【Up to today 5000 yen coupon available!】A concrete method to aim for a large wave on the 1-minute chart by using the 【鉄板パターン】(ironclad pattern)!

You can take this big gain easily here.

In this chart, one of the common ironclad patterns appears as a chart shape.

Therefore, based on how to profit from that shape,we will use 【 Fierce Attack Iron Defense 】.

Though the exact shape of the ironclad pattern cannot be shared,

the risk-reward ratio can target -1 : +3, so

based on that, we will select profit-taking points.

M15 IPD can also be used as a profit-taking target in some cases.

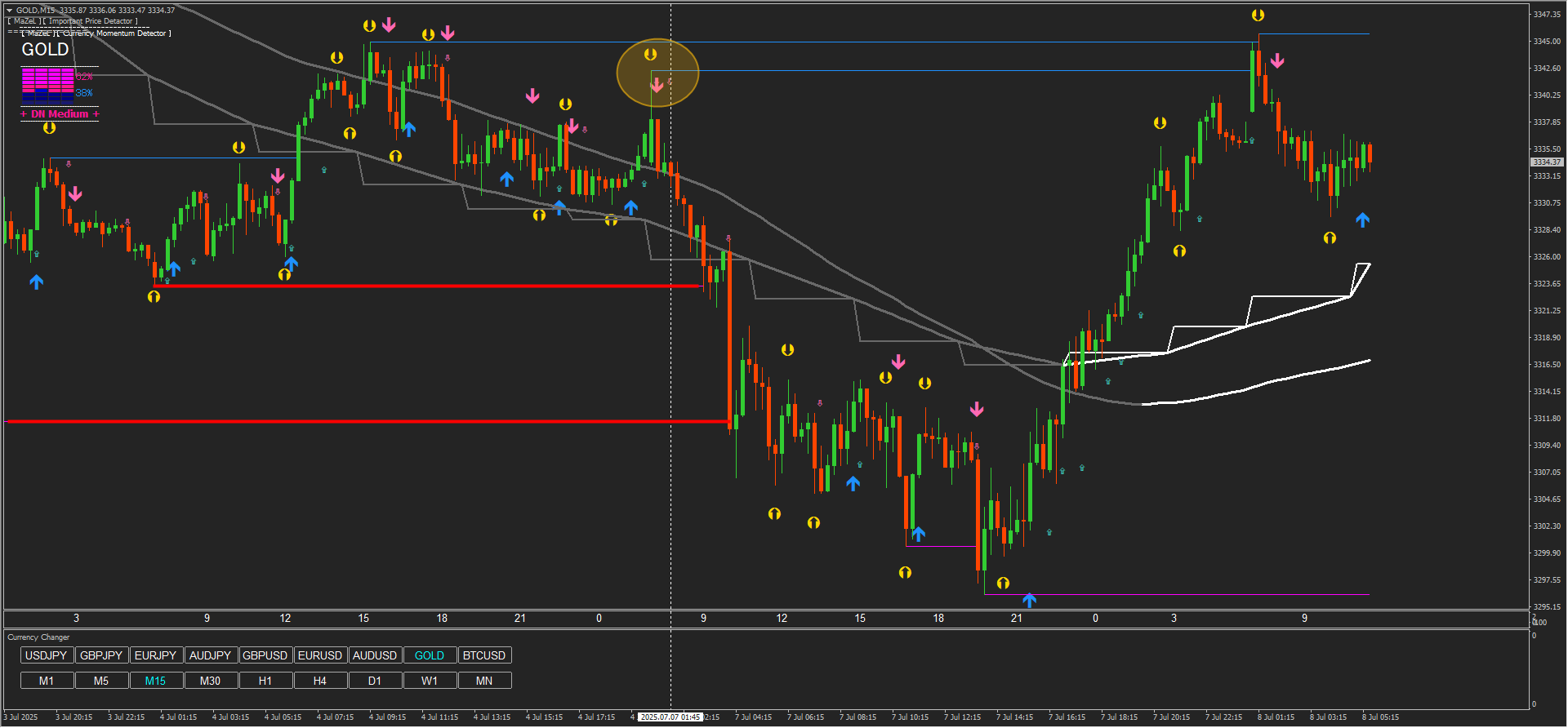

↓15-minute chart↓

※ If the profit target on higher timeframes is reached, it may be in a distant position.

