2025-7-5 Dollar Yen, Gold, S&P 500

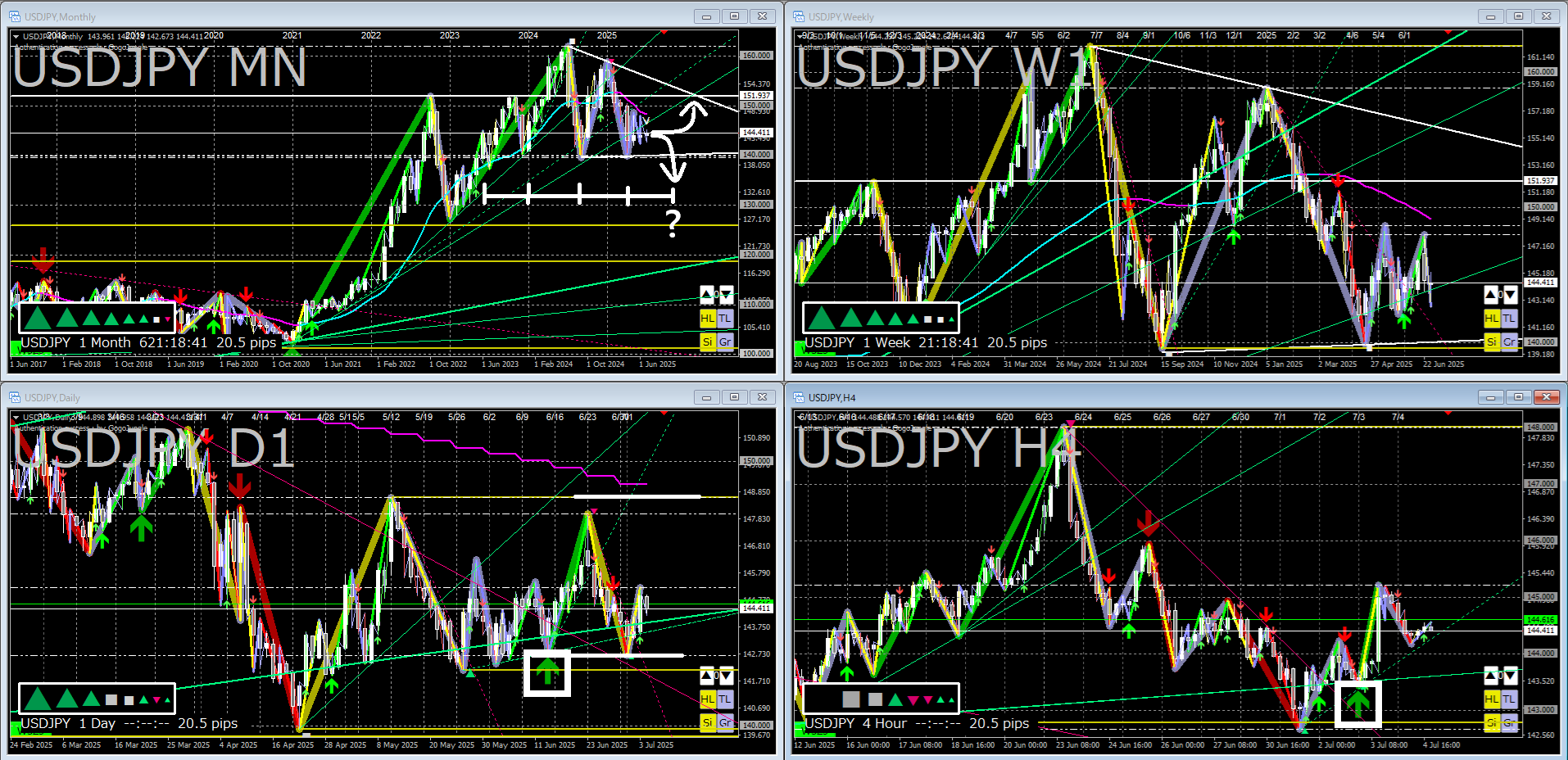

【USD/JPY】

The image above overlays “Starting from the World’s Smallest: Next-Generation ZigZag” and “Trendline Pro 2”.

The monthly chart’s bearish triangle (descending triangle) suggests that many short positions are still aiming for a break below 140 yen.

However, when looking at the 140-yen touch interval on the monthly chart, it seems that price may require at least another 1–2 months of consolidation before a downside break.

As a premise, the monthly level is still in an uptrend phase.

If a break below 140 yen cannot occur, accumulated short positions could be squeezed, potentially driving the yen sharply weaker.

This week, USD/JPY remained flat, but the range was about 2 yen.

Considering it stayed flat, the dips at the start and end of the week were technically clear.

Next week too, USD/JPY may continue its flat trend (weekly ZigZag turning purple).

At the present moment, it is barely in an uptrend shape, but both the upside and downside look solid, so neither side seems likely to gain momentum easily.

The MA (moving average; period: 1 year; for monthly charts 12, for weekly charts 52) is trending downward smoothly and next week it seems likely to overlap with the upper white line on the daily chart.

If there is a rise here and a rebound occurs, it may lead to a solid decline.

If the daily lower white line is broken below, the range of defense/offense may shift down to between there and 140 yen.

However, breaking below 140 yen still feels too early unless some shock occurs.

In some cases, the movements may be contained inside the white circle in the image above.

In such a case, the price range is about 1 yen, so it may be better to straightforwardly look at other currency pairs.

【GOLD】

The image above overlays “Starting from the World’s Smallest: Next-Generation ZigZag” and “Trendline Pro 2”.

This week, gold rebounded upward as the trendline was respected.

As before, when the trendline is met by a rebound, the expectation is for a new high to be reached.

