Should we include this chart? —— The record of the "gap" detected by the rules [No. 35]

Should I include this chart?

── Recording the narrow gap (Between the Skies) by rules【Issue 35】

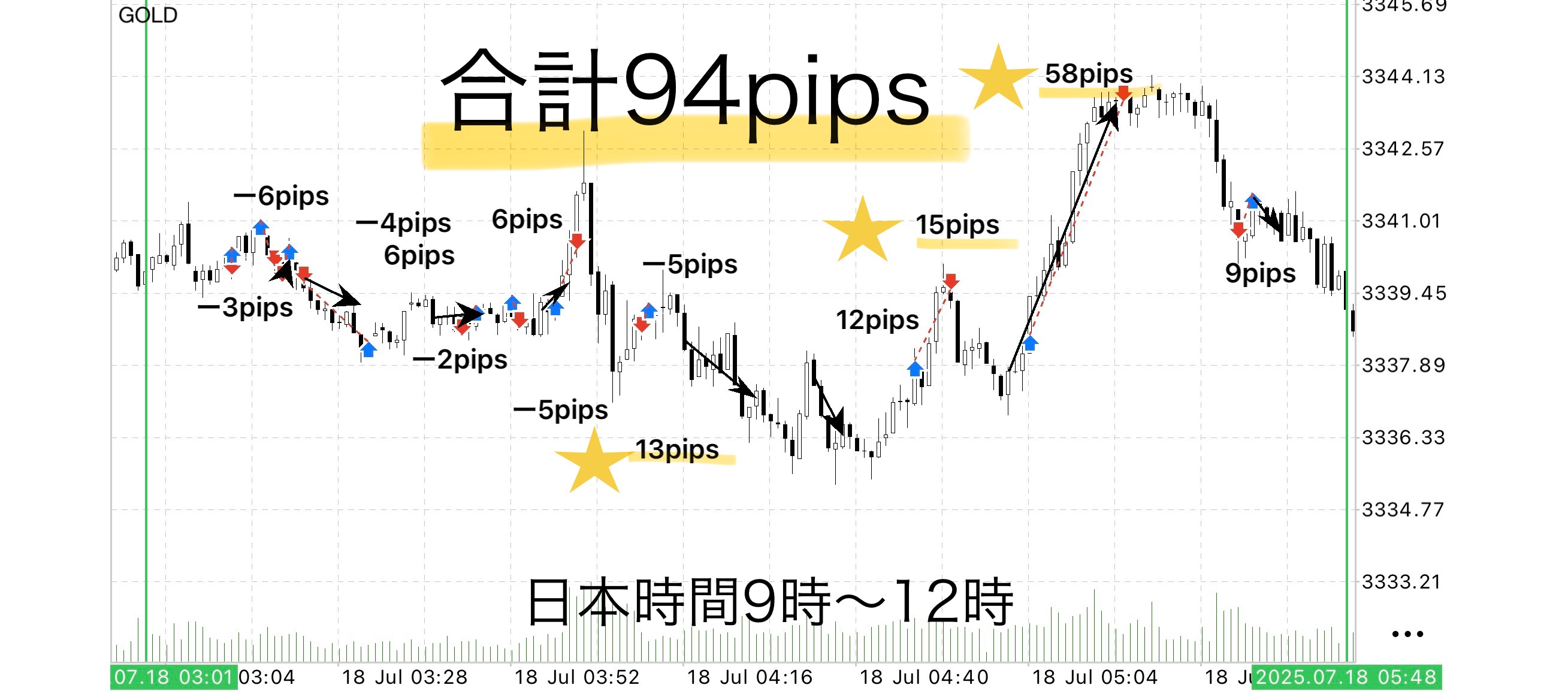

【July 18, 2025 (Friday)

── Entry is automatic, judgment is by model. Reproducibility of +94 pips in 3 hours

⸻

?Purpose and perspective of the verification

In this verification, we used the core of the “Skyward Narrow Gap” strategy—the automated entry EA—and traced the real trading flow for three hours from 9:00 to 12:00 Japan time.

The theme is to confirm whether a reproducible operation can be achieved by a process of “notification → monitoring → discretionary take-profit” after entry, where the decision is made by oneself.

