Will you include this chart? —A record of the “gap” identified by the rules [Issue 46]

Should we include this chart?

── Records of the “Gaps” as revealed by the rules【第46回】

Special Trial Information

・Number of people: limited to 10 (ends when support becomes difficult) / remaining 6 people

・For those interested, we will send a password via message that allows purchase at a special price.

・Conditions are very simple. Details will be individually explained to those who contact us.

“I want to try first” “I want to confirm whether it works in my time zone”

If you feel that way, please take advantage of this opportunity.

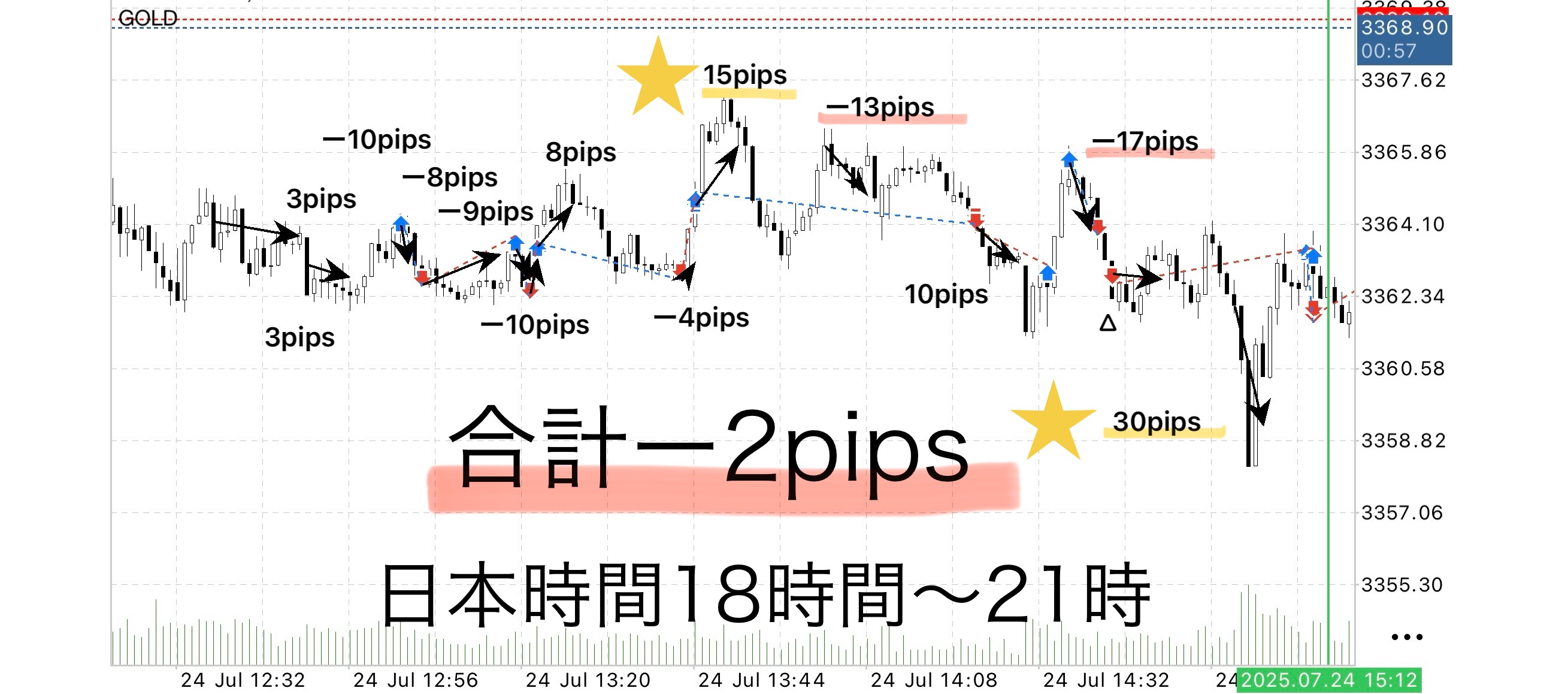

GOLD|July 24 verification from 18:00 to 21:00 with the first negative result and a T-zone prototype

