Should I include this chart? ──A record of the “gap” discerned by rules [Issue 34]

Should we include this chart?

— Recording of the “Between” discerned by rules【Issue No. 34】

In this validation, we used an entry-only EA to reproduce the flow of “Notification → Monitoring → Take-profit discretionary judgment” in a verifiable form.

Together with the actual trading chart, we will convey the overall strategy accuracy and the feel of real operation.

⸻

Overview and purpose of the logic used

This EA is a automatic entry assist tool for the “Tenkuu no Hazama” strategy.

Under conditions of a trending phase (perfect order by moving averages), it notifies the entry point at breakouts.

In this test, the EA’s entry accuracy was the sole objective, so take-profit and stop-loss were deliberately not performed manually, and after notification it was left completely as is.

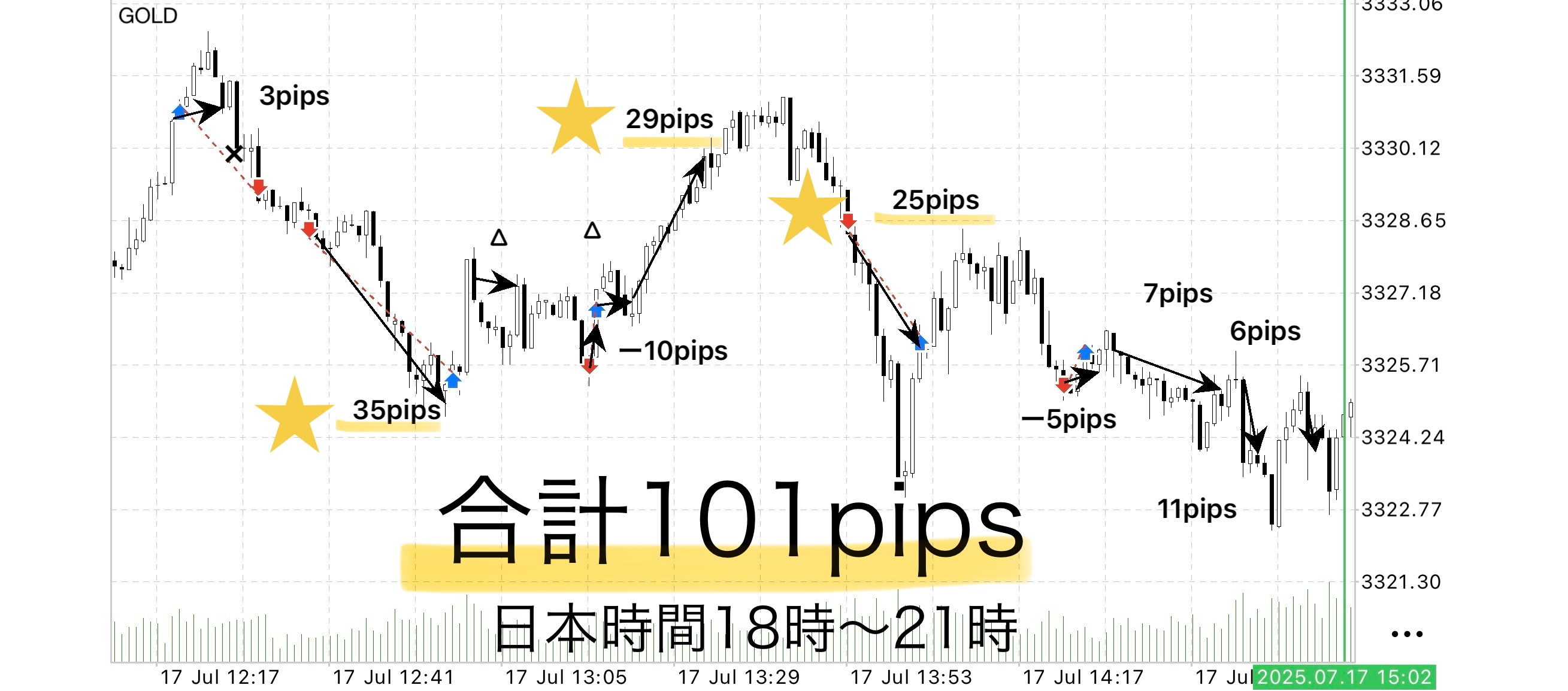

Validation time frame

• Date: July 17, 2025

• Time: Japan Time 18:00–21:00 (approx.)

How to read the chart

The chart below clearly indicates discretionary exit points and the structural profit/loss flow.

• ? Blue arrow: position where take-profit would have been possible (discretionary take-profit guideline by zone judgment)

• ? Red arrow: scene where it moved against the trader and would have stopped out, or a timing for closing in the opposite direction

※ In reality, entry filters are determined by the arrangement of the moving averages, and some arrows are reference displays without filters.

