Shall we include this chart? ── A record of the “gap” identified by rules [No. 53]

Should we include this chart?

── Recording the “gap” discerned by the rules【第53回】

GOLD | Verification on July 28 –The Gap in the Sky and MIRAIComparison (18:00–21:00)

Monday, July 28, 2025 – 18:00–21:00 Japan Time

This time as well, we compared the traditional “Gap in the Sky” with the redesigned “Gap in the Sky MIRAI” that reduces deception with new parameters.

In the morning, in the Gap in the Sky +56 pips, MIRAI also +13 pipsfinished in positive territory.

In the evening, ranges formed, leading to more stop-outs and at-break-even closes, but when totaling morning and evening, both logics ended with small profits overall.

⸻

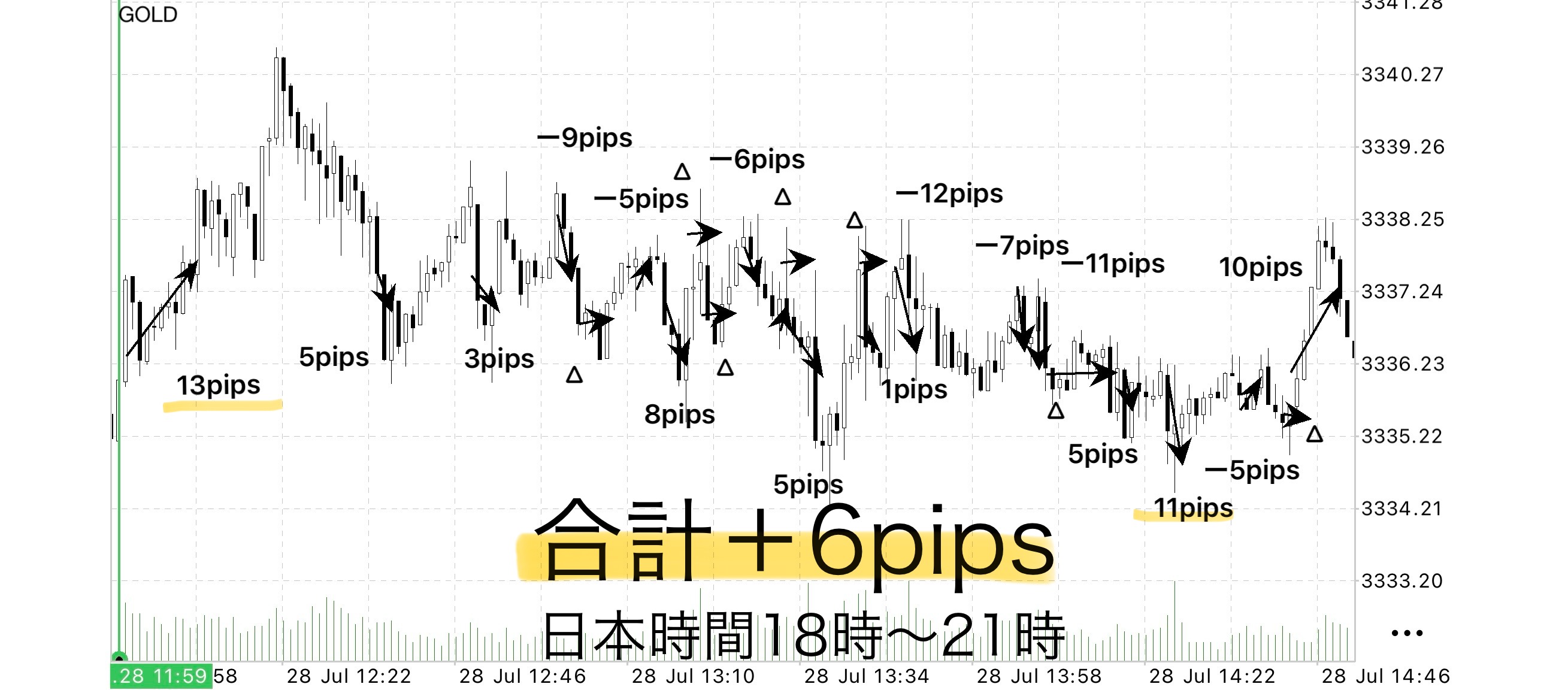

Results (18:00–21:00)