Therefore, before reaching there,

based on the capital management in the product manual,

it is best to firmly seize profits using the risk-reward ratio as the basis.

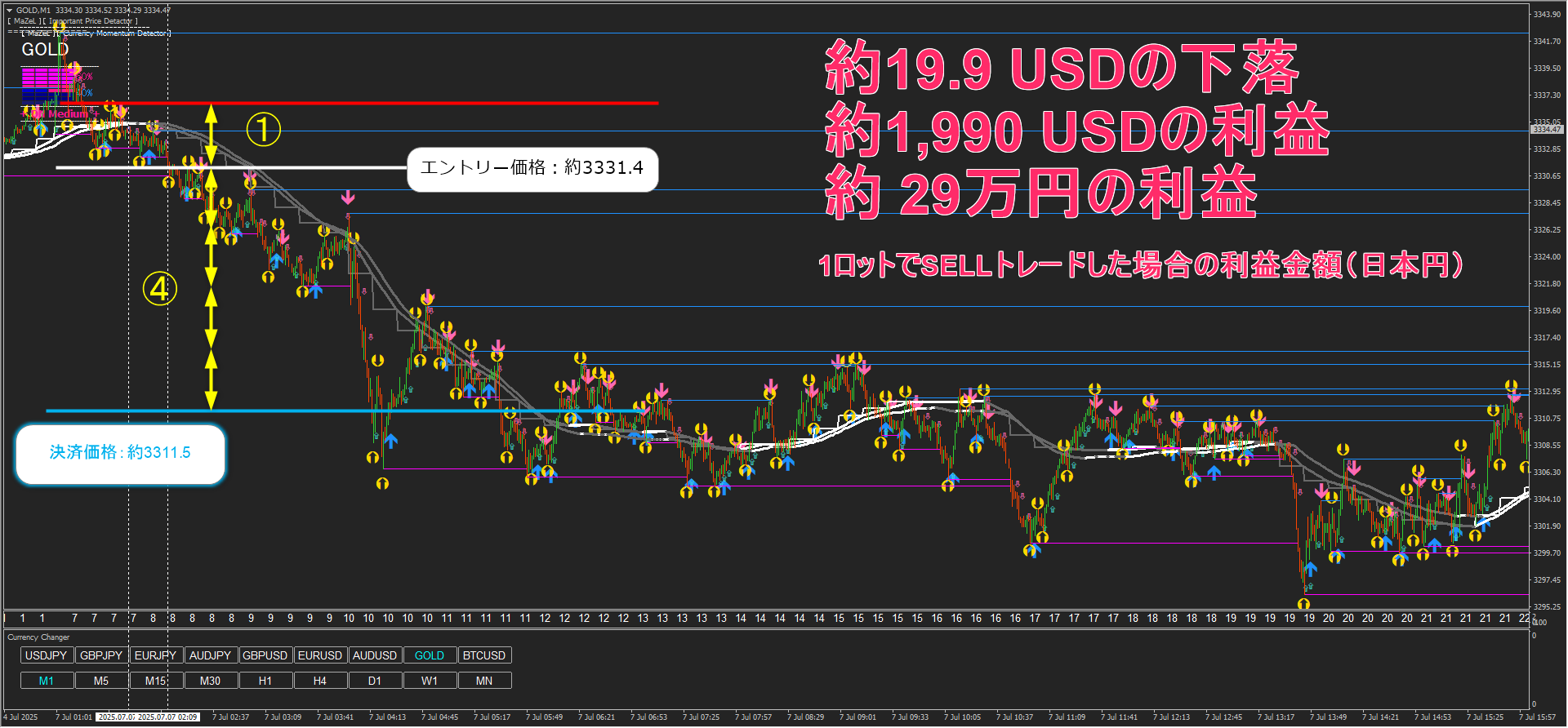

↓ 1-minute chart ↓

If you assume a potential loss of 10,000 yen,+40,000.