July 24, 2025 (Thu) – Japan time 18:00–21:00

Trading results (normal logic)

• Total trades: 14

• Take-profit successes: 6

• Stop losses: 7

• Breakeven settlements: 1

• Total acquired pips: +69 pips

• Total lost pips: -71 pips

• Net profit/loss: -2 pips

• Win rate: about 43% (6 wins / 14 trades)

• Profit Factor (PF): 0.97

Example of returns (USD/JPY 145 yen conversion)

• For 1 lot operation:-2,900 yen

• For 0.1 lot operation:-290 yen

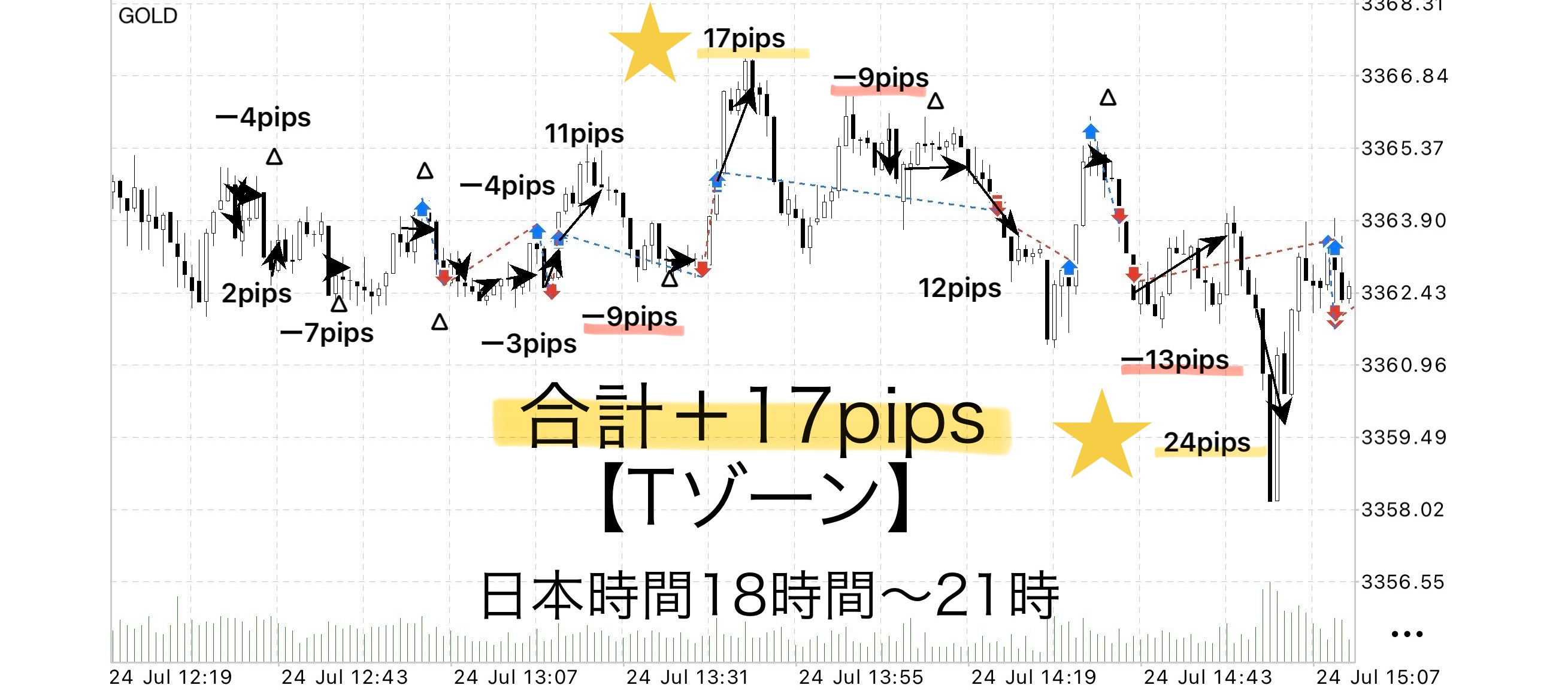

Prototype of T-zone logic

• Total trades: 19

• Take-profit successes: 5

• Stop losses: 7

• Breakeven settlements: 7

• Total acquired pips: +66 pips

• Total lost pips: -49 pips

• Net profit/loss: +17 pips

• Win rate: about 26% (5 wins / 19 trades)