Gap in the Sky

• Total trades: 23

• Profit closes: 9

• Loss closes: 7

• Open-price closes: 7

• Gained pips: +61 pips

• Lost pips: −55 pips

• Total net: +6 pips

• Win rate: about 39% (9 wins / 23 trades)

• PF: 1.11

• Example profit (1 lot): +8,700 yen

• Example profit (0.1 lot): +870 yen

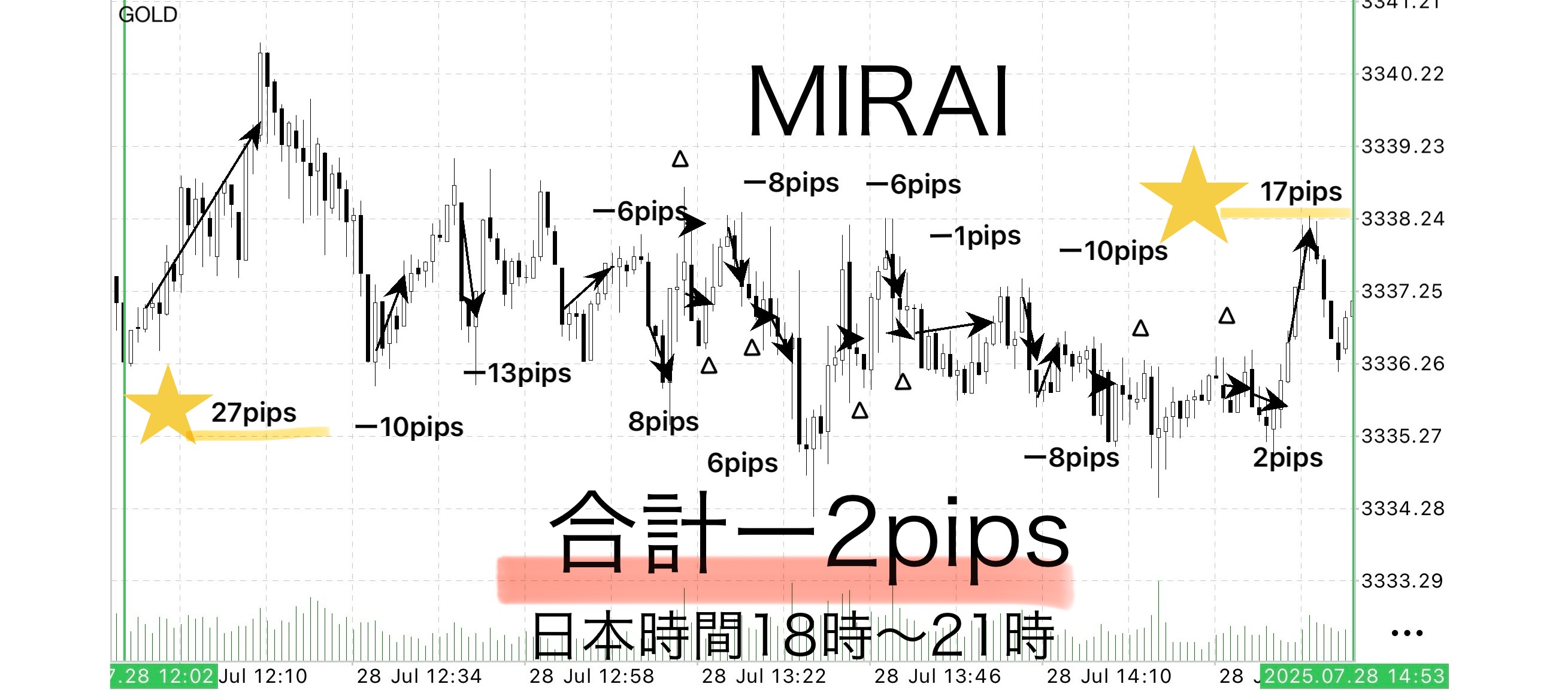

Gap in the Sky MIRAI

• Total trades: 20

• Profit closes: 5

• Loss closes: 8

• Open-price closes: 7

• Gained pips: +60 pips

• Lost pips: −62 pips

• Total net: −2 pips

• Win rate: about 25% (5 wins / 20 trades)

• PF: 0.97

• Example profit (1 lot): −2,900 yen

• Example profit (0.1 lot): −290 yen

⸻

Impressions

In this 18:00–21:00 period, the Gap in the Sky ended slightly positive (+6 pips) while MIRAI ended slightly negative (−2 pips).

In range-friendly conditions with many wicks, after breaks reversals became more common, leading to somewhat more open and stop-out closes.

Effectiveness of fixed risk-reward trades

In “Gap in the Sky,” fixed RR-type trades form the base.

• Floating zone (RR1:1)

• Air zone (RR1:2)

• Sky zone (RR1:3–5)

Adopting these fixed RR types in the practice phase helps to reliably secure profits.

On the other hand, trades that maximize profit are typically the advanced trade examples published in “Investment Navigator+.”

Using both bases: “Foundation: fixed RR trades” and “Application: maximum take-profit trades” as two wheels enhances the reproducibility of rule-based trading even further.

⸻

Future plan

There are buyers who worry when losses continue, so designing MIRAI to reduce number of trades may help mental stability.

From now on, we will continue to validate Gap in the Sky and MIRAI in parallel, and if usefulness increases, MIRAI will be added as a paid teaching resource.

Progress comes from not hesitating

“Gap in the Sky” is not a flashy strategy aiming for a single big reversal.

It’s about “accumulating small wins to end up with a net positive.”

That stability is its greatest strength.

With EA, entries can be automated,

allowing a state where you only monitor the closes.

This is a significant advantage that makes it easy to implement even while working or doing chores.

