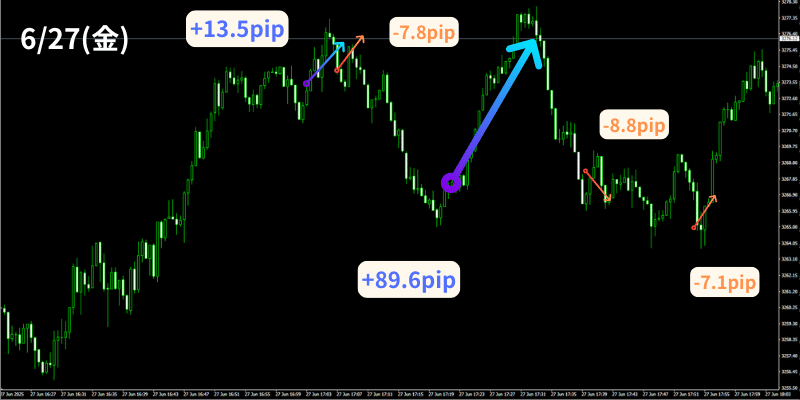

[June 27] 30-second足 GOLD discretionary-free scalping trade results

Details of 30-Second GOLD Discretionless Scalping

+++++++++++++++++++++++++++++++++

This is the trade from June 27.

21:30

U.S. PCE Price Index May [PCE Price Index - MoM]

21:30

U.S. PCE Price Index May [PCE Price Index - YoY]

21:30

U.S. PCE Price Index May [Core PCE Price Index - MoM]

21:30

U.S. PCE Price Index May [Core PCE Price Index - YoY]

23:00

U.S. University of Michigan Consumer Sentiment Index (Preliminary) Jun [University of Michigan Consumer Sentiment Index]

and other indicators are ahead.

For a Friday, the range of movement and importance are relatively small, so there’s no particular cause for concern.

Trades are made with these in mind.

Yesterday, it rose gradually, but in the NY session it dropped sharply and approached the recent low.

There was a moment showing an attempt to break the low, so the question is how it would move from here.

In the Tokyo market there were no major moves, but it gradually fell, broke the recent low, and plunged significantly.

It also updated the 24th low early, and if the 25th-26th were a corrective range, that aligns with a long-term downtrend, so acceleration is possible.

There was a large drop through the Tokyo and London sessions, exceeding 600 pips.

After selling pressure subsided once it fell enough, the NY market rose sharply.

At the moment of reversal, a long entry aligned, earning nearly 100 pips in two moves.

Even after deducting a small drawdown from a false move, the gains were substantial.

This week has been a tough market, so turning past losses into gains here is significant.

Ideally, one would not rely on such a single lucky moment, but steadily surviving a bad market and turning it into profit is meaningful.

Let’s continue to enter trades in a disciplined, discretionary-free manner next week as well.

Thanks for your hard work this week.

*********************************