Will you include this chart? ──Records of the “gap” seen through the rules [Issue 45]

Should we include this chart?

── Recording the “in-between” through rules【Issue 45】

Special Trial Information

・People: about10 participants limit (ends when support becomes difficult) / remaining 7

・If you are interested, we will send you a password for special pricing via a message.

・Conditions are very simple. Details will be individually guided to those who contact us.

“I want to try first” “I want to see if it works in my time zone”

If you feel that way, please take advantage of this opportunity.

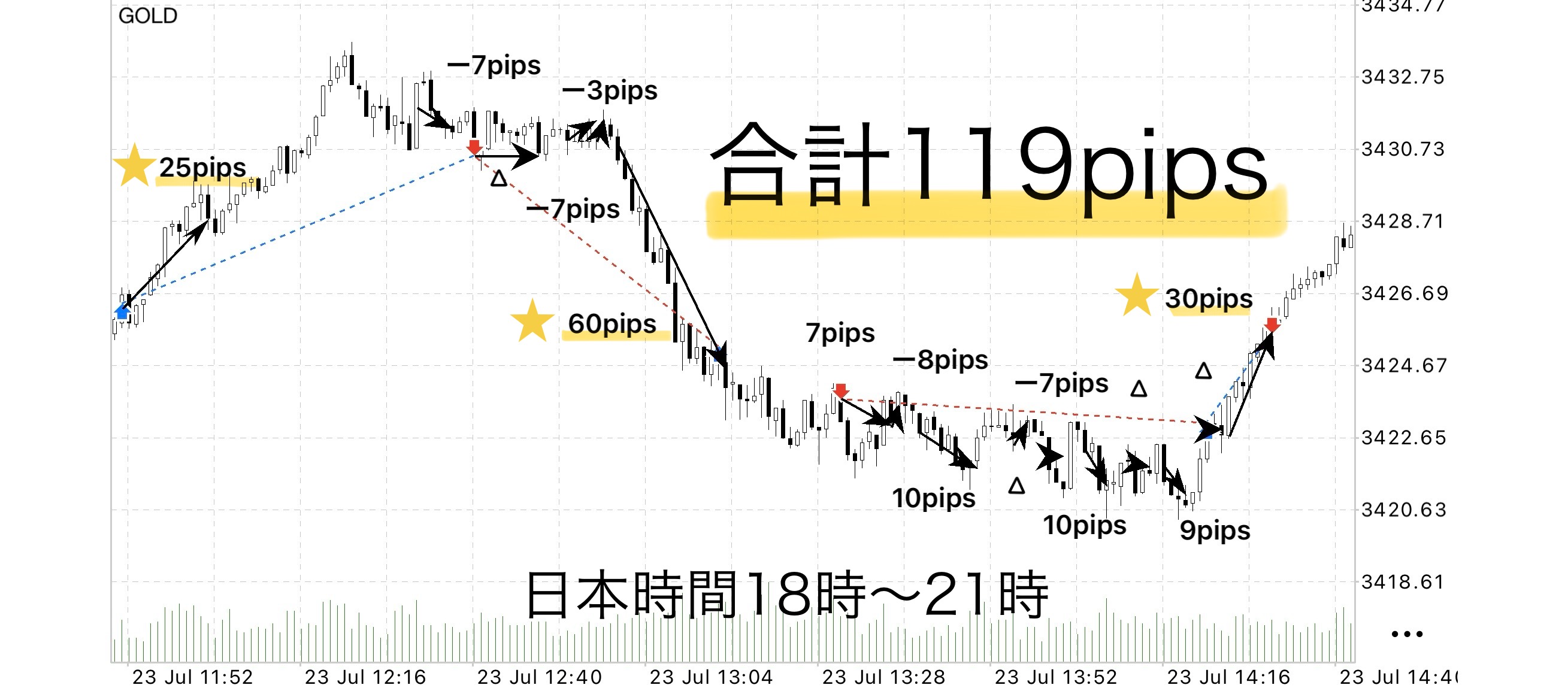

GOLD|+119 pips in Breakout Market – Sky Between the Lines Logic Verification

Wednesday, July 23, 2025 – Japan Time 18:00–21:00

Trading results (GOLD)

• Total trades:16 trades

• Profit-taking successes:7 times

• Stop losses:5 times

• Breakeven closures:4 times

• Total gained pips:+151 pips

• Total lost pips:-32 pips

• Net profit/loss:+119 pips

• Win rate:Approximately 43.7% (7 wins / 16 trades)

• Profit Factor (PF): 4.71

Performance example (USD/JPY at 145 yen conversion)

• If trading 1 lot: +172,550 yen

• If trading 0.1 lot: +17,255 yen

⸻

Market conditions – An ideal scenario with ongoing large breaks

Although the previous day ended around ±0,this time after a breakout the price movements were very straightforward, with many instances moving as expected.