⸻

Role of the logic and verification style

This EA is a tool that automatically enters at the moment of a breakout.

It features a filter based on the arrangement of moving averages, designed to eliminate unnecessary entries.

In this test, we deliberately left after entry, focusing on the accuracy of entries themselves.

⸻

?Trading results (GOLD)

• Total trades: 13

• Profit-taking successes: 7

• Stop losses: 6

• At-break-even closes: 0

• Total gained pips: +119 pips

• Total lost pips: -25 pips

• Net profit/loss: +94 pips

• Win rate: about 53.8% (7 wins / 13)

• Profit Factor (PF): about 1.90

• Profit per lot (1 pip = 1450 yen): about +136,300 yen

• Profit per 0.1 lot: about +13,630 yen

⸻

?How to read the chart commentary

• ?Blue arrows: points where discretionary take-profit was likely possible

• ?Red arrows: points where leaving as-is led to a stop loss

Notes: Some entries are actually excluded by the moving average filter. The arrows are for reference in the comparative analysis.

⸻

✅Key points from verification

• No more hesitation at entry, reducing mental burden significantly

• Take-profit patterns are structurally defined (e.g., Skyline ③), making discretionary judgments easier to reproduce

• The trailing feature to catch momentum during trends worked well, with some large gains

• If you do not make take-profit decisions after notification, you may end up hitting a stop loss

• The EA does not automatically handle retreat to cost or pullback escapes, so full automation is not ideal

⸻

✏️Summary

Using a method like this, where only the entry is automated, is very effective for those with time constraints or who tend to waver at decision moments.

Take-profit decisions must follow the rules, but if you do, the trading flow becomes surprisingly simple.

Not having to agonize at entries makes you feel much more at ease—this is a real experience.

Verification continues, but the sense that “if you follow the rules, results follow” is steadily accumulating.

⸻

?Time-of-day verification aligned with lifestyle is also possible

• Can you earn just in the morning?

• Is it effective only at night when you can’t monitor charts?

• How does the market react during daytime?

⸻

?Notice regarding price changes (limited to a number of people)

This change was made with the intention of “increasing companions who can speak about the market from a common perspective.”

If anyone is interested, we would be glad if you take this opportunity.

⸻

ℹ️Guide to a dedicated tool (review bonus)

Though reviews are still few, this may be because the structure is simple and straightforward enough that pre- and post-purchase communication isn’t required.

If usage increases in the future, charging may be considered.

This is because there could be a need to operate as a “support and collaboration” rather than standalone tool sales.

____

◻️ For those who want automatic entry by EA

We are considering distributing an EA version of this logic as a review bonus.

If you are considering purchasing, please feel free to contact us.

Skyward Narrow Gap Entry EA here

If you are interested in the Skyward Narrow Gap, you can join our online community

Join the online community here

We cannot explain concrete trading logic inside the online community, but

you can join the “Chart Review Community” that utilizes the Skyward Narrow Gap.

• If you send a chart image you’re curious about,

“What would have been the right judgment in this moment?”

“Where were the entry and take-profit points?” etc., we will provide feedback with rule-based examples.

• Past charts for specific time frames are also OK.

We will respond in due course within the time you have.

To you who are interested in Skyward Narrow Gap

In short-term trading, establishing a foundation to judge without hesitation by the rules—

that is the core philosophy of Skyward Narrow Gap.

? Free material here:

▶︎Download ‘Path to the Narrow Gap’

In ‘Path to the Narrow Gap,’ you will learn more clearly in which situations you can actually trade and the criteria for judgment.

It explains more concretely about entry points and zone selection that could not be fully conveyed on the sales page for “Skyward Narrow Gap,”

with diagrams and case-by-case explanations.

Even first-time readers will find it easy to reproduce, so if you’re curious, please take advantage of it as well.

⸻

If you are interested, please first receive the free material ‘Path to the Narrow Gap’.

From there, your step into the Narrow Gap begins.

? When you’re unsure about whether to enter this chart,

I hope it helps shift your thinking from “I feel it” to “I judge by rules.”

Skyward Narrow Gap

https://www.gogojungle.co.jp/tools/ebooks/64393?via=toppage_recentViewed