• Profit Factor (PF): 1.35

Example of returns (USD/JPY 145 yen conversion)

• For 1 lot operation:+26,650 yen

• For 0.1 lot operation:+2,465 yen

First negative result in early July

From July 1, almost daily, from 18:00 to 21:00, we have been testing with the “Sky Gap” logic.

We have previously accrued stable gains, but this time it resulted in a negative outcome for the first time.

That said, looking back at the content, it was the result of following the rules faithfully, not due to any forced entry or emotional decisions.

⸻

Background of the T-zone Logic Prototype

In response to this negative result,we are prototyping a “T-zone” logic focused on short-term settlements.

The lines used are essentially the same as the “Sky Gap,” but have the following features:

1. Increased number of trades

2. Emphasis on risk avoidance

3. Fast take profits and breakeven exits

Market conditions

On the 24th, momentum after the breakout did not continue, with many small retracements.

Therefore, a trading style that buys up briefly in the short term rather than riding momentum for long holds seemed more suitable.

Even in this pattern in T-zone, we secured a 17 pips gain, indicating adjustments for short-term settlements are effective.

Because we don’t hesitate, the gains accumulate

“Sky Gap” is not a flashy strategy aimed at a single big reversal.

The stability of “accumulating small wins to end with a net positive”

is its greatest strength above all.

Using EA automates entries,

creating a state where you only need to monitor settlements.

This is a major advantage that makes it easy to implement while working or doing house chores.

⸻

ℹ️ Guide to dedicated tools (review bonus)

Currently, for those who leave a review, we provide auxiliary tools (automatic entry + stop-loss processing).

This was created from the idea that I want to use it daily, and

it is designed to delegate breakouts and risk management according to the market structure.

For those who consider taking profits as their own judgment, this tool is compatible.

Reviews are not yet plentiful, but this may be because the structure is simple and straightforward enough not to require extensive back-and-forth before or after purchase.

However, if usage increases in the future, we may consider charging for it.

The reason is that it may no longer be sold as a standalone tool but require “support and set” together.

____

◻️ For those who want automatic EA entries

A tool that automates this logic as an EA is being considered for distribution as a review bonus.

If you are considering purchasing, please feel free to contact us.

If you are interested in Sky Gap, you can join the online community

Join the online community here

Within the online community, we cannot explain specific trade logic, but

you can participate in a “Chart critique community” using the Sky Gap.

• If you send a chart image you are curious about,

“In this scenario, how should I judge it?”

“Where were the entry and take-profit points?”,we will provide feedback with examples based on the rules.

• Past charts of specific time frames are also OK.

We will respond in sequence as time permits.

To you who have become interested in Sky Gap

In short-term trading, the foundation for making decisions by rule without hesitation—

that is the basic philosophy of Sky Gap.

? Free教材 here:

In ‘Trace to the Gap,’ you will learn in which scenarios you can actually trade and how to judge them more clearly.

It explains more clearly than the sales page for “Sky Gap” the entry points and zone selection with diagrams and cases.

Even beginners can reproduce easily, so

if you’re interested, please take advantage of it as well.

⸻

If you’re interested, first receive the free material ‘Trace to the Gap’.

From there, your first step in the Gap begins.

? When you’re hesitant about whether to include this chart,

we hope it helps you switch to thinking to “decide by rules, not by intuition.”

Sky Gap

https://www.gogojungle.co.jp/tools/ebooks/64393?via=toppage_recentViewed