Will you include this chart? — A record of the “gap” seen through the rules [Issue 26]

Do you want to include this chart?

— An Examination of the “Chasm” Records by Rules [Issue 26]

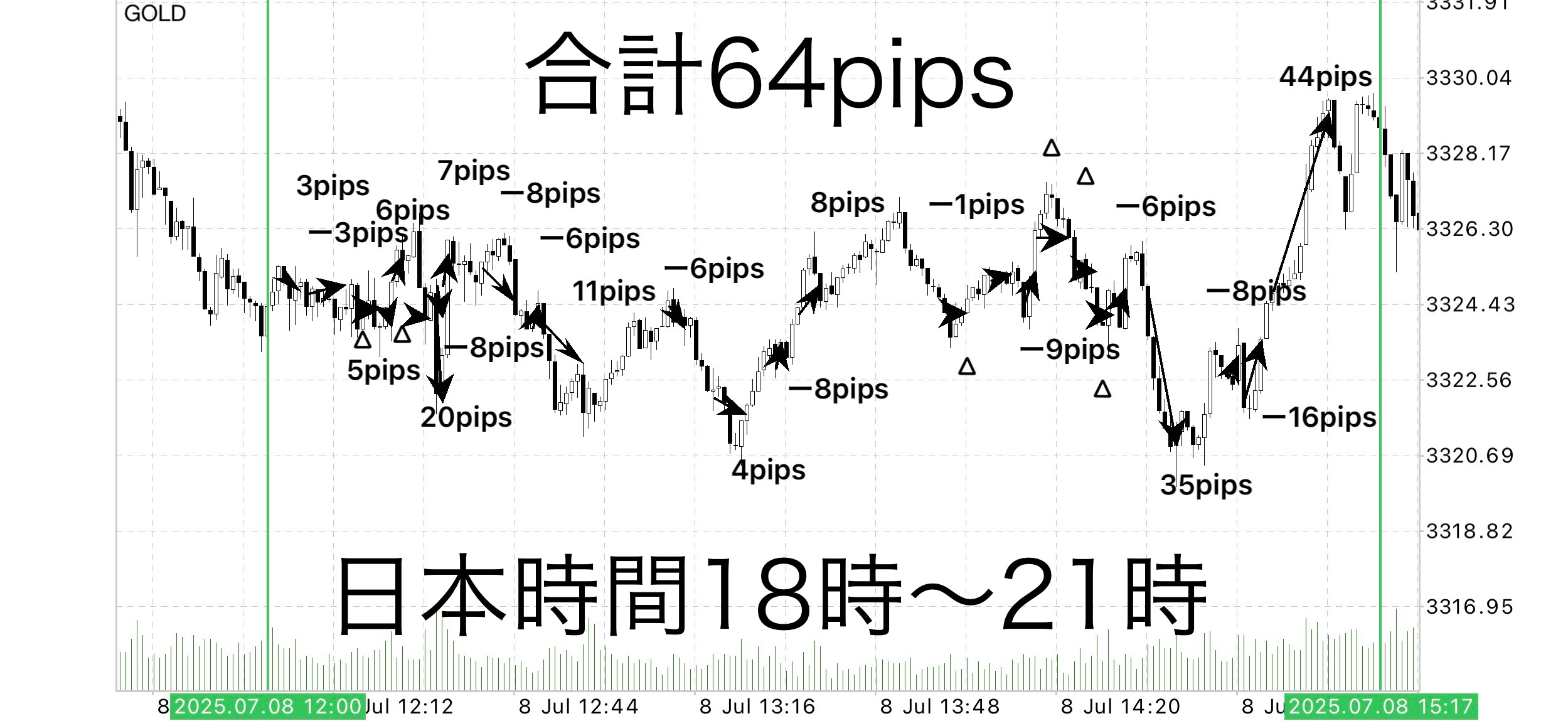

【July 8, 2025】 GOLD (XAU/USD) 1-minute chart

London later session to NY early session | The Sky’s Chasm Logic Verification Report

⸻

?About this verification

Using GOLD (XAU/USD) 1-minute chart, we verified the behavior of the “Sky’s Chasm” logic during 18:00–21:00 (3 hours).

