Will you include this chart? — A record of the “gap” identified by rules [Issue 31]

Do you want to include this chart?

— Recording of the Narrow Gap discerned by rules [Issue 31]

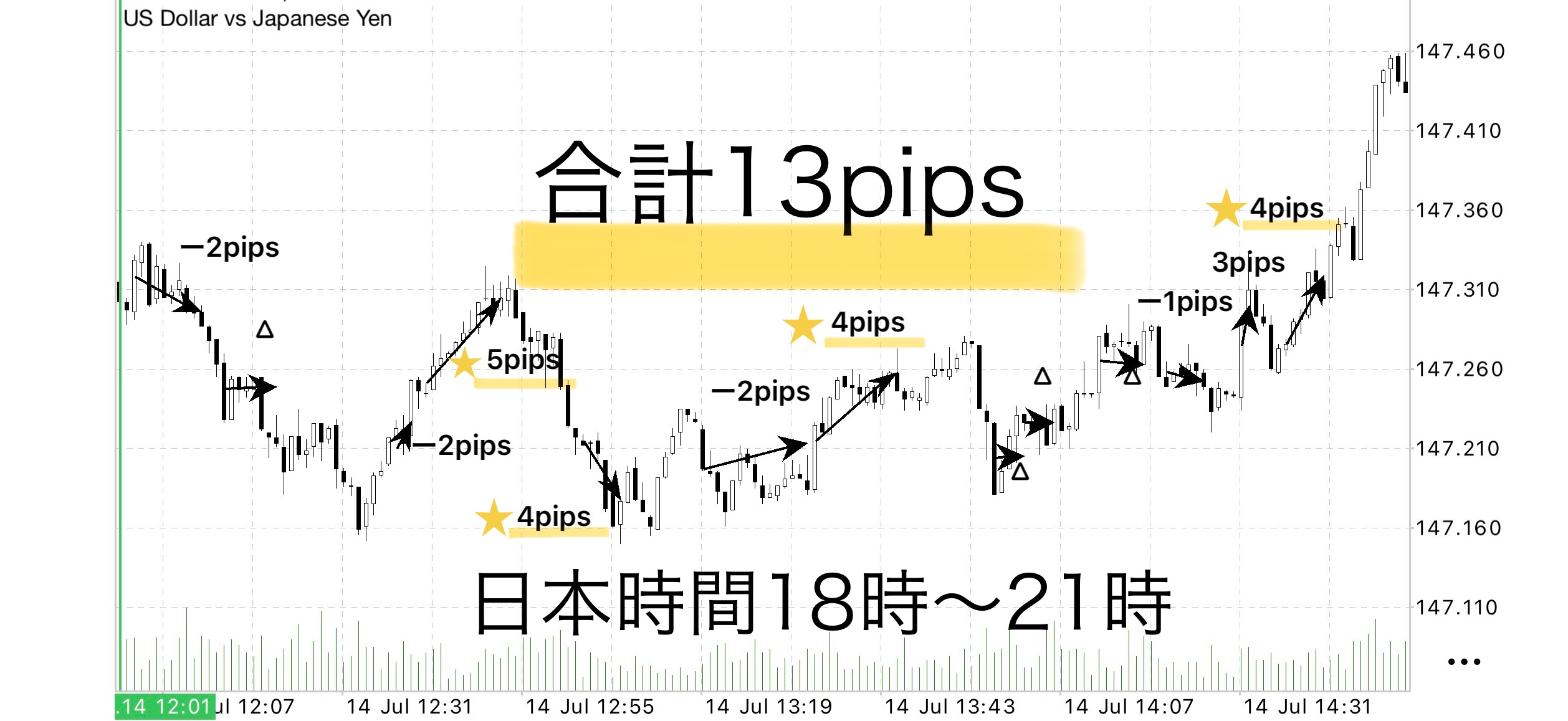

【USD/JPY】 1-minute chart Sky Narrow Gap Logic Verification

July 14, 2025 (Mon) 18:00–21:00 (Japan time)

The potential of gradually building on a “Relaxed Trade”

Some say “Trades are meaningless unless they are extended,” but is that really true?

