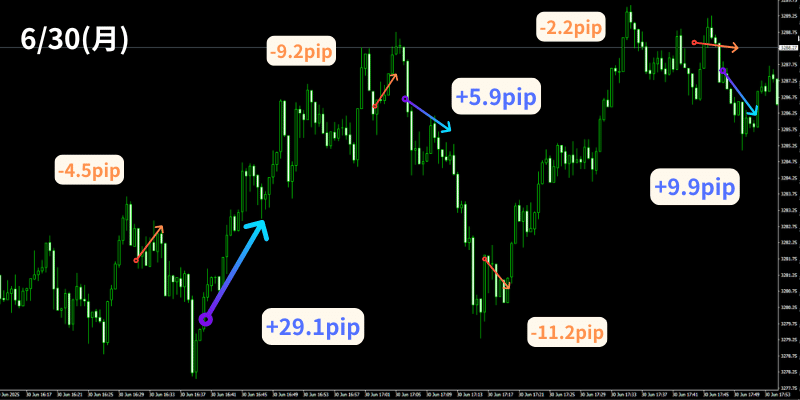

[June 30] 30-Second Foot GOLD No-Discretion Scalping Trading Result

Details of 30-second GOLD No-Discretion Scalping

+++++++++++++++++++++++++++++++++

Trading on June 30.

22:45

U.S. PMI (Purchasing Managers' Index—Final) June [Manufacturing PMI—Final]

23:00

U.S. ISM Manufacturing PMI June

23:00

U.S. JOLTS Job Openings May

23:00

U.S. Construction Spending May [MoM]

Such indicators are ahead.

Especially because it is the end of the month, the indicators at 23:00 can have large fluctuations and high importance, so be careful.

Trading is based on these considerations.

Gold fell sharply last Friday, but the rapid downward momentum is concerning.

Since it dropped sharply relative to the range on the 25th and 26th, there is some doubt about whether it will continue to fall when considering the time axis.

Additionally, there were no large gaps at the start of the Tokyo market on the 30th, but it fell sharply from the morning.

However, on a longer time frame, it shows a long lower wick indicating a temporary decline.

From there it rose again and there is a solid resistance/support level.

In the London market it fell temporarily but did not drop below the morning low and began to rise; the trend looked questionable as we entered the NY market.

When it entered the NY market, it turned to rise.

However, buying and selling forces were still balanced, and there was significant intraday movement.

It traced a very fine zigzag, and it appeared many entries occurred more often than the rules would normally permit.

From this chart, the trend direction remains unstable.

If the timing of exits had been different, there would have been opportunities to extend pip gains, but since there is no discretion, there is nothing to do.

The day ended with a small profit.

From tomorrow it will be July and the monthly candle will change, which is also of interest, but tomorrow too we will continue with no-discretion entries in a steady manner.

*******************************