Thrives in strong-trend markets! "Best Friend" What are the differences in expected annual yield between Best Friend and White Phoenix?

LONE, the developer of 'White Phoenix', has a new release is

a day-trading EA that performs well in strong trending markets!

『Best Friend』

【Best Friend Overview】

Currency pair: [USD/JPY] [Day trading]

Maximum number of positions: 3

Maximum stop loss: 35 Other: 35 pips for buys, 40 pips for sells.

Take profit: 50 Other: 50 pips for buys, 65 pips for sells.

Forward testing has been under way for just under a month, with only 3 trades so far, but

it bravely traded during the initial crash, and although it incurred losses repeatedly, it traded profitably on a daily basis.

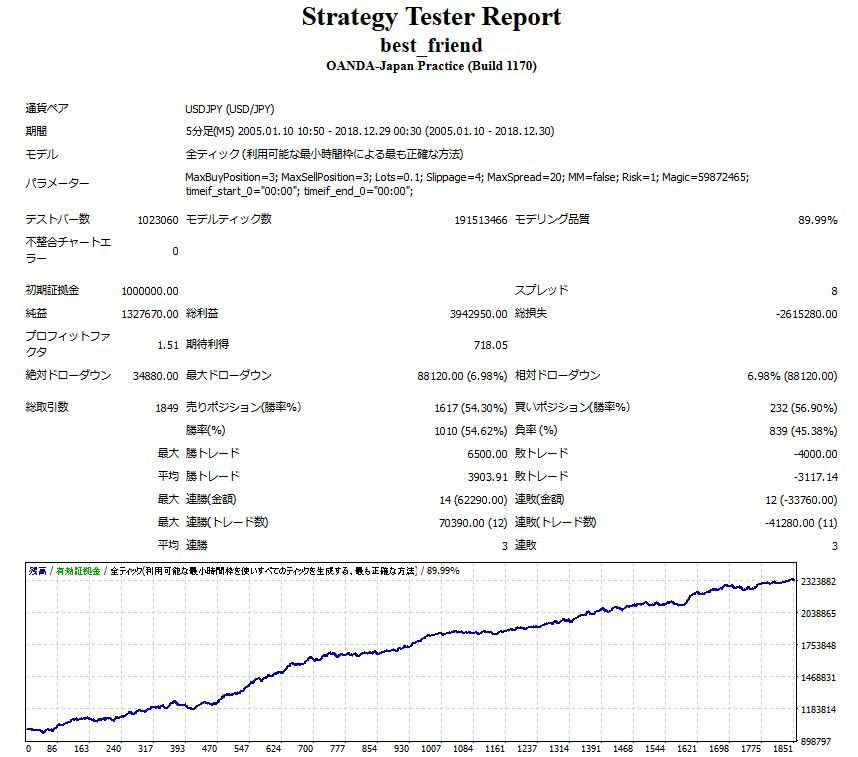

【Backtest Analysis】

2005.01.10-2018.12.30

0.1 lot fixed

Spread 1.0

Net profit +¥1,327,000 (annual average ¥102,000)

Maximum drawdown ¥88,000

Total trades 1,849 (annual average 140)

Average gain ¥3,903

Average loss ¥-3,117

Win rate 54.6%

It turned out like this.

TP:SL is designed at 1.2:1 with profits slightly higher than losses; although the win rate isn't extremely high, it stays around the 50% range

and the profits accumulate gradually.

About recommended margin

(4.5*3)+(8.8*2)=31.1

With 25x leverage, you can operate 0.1 lot for about 310,000 yen.

In that case,Expected annual return is around 28%, perhaps.

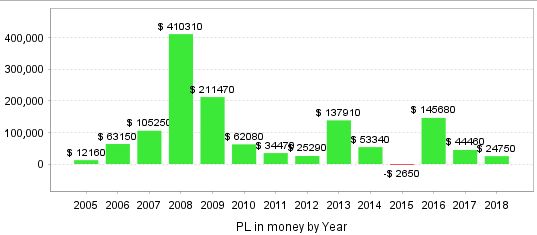

Monthly, August tends to be weak. Also, since it does not trade when the market isn't moving, there are months with no trades.

These can be seen occasionally.

Among years, profits in 2008, when the market moved a lot, stand out.

Recently, profits were large in 2016. In 2019, yen appreciation began from the start of the year, but if there is a big move ahead, it could become a year with large profits!

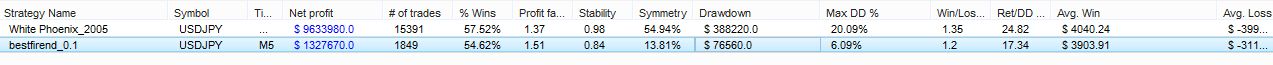

【Difference from White Phoenix, compatibility?】

Compared with LONE's first work "White Phoenix", what differences are there?

White Phoenix has a maximum holding of 9 positions, so the maximum drawdown is larger and more margin is required.

The recommended margin per 0.1 lot is ¥1,160,000, annual average profit is ¥740,000, and the expected annual return is about 63%. Because there are many positions, the total number of trades per year is also around 1,200.

On the other hand, Best Friend has a recommended margin of ¥310,000 per 0.1 lot, annual average profit of ¥88,000, and expected annual return about 28%.

Rather than being the main EA to operate, isn't it an EA you'd like to use as a sub with larger lots when a trend market occurs?

The price is also reasonable★

The EA's product image seems to convey the image of "rest is also market"; it only works when the market moves, perhaps?

Over 1,000 trades per year!