Chart-wise, the uptrend is still maintained, but it appears funds are moving away from gold to other assets after a sharp rise.

This is simply moving to more efficient investments, so I think gold itself will continue to rise in the future.

The daily white horizontal range tends to be watched; if it breaks upward smoothly, otherwise a deeper correction may follow.

Even if the drop is somewhat larger, the supply-demand dynamics suggest the decline will not continue indefinitely.

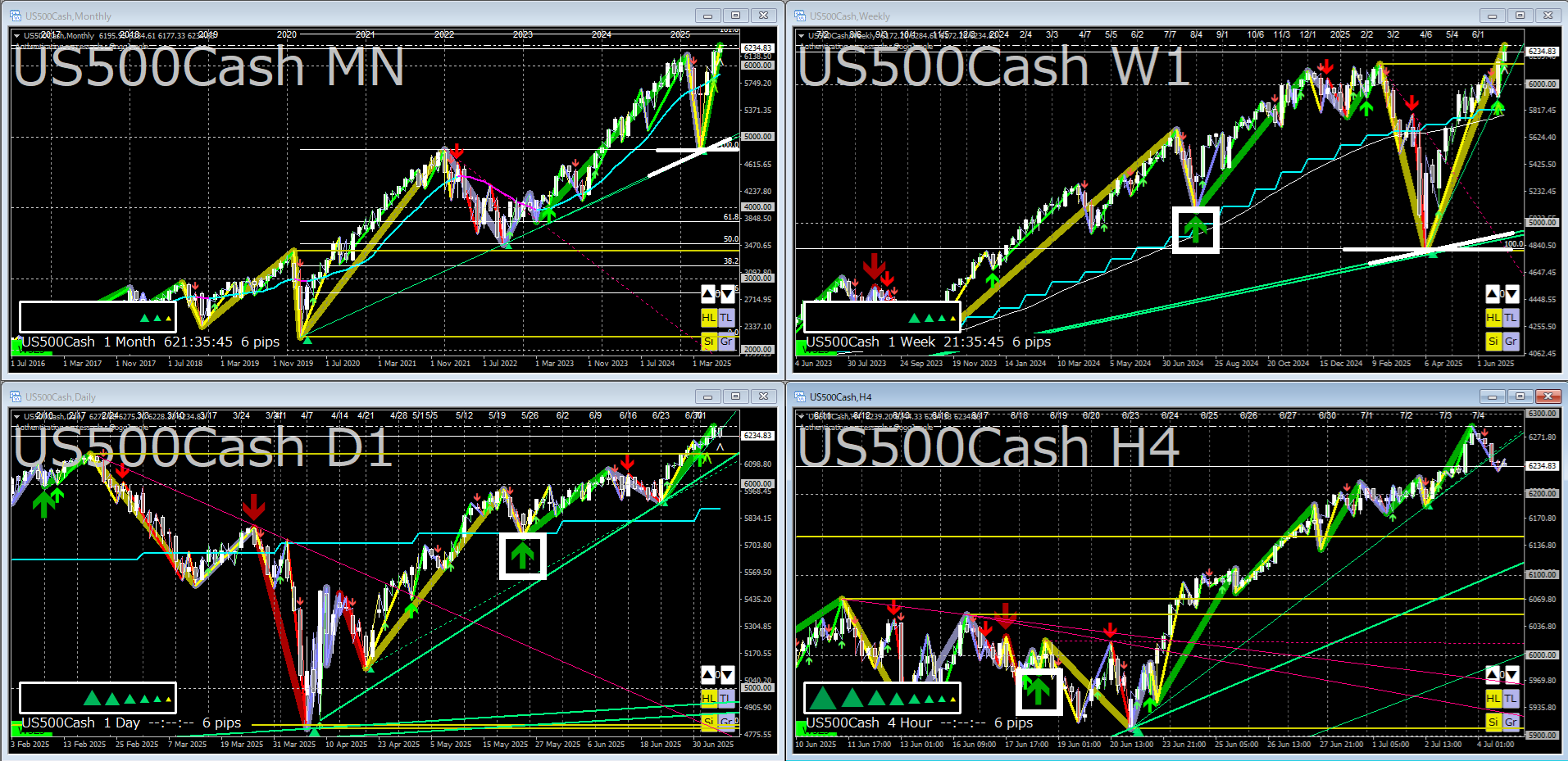

【S&P 500】

The image above overlays “Starting from the World’s Smallest: Next-Generation ZigZag” and “Trendline Pro 2”.

I view the S&P 500 on a long-term basis rather than weekly.

Basically, like gold, money supply continues to increase, so there is a long-term upside premise.

That said, moves to challenge American dominance are occurring in various places; especially China appears to have a chart that could rise sharply, which is concerning.

There are efforts to curb dollar dominance, including actions around Iran, and depending on how things unfold, this could lead to an unprecedented long-term decline, so be alert.

In the near term, after hitting new highs, momentum is weak for now.

If it does not clear the Fibonacci 161.8 level as previously discussed, the rise could lose steam after tariff shocks and trend toward a sideways consolidation.

Even if it retraces, since it has just updated the high, buying interest could resume on the upside.

Americans tend to buy more when prices rise, unlike Japanese traders, so big trends tend to form easily.

With the current chart shape, funds seem to flow in, but if the gains fail to materialize fully, I may consider pulling funds.

* The white circles and lines in the reference image were added later.

* If the image is small and hard to read, right-click the image and choose “Open image in new tab” to view at actual size.

*Preconceptions only cause harm, so please treat this as just one scenario for reference.

ーーーーーーーーーーーーーーーーーーーー

If you found this article helpful, please press the below‘ Read more’ button— I would be glad. (No continuation. It’s a like.)

ーーーーーーーーーーーーーーーーーーーー