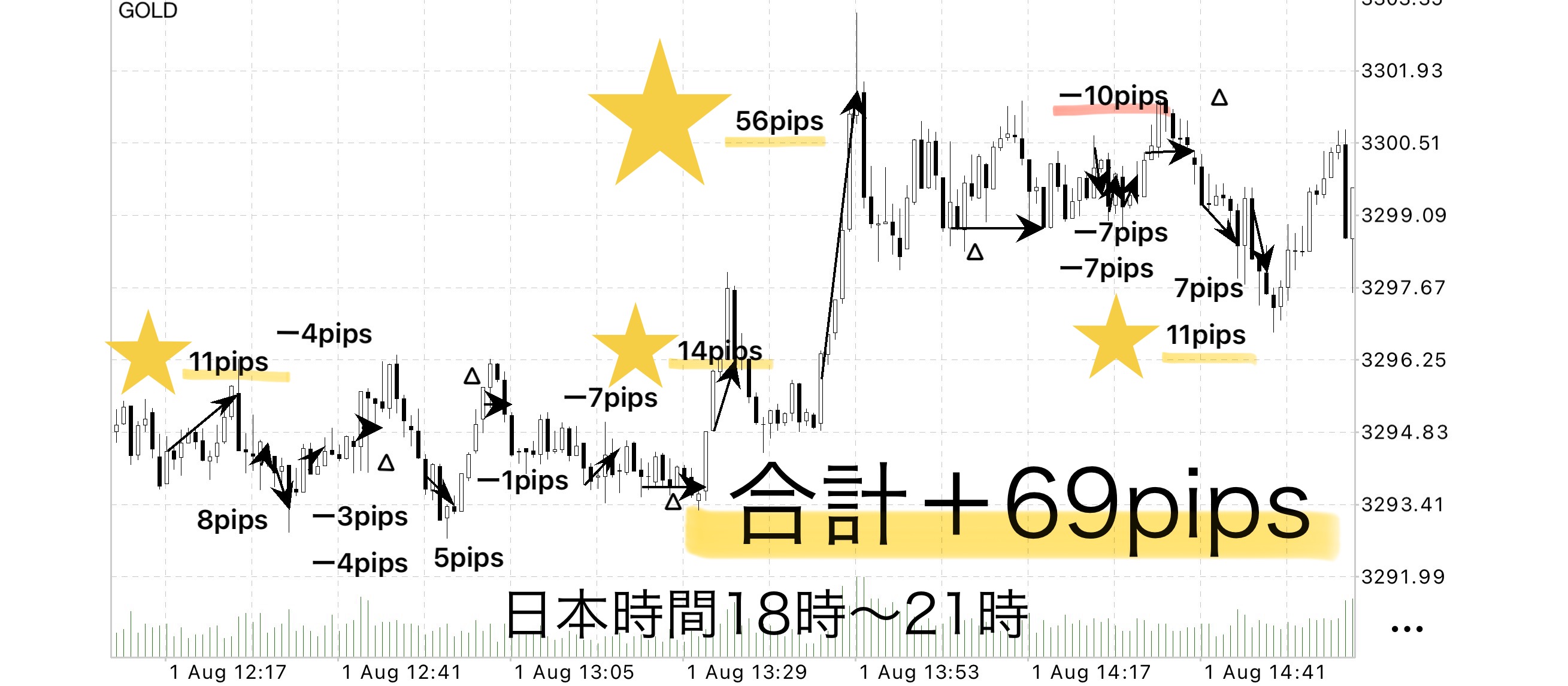

• Total trades: 20

• Profit exits: 7

• At-the-price exits: 5

• Stop loss: 8

• Total acquired pips: +112 pips

• Total lost pips: −43 pips

• Net: +69 pips

• Win rate: ≈35% (7 wins / 20 trades)

• PF: 2.60

This week, Day 1 (July 28) was volatile with small results, but

after that, profits were steadily accumulated, ending with

+289 pips as a solid result.

By strictly following the rule of “break → pullback,”

we proved that you can accumulate profits steadily without being swayed by emotions.

UpdatedEA

We have created a new version of the entry EA implementing the following features.

• Entry can be done simultaneously in 3 splits

• 1st position: manual exit aiming for the Sky Zone (final pullback exit at Sky Line ③)

• 2nd position: automatic take profit at Floating Line (parameters can be changed)

• 3rd position: automatic take profit at Aerial Line (parameters can be changed)

This ensures the zone you aim for is followed by the rules,

and some exits can be automatically taken at pre-set lines, for greater certainty,

“you don’t have to settle instantaneously” peace of mind and “not hesitating” trade-off is possible..

Also, the EA offers three patterns for stop loss.

1. Fixed pips

2. Trailing with moving averages (new in this version)

3. Stop loss at the opposite entry point

Note thatthis is not a completely hands-off system,

so, if the price moves against you soon after entry, it may be more efficient to cut losses manually according to the rules.

Please keep safety in mind when operating.

