[275 pips after 3 hours of work × 5 days] Evening scalping strategy, 5 days of real-time testing!

Facing the chart is always a little time after work.

Even in such a situation, can you still achieve results?

In this test, using only “3 hours in the evening” yielded +275 pips in one week.

We will disclose the rules and strengths behind this.

In the USD/JPY rate at 145 yen

• 1 lot equivalent: about 398,800 yen

• 0.1 lot equivalent: about 39,900 yen

The Sky Between← Logic

This week’s test from July 7 to 11 was conducted entirely in a specific time window of 18:00–21:00 Japan time.

This time window corresponds to the latter part of the London market and the early part of the New York market, so some price movement is expected,

while also allowing trading in a “calm liquidity” with little excessive volatility.

Furthermore,it is a time period where those who cannot devote time during the day can still trade after returning home.

That is why we narrowed it to this 3-hour window and tested whether there is truly an edge during this time.

Whether stable trading is possible within limited time

We believe it is very important to establish an operable style that is easy to implement in daily life by confirming this.

7th to 11th (5 days) limited to 18:00–21:00

Total 275 pips

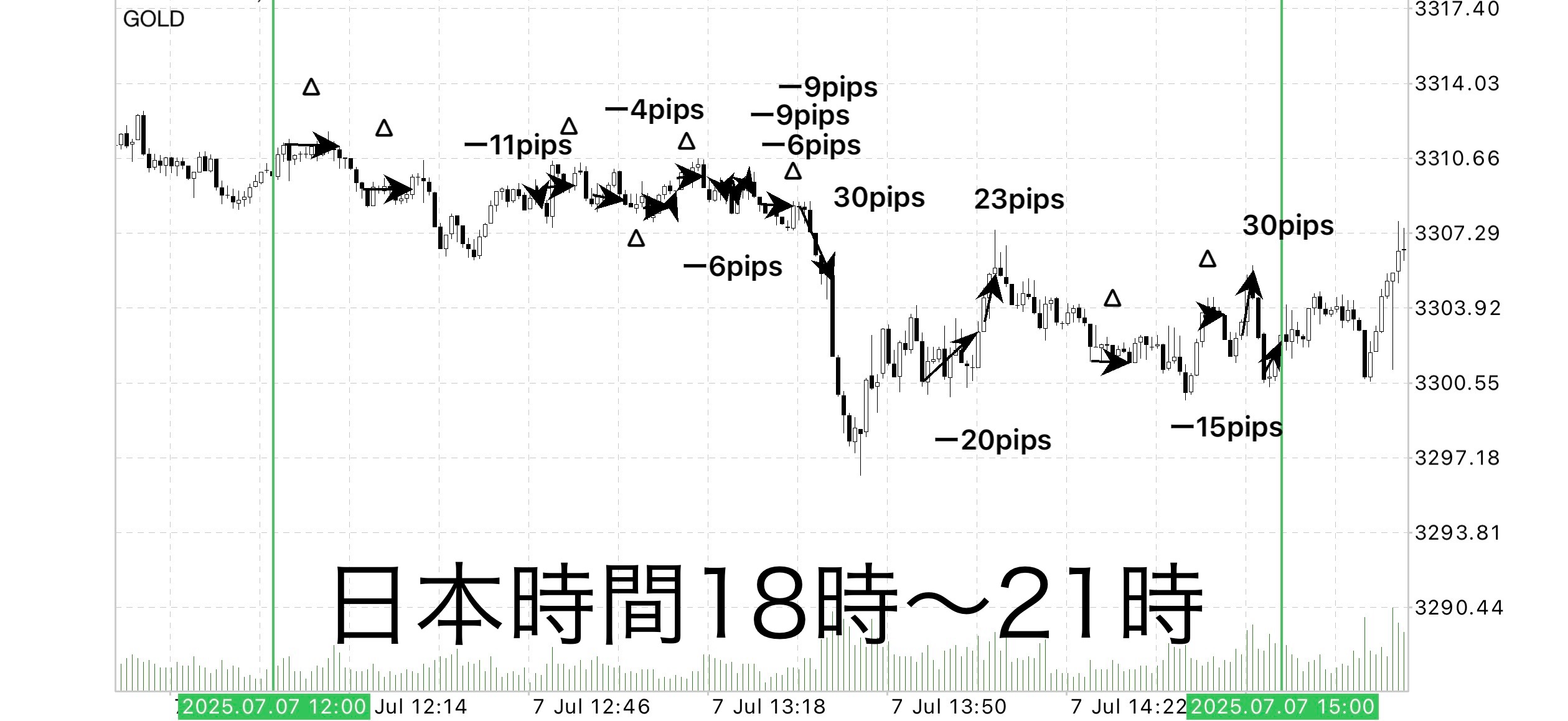

7th: 3 pipsInvestment Navi Vol. 24

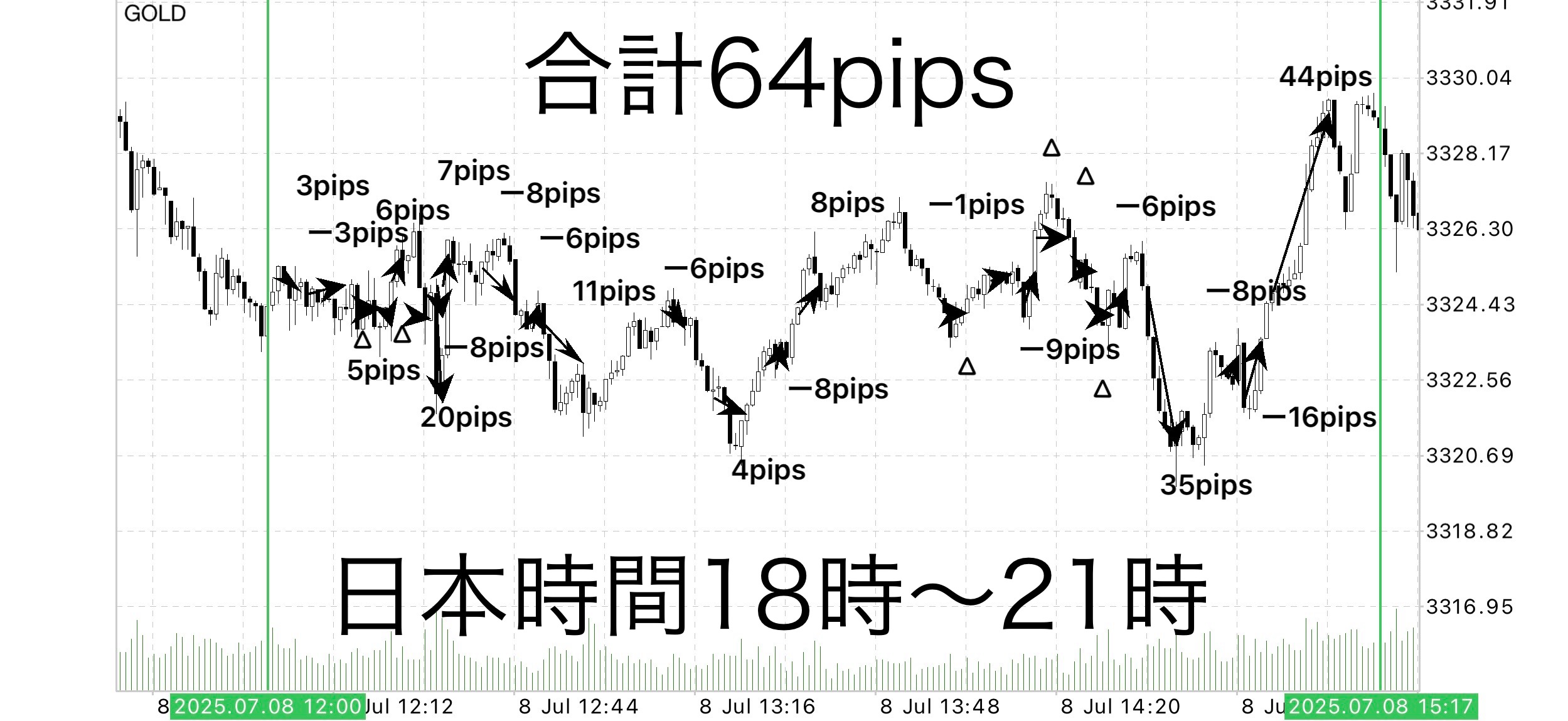

8th: 64 pipsInvestment Navi Vol. 26

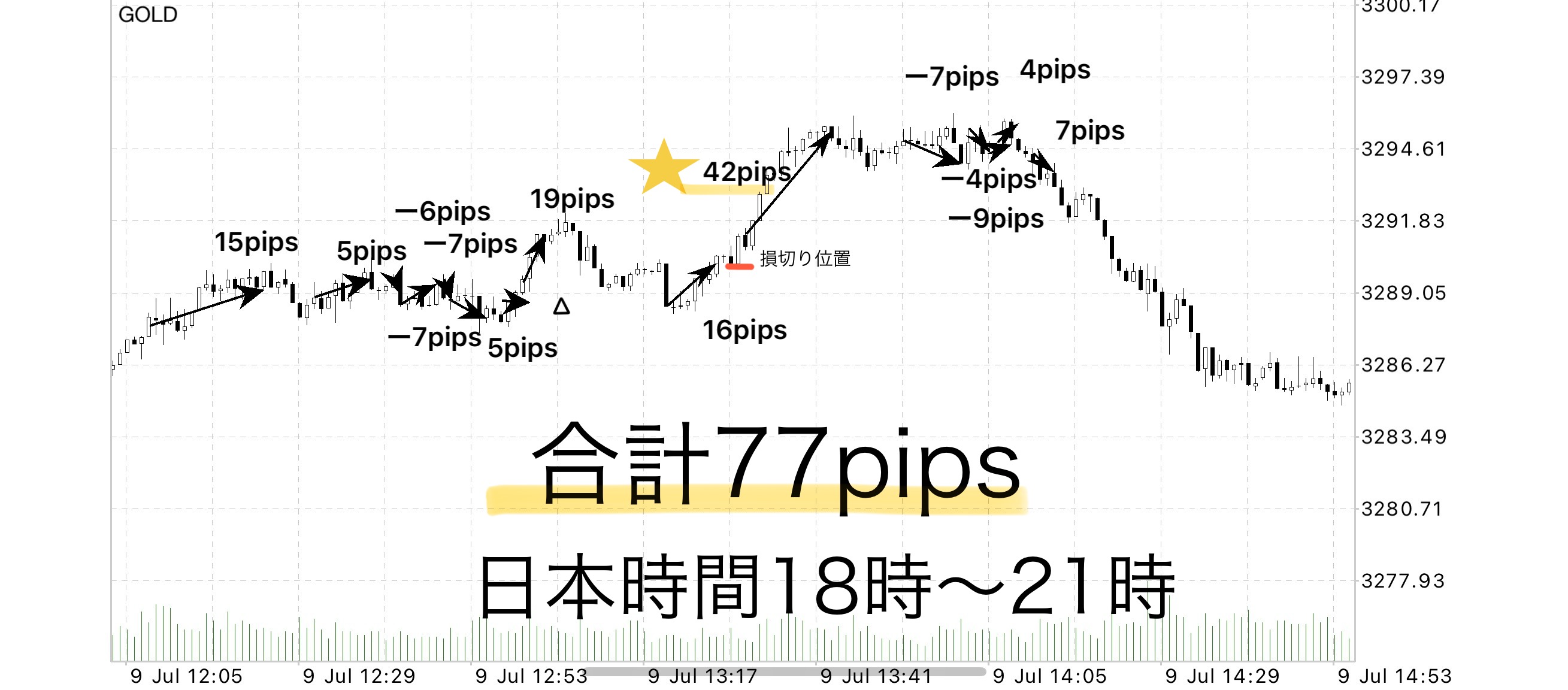

9th: 77 pipsInvestment Navi Vol. 27

10th: 41 pipsInvestment Navi Vol. 28

11th: 90 pipsInvestment Navi Vol. 29

?Edge and logic revealed by the test

Throughout this week,we confirmed that a rule-based strategy built on a specific time window can yield sufficient profit opportunities.