We conducted a test on the USD/JPY 1-minute chart using a logic designed with only rules in mind.

Even if each trade’s profit target is small, by repeating strictly according to the rules,you can accumulate profits with mental ease—this is a practical record of a “Relaxed Trade.”

Without relying on environment recognition or market trends, the strict stance of “the rule is everything”what kind of insight does it yield in the end?

Trading results (Japan time 18:00–21:00)

• Total trades: 13

• Profit-taking: 5

• Positioned exits (including small profits): 4

• Stop losses: 4

• Gains: +20 pips | Losses: −7 pips → Net P/L: +13 pips

• Win rate: 38.5% (5 wins / 13 trades)

• Average RR ratio: roughly about 1.4 (profit target 3–5 pips, stop 1–2 pips base)

• Profit Factor (PF) ~2.86

• 1 lot equivalent: approx. +13,000 JPY

• 0.1 lot equivalent: approx. +1,300 JPY

1.✅“Reassurance” from calmly following the rules

In this test,we operated with a style that entrusts all entries and stop-loss handling to an EA. This eliminated any emotions such as "Should I enter?" or fear of stop loss during trades, resulting in a very low-stress trading experience.

Even if a series of stop losses occurs, adopting the stance that “everything is per the rules” proves to be a major psychological and total-profit advantage.

✅Small profits, when accumulated, become substantial

This time, the core was very short-term profits of +2 to +5 pips,but overall earned +13 pips.

By incorporating a few instances of “slight-profit exits” aimed at winning with a win rate in mind, losses were canceled out and the overall balance stabilized.

We again realized the effectiveness of “winning little many times rather than waiting for one big win.”

✅It is better to minimize losses than to chase bigger wins

Rather than risking a larger loss to gain a bigger win, cutting losses early improves total profitability and stability, which this practice reaffirmed.

✅A mindset of “not expecting to stretch it” is also important

After entry, the rule is clear: exit immediately upon touching a specific line, leaving no room for the temptation to aim for a few more pips.

As a result, the reproducibility of judgment and mental steadiness improved dramatically.

✅Including micro-profit exits raises overall win rate

This time there were four micro-profit exits near the break-even point. They functioned as effective “loss-avoidance” and increased the overall win rate (profit-taking plus micro-profits).

Having a rule that allows you to escape before a stop loss makes the entire trading experience much easier.

This is not only about winning trades, but about actively incorporating losing-protection into the strategy.

This study shows that even within a limited time window like Japan time 18:00–21:00, using the “Sky Narrow Gap” logic makes it possible to accumulate profits steadily without hesitation.

“Don’t try to take all of the market. Set a time, follow the rules.”

This approach is highly important for realizing a practical trading style that can be integrated into daily life.

If you are interested in Sky Narrow Gap, you can join the online community

Join the online community here

Specific trading logic cannot be explained inside the online community, but

you can participate in the “Chart Review Community” using Sky Narrow Gap.

• If you send a chart image you’re curious about,

“What would have been the right decision at this moment?”

“Where were the entry and take-profit points?” etc.,we will provide feedback with rule-based decision examples.

Past charts for specific timeframes are also OK.

We will reply in due time as time permits.

In short-term trading, building a foundation to判断 with rule rather than hesitation —

that is the core philosophy of Sky Narrow Gap.

Free教材 here:

▶︎Download “Traces to the Narrow Gap”

In “Traces to the Narrow Gap,” you’ll learn in which situations you can actually trade,

and the decision criteria will be explained more clearly.

Compared to the Sky Narrow Gap sales page, this provides

more details on entry points and zone selection, with diagrams and case studies.

Even first-time readers will find it easy to reproduce,

so if you’re curious, please use it as well.

If you are interested, please first receive the free material “Traces to the Narrow Gap.”

From there, your step into the Narrow Gap begins.

When you hesitate on this chart,

I hope this helps switch your thinking from “feeling” to “rule-based judgment.”

Sky Narrow Gap

https://www.gogojungle.co.jp/tools/ebooks/64393?via=toppage_recentViewed