In this verification, rather than actual trading, assuming that an EA (automatic trading program) operated according to the rules, we recreated and recorded on the chart what entries, stop losses, and take profits would have been executed.

No discretionary judgments are included; this focuses on movement as a purely rule-based “mechanical reaction.”

⸻

?Trade Results Summary (GOLD)

• Total trades: 27

• Take profits: 10

• Breakeven or small profit closures: 6

• Stop losses: 11

• Total gained pips: +143 pips

• Total lost pips: -79 pips

• Net profit: +64 pips

• Win rate (Take profits / Total trades): approximately37.0%

• Profit factor (PF): approximately1.81

Value equivalent (1 pip ≒ ¥1,450)

• 1 lot: approximately +¥92,800

• 0.1 lot: approximately +¥9,280

⸻

?Market Development Characteristics and Impressions

In this time period, GOLD overall showed unstable and difficult-to-read movements, with directionless fluctuations continuing. Among them, the logic repeated prescribed actions and achieved consistent results.

Main points:

① A market that starts but does not continue

• Initial reactions were often followed by quick reversals, frequent exits at break-even.

• Small-wave stops also occurred; the early phase felt somewhat challenging.

② Take profits functioned according to the rules

• After clearly breaking a line (up or down),take profits when it returned to the next lineacted precisely.

• Not based on sense or discretionary “feels,”take-profit decisions grounded in clear structure supported performance.

③ Large price moves in the late stage supported the results

• An upward wave after 20:45 led to successive take-profits.

• In this time frame alone, nearly +50 pips of profit added, greatly boosting overall results.

⸻

?Automation and the Essence of Take Profit

In this logic, entries and stop losses are executed entirely by the EA. This is a major advantage in terms of trading discipline free from emotion.

On the other hand, take profit is often misunderstood, but it is not about discretionary “feel” or reading the market’s mood.

In this strategy, after breaking a line, you take profit when it returns to the next line.

Simply and mechanically repeating this is all there is to it.

Therefore, there is no room for hesitation,

instead of asking “how far will it run,”

the sole criterion is whether it returns to the next structural line.

This enables highly reproducible take-profit actions,allowing trades to proceed calmly according to the rules without being swayed by market quirks and noise.

⸻

✅Verification Summary

• Overall, many small waves made this a difficult time, but trading reactions according to the rules secured +64 pips.

• Win rate is not high, butstructured take profits and stop designs effectively contribute to small losses and large gains

• Take-profit decisions are not discretionary,they are executed according to clear line-structure criteria.

• Going forward, the same structurally-based market conditions are expected to yield stable performance

____

◻️ For those who want automatic EA-based entries

We are considering distributing an EA version of this logic as a review bonus.

If you are considering purchasing, please feel free to contact us.

If you are interested in Sky’s Chasm, you can join the online community

Join the online community here

In the online community, we cannot explain specific trading logic, but

you can participate in the “Chart Review Community” that uses Sky’s Chasm.

• If you send a chart image you are curious about,

“What would have been the right judgment in this moment?”

“Where were the entry and take-profit points?”,we will provide feedback with rule-based examples.

• Past charts for specific time zones are also OK.

We will respond in due course within the time available.

To you who have become interested in Sky’s Chasm

Build a foundation to judge with rules without hesitation in short-term trades —

that is the core philosophy of Sky’s Chasm.

? Free materials here:

▶︎Download “Path to the Chasm”

In “Path to the Chasm,” you’ll learn when you can actually trade in various scenarios

and its decision criteria in a clearer way.

This provides more concrete entry points and zone selection explanations than the Sky’s Chasm sales page alone,

with diagrams and case-specific clarifications.

Even beginners can follow along easily,

so if you’re interested, please take advantage of it as well.

⸻

If you’re interested, please first receive the free material “Path to the Chasm.”

From there, your first step in the Chasm begins.

? When you’re unsure about whether to include this chart,

I hope this helps shift your thinking from “feeling” to “rule-based judgment.”

Sky’s Chasm

https://www.gogojungle.co.jp/tools/ebooks/64393?via=toppage_recentViewed