If you assume 100,000 yen,+400,000.

If you assume 1,000,000 yen,then+4,000,000.

If you want to trade like this,

please be sure to read to the end.

Please see the image below.

This is GOLD 1-minute chart from Monday this week (2025-06-02).

It has risen sharply in just one day.

Seeing this kind of wave,

“I want to ride the big wave.”

“If I could ride a wave like this, the risk-reward would be superb.”

“I want to make big profits.”

Thinking so, you just bite your nails and watch...

Even if you plan, you can’t realize it...

If you are reading this article and

you have the trouble of not being able to ride such waves,

please read the following article!

A method to solve itwill be shared!

So, how to aim for it?

A method that even beginners can easily imagine is

“Aim for the big wave using lower timeframes”

I think this is the strategy.

Please look at the image below.

We displayed the earlier rise on the 15-minute chart andadded a white frame area.

Let’s observe the wave movement.

※ From here on, wave drawing varies by individual, so please use this as a reference.

As drawn in yellow, the 15-minute chart shows waves.

The 15-minute chart is 15 times larger than the 1-minute,

so if you can capture even one wave, you can target a high risk-reward ratio.

Now, let's check this on the 1-minute chart.

On the 1-minute chart, waves unfold as shown by the red line.

“I understand the wave movement, but how exactly do I enter?”

This question may be on the minds of some.

Let’s validate a few widely known methods.

For example, if using Dow Theory or line trading,

it’s a simple form, but it seems possible to perform this kind of analysis.

Since the analysis method and wave interpretation depend on the individual,

the above example is just a sample,

beginners in particular may find it difficult.

Also, when using widely used moving averages,

you might become more confused.

※ Short-term: 20 SMA & EMA

※ Medium-term: 50SMA & EMA

※ Long-term: 200 SMA & EMA

※ Refer to numbers commonly seen in books, online articles, videos, etc.

However, those who have achieved results may think this:

• It is important to narrow down the methods and train hard

• Use indicators to set a standard for wave interpretation

• Master winning and losing patterns

• Study by repeatedly reviewing various entry points

etc...

Indeed, there are many ways to profit in financial markets,

first narrow to one method and master it,

not a misguided approach but rather a shortcut.

However, how long does that take,

whether that method is truly best for you,

even if you study a lot, the average risk-reward may be “-1 : +1.5” and

the win rate may be around 55%.

Some may say, “If there’s profit, that’s enough.”

However, if you can change the outcome to not be satisfied despite your efforts,

there is nothing better than that.

In the market, macros show many similar shapes, but

micro-wise, the same shape rarely repeats,

and there will be times you need to rethink.

Of course, exploring methods that suit you is wonderful.

However, being able to profit while also further finding a method that suits you

is a very meaningful environment to create.

If I use the system I’ve developed, “Fierce Attack Iron Defense,”

in the previous market you could enter with a “simple 4-step”

as shown in the image below.

↓ 15-minute chart ↓

↓ 1-minute chart ↓

↓ Overall view of the 1-minute chart ↓

If you’re curious about the system details,

you can view them at the URL below.

There are testers who became six times in one month

“attack and defense”

★ For beginners and those struggling to make a profit, please grab this!

Solidifying basics! A leap forward!

Fully supports scalping and binary options as well.

High win raterecorded

“Sure-fire opportunities” to detect and respond with high precisionin trading system!

If you haven’t viewed it yet, please use the links below!