Supplementary notes

This EA update is available to customers who purchased “Sky of the Gap” as a supplementary tool (auto-entry + loss processing) distributed progressively as MT4/MT5 compatible files.

Although an alert function was originally implemented,

email notification functionality has been added this time.

Strengths of EA entries and rule-based settlements

“Merits of letting the EA decide entry decisions” allow traders to seize breakouts without hesitation, eliminating emotion and hesitation,and focus only on the settlement timing. This is a key advantage.

Also, trades aiming for the Sky Zone have large single-profit exits, and even with one or two stop losses, a few profitable exits can bring the total back to positive. This confirms the教材’s core idea:“Following the rules consistently leads to mid- to long-term stability.”

Furthermore, in ranges with many wicks, close-at-the-price exits tend to increase, which can be a safety valve to avoid wasteful losses. Conversely, in market with few wicks and clear breakout direction, the Sky Zone becomes a very strong weapon.

EA-triggered breakout strategy

“Sky of the Gap” is a simple strategy where entry is automated by an EA, and the trader only monitors after entry and executes settlements according to rules.

The EA continually monitors the chart and can enter the breakout precisely without missing the moment.

This reduces the stress of staring at the screen before entry and the anxiety of missing timing.

As a purchaser benefit, this EA is made available for use.

If you’d like to use it, send a message and I’ll provide the download password.

Why publish negative results?

Investing Navigator+ deliberately publishes negative results without hiding them.

The reason is that “trading cannot always win.”

Rather, by recording losses, we can analyze under what conditions losses occur and strengthen the logic.

Rather than focusing on individual wins and losses,

Over a week or a month, achieving a net positiveis what matters.

• “Happy about a win today”

• “Worried because of a loss today”

“Want to win” rather than “Want to earn” — this mindset is the foundation for long-term profits.

Stability gained by following the rules

The common cause of big losses in trading is the urge to win, breaking the rules.For example, delaying exits to push profits can wipe out profits in an instant.

Sky of the Gap features:

• Entry fully automated by EA

• Settlement under a fixed, rule-based condition

This reduces human intervention to the bare minimum and eliminates hesitation.

Just mechanically following the rules stabilizes win rate and risk-reward naturally.

⸻

We tested the “maximum take profit” rule aiming at Sky Zone,

and although close-at-the-price settlements occur, adhering to the rules allows calm capture of the next opportunity.

Even in moments where you might think, “I could have taken more,”

the rule-based close at the price ensures the overall total remains positive — a strength of this strategy.

What matters in trading is “profitability” not “win rate.”

Many traders worry about win rate, but

What’s important is having a rule that yields the same result no matter who uses it — true “reproducibility.”

Sky of the Gap is built on:

•EA entry → mechanical stop → rule-based take profit

Performing this sequence with zero emotion emphasizes treating trading as a business.

⸻

Do not cling to daily gains/losses.

Viewed over a week or month, some negative days are acceptable if the total remains positive.

Since the EA has no emotions, it is ideal for long-term capital management as well.

Operating the rules with a mindset of “earn” rather than “win” tends to produce a smoother growth of capital.

ℹ️

Currently, for those who purchased Sky of the Gap, supplementary tools (automatic entry + stop processing) are provided as a bundle.

This was created from the desire to use it daily, and is designed to automatically handle breakout judgment and risk management according to market structure.

Profit-taking remains a matter of your own judgment, making it a suitable tool for those who prefer that approach.

There are not many reviews yet because it’s simple and clear enough that it requires little interaction before or after purchase.

However, if usage increases, there is a possibility of charging for it in the future.

The reason is that it may become necessary to operate it as a service with support, not just standalone tool.

____

◻️ For those who want automatic EA entries

The tool that automates this logic is distributed as a purchase perk.

If you are considering purchasing, please feel free to contact us.

If you are interested in Sky of the Gap, you can join the online community

Join the online community here

In the online community, we cannot explain specific trading logic, but

you can participate in a “chart critique community” using Sky of the Gap.

• If you send a chart image you’re concerned about,

we will provide feedback with rule-based judgments such as “what should have been judged in this situation?”

“Where was the entry and take-profit point?”,with illustrative examples.

• Past charts at specific times are also OK.

We respond in due time as allowed.

To those interested in Sky of the Gap

Build a foundation for rule-based decision making in short-term trading — that is the core idea of Sky of the Gap.

Free material here:

▶︎ Download ‘Trail to the Gap’

In ‘Trail to the Gap,’ learn the criteria for which situations you can actually trade more clearly.

The sales page for “Sky of the Gap” could not convey everything,

so this provides detailed entry points and zone selection with diagrams and case-by-case explanations.

Even beginners can reproduce this easily, so if you’re curious please take advantage of it.

If you’re interested, please first receive the free material ‘Trail to the Gap’.

From there, your first step in the Gap begins.

“Will you include this chart?

When unsure,switch your thinking from “feeling” to “judging with rules.”