Trade results

• Total trades: 11

• Take-profit successes: 7

• Stop losses: 2

• Position closed at entry price: 2

• Total gained pips: +116 pips

• Total lost pips: -15 pips

• Net P/L: +101 pips

• Win rate: approximately 63% (7 wins / 11 trades)

• Profit factor (PF): about 7.73

• Profit per lot (1 pip = ¥1,450): ¥146,450

• Profit per 0.1 lot: ¥14,645

Impressions of operation

This time we tested by leaving the EA after notification without any monitoring, and gained the following insights.

Positive points

• You can delegate entry decisions, so you don’t need to stay glued to the chart

• Take-profit points often occur after the break of Tenkuu Line 3 and return, making discretionary replication easier

• During trend continuation, trailing take-profit functioned, and there were cases where it extended beyond expectations

Cautions and future improvements

• If you don’t make take-profit judgments after notification, there are cases where it may move directly into a stop loss

• The EA does not automatically handle exit at entry price or bounce-backs, so it is not suitable for completely hands-off use

• If you are not accustomed to discretionary judgment, you may encounter situations like “just a few pips more to take-profit,”

Summary

This EA is designed to specifically “remove hesitation in entering.”

By following the notification and monitoring, and deciding take-profit/stop-loss according to fixed rules, a consistent trading flow naturally becomes familiar in this validation as well.

Moreover, since the price movement repeats in a structure where the price returns to the zone after a breakout,

the inherent advantages of the logic are gradually becoming evident.

As the pattern from entry to take-profit becomes a reproducible flow,

I feel that anxiety about trading decisions has diminished further.

Rather than “wins or losses,” it is about whether you can “execute according to the decided model” —

This is the essential trading sense we aim to cultivate, and this tool should be a useful aid.

⸻

?Time-zone validation to fit your lifestyle is also possible

• Can you make money only in the morning?

• Is it viable if you can only monitor at night?

• How does the market react during the day?

We will continue to perform validations at times that suit your lifestyle.

If you’re curious, please feel free to consult us.

?Notice of price change (limited number of people)

Originally, a campaign was planned from [July 15], but due to Gogojan’s policy, “prices change cannot be used for one month afterward,” so this time price change is available for an undetermined period with limited slots.

This change was a decision born from the desire to “increase friends who can discuss the market from a common viewpoint.”

If anyone is interested, we would be grateful if you take advantage of this opportunity.

ℹ️Information on exclusive tool (review bonus)

Currently, we are providing an auxiliary tool (automatic entry + stop-loss handling) to those who leave a review.

This was created from the desire to use it myself every day, and

It is designed to delegate only break decisions and risk management in accordance with price structure.

For those who believe take-profit is ultimately your own judgment, this tool is well-suited.

Reviews are not yet numerous, but this may be because the structure is simple and clear enough not to require active communication before or after purchase.

However, as usage increases in the future, paid options may be considered.

The reason is that there is a possibility that it will require operation as a “support and set,” not just a stand-alone tool.

____

◻️ For those who wish automatic entry via EA

A tool that converts this logic into an EA is being considered for distribution as a review bonus.

If you are considering purchasing, please feel free to contact us.

Tenkuu no Hazama Entry EA is here

If you are interested in Tenkuu no Hazama, you can join the online community

Join the online community here

Specific trading logic cannot be explained inside the online community, but

you can join a “Chart Review Community” that utilizes Tenkuu no Hazama.

• If you send a chart image you are curious about,

“What would have been the right decision in this moment?”

“Where was the entry and take-profit point?”, we will provide feedback with examples based on rules.

• Past charts for a specific time zone are also OK.

We will respond in sequence as time allows.

To you who have become interested in Tenkuu no Hazama

In short-term trading, the foundation is to make judgments according to rules without hesitation —

That is the basic philosophy of Tenkuu no Hazama.

? Free material here:

▶︎Download ‘Path to the Between’

What exactly does ‘Path to the Between’ explain about when you can trade?

It explains the judgments in a simpler way.

Beyond what can be conveyed on the Tenkuu no Hazama sales page,

the specific entry points and how to choose zones are also

explained diagrams and case-by-case details.

Even beginners can reproduce it, so

if you’re interested, please make use of it as well.

If you’re interested, please first receive the free material ‘Path to the Between’.

From there, your first step in the Between begins.

? When you’re unsure, like, “Should I include this chart?”

I hope it helps shift your thinking to “judge by rules, not by intuition.”

Tenkuu no Hazama

https://www.gogojungle.co.jp/tools/ebooks/64393?via=toppage_recentViewed