Should I include this chart? ── Records of the “gap” seen through the rules [Issue 33]

Should we include this chart?

── Records of the “gap” detected by rules【Issue 33】

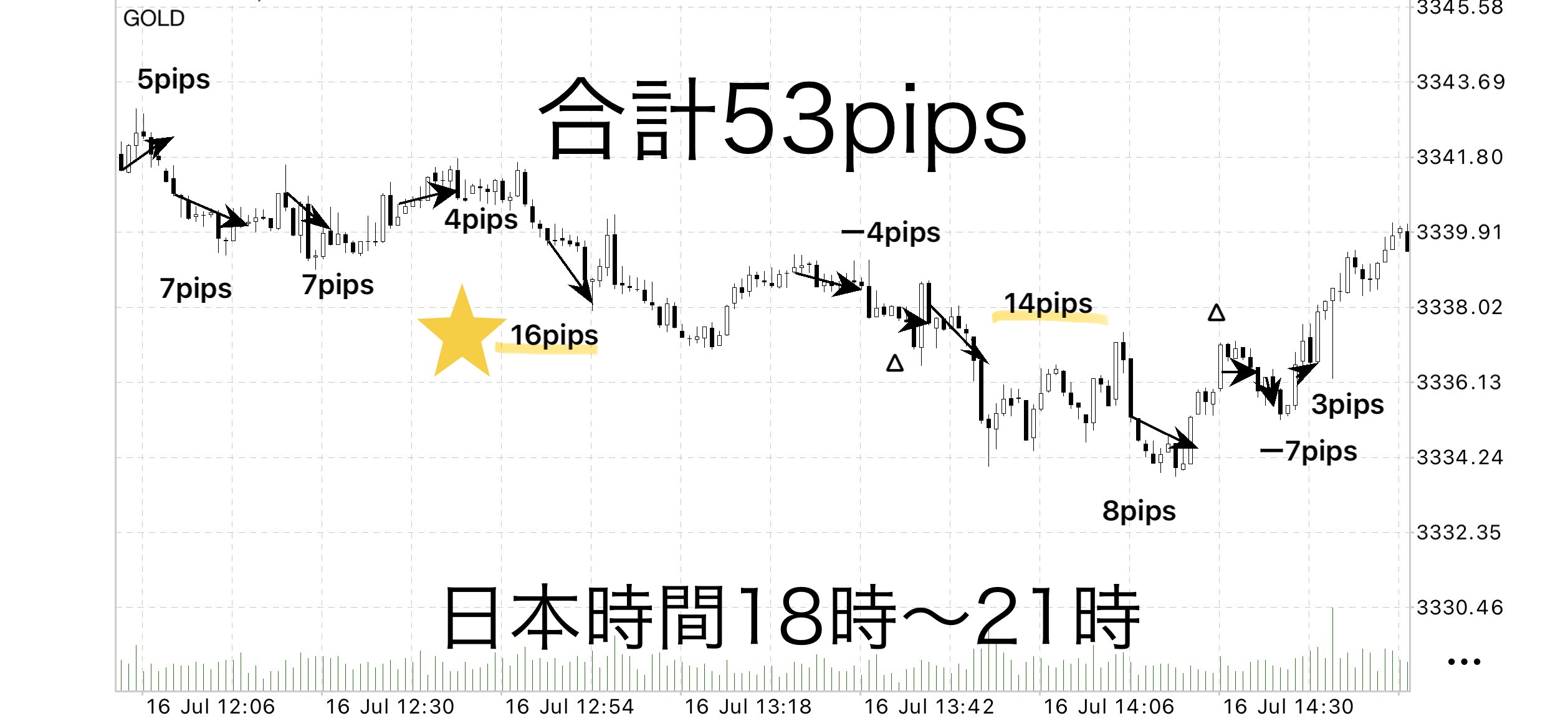

【July 16, 2025 (Wednesday)】GOLD | Verification report of the Sky Gap Logic

── Simply following the rules yields +53 pips. A record of decisive trades

⸻

Purpose and background of the verification

This verification was conducted from the perspective of “how stable can profits be within a limited time window?”

The focus was on 3 hours from 18:00 to 21:00 Japan time. During this period, we tested practically whether one could trade by the rules without burdening daily life and still achieve results.

In addition, by minimizing discretionary decisions and returning to the original principle of “acting calmly according to the rules,” we aimed to confirm how much the reproducibility and stability of trading can be guaranteed.

⸻

Components of trading

• Entry and stop-loss: Clear rules based on break criteria and high/low prices

• Take profit: Visual judgment based on chart structure and zones

• Auxiliary: Trailing using ATR, price level adjustments, etc.