ℹ️Guide to the dedicated entry tool

Purchased by owners of Gap in the Sky

We provide auxiliary tools (auto-entry + stop-loss handling).

This tool was created from the desire that users will want to use it daily,

and is designed to delegate only the break decisions and risk management to follow market structure.

For those who believe profit-taking is primarily your own judgment, this tool is a good match.

However, if usage increases in the future, paid access may be considered.

The reason is that selling tools alone may not suffice; support and a package may be required.

____

If you are considering purchase, please feel free to inquire.

For those interested in Gap in the Sky, an invitation to an online community

Join the online community here

Within the online community, specific trade logic cannot be explained, but

you can participate in the “Chart Critique Community” that uses Gap in the Sky.

• If you send a chart image you’re curious about,

“What should have been judged in this moment?”

“Where was the entry and take-profit point?” etc., feedback with rule-based judgments will be provided.

• Past charts for specific time ranges are also OK.

We respond in order as time permits.

To you who have become interested in Gap in the Sky

In short-term trading, the foundation is to judge with rules without hesitation—

that is the fundamental philosophy of Gap in the Sky.

Free materials here:

In “Trace to the Gap,” you’ll learn in more accessible terms what situations you can actually trade in.

It explains decision criteria more clearly,

and covers concrete entry points and zone selection with diagrams and cases, which could not be fully conveyed on the Gap in the Sky sales page.

Even first-time readers can reproduce it easily, so if you’re interested, please use that too.

⸻

If you’re interested, please first receive the free material “Trace to the Gap.”

From there, your first step in the Gap begins.

When you’re unsure about whether to include this chart,

we hope it helps you switch to thinking “judge by rules, not by intuition.”

Gap in the Sky

https://www.gogojungle.co.jp/tools/ebooks/64393?via=toppage_recentViewed