In such markets,the key is not “how far can you push profits” but “hold without rushing until the breakout stops.”

Contrarian strategies or discretionary judgments often miss such one-directional strong markets, but

Sky Between the Lines Logic can demonstrate its edge simply by riding the wave.

Especially today, from European time to early New York time,

the ideal pattern “Break → Follow → Short pullback → Break again” repeated, achieving multiple profit realizations.

⸻

Key Points of this time– “Hold without rushing” and “Protect at entry price”

1. Hold without rushing as long as the breakout continues

Don’t close early; let the price extend as far as it can.

This leads to several trades with large profit margins.

2. Exit at breakeven when pullbacks are fast

When momentum declines rapidly, a quick exit near the breakeven is effective.

This helps minimize losses and prevent drawdowns.

⸻

Strength of the logic– Simplicity and reproducibility

• Stop-loss width can be adjusted according to volatility

Avoid being stopped out by too-narrow stops while taking only the necessary risk.

• Trade rules are highly visible and easy to memorize

“Break → Continuation → Retrace” completes the system,as simple as moving average crossovers, and quickly repeatable.

• Verification is very easy

For 3 hours of verification,the rules are so clear that it can be completed in 5–10 minutes.

This allows you to quickly grasp market characteristics and win rates.

⸻

Summary– Maximize the strengths of breakout-type logic

This verification reaffirms how effective riding an active market can be.

No need for complex indicators or discretionary judgments; set a line to break, trade, and hold if momentum continues—the results come out surprisingly comfortably.

Less hesitation leads to more accumulation

“Sky Between the Lines” is not a flashy strategy aiming for a single big reversal.

It’s about “accumulating small wins to end up positive.”

That stability is its greatest strength above all.

Using EA automates entries,

creating a state where you only need to monitor the settlements.

This is a major advantage that makes it easy to use while working or doing chores.

⸻

ℹ️Guidance on dedicated tool (review bonus)

Currently, we are providing auxiliary tools (auto-entry + stop-loss processing) to those who post a review.

This was designed from the desire that users themselves would want to use it daily,

and it delegates only break decisions and risk management in line with market structure.

Profits remain primarily a matter of your own judgment, making it a well-suited tool for some.

Reviews are not many yet, but this may be because the structure is simple and clear enough that there is little need for active pre- or post-purchase communication.

However, if demand grows, a paid option may be considered.

The reason is that it may be necessary to operate the tool as a “tool sold with support” rather than standalone.

____

◻️ For those who desire automatic entry with EA

The tool that turns this logic into an EA is being considered for distribution as a review bonus.

If you are considering purchase, please feel free to contact us.

Sky Between the Lines Entry EA here

If you are interested in Sky Between the Lines, you can join the online community

Join the online community here

Within the online community, we cannot explain specific trade logic, but

you can participate in the “Chart Review Community” using Sky Between the Lines.

• If you send a chart image you’re curious about,

“What would have been the correct decision in this moment?”

“Where were the entry and profit-taking points?”,we will provide feedback with rule-based guidance.

• Past charts for specific time periods are also OK.

We respond in sequence as time allows.

To you who are interested in Sky Between the Lines

In short-term trading, establishing a foundation to decide by rules without hesitation—

that is the core philosophy of Sky Between the Lines.

? Free materials here:

▶︎Download ‘Trail to the Narrow Between’

In ‘Trail to the Narrow Between,’ when exactly can you trade?

We explain those decision criteria more clearly.

For Sky Between the Lines’ sales page alone, it may not fully convey

the specifics of entry points and zone selection,

which are also carefully supplemented with diagrams and case studies.

Even first-time readers can reproduce it, so

if you’re interested, please take advantage of that as well.

⸻

If you are interested, first receive the free material ‘Trail to the Narrow Between’.

From there, your first step in the Narrow Between begins.

When you wonder, “Should I include this chart?”

I hope this helps shift your thinking to a rule-based approach rather than relying on a feeling.

Sky Between the Lines

https://www.gogojungle.co.jp/tools/ebooks/64393?via=toppage_recentViewed