※ Some auxiliary processes are supported by dedicated tools, but the core is based on discretionary decision-making.

⸻

?Trade results summary (GOLD)

• Total trades: 12

• Take profit success: 8

• Close at entry price: 2

• Stop losses: 2

• Total pips gained: +64 pips

• Total pips lost: -11 pips

• Net profit: +53 pips

• Win rate: approximately 75% (9 wins / 12 trades)

• Average RR ratio: about 1.6–1.8 (visual estimate)

• Profit factor: about 3.8 (rough estimate)

⸻

Revenue image (Reference: 1 pip ≈ 1,450 JPY)

• When trading 1 lot: +76,850 JPY

• When trading 0.1 lot: +7,685 JPY

※ Realized spread and slippage not reflected; theoretical values

⸻

What was learned from this verification

● Profit-taking follows conditions, not emotions

In this trade, movements after entry were treated with calm decisiveness under the rule “take profit if it returns,” without emotional fluctuation.

Even if the profit margin wasn’t large, following a well-structured setup can accumulate reliable gains.

● Losing cuts protect the “next” trades

Both stop-loss executions occurred under clear conditions. Acting without hesitation minimized impact on subsequent trades. It even felt like a rhythm was restored.

“Stop-loss to prevent losses” is not the goal; it is “stop-loss to keep winning.”

I reaffirm its importance.

● Reproducibility of the pattern matters more than win rate

The win rate was about 75%, but the key is that the wins followed a similar pattern.

This reproducibility of the shape raises the stability and quality of discretionary judgments.

⸻

Summary

By trading in a short time with clear conditions, I could feel how much a decisive judgment reduces uncertainty in results.

Most importantly, the feeling that “trading naturally blends into life” is a huge personal gain.

⸻

Is it possible to verify by time slot that fits your lifestyle?

• Can you make money just in the morning?

• Do trades work when you can only watch charts at night?

• How does daytime market reaction look?

We will continue to conduct verifications in time slots that match your lifestyle.

If you’re curious about whether profits can be made even in limited times, please feel free to contact us.

⸻

?Notice of price change (limited to a limited number of people)

Originally, a campaign was planned from [July 15], but due to Gogojan’s policy there is a rule that “after a price change, the campaign cannot be used for one month,” so this time limited-time, limited-availability price change is being implemented.

This change was decided with the desire to “increase friends who can discuss the market from a common perspective.”

If anyone is interested, we would be glad if you take advantage of this opportunity.

⸻

ℹ️Guidance on the dedicated tool (review benefit)

Currently, we are providing auxiliary tools (auto-entry + stop-loss processing) to those who submit a review.

This was created from the desire to use it personally every day, and

the system delegates break decisions and risk management in accordance with market structure.

For those who place priority on “your own judgment” for take profits, this tool is a good fit.

Reviews are not yet abundant, but this may be because the structure is simple and clear enough that there is little need for proactive back-and-forth before or after purchase.

However, if the user base grows, paid options may be considered.

This is because there is a possibility that the tool will need to be used as part of a support-and-set training rather than sold as a standalone product.

____

◻️ For those who want automated entry via EA

We are considering distributing an EA version of this logic as a review bonus.

If you are considering purchasing, please feel free to contact us.

If you are interested in Sky Gap, you can join our online community

Join the online community here

Within the online community, we cannot explain specific trading logics, but

you can participate in a “Chart Feedback Community” using Sky Gap.

• If you send a chart image you’re curious about,

“What would have been the right decision in this moment?”

“Where were the entry and take-profit points?”, and we will provide feedback with rule-based justification.

• Past charts for specific time slots are also OK.

We will answer in due course as time allows.

To those interested in Sky Gap

Build a foundation to judge rules without hesitation in short-term trading—

that is the core philosophy of Sky Gap.

? Free material here:

▶︎Download ‘Trajectory to the Gap’

In ‘Trajectory to the Gap,’ you’ll learn in more accessible terms what kinds of situations you can trade,

the criteria for judgments are explained more clearly.

Compared to the Sky Gap sales page alone, more concrete entry points and zone selection are also

shown with diagrams and case-by-case explanations.

Even first-time readers will find it easy to reproduce, so

if you’re curious, please take advantage of it as well.

⸻

If you’re interested, please first receive the free material ‘Trajectory to the Gap’.

From there, your step into the Gap begins.

? When you’re unsure whether to include this chart,

I hope it helps you switch to thinking “judge by rules, not by intuition.”

Sky Gap

https://www.gogojungle.co.jp/tools/ebooks/64393?via=toppage_recentViewed