Three points stand out:

⸻

①Effectiveness of the time window filter

Many traders think “you must watch the market all the time to win,” but

this test shows that “limiting to just 3 hours yields +275 pips.”

In other words, “restricting time = disadvantage” is not accurate;it acts as a filter that reduces unnecessary trades.As a result, decisions can be made in a highly focused state, and trade accuracy stabilized.

⸻

②Mechanical processing of the logic × discretionary profit-taking

In this trading, automated entry and stop-loss were used by EA, and profit-taking was performed discretionary based on chart structure.

This “hybrid of automation and discretion”

・ Entry and stop-loss not swayed by emotions

・ Optimal profit-taking corresponding to trend strength

made it possible to reconcile these aspects, and it reinforced the importance of discretionary profit-taking.

⸻

③Clear reproducibility through line-break structures

The “Sky Between” logic is built on break decisions based on multiple predefined horizontal lines.

Thus, even in daily changing market environments, such as the current week, it is possible to:

• Make entry decisions starting from the same line

• Position management based on the same rules

• Trail and close in a fixed pattern

demonstrating that trades are reproducible without relying on feel, and the result strongly confirms this.

⸻

✅Test summary

• Even with 1 week of limited 3-hours-a-day trading, +275 pips secured

• Practice in a stable time window directly links to long-term edge

• Robustness of automated entry and stop-loss management by EA

• High reproducibility through line-break type logic

From now on, we will continue to accumulate more trading data centered on the 18:00–21:00 homecoming time window,

and aim to prove “you can win by following the rules.”

____

◻️ For those who want automated EA entries

We are considering distributing a tool that converts this logic into an EA as a review perk.

If you are considering a purchase, please feel free to contact us.

If you are interested in Sky Between, you can join the online community

Join the online community here

Inside the online community, we cannot explain specific trading logic, but

you can participate in a “Chart Review Community” using Sky Between.

• If you send a chart image you’re curious about,

“What would have been the right decision in this moment?”

“Where were the entry and take-profit points?”,we will provide feedback with rule-based decision examples.

• Past charts for specific time windows are also OK.

We respond in order as time permits.

To those interested in Sky Between

In short-term trading, building a foundation to “judge by rule without hesitation”

That is the core philosophy of Sky Between.

? Free materials here:

▶︎Download ‘Path to the Threshold’

In ‘Path to the Threshold,’ you’ll learn what situations you can actually trade in,

and the decision criteria are explained more clearly.

Beyond what the sales page for Sky Between could convey,

the specific entry points and zones are also explained in detail with diagrams and case-by-case explanations.

Even beginners can reproduce it easily,

so if you’re interested, please use that as well.

⟲

If you’re interested, please first receive the free material ‘Path to the Threshold’.

From there, your step into the threshold begins.

When you think, “Should I enter this chart?”

I hope this helps shift your thinking to the mindset of judging by rules rather than by intuition.

Sky Between

https://www.gogojungle.co.jp/tools/ebooks/64393?via=